Graphic:

Publication Date: 27 Jun 2025

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 27 Jun 2025

Publication Site: Treasury Dept

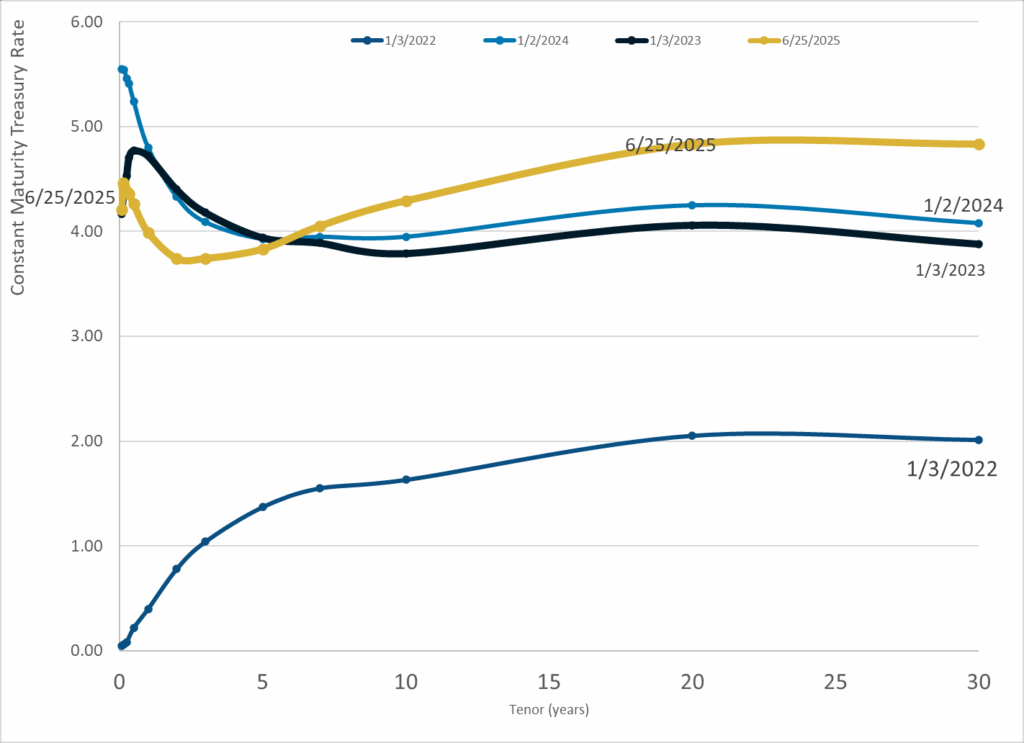

Graphic:

Publication Date: 25 Jun 2025

Publication Site: Treasury Dept

Graphic:

Publication Date: 12 Jun 2025

Publication Site: Treasury Dept

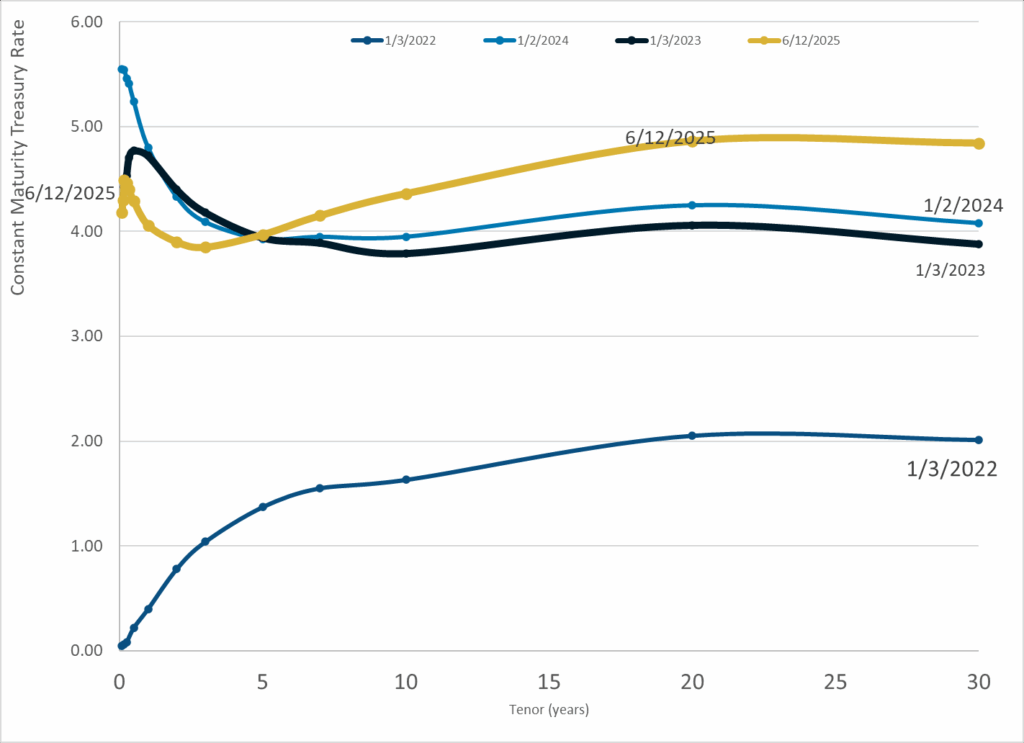

Graphic:

Publication Date: 22 May 2025

Publication Site: Treasury Dept

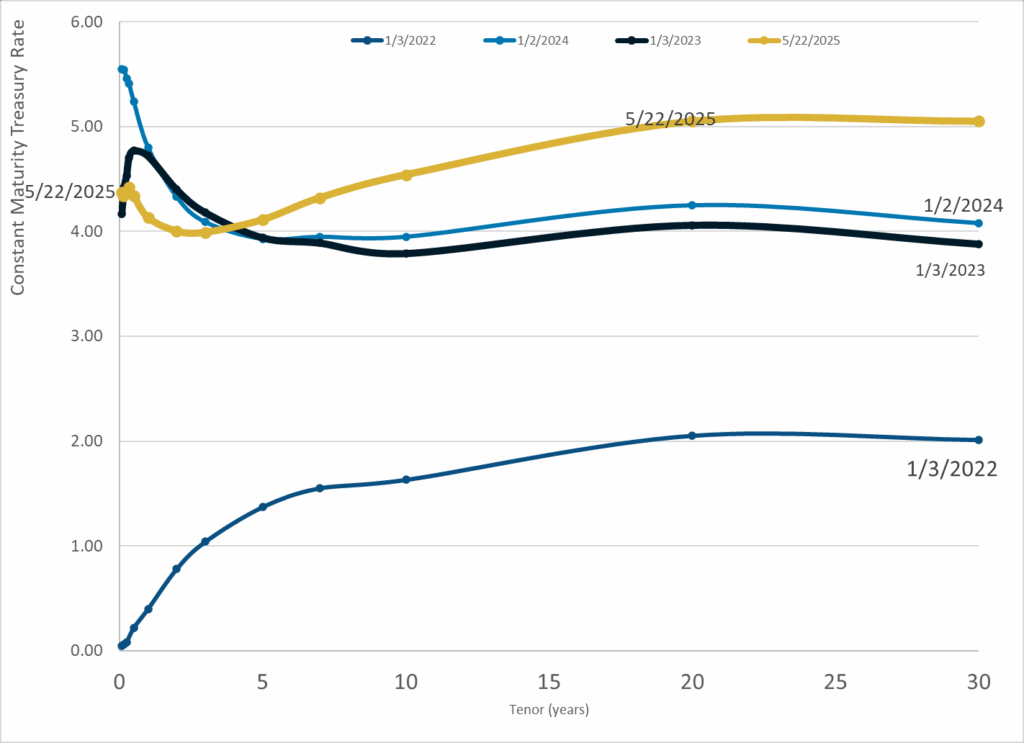

Graphic:

Publication Date: 16 May 2025

Publication Site: Treasury Dept

Graphic:

