Excerpt:

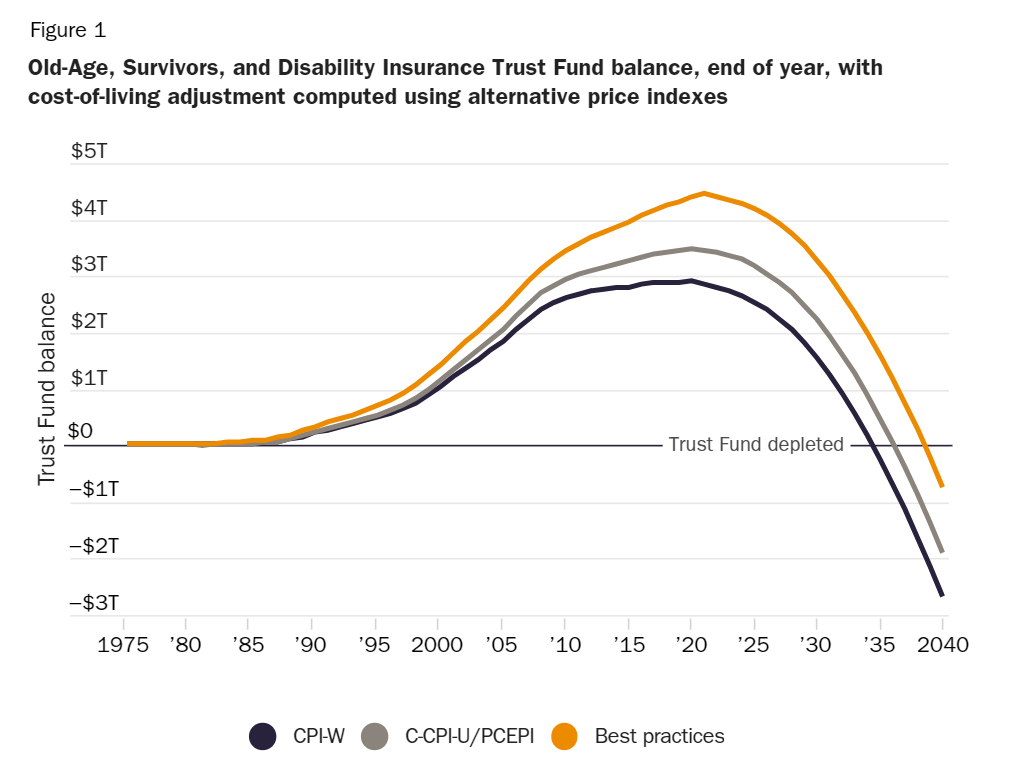

What wasn’t inevitable was a funding crisis. In fact, from 1950 to 1971, Congress was able to increase benefits nine times. That changed in 1977 when Social Security Amendments responded to a technical error in 1972 legislation which caused retirement benefits to skyrocket and threatened insolvency by 1979.

The 1977 law sought to slow the rapid growth in benefits for future retirees. At the time, Congress considered two options. The first, recommended by an expert commission headed by Harvard economist William Hsiao, would link the growth of the initial benefits paid to new retirees to the rate of inflation. The second approach, favored by the Carter administration, would index initial benefits to national average wage growth.

While differing only in seemingly technical ways, the two approaches had dramatically different effects on Social Security’s long-term finances. Simply put, the Hsiao Commission’s recommendation was fully sustainable under then-legislated tax rates. It would allow, as the commission wrote, “future generations to decide what benefit increases are appropriate and what tax rates to finance them are acceptable.”

In contrast, the alternative approach of “wage-indexing” initial benefits could not be sustained without substantially higher future taxes.

The Hsiao Commission bluntly criticized that policy, saying that it “gravely doubts the fairness and wisdom of now promising benefits at such a level that we must commit our sons and daughters to a higher tax rate than we ourselves are willing to pay.” Congress, nevertheless, opted for wage indexing.

Author(s): ANDREW G. BIGGS, JOHN F. COGAN AND DANIEL HEIL

Publication Date: 17 Oct 2023

Publication Site: The Hill