Graphic:

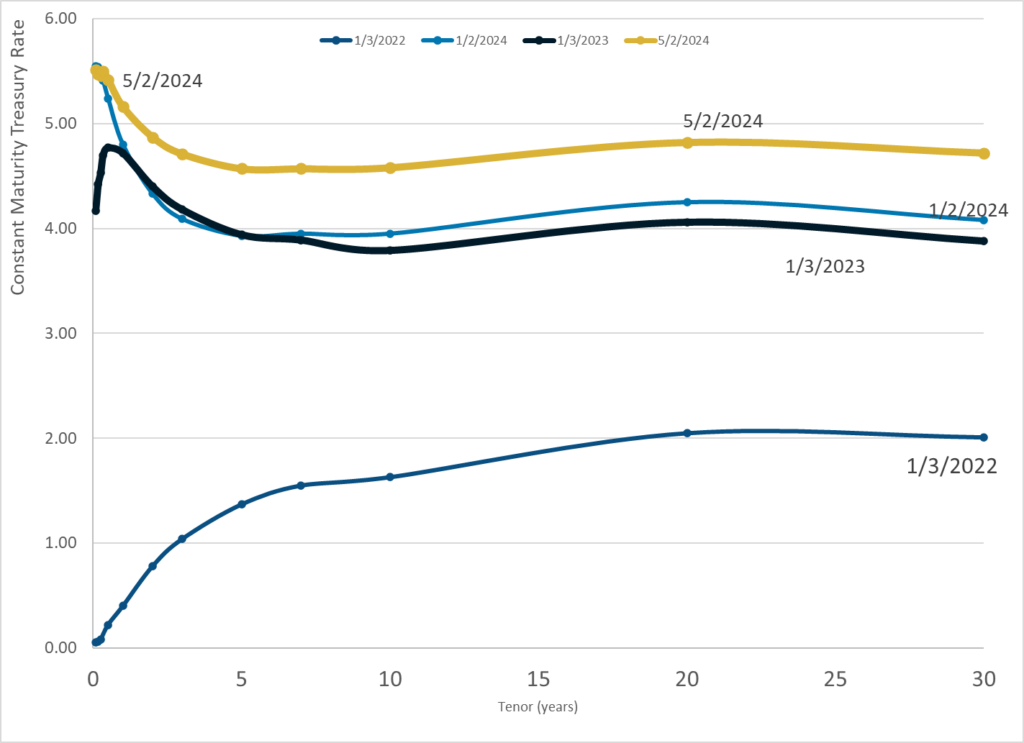

Publication Date: 6 May 2024

Publication Site: Treasury Dept

All about risk

Graphic:

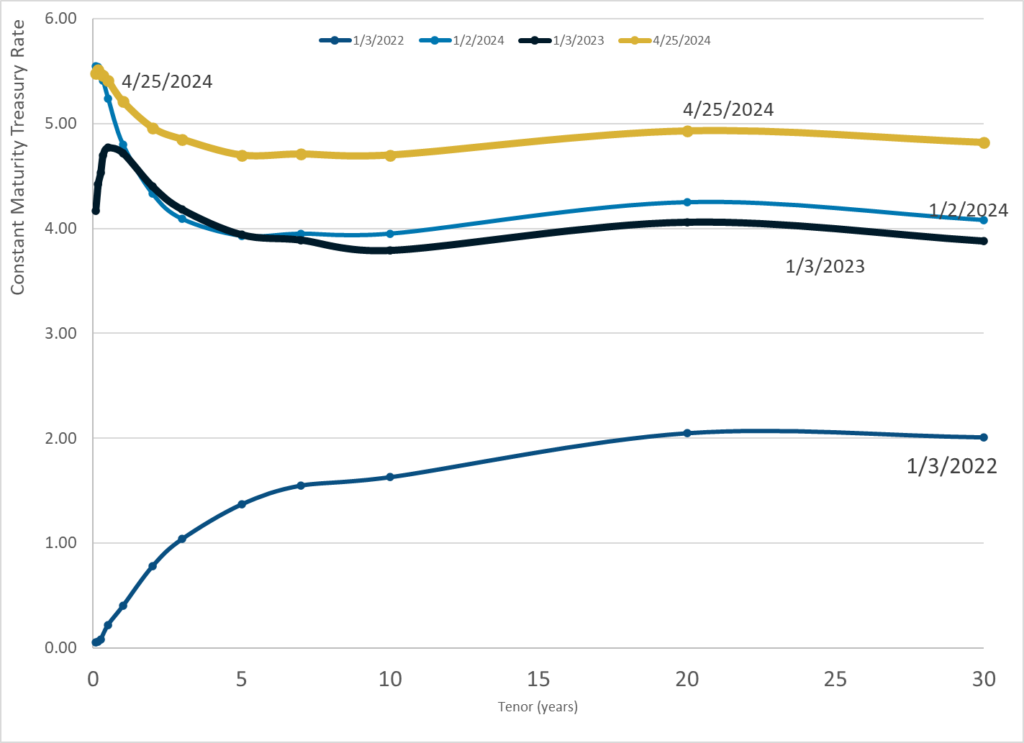

Publication Date: 6 May 2024

Publication Site: Treasury Dept

Graphic:

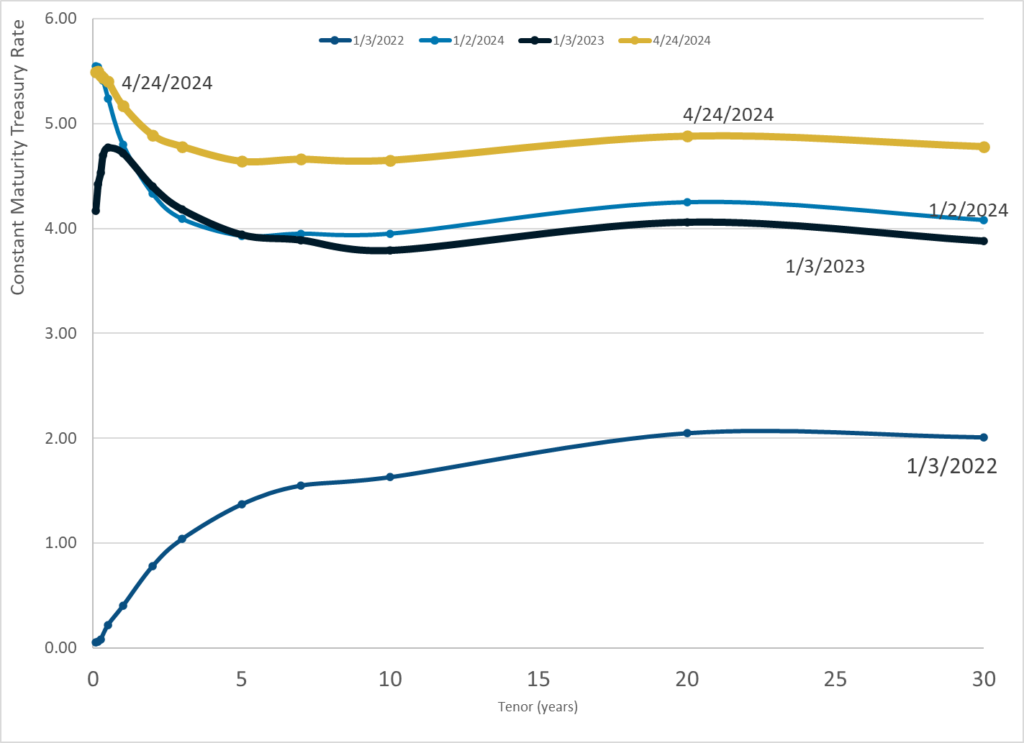

Publication Date: 2 May 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 25 Apr 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 24 Apr 2024

Publication Site: Treasury Dept

Graphic:

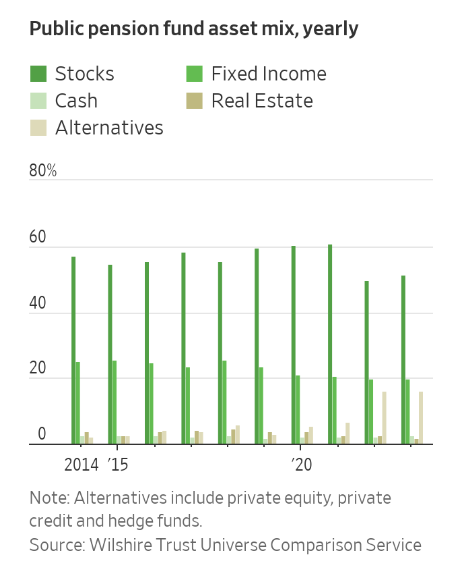

Excerpt:

