Graphic:

Publication Date: 27 Apr 2023

Publication Site: Treasury Dept

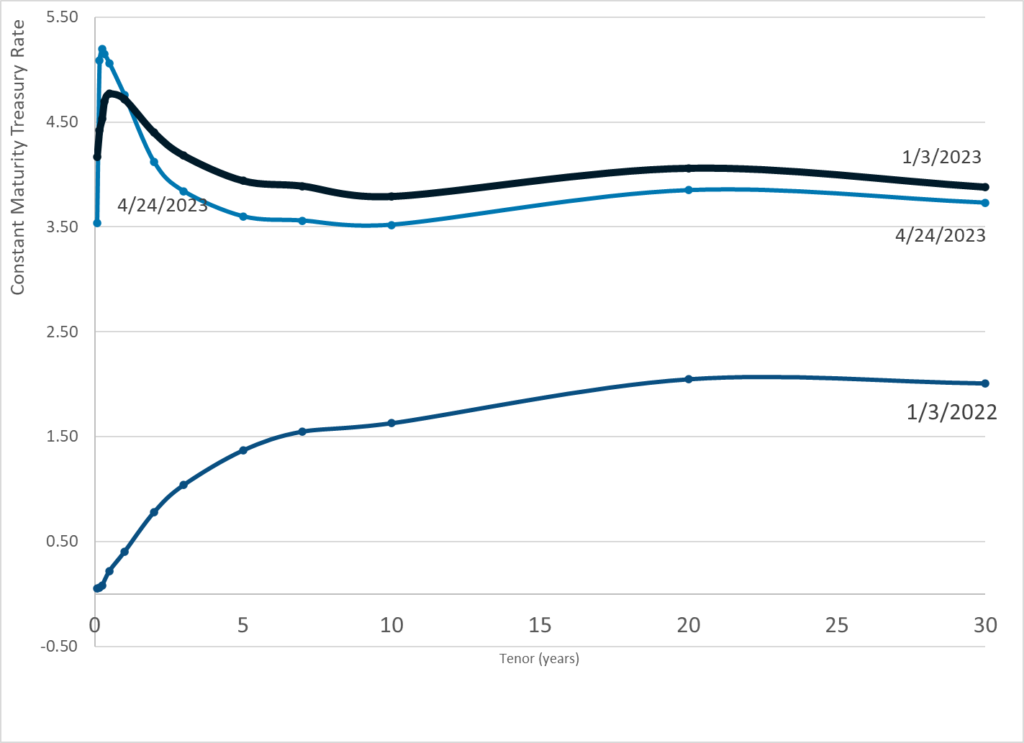

All about risk

Graphic:

Publication Date: 27 Apr 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

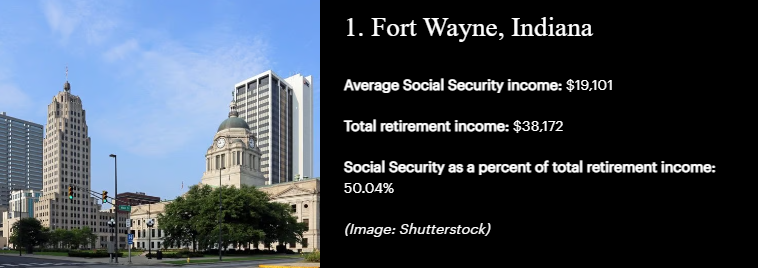

A new report from SmartAsset finds that Social Security benefits comprise 41.7% of a retiree’s total income of $50,780, on average. That percentage is even higher for retirees in some cities, where benefits can make up half of overall retirement income.

To find out where retirees rely most on Social Security, SmartAsset examined data for Social Security income as a percentage of overall retirement income in the 100 U.S. cities with the largest population of residents ages 65 and older.

Author(s): Michael S. Fischer

Publication Date: 26 Apr 2023

Publication Site: Think Advisor

Link: https://onlinelibrary.wiley.com/doi/full/10.1111/eci.13998

Graphic:

Excerpt:

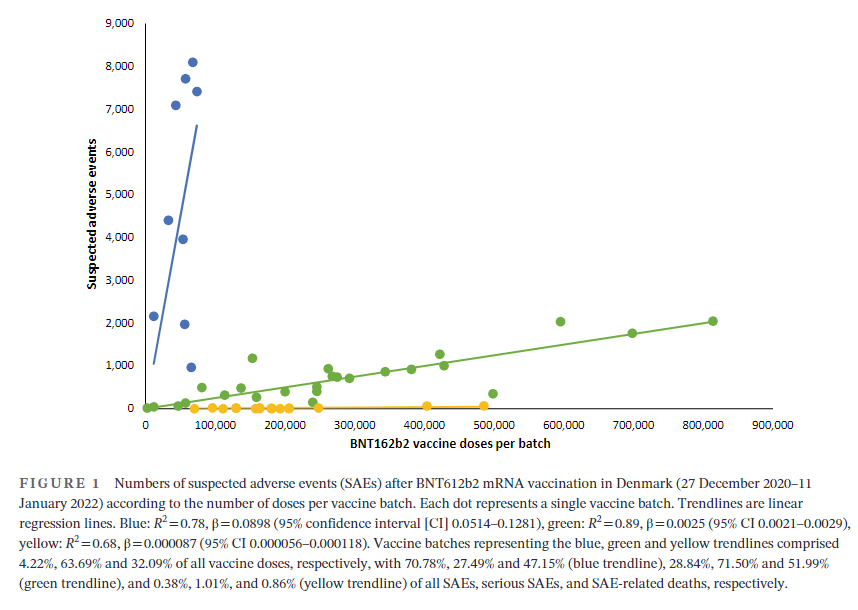

Vaccination has been widely implemented for mitigation of coronavirus disease-2019 (Covid-19), and by 11 November 2022, 701 million doses of the BNT162b2 mRNA vaccine (Pfizer-BioNTech) had been administered and linked with 971,021 reports of suspected adverse effects (SAEs) in the European Union/European Economic Area (EU/EEA).1 Vaccine vials with individual doses are supplied in batches with stringent quality control to ensure batch and dose uniformity.2 Clinical data on individual vaccine batch levels have not been reported and batch-dependent variation in the clinical efficacy and safety of authorized vaccines would appear to be highly unlikely. However, not least in view of the emergency use market authorization and rapid implementation of large-scale vaccination programs, the possibility of batch-dependent variation appears worthy of investigation. We therefore examined rates of SAEs between different BNT162b2 vaccine batches administered in Denmark (population 5.8 million) from 27 December 2020 to 11 January 2022.

….

A total of 7,835,280 doses were administered to 3,748,215 persons with the use of 52 different BNT162b2 vaccine batches (2340–814,320 doses per batch) and 43,496 SAEs were registered in 13,635 persons, equaling 3.19 ± 0.03 (mean ± SEM) SAEs per person. In each person, individual SAEs were associated with vaccine doses from 1.531 ± 0.004 batches resulting in a total of 66,587 SAEs distributed between the 52 batches. Batch labels were incompletely registered or missing for 7.11% of SAEs, leaving 61,847 batch-identifiable SAEs for further analysis of which 14,509 (23.5%) were classified as severe SAEs and 579 (0.9%) were SAE-related deaths. Unexpectedly, rates of SAEs per 1000 doses varied considerably between vaccine batches with 2.32 (0.09–3.59) (median [interquartile range]) SAEs per 1000 doses, and significant heterogeneity (p < .0001) was observed in the relationship between numbers of SAEs per 1000 doses and numbers of doses in the individual batches. Three predominant trendlines were discerned, with noticeable lower SAE rates in larger vaccine batches and additional batch-dependent heterogeneity in the distribution of SAE seriousness between the batches representing the three trendlines (Figure 1). Compared to the rates