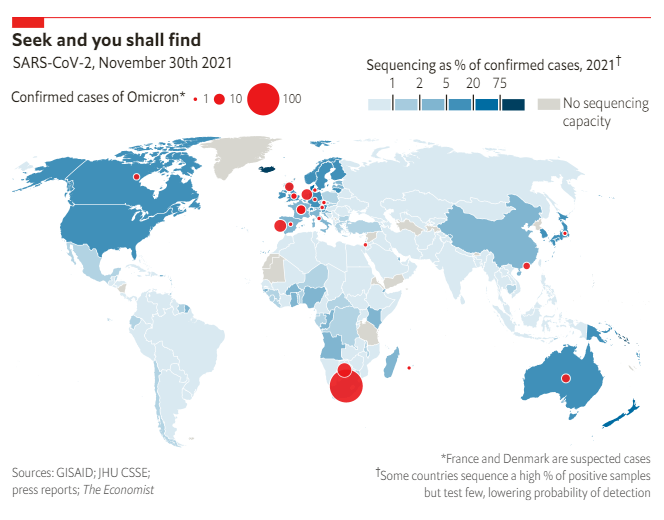

Link:https://www.economist.com/graphic-detail/2021/11/29/omicron-is-starting-to-spread-around-the-world

Graphic:

Excerpt:

Days after a new variant of SARS-CoV-2 was identified in southern Africa, countries around the world are confirming that they have found cases of it too. The new strain of the virus, B.1.1.529, was first detected in genetic samples from Botswana and South Africa. (Nearly 150 cases have been confirmed in southern Africa since, although the true number is thought to be higher.) On November 24th South Africa’s health authorities told the World Health Organisation, which quickly labelled it a “variant of concern” and assigned it the Greek letter Omicron. Just how long—and where—it has been circulating is not yet clear.

Publication Date: 29 Nov 2021

Publication Site: The Economist