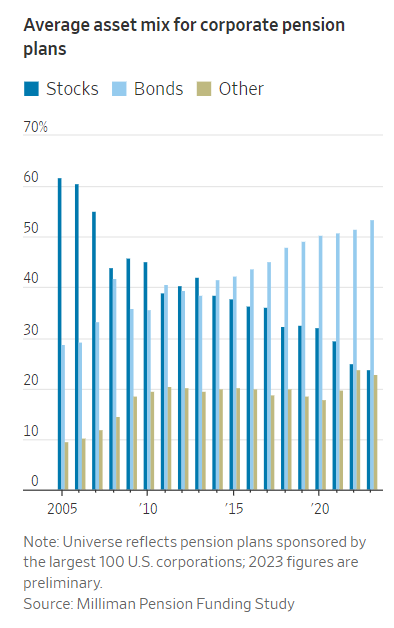

Stock portfolios at large pension funds had a blockbuster run. Now, managers are cashing out.

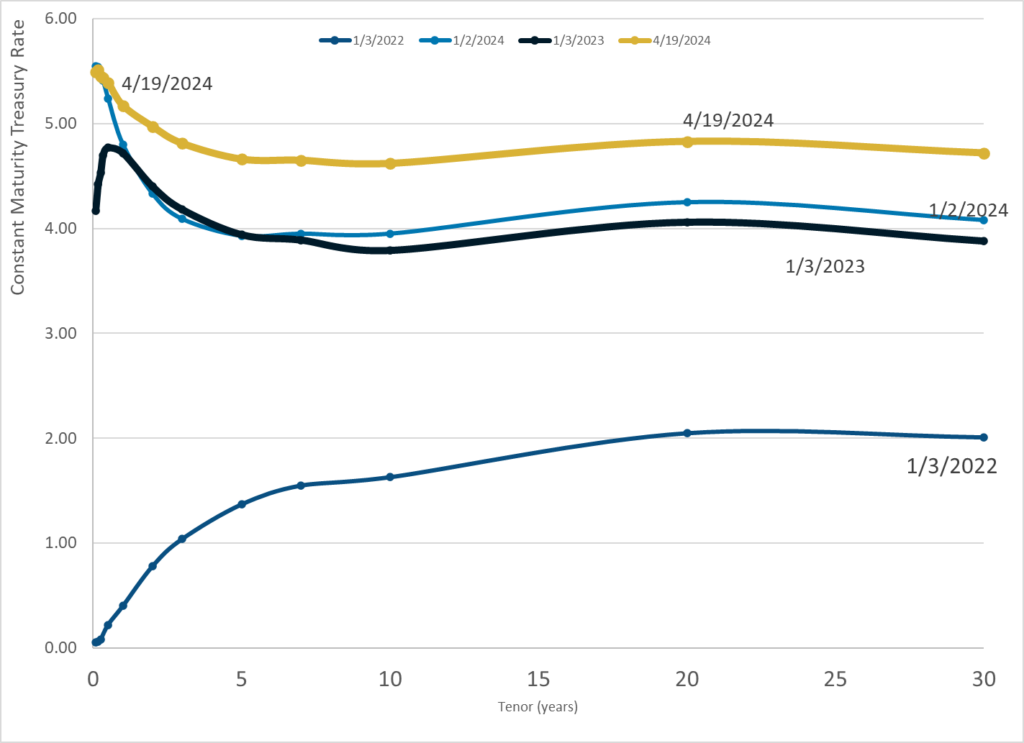

Corporate pension funds are shifting money into bonds. State and local government funds are swapping stocks for alternative investments. The nation’s largest public pension, the California Public Employees’ Retirement System, is planning to move close to $25 billion out of equities and into private equity and private debt.

Like investors of all kinds, the funds are slowly adapting to a world of yield, where they can get sizable returns on risk-free assets. That is rippling throughout markets, as investors assess how much risk they want to take on. Moving out of stocks could mean surrendering some potential gains. Hold too much, for too long, and prices might fall.

Author(s): Heather Gillers, Charley Grant

Publication Date: 18 Apr 2024

Publication Site: WSJ

Graphic:

Publication Date: 19 Apr 2024

Publication Site: Treasury Dept

Link: https://www.wsj.com/us-news/homeless-california-mental-illness-care-court-f63d2027

Excerpt:

Disruptions in mental-health care during the pandemic left many Americans vulnerable. Among people ages 18 to 44, insurance claims related to psychotic episodes rose 30% to 2 million in 2023 from 2019, according to LexisNexis Risk Solutions, a data-analytics company. Around the U.S., hospitals are overwhelmed. Emergency rooms are adding security guards. Jails serve as a last resort for those unable to care for themselves.

