Link: https://www.brookings.edu/research/capital-regulation-and-the-treasury-market/

PDF: https://www.brookings.edu/wp-content/uploads/2023/03/Brookings-Tarullo-Capital-Regulation-and-Treasuries_3.17.23.pdf

Excerpt:

The dramatic, though short-lived, disruption of the market for U.S. Treasury debt in September 2019 and the more profound market dislocations at the onset of the COVID crisis in March 2020 have raised the issue of whether the treatment of central bank reserves and sovereign debt in bank capital requirements exacerbated the problems. Changes have been proposed to the Enhanced Supplementary Leverage Ratio (eSLR) and G-SIB (Global Systemically Important Bank) capital surcharge, both of which apply only to the eight U.S. banks designated as globally significant. Because these banks are some of the most important dealers in U.S. Treasuries, regulatory disincentives to hold and trade Treasuries can adversely affect the liquidity of the world’s most important debt market.

Disagreement over whether to adjust the eSLR, the surcharge or both is often just a version of the continuing debate over the right level of required capital. Some banking interests seize on episodes of Treasury market dysfunction to argue for reductions in the eSLR and surcharge. Some regulators, elected representatives, and commentators see any adjustments as weakening post-Global Financial Crisis (GFC) capital standards. Yet it is possible to reduce the current regulatory disincentive of banks, especially at the margin, to hold and trade Treasuries without diminishing the overall capital resiliency of large banks.

The concern with eSLR is that when it is effectively the binding regulatory capital constraint on a bank, that institution will limit its holding and trading of Treasuries. The eSLR can be modified to accommodate considerably more intermediation of Treasuries without significantly undercutting its regulatory rationale. As for the G-SIB surcharge, there are some unproblematic changes that could help. But the chief complaints from banks about the G-SIB surcharge will be harder to satisfy without undermining the rationale of imposing higher capital requirements on systemically important banks.

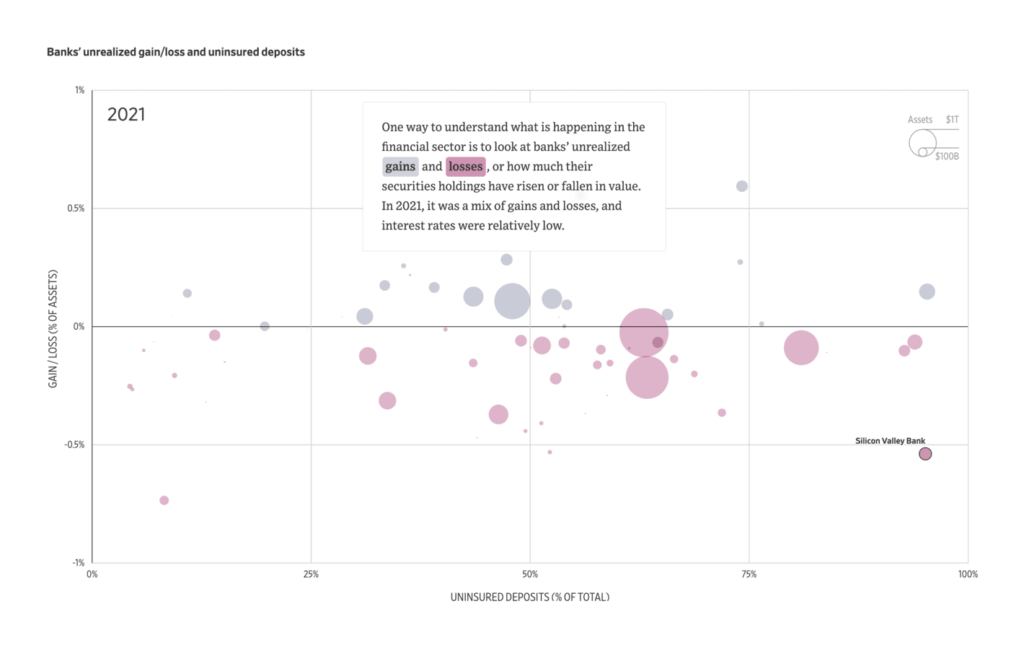

Even with a change in the eSLR, banks’ holdings of Treasuries would continue to be subject to capital requirements for market risk. Moreover, as the failure of Silicon Valley Bank has demonstrated, the exclusion of unrealized gains and losses on banks’ available-for-sale portfolio of debt securities, including Treasuries, can give a misleading picture of a bank’s capital position. Following the Federal Reserve’s 2019 regulatory changes, only banks with more than $700 billion in assets or more than $75 billion in cross-jurisdictional activity are required to reflect unrecognized gains and losses in their capital calculations. The banking agencies should consider a significant reduction in these thresholds.

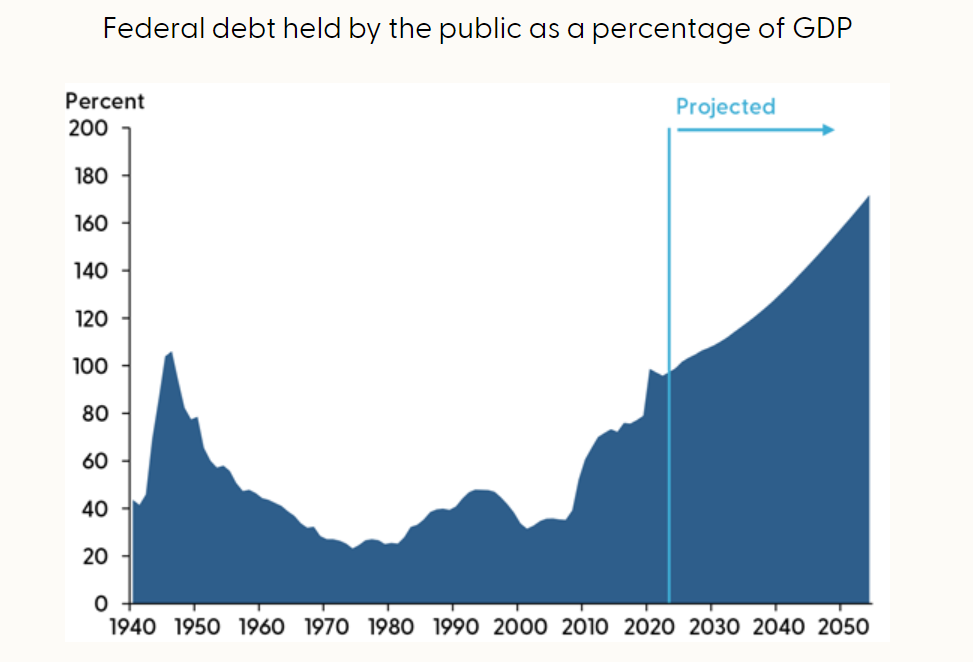

Far-reaching deregulatory changes would not remedy all that is worrisome in Treasury markets today. As the studies cited in the full paper emphasize, a multi-pronged program is needed. In any case, it would be misguided to seek greater bank capacity for Treasury intermediation at the cost of undermining the increased resiliency of the most important U.S. banking organizations or international bank regulatory arrangements. At the same time, it would be ill-advised not to recognize the changes in Treasury markets, beginning with their increased size because of fiscal policy. The modifications of capital regulation, especially the eSLR, outlined in the paper should ease (though not eliminate) constraints on banks holding and trading Treasuries without endangering the foundations of the post-GFC reforms.

Author(s): Daniel K. Tarullo

Publication Date: 17 Mar 2023

Publication Site: Brookings