Graphic:

Excerpt:

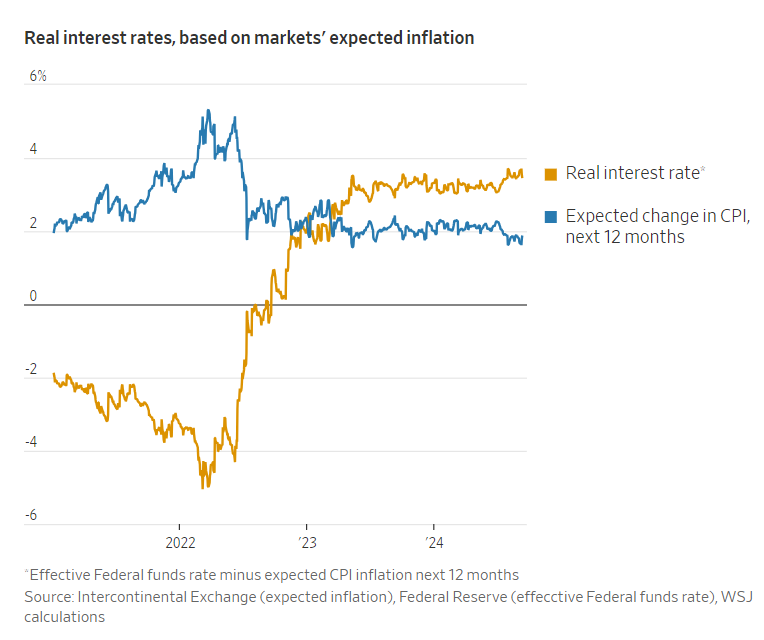

A year ago inflation as measured by the consumer-price index was 3.2%. In August, it was 2.5%. In that time, core inflation, which excludes food and energy, has fallen from 4.2% to an estimated 2.7%, using the Fed’s preferred gauge, the price index of personal-consumption expenditures, or PCE.

The gap between 2.7% and the Fed’s 2% target largely reflects the lagged effects of higher housing, auto and other prices from a few years ago. Some alternative indexes attempt to exclude such idiosyncratic factors. Harvard University economist Jason Furman averages several over different time horizons to yield a single, PCE-equivalent underlying inflation rate. It was 2.2% in August, the lowest since early 2021.

Inflation is likely to keep falling. Oil has plunged from $83 a barrel in early July to below $70 on Friday. This will directly lower headline inflation and, indirectly, core inflation because oil is an input into almost every business. A study by Robert Minton, now at the Fed, and Brian Wheaton at the University of California, Los Angeles, found oil can explain 16% of fluctuations in core inflation, and it takes two years for 80% of the effect to show up.

Author(s): Greg Ip

Publication Date: 15 Sept 2024

Publication Site: WSJ