Link: https://www.forbes.com/sites/dandoonan/2024/09/02/erisa-reflecting-on-50-years-and-looking-to-the-future/

Graphic:

Excerpt:

This year is a major milestone for the retirement industry as the Employee Retirement Income Security Act of 1974 (ERISA) reaches its 50th anniversary today.

ERISA is the federal law that for the first time set important standards for most voluntarily established retirement and health plans in the private sector to protect individual participants and beneficiaries. Key provisions of ERISA require plans to provide participants with essential plan information; set minimum standards for participation, vesting, benefit accrual, and funding; establish fiduciary responsibilities for those who manage plan assets; and guarantee payment of benefits through the Pension Benefit Guaranty Corporation (PBGC) for terminated defined benefit pension plans.

There are numerous ERISA successes to celebrate, but there also are challenges associated with the law that can be addressed to help create better retirement outcomes in the future.

Major Successes of ERISA

ERISA has helped Americans prioritize saving for retirement through employer plans at a key juncture when people are living longer. When ERISA was enacted, defined benefit pension plans were the primary type of retirement plan offered by private sector employers.

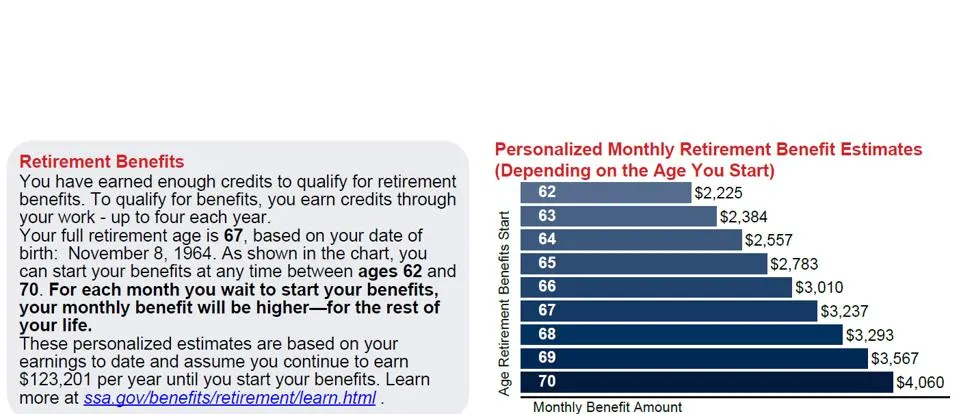

Thanks in part to ERISA, U.S. pension plans have paid out roughly $8.7 trillion dollars to America’s seniors just since 2009. According to the Investment Company Institute, another $12 trillion in assets are held by pension plans that invest and manage these funds for the benefit of 25 million retirees and millions of workers. Pensions continue to do much of the heavy lifting to preserve a reasonable standard of living for retirees by supplementing Social Security benefits.

Another success of ERISA is that it provides a wide range of protections to workers to ensure retirement assets go toward workers’ retirement benefits and employers are adequately funding these plans. ERISA also created a federal insurance program directed by the PBGC that protects retirement benefits, even if a plan closes or a company goes out of business. Importantly, the program is funded by premiums paid by pension funds, not taxpayers. Typically, the PBGC steps in to oversee plan assets and ensure payment of benefits after a firm ceases to exist. This has proven to be an incredibly successful program, protecting millions of retirees and their beneficiaries.

Author(s): Dan Doonan

Dan Doonan is executive director of the National Institute on Retirement Security, a non-partisan, non-profit research think tank located in Washington, D.C. Dan has been a Forbes Contributor since 2021, and he has more than 25 years of experience on retirement issues from a variety of vantage points – an analyst, consultant and plan trustee. His work is driven by the belief that everyone has a shared interest in a strong and resilient retirement infrastructure in the U.S. that provides sufficient retirement income in the most cost-efficient manner possible. Dan holds a B.S. in Mathematics from Elizabethtown College and is a member of the National Academy of Social Insurance.

Publication Date: 2 Sept 2024

Publication Site: Forbes