Author(s): Julie Wernau

Publication Date: 23 Mar 2024

Publication Site: WSJ

Link: https://www.fastcompany.com/91041966/us-yearly-lightning-ground-strikes-damage-prevention

Graphic:

Excerpt:

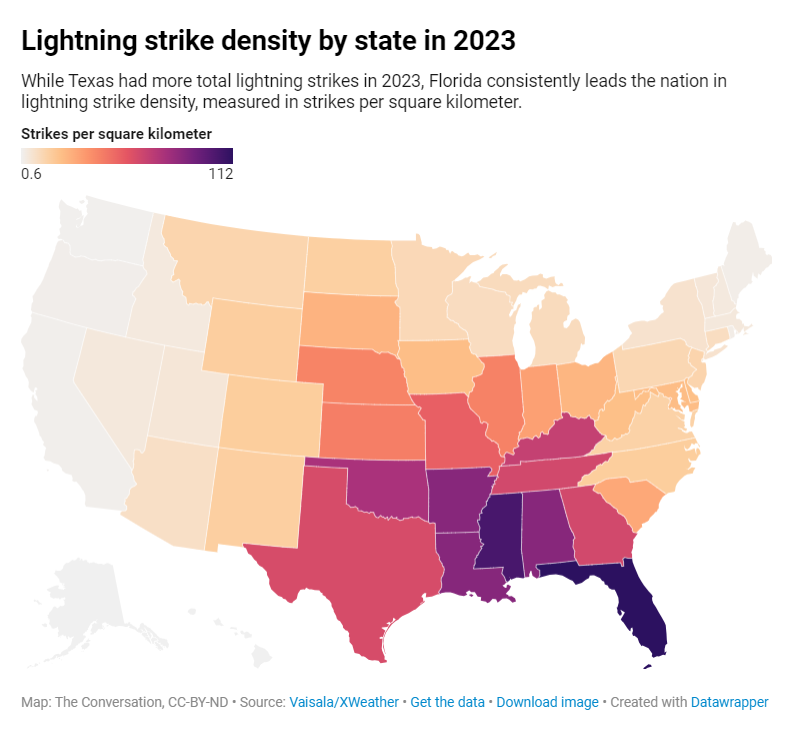

Lightning kills or injures about 250,000 people around the world every year, most frequently in developing countries, where many people work outside without lightning-safe shelters nearby. In the United States, an average of 28 people were killed by lightning every year between 2006 and 2023. Each year, insurance pays about $1 billion in claims for lightning damage, and around 4 million acres of land burn in lightning-caused wildfires.

Author(s): Chris Vagasky

Publication Date: 2 Mar 2024

Publication Site: Fast Company

Link: https://www.cnn.com/2024/02/09/health/why-autoimmune-disease-affects-more-women-study-scn/index.html

Excerpt:

Why women are at greater risk of autoimmune disease such as multiple sclerosis, lupus and rheumatoid arthritis is a long-standing medical mystery, and a team of researchers at Stanford University may now be a step closer to unraveling it.

How the female body handles its extra X chromosome (the male body has just one plus a Y chromosome) might be a factor that helps explain why women are more susceptible to these types of disorders, a new study has suggested. The predominantly chronic conditions involve an off-kilter immune system attacking its own cells and tissues.

While the research involving experiments on mice is preliminary, the observation, after further study, may help inform new treatments and ways to diagnose the diseases, said Dr. Howard Chang, senior author of the paper published in the journal Cell on February 1.

….

Other researchers had focused on the disorders’ “female bias” by analyzing sex hormones or chromosome counts. Chang instead zoned in on the role played by a molecule called Xist (pronounced exist) that is not present in male cells.

The Xist molecule’s main job is to deactivate the second female X chromosome in embryos, ensuring that the body’s cells don’t get a potentially toxic double whammy of the chromosome’s protein-coding genes.

“Xist is a very long RNA, 17,000 nucleotides long, or letters, and it associates with approximately almost 100 proteins,” Chang said. Xist molecules work with those proteins to shut down gene expression in the second X chromosome.

