Link: https://www.lifehealth.com/a-conversation-with-benny-goodman/

Graphic:

Excerpt:

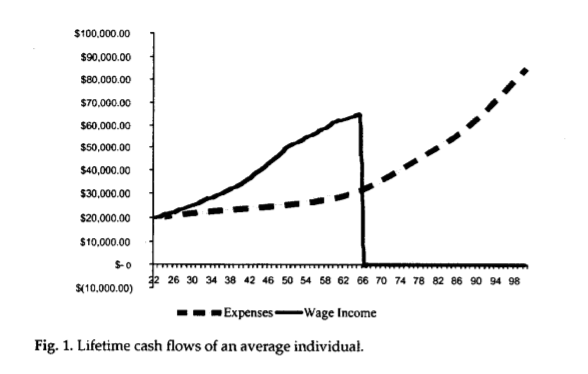

PEK: Your research reveals a conundrum when comparing a variable annuity with systematic withdrawals from investment accounts (assuming similar investment returns): the annuity will generally outperform. How do we convey this very basic equivalency to our clients?

BG: In my experience, I’ve seen that when some people get to retirement, they may have upwards of a half a million dollars in their accounts. Financial planners owe their clients more than just plans to help them accumulate assets and some well-wishes. Most people do not understand how to generate income from their savings that will last the rest of their lives.

Savings are exposed to market risk that can erode account balances before or in retirement, as we saw in The Great Recession of 2009 and the economic contraction during the coronavirus pandemic. And fifty percent of the population can expect to live beyond the average life expectancy in retirement, exposing them to longevity risk.

The practical reality is that most individuals cannot insulate themselves from risk on their own. Annuitizing a portion of a portfolio’s assets can help mitigate these issues.

PEK: You demonstrate that delaying the start of an annuity by five years may cost 5% in future income, which delaying ten years may cost 15%. Please talk about the time factor and the cost of delay.

BG: The concept is based on something called “mortality credits.” When buying an annuity, you join an annuity pool. Every time someone dies early (before he spent all the money he contributed) the leftover money stays in the pool and is shared by all those still in the pool. The money becomes a mortality ‘credit’ for those who did not die. These mortality credits allow the former to get lifetime income. They start adding value from the day someone enters the pool. Those who purchase the annuity at a later time were not in that pool and do not get that credit. Purchasers only receive mortality credits for those people who died after the purchasers joined the pool. Lower mortality credit means lower lifetime income. Mortality credits have value by adding to income.

….

PEK: Likewise, how real is the prospect of outliving one’s assets today?

BG: It’s very real. Data from EBRI indicates that about 40% of Americans face the risk of running out of money in retirement.

Now, not many people continuously spend and then one day look at their account and say, “Oh no! There is no money left!” But well before that day, they will start adjusting their spending downward so as to make sure they don’t outlive their money. And some have to make drastic and painful decisions, like choosing between paying for rent or healthcare; to pay for the electric bill or for medicine. Some retirees will even take half the dosage of their prescribed medicine to conserve it. It may even require that retirees move in with a child rather than live in poverty. In certain family dynamics, living with elderly parents is expected, but it may not be ideal for many.

Author(s): P.E. Kelley, Benjamin Goodman

Publication Date: 30 Oct 2023

Publication Site: Advisor Magazine