Excerpt:

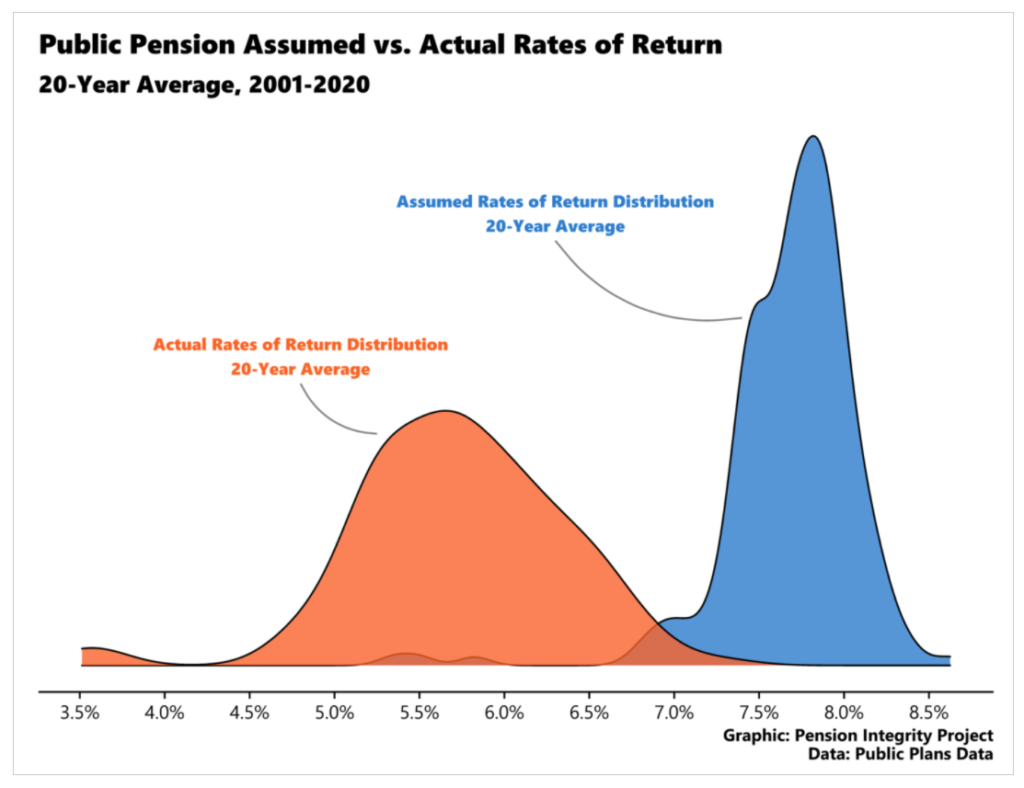

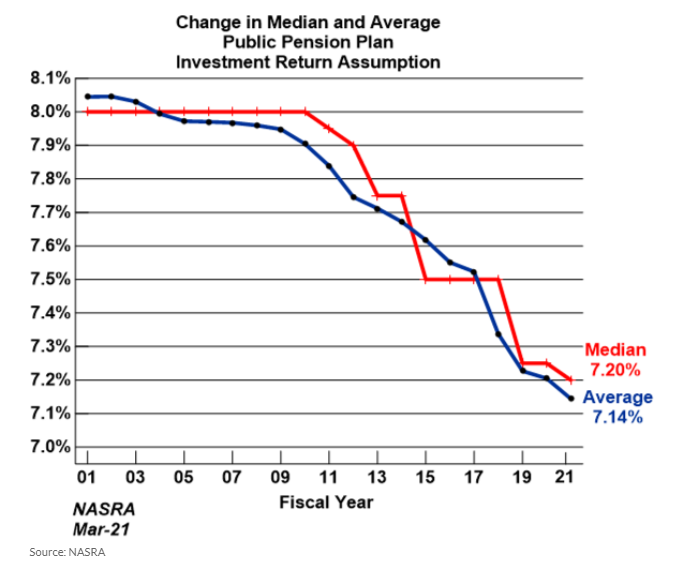

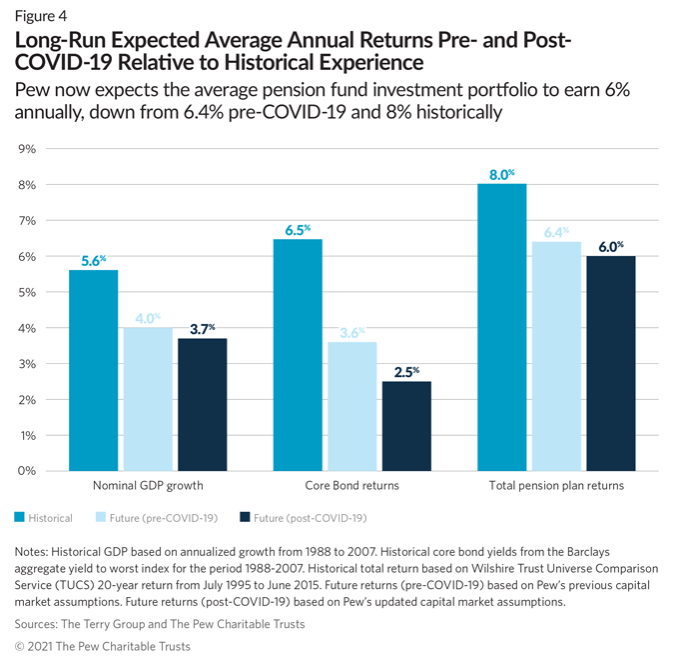

DiNapoli announced today that he’s approved a recommendation by the State Retirement System Actuary to reduce, from 6.8 percent to 5.9 percent, the assumed rate of return (RoR) on investments by the $268 billion Common Retirement Fund, which underwrites the New York State and Local Employee Retirement System (NYSLERS) and Police and Fire Retirement System (PFRS), of which the comptroller is the sole trustee.

To be sure, even at 5.9 percent, the RoR that the pension fund literally counts on to pay constitutionally guaranteed benefits will remain considerably higher than the yields from commensurate low-risk U.S. Treasury or high-quality corporate bonds, which currently range from 2.3 percent to 3.3 percent. Nonetheless, in isolation, cutting the RoR assumption is an unequivocally good and prudent thing for the comptroller to do.

Assuming lower earnings also tends to result in higher required contributions by employers—which is why politically sensitive public pension fund administrators across the country have tended to set their RoRs at much higher levels than those required for private corporate plans. To guard against volatility in investment returns, which has been especially pronounced over the past 25 years, DiNapoli and other pension fund administrators also resort to “asset smoothing” — i.e., counting average market returns over several years—as a basis for estimating the assets available to pay retirement benefits. In New York’s case, the smoothing period is five years.

Author(s): E.J. McMahon

Publication Date: 25 August 2021

Publication Site: Empire Center for Public Policy