Link: https://www.city-journal.org/the-biden-bucks-blowout

Excerpt:

Not to worry: the Biden administration is coming to the rescue. The town of Palm Beach Gardens is using $2 million in federal money from President Biden’s $1.9 trillion American Rescue Plan Act (ARPA) to build a $16 million public course, with a two-story clubhouse and driving range that should help at least partially slake the new thirst for golf. The city’s project, one of several golf-course investments that the Biden legislation is funding, is entirely within the spirit of the “rescue” act, which devotes only about 9 percent of its money to public-health causes that fight the virus but allocates hundreds of billions of dollars to local governments and schools for the vague task of providing “support for a recovery” and funding “investments in infrastructure.” As one wag at a South Florida newspaper observed, “If this keeps up much longer, Palm Beach Gardens may get an equestrian center from it.”

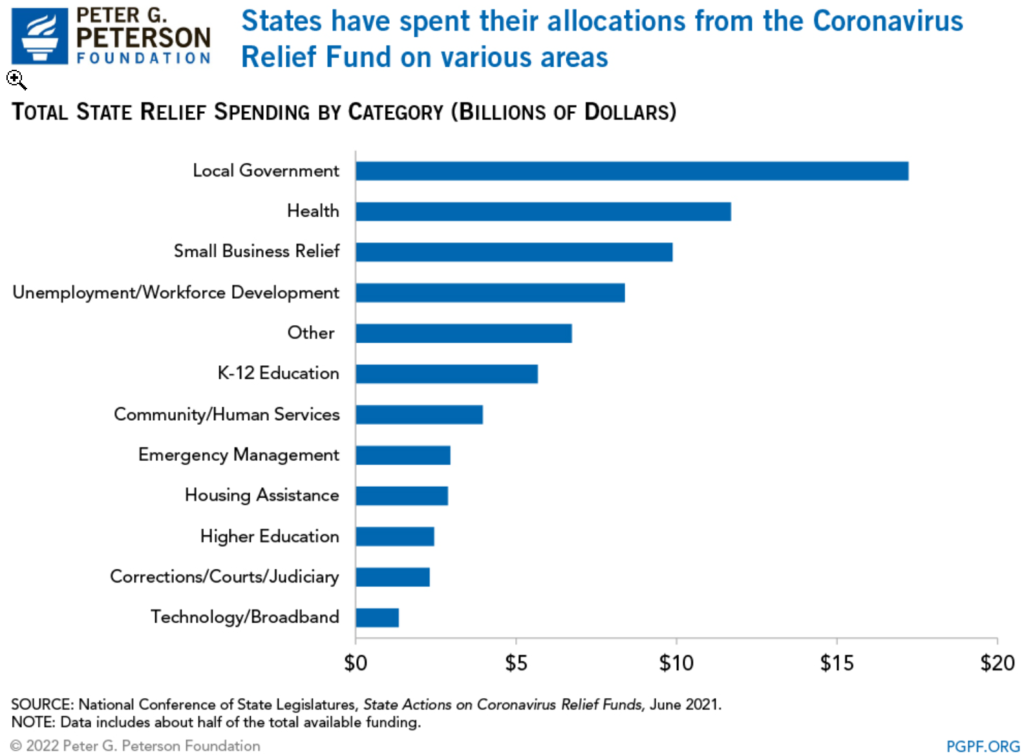

Showering local governments with unprecedented federal dollars, ARPA is the last of several emergency packages, totaling more than $5 trillion, to come from Washington in response to the pandemic. Though termed a “rescue bill” to enhance its appeal, the Biden legislation was more of a stimulus, designed to stoke spending by the country’s tens of thousands of local governments to boost economic activity. Signed by the president in March 2021, even as the economy was recovering and tax revenues were rebounding far faster than most analysts had predicted, ARPA allows for wide discretion in how to spend “Biden Bucks.”

The federal money has turned pols into the proverbial kids in the candy shop. They’re using it to restart parades, fund street performers, upgrade high school weight rooms and sports fields, and build bike paths, golf courses, pickleball courts, and other “essential” infrastructure. Billions of dollars are going to illegal aliens. Cities are testing efforts to give low-income residents guaranteed money that supporters say will end poverty. Municipalities are moving to construct their own broadband networks, in competition with the private sector. It’s all part of a program whipped up so quickly that it included billions of dollars for municipal governments that don’t even exist.

To many local officials, ARPA’s allocations seem like free money. But it comes at a cost to the United States. The act’s funds haven’t been generated by taxes or other federal revenues. Instead, they’re financed by “printing” new money (something done mostly via electronic keystrokes these days)—massively expanding the dollars in circulation and thus intensifying our current inflation, the highest in decades. Aside from the pain that the upward spiral of costs is causing ordinary Americans, inflation is also raising the price that governments pay for essential services like police and fire protection, even as politicians rush to spend their one-time Biden Bucks on ephemeral projects and untested programs. With a Federal Reserve–induced recession, sparked by high interest rates to curb inflation, now a distinct possibility, Biden Bucks may soon be remembered as the spending blowout that preceded a local government budget bust-up.

Author(s): Steve Malanga

Publication Date: Autumn 2022

Publication Site: City Journal