Graphic:

Publication Date: 6 May 2024

Publication Site: Treasury Dept

All about risk

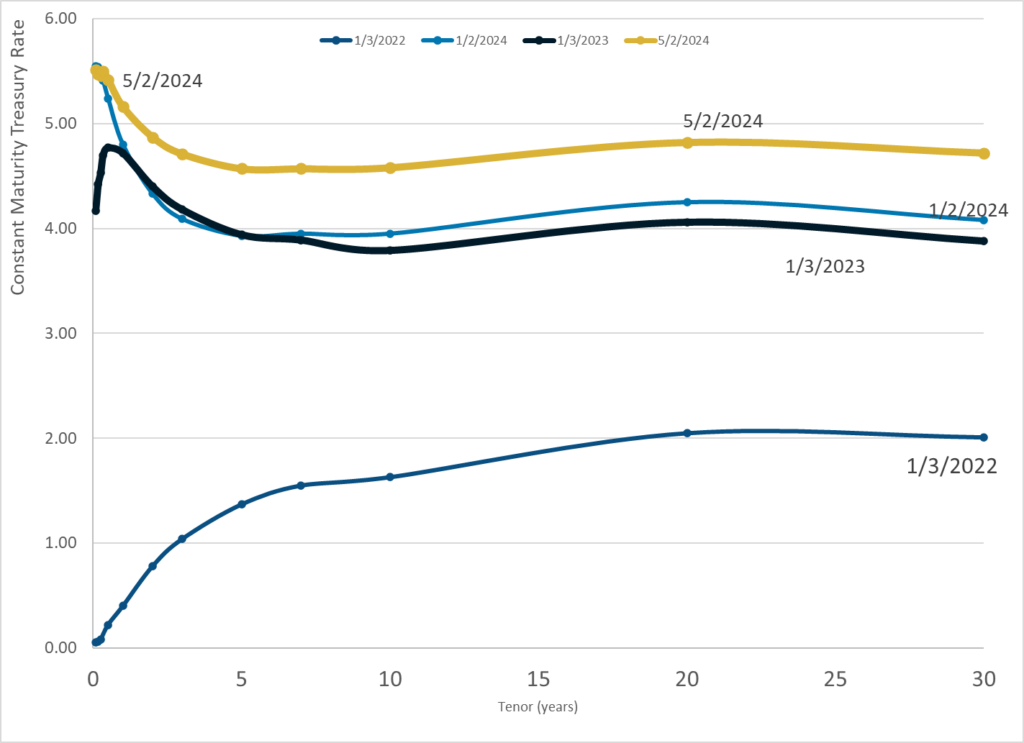

Graphic:

Publication Date: 6 May 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 2 May 2024

