Graphic:

Excerpt:

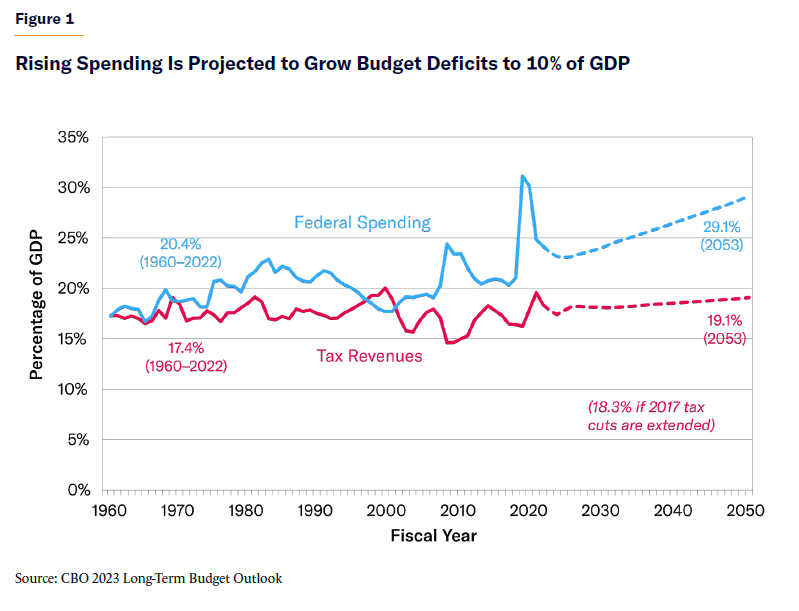

As budget deficits surge toward the stratosphere, Congress will soon have to get serious about savings proposals. Yet reforming Social Security and Medicare—the leading drivers of long-term deficits—remains a political nonstarter. Neither party is willing to raise middle-class taxes. And cutting defense and social spending would save at most $200 billion annually from deficits that are projected to approach $3 trillion by 2034.

That leaves one option: Tax the rich. It won’t be nearly enough.

There are a few excessive tax loopholes and undertaxed corporations that lawmakers could address. It’s farcical, however, to suggest that the tax-the-rich pot of gold is large enough to rein in our deficits and finance new spending programs. Seizing every dollar of income earned over $500,000 wouldn’t balance the budget. Liquidating every dollar of billionaire wealth would fund the federal government for only nine months.

In a study for the Manhattan Institute, I set upper-income tax rates at their revenue-maximizing level, while paring back tax loopholes and fighting tax evasion. As background, the Congressional Budget Office projects that our budget deficits—which currently exceed 7% of gross domestic project—will surpass 10% of GDP over the next three decades. My research shows that the “tax the rich” model would raise at most 2% of GDP in additional revenue over the long term.

Author(s): Brian Riedl

Publication Date: 22 Jan 2024

Publication Site: WSJ, op-ed