Link: https://blog.datawrapper.de/why-do-swiss-people-die/

Graphic:

Excerpt:

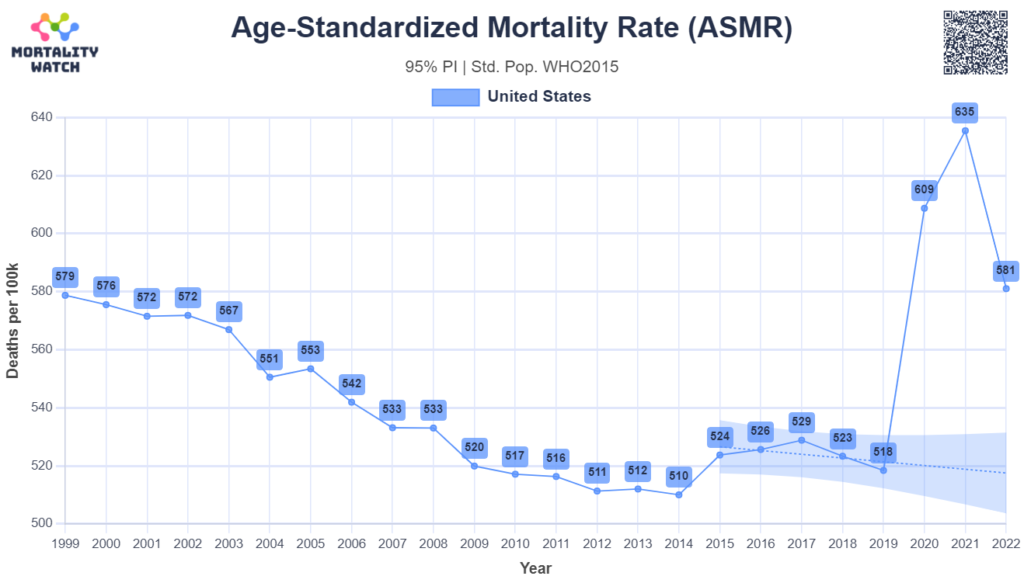

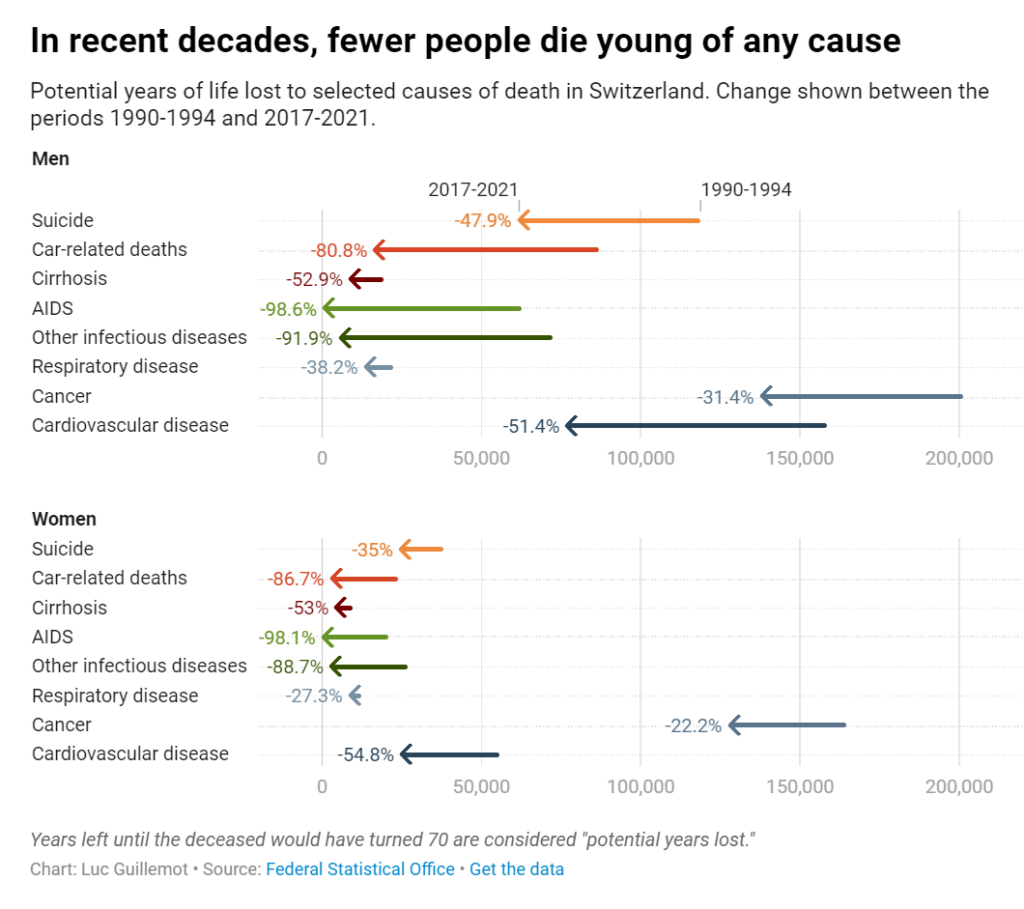

Looking at the evolution of premature deaths, we can celebrate the progress made in medical research. Years lost to infectious diseases like tuberculosis have reduced dramatically, and deaths due to AIDS in particular are nowadays close to zero, a drastic decline since the height of the pandemic in the 1990s. Cancer and cardiovascular diseases have followed a similar path, though they still cause a high number of premature deaths. We can observe that years lost to suicide before age 70 have also declined significantly. In a country where assisted suicide is legal, there is maybe something empowering in the prospect of dying healthy of old age. Years lost to alcoholism and car accidents have also declined — it may be that prevention and overall security have reduced these types of more behavioral deaths.

Author(s): Luc Guillemot

Publication Date: 26 Oct 2023

Publication Site: datawrapper