Author(s): Katie Hunt

Publication Date: 9 Feb 2024

Publication Site: CNN Health

Link: https://nymag.com/intelligencer/article/staged-car-crashes-insurance-fraud.html

Graphic:

Excerpt:

There’s a narrow path to such ostentation for the non-famous and non-college-interested who mock the idea of an actual job. Mize found his muse in the con and his ability to rope others into it. Here’s how they say it happened: He struck when you wanted cash. When totems of the middle class were slipping from reach. When you needed a down payment. To pay off credit cards. To start a business. When asking your parents for money made you feel like a failure. When you were suffocated by medical bills, neither earning enough to pay nor poor enough for government help.

Yet money alone doesn’t completely explain why the people closest to Mize entered the ring. Mize had a way of making himself your center of gravity, the one from whom you wanted approval, mentorship, love. Mize could be fun, even thrilling. But getting all that meant pleasing him. And pleasing him meant fraud.

Author(s): Lauren Smiley

Publication Date: 3 Oct 2022

Publication Site: NY Mag

Excerpt:

The Dallas Police and Fire Pension System — which as been severely underfunded for years — still has about 25% of its assets tied up in private investments.

That’s according to pension system official’s briefing during Thursday’s Ad Hoc Committee on Pensions meeting.

Those include investments in an energy fund, natural resources — and assets in real estate. The private investments were deemed “legacy” assets that the pension system still maintains.

It was risky private investments that landed the system in the situation it’s in now — with over a billion dollars in unfunded liabilities.

“Currently we’ve gotten that down to 26%,” Dallas Police and Fire Pension System Chief Investment Officer Ryan Wagner said during the meeting.

Author(s): Nathan Collins

Publication Date: 9 Feb 2024

Publication Site: KERA News

Link: https://www.macs.hw.ac.uk/~andrewc/papers/JRSS2016B.pdf

Graphic:

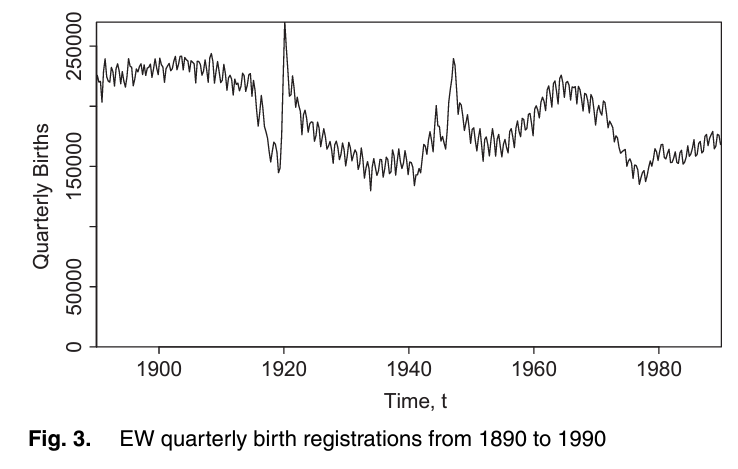

Summary:

The analysis of national mortality trends is critically dependent on the quality of the population, exposures and deaths data that underpin death rates. We develop a framework that allows us to assess data reliability and to identify anomalies, illustrated, by way of example, using England and Wales population data. First, we propose a set of graphical diagnostics that help to pinpoint anomalies. Second, we develop a simple Bayesian model that allows us to quantify objectively the size of any anomalies. Two-dimensional graphical diagnostics and modelling techniques are shown to improve significantly our ability to identify and quantify anomalies. An important conclusion is that significant anomalies in population data can often be linked to uneven patterns of births of people in cohorts born in the distant past. In the case of England and Wales, errors of more than 9% in the estimated size of some birth cohorts can be attributed to an uneven pattern of births. We propose methods that can use births data to improve estimates of the underlying population exposures. Finally, we consider the effect of anomalies on mortality forecasts and annuity values, and we find significant effects for some cohorts. Our methodology has general applicability to other sources of population data, such as the Human Mortality Database.

Keywords: Baby boom;Cohort–births–deaths exposures methodology; Convexity adjustment ratio; Deaths; Graphical diagnostics; Population data

Author(s): Andrew J.G.Cairns, Heriot-Watt University, Edinburgh, UK David Blake, Cass Business School, London, UK Kevin Dowd Durham University Business School, UK and Amy R. Kessler Prudential Retirement, Newark, USA

Publication Date: 2016

Publication Site: Journal of the Royal Statistical Society

J. R. Statist. Soc. A (2016) 179, Part 4, pp. 975–1005