Publication Date: 29 Apr 2025

Publication Site: Treasury Dept

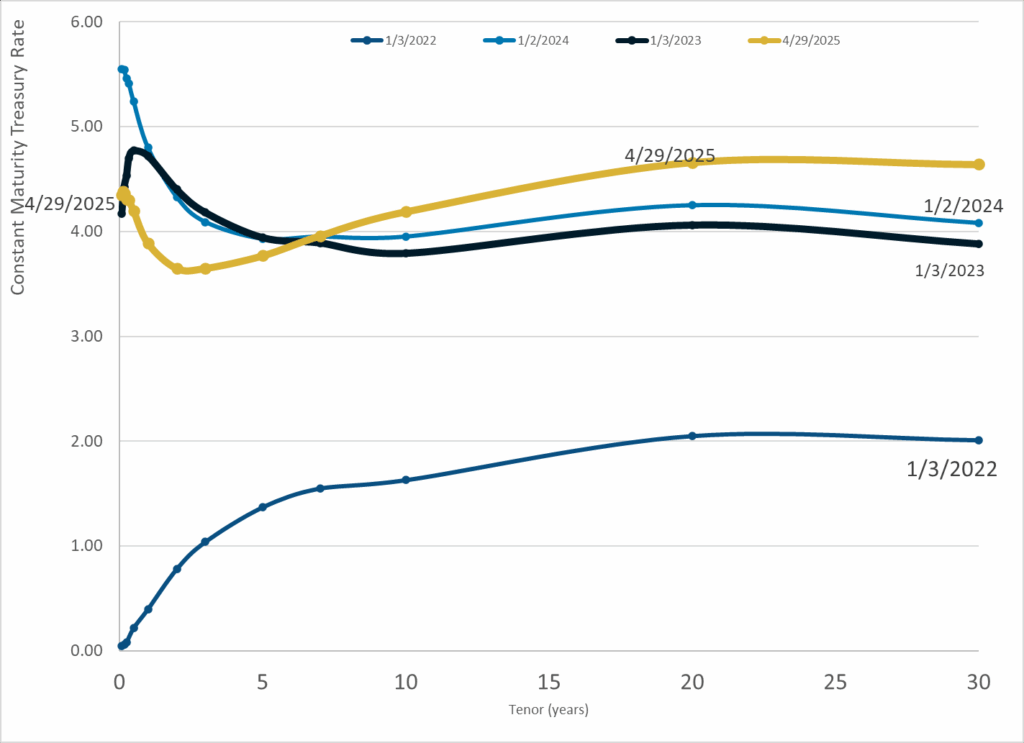

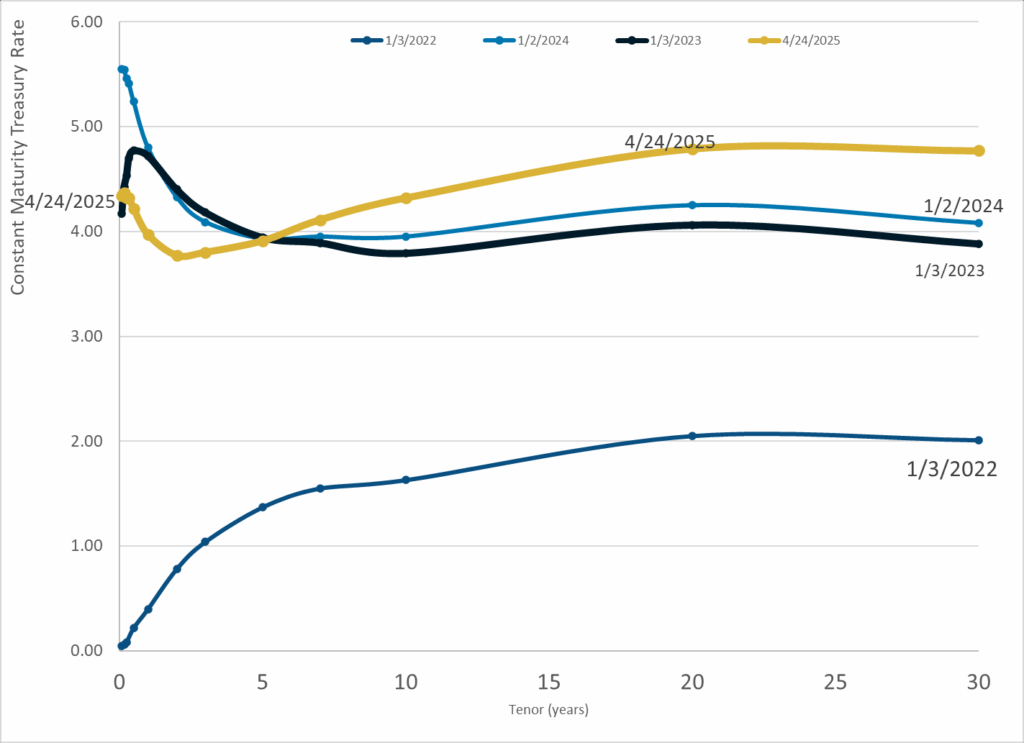

Graphic:

Publication Date: 24 Apr 2025

Publication Site: Treasury Dept

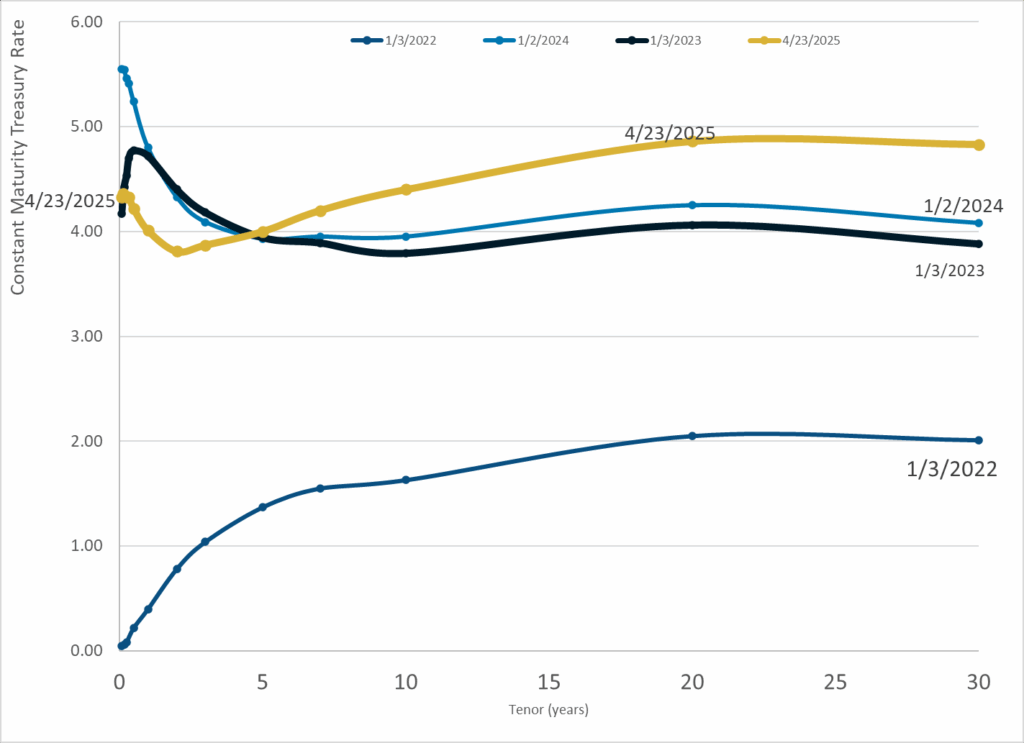

Graphic:

Publication Date: 23 Apr 2025

Publication Site: Treasury Dept

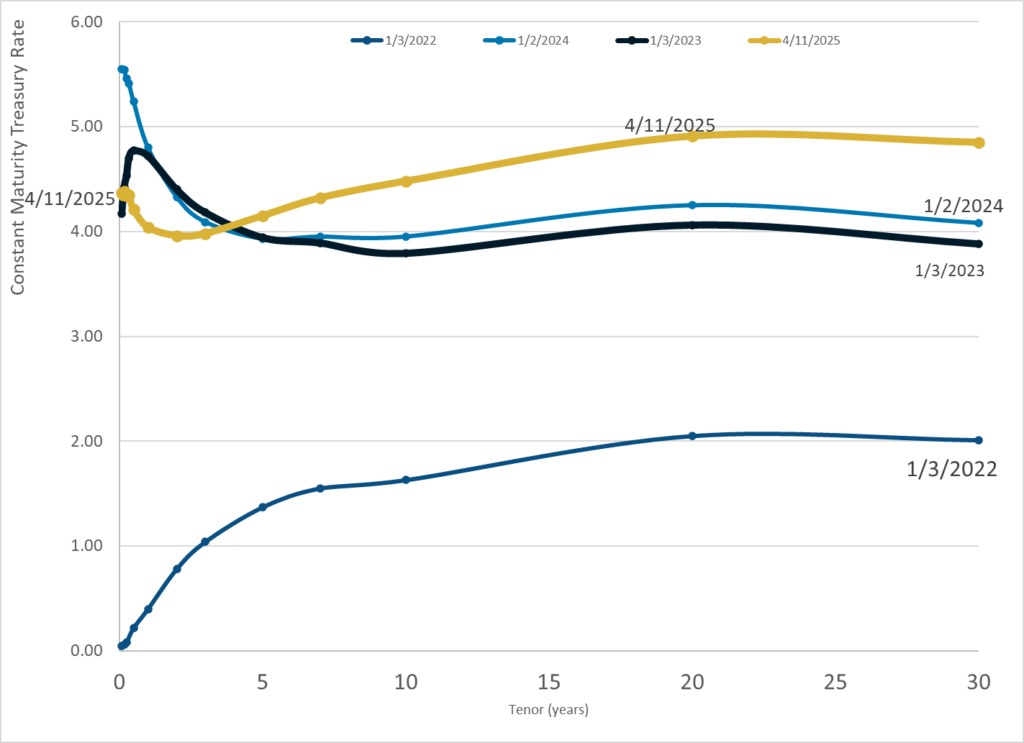

Graphic:

Publication Date: 11 Apr 2025

Publication Site: Treasury Dept

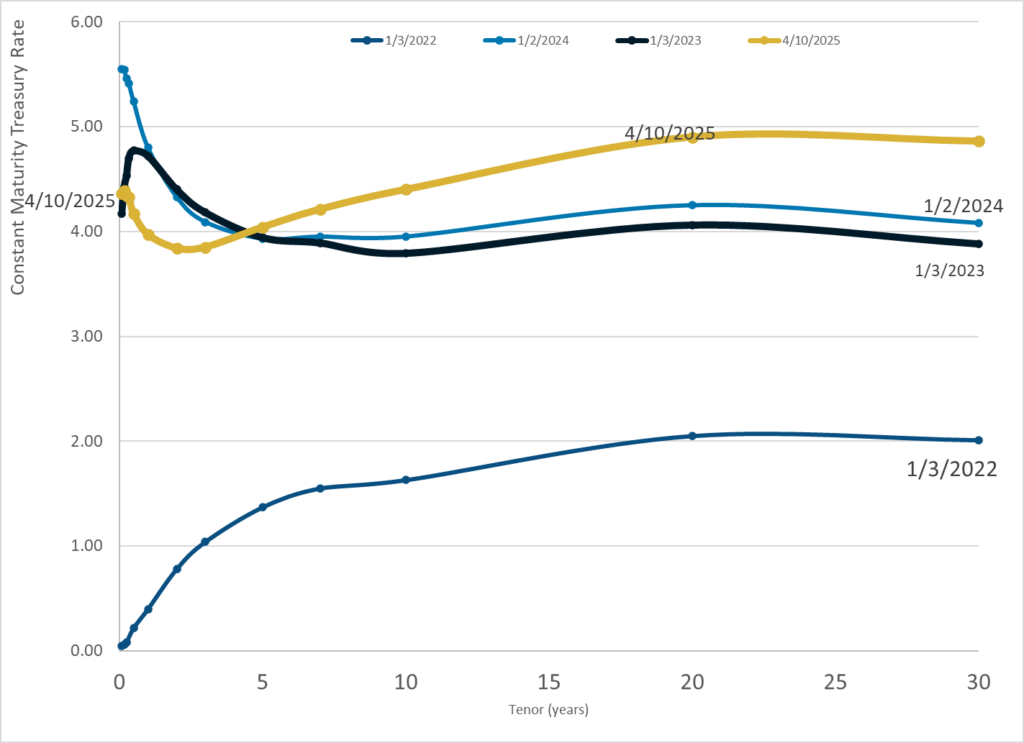

Graphic:

Publication Date: 10 Apr 2025

Publication Site: Treasury Dept

Graphic:

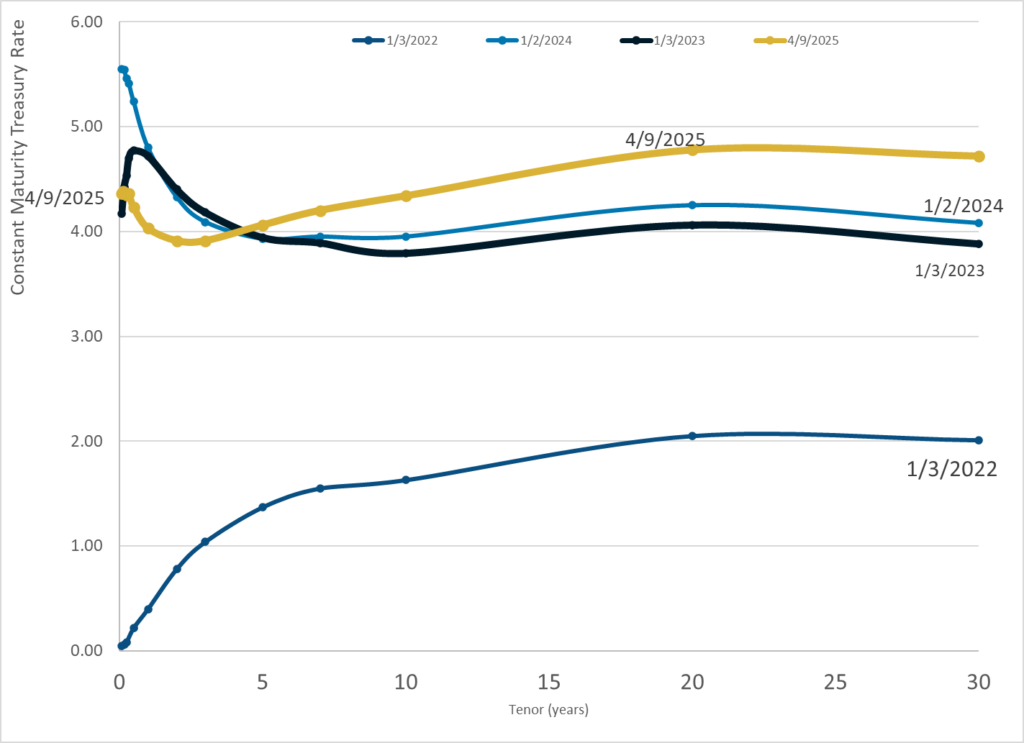

Publication Date: 9 Apr 2025

Publication Site: Treasury Dept

Graphic:

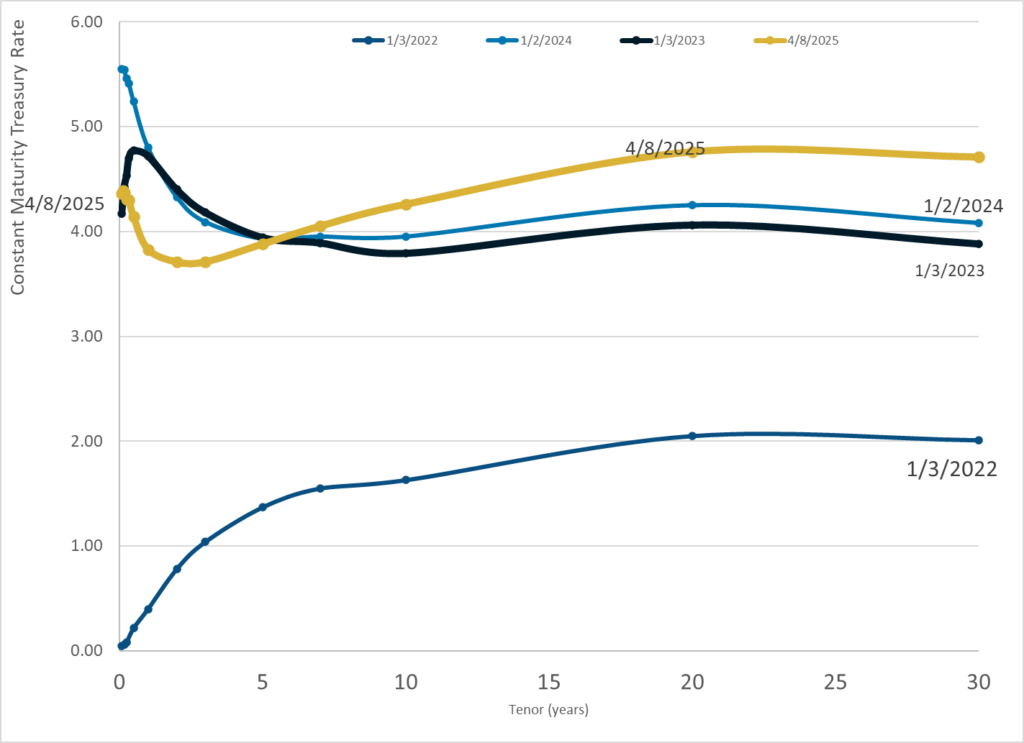

Publication Date: 8 Apr 2025

Publication Site: Treasury Dept