Graphic:

Publication Date: 6 May 2024

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 6 May 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 2 May 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 25 Apr 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 24 Apr 2024

Publication Site: Treasury Dept

Graphic:

Excerpt:

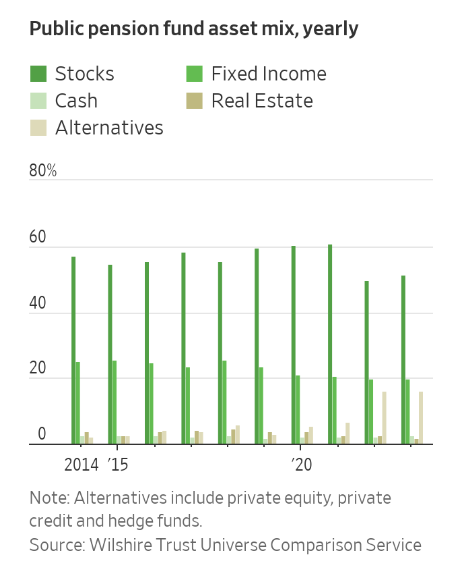

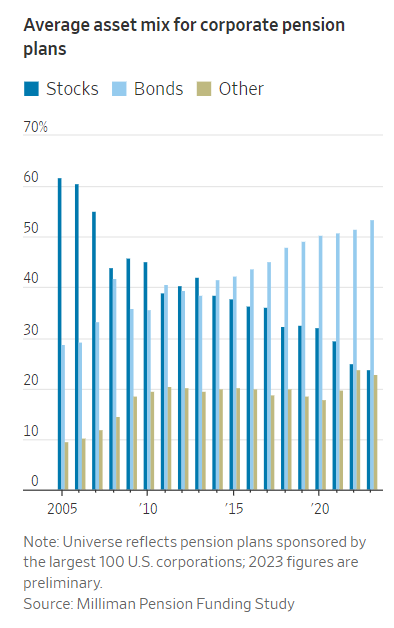

Stock portfolios at large pension funds had a blockbuster run. Now, managers are cashing out.

Corporate pension funds are shifting money into bonds. State and local government funds are swapping stocks for alternative investments. The nation’s largest public pension, the California Public Employees’ Retirement System, is planning to move close to $25 billion out of equities and into private equity and private debt.

Like investors of all kinds, the funds are slowly adapting to a world of yield, where they can get sizable returns on risk-free assets. That is rippling throughout markets, as investors assess how much risk they want to take on. Moving out of stocks could mean surrendering some potential gains. Hold too much, for too long, and prices might fall.

Author(s): Heather Gillers, Charley Grant

Publication Date: 18 Apr 2024

Publication Site: WSJ

Graphic:

Publication Date: 19 Apr 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 5 Apr 2024

Publication Site: Treasury Dept

Link:https://mishtalk.com/economics/ominous-technical-trends-for-us-treasury-bulls-three-durations/

Graphic:

Excerpt:

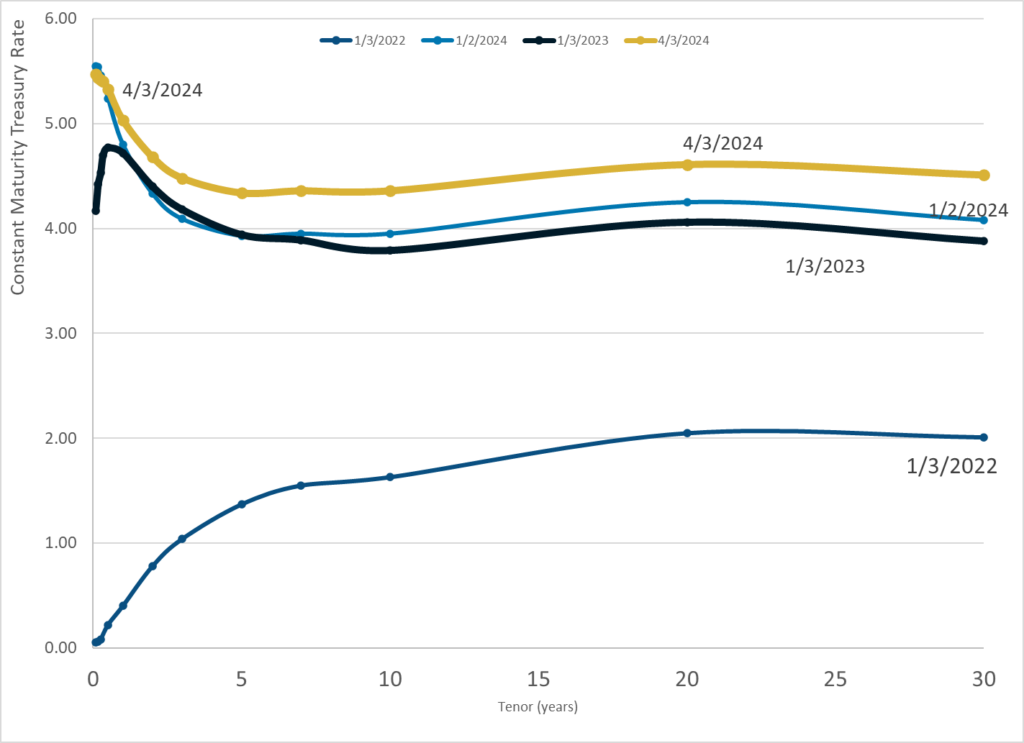

Technical patterns on 2-year, 10-year, and 30-year US treasuries all suggest yields are heading higher. Let’s also discuss the supporting fundamental case.

Centerpoint explains “An ascending triangle chart pattern is a bullish technical pattern that typically signals the continuation of an uptrend. They can signal a coming bullish breakout above an area of resistance after it has been tested several times.”

Many people do not believe in technical patterns, others believe in nothing else. Certainly, technical patterns fail often enough.

My take is they work best as entry and exit point strategies, especially when fundamentals align.

Author(s): Mike Shedlock

Publication Date: 3 Apr 2024

Publication Site: MishTalk

Graphic:

Publication Date: 4 Apr 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 3 Apr 2024

Publication Site: Treasury Dept

Graphic:

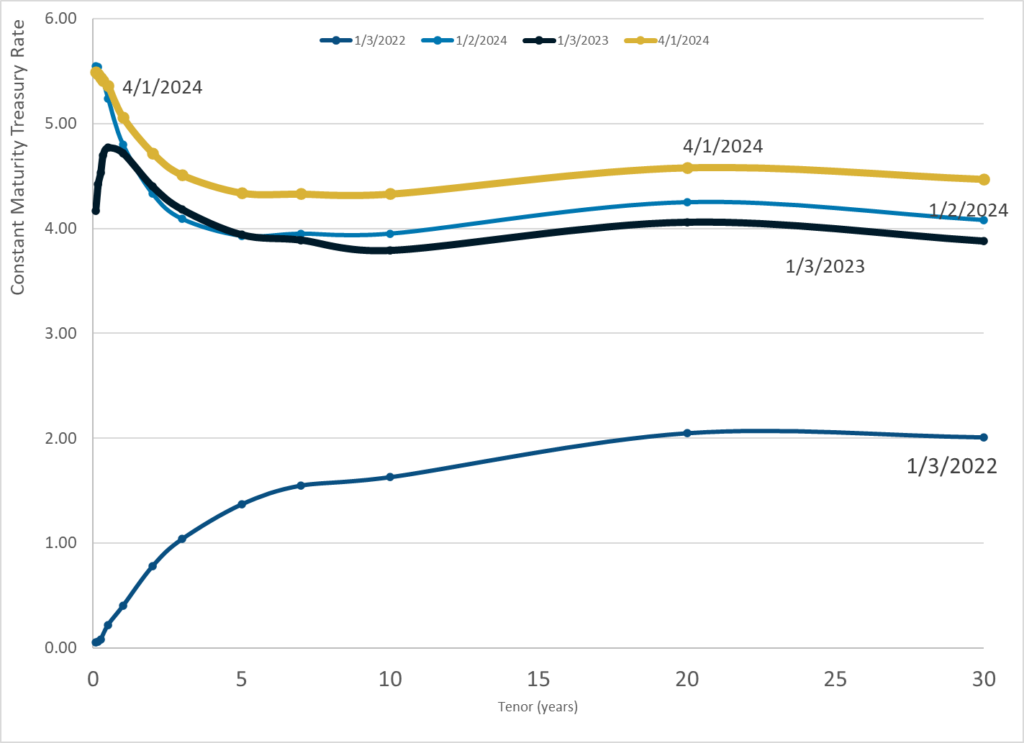

Publication Date: 1 Apr 2024

Publication Site: Treasury Dept

Graphic:

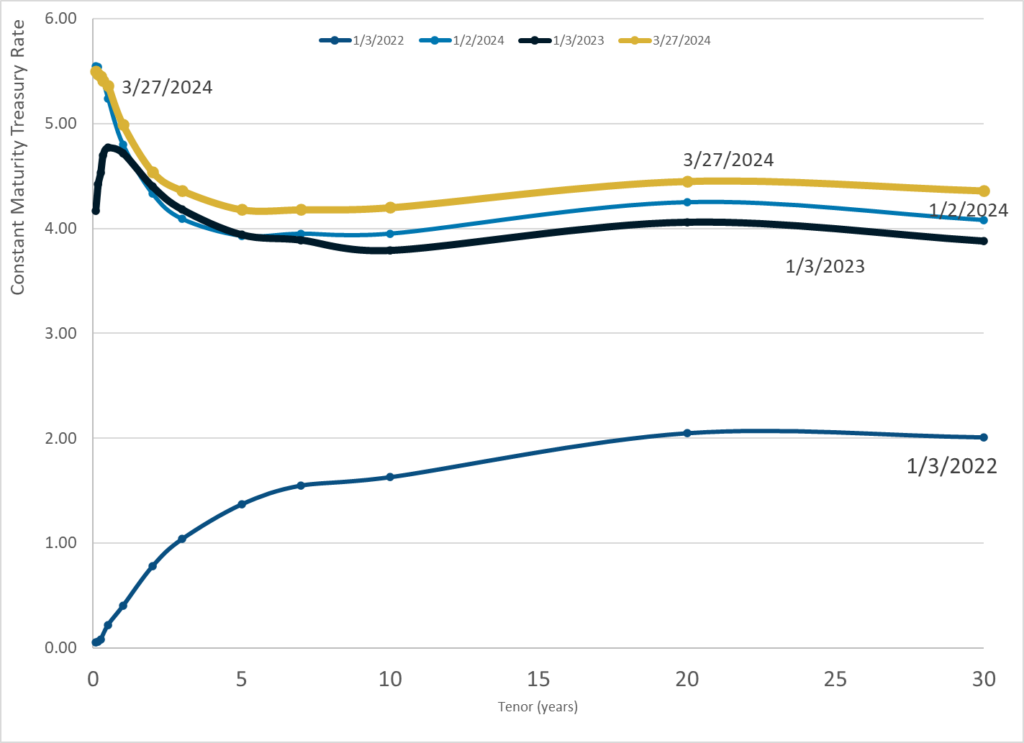

Publication Date: 27 Mar 2024

Publication Site: Treasury Dept