Graphic:

Excerpt:

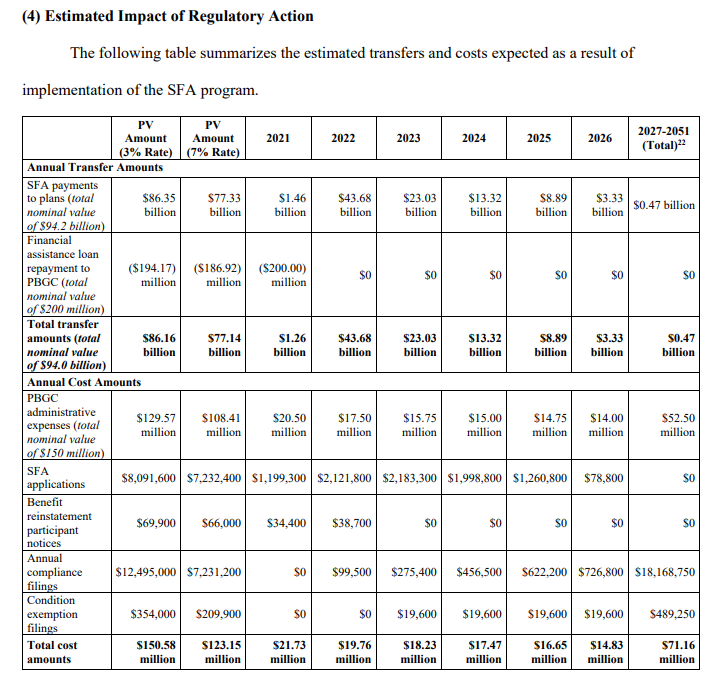

The Pension Benefit Guaranty Corporation (PBGC) on July 9, 2021 announced an interim final rule implementing a new Special Financial Assistance (SFA) Program for financially troubled multiemployer defined benefit pension plans.

What struck me:

…..

It is expected that over 100 plans that would have otherwise become insolvent during the next 15 years will instead forestall insolvency as a direct result of receiving SFA. Section 9704 of ARP amends section 4005 of ERISA to establish an eighth fund for SFA from which PBGC will provide SFA to multiemployer plans under the program created by the addition of section 4262 of ERISA. The eighth fund will be credited with amounts from time to time as the Secretary of the Treasury, in conjunction with the Director of PBGC, determines appropriate, from the general fund of the Treasury Department. Transfers from the general fund to the eighth fund cannot occur after September 30, 2030. (page 6)

Unlike the financial assistance provided under section 4261 of ERISA, which is in the form of a loan and provided in periodic payments, a plan receiving SFA under section 4262 has no obligation to repay SFA, and PBGC must pay SFA in the form of a single, lump sum payment. (page 7)

Author(s): John Bury

Publication Date: 10 July 2021

Publication Site: burypensions