Publication Site: Treasury Dept

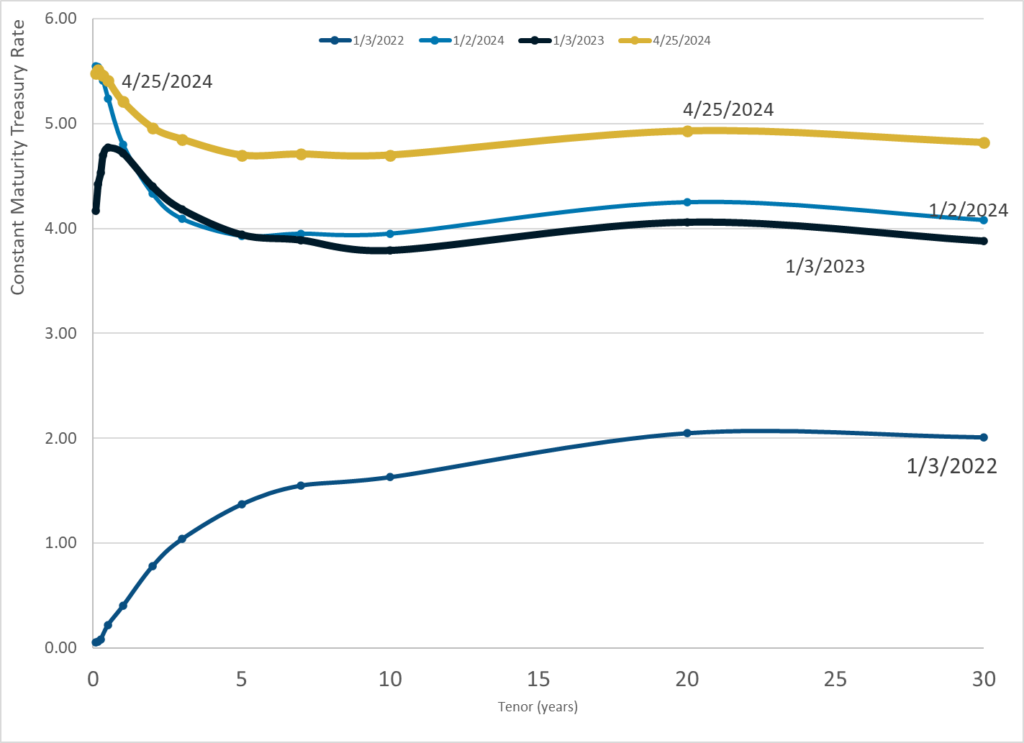

Graphic:

Publication Date: 25 Apr 2024

Publication Site: Treasury Dept

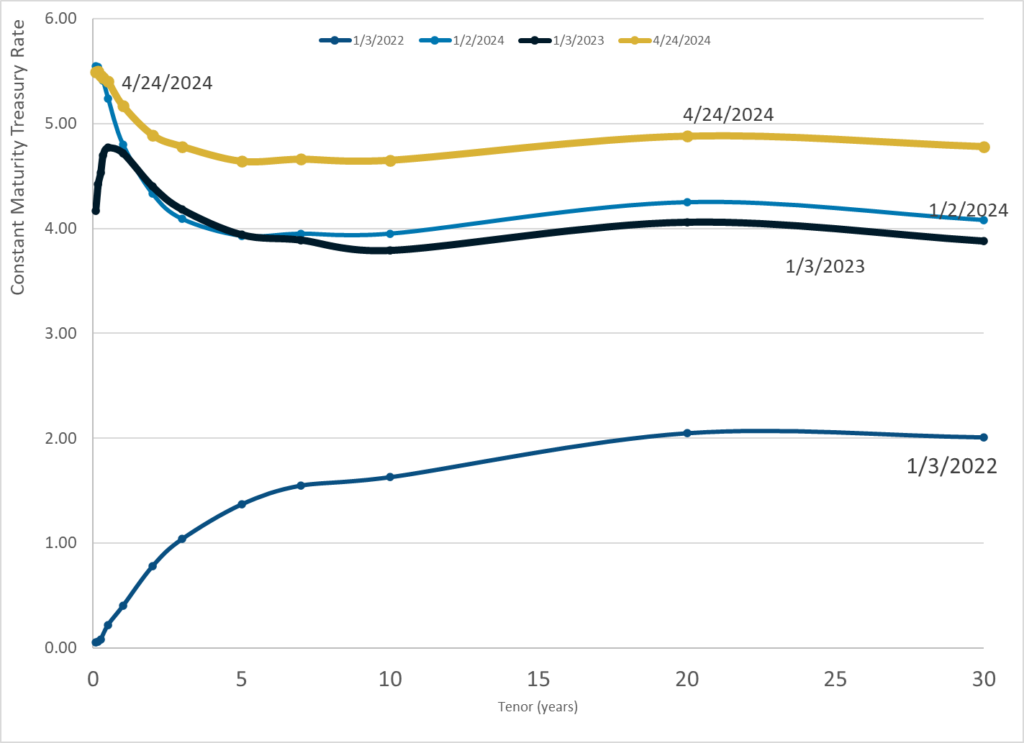

Graphic:

Publication Date: 24 Apr 2024

Publication Site: Treasury Dept

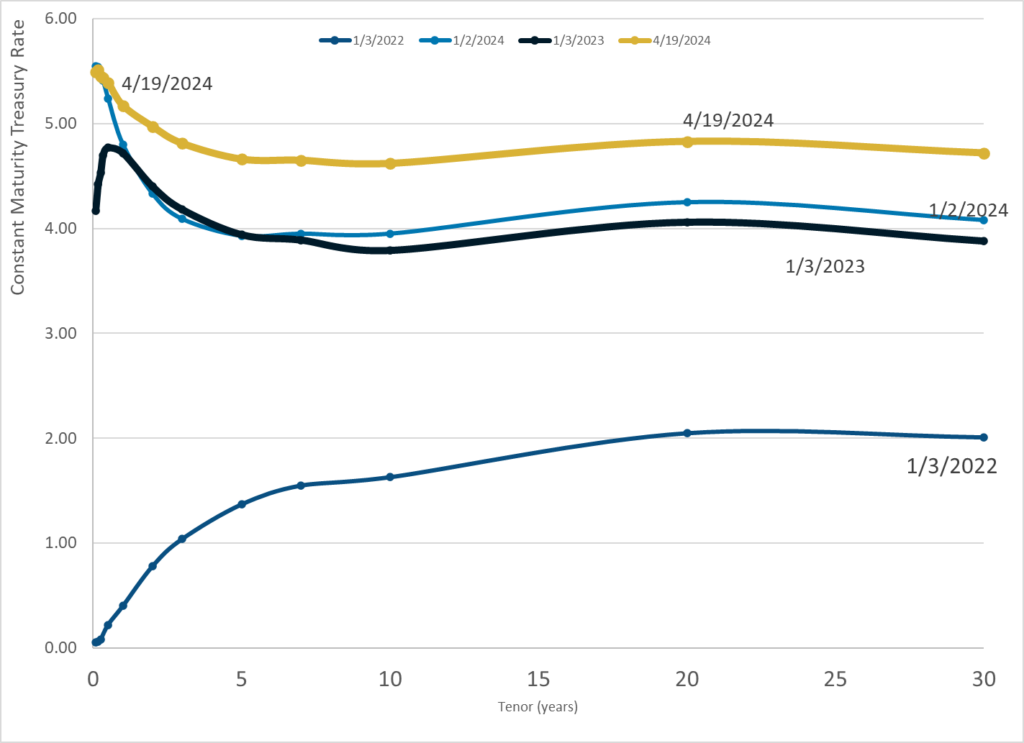

Graphic:

Publication Date: 19 Apr 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 5 Apr 2024

Publication Site: Treasury Dept

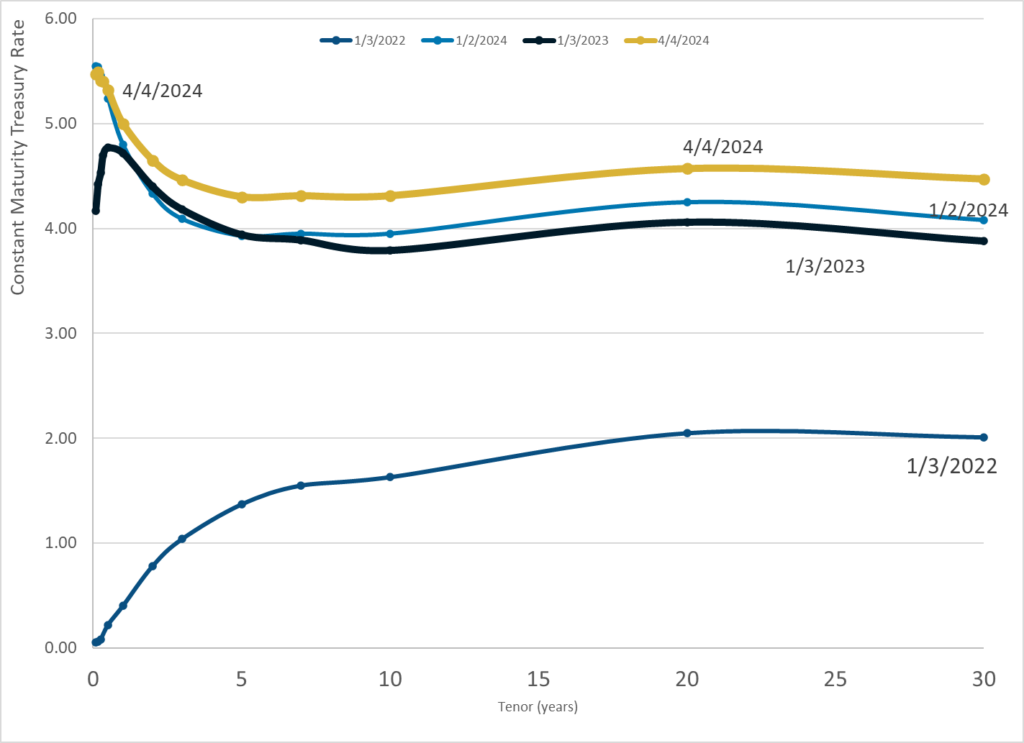

Graphic:

Publication Date: 4 Apr 2024

Publication Site: Treasury Dept

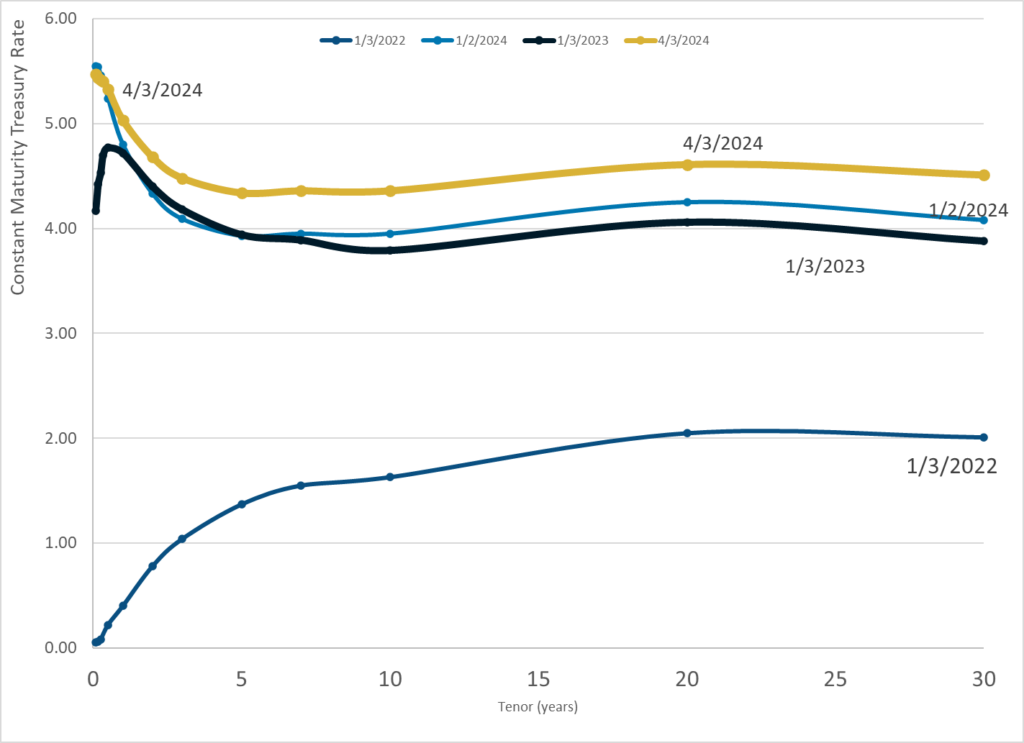

Graphic:

Publication Date: 3 Apr 2024

Publication Site: Treasury Dept

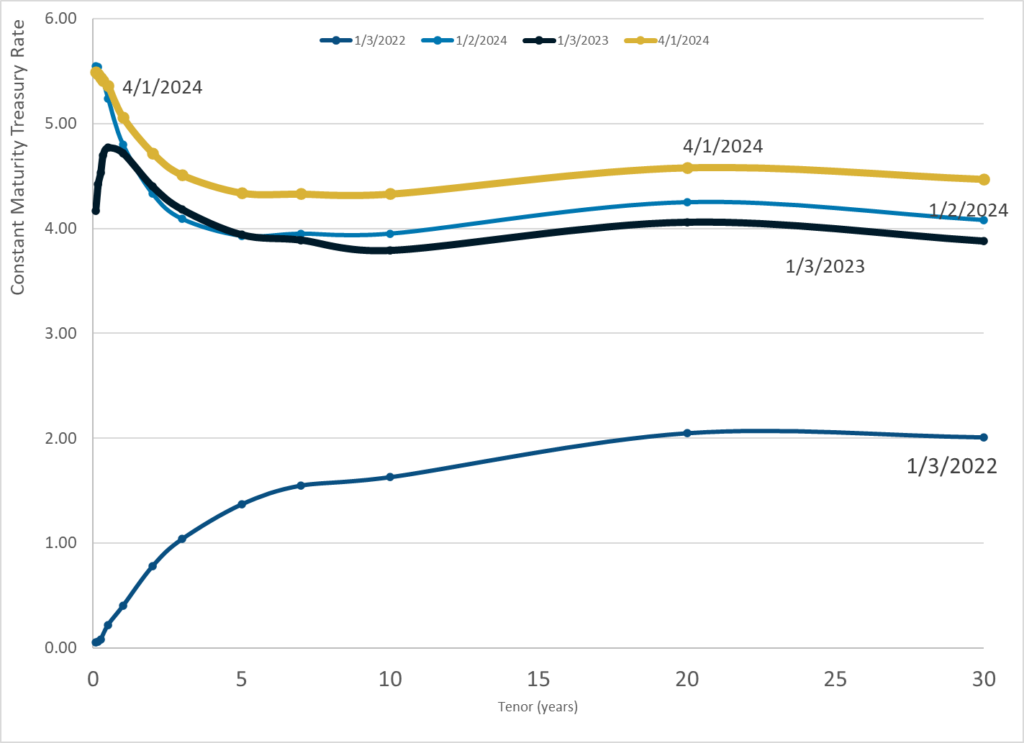

Graphic:

Publication Date: 1 Apr 2024

Publication Site: Treasury Dept

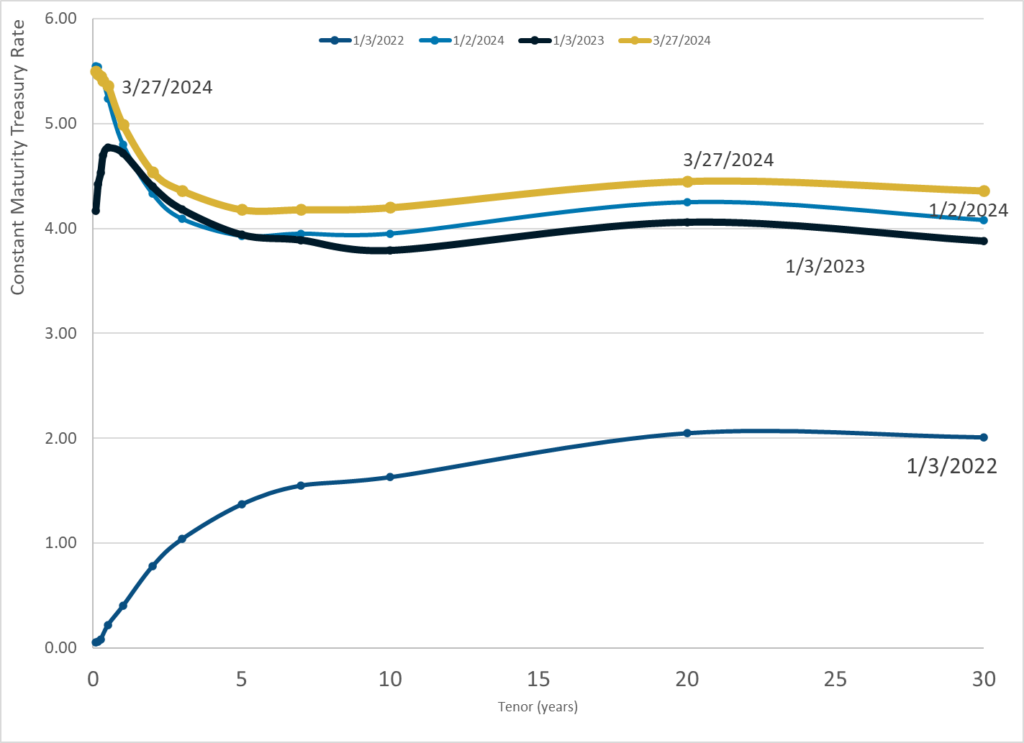

Graphic:

Publication Date: 27 Mar 2024

Publication Site: Treasury Dept

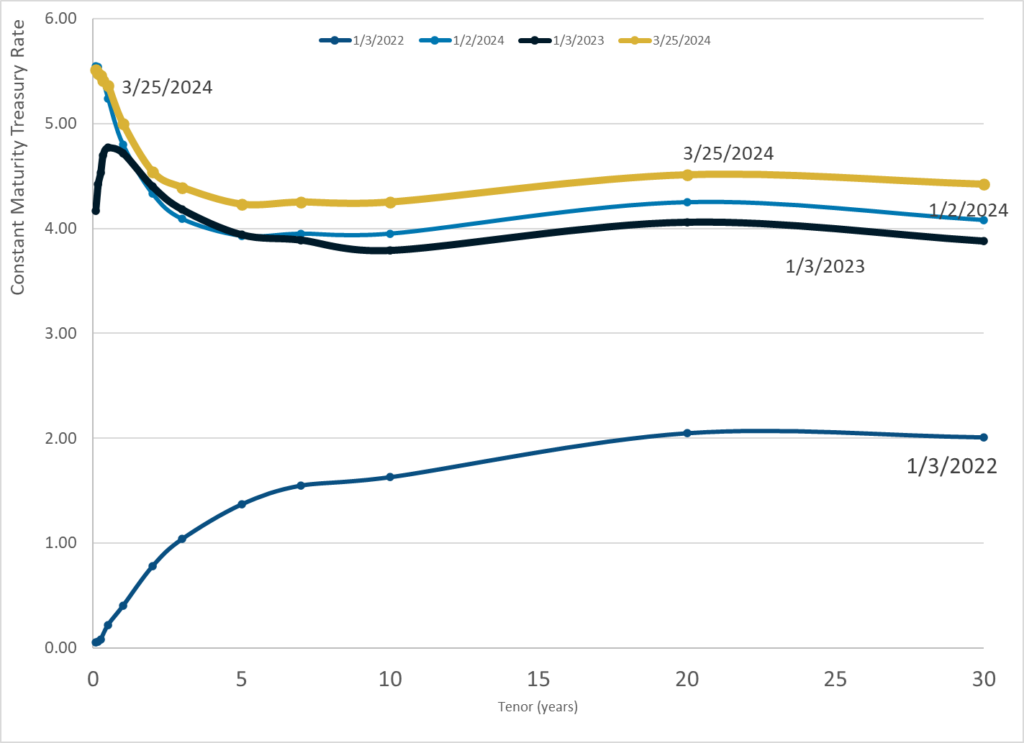

Graphic:

Publication Date: 25 Mar 2024

Publication Site: Treasury Dept

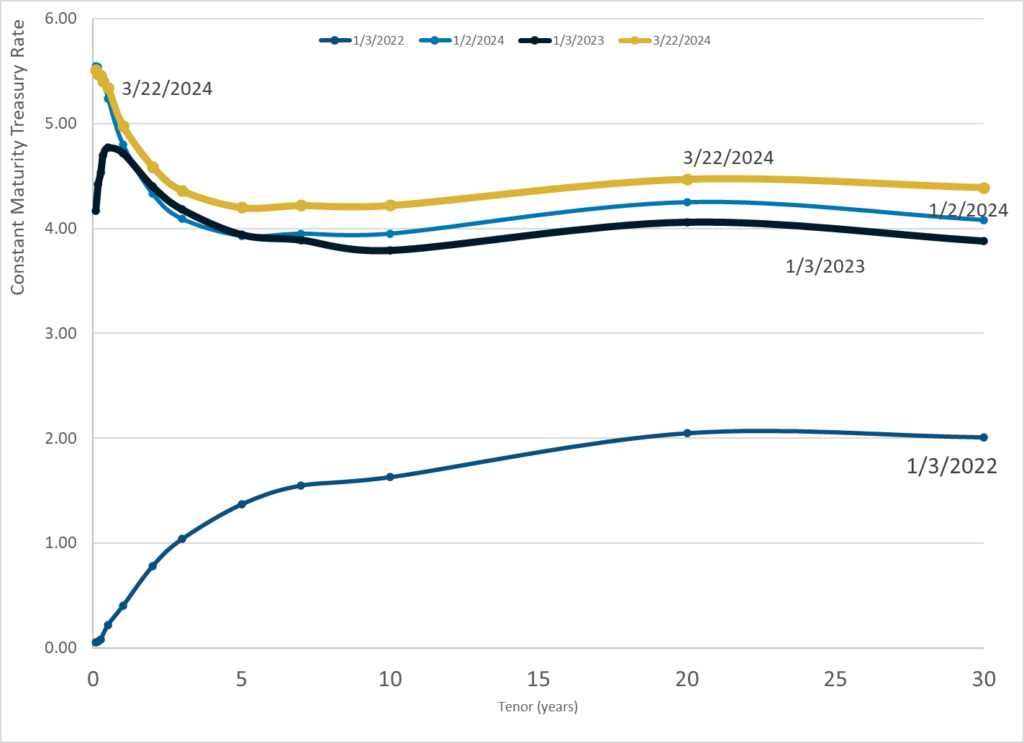

Graphic:

Publication Date: Treasury Dept

Publication Site: 22 Mar 2024