Graphic:

Excerpt:

Regulators are carrying out a sweeping investigation of conflicts of interest at the nation’s largest accounting firms, asking whether consulting and other nonaudit services they sell undermine their ability to conduct independent reviews of public companies’ financials, according to people familiar with the matter.

The Securities and Exchange Commission probe highlights the agency’s new focus on financial-market gatekeepers such as accountants, bankers and lawyers. These firms help companies raise capital and communicate with shareholders, but also have duties under federal investor-protection laws. Auditors are a shareholder’s first line of defense against sloppy or dodgy accounting.

….

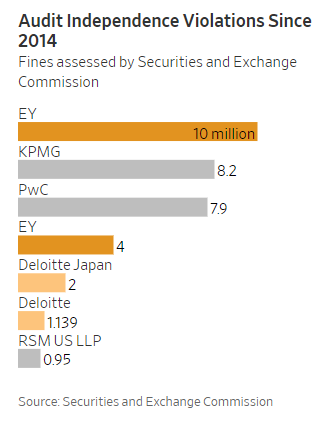

The Big Four audit 66% of all public companies with a market capitalization over $75 million, according to Audit Analytics. All four have paid fines to the SEC since 2014 to settle prior regulatory investigations of audit independence violations.

Author(s): Dave Michaels

Publication Date: 15 Mar 2022

Publication Site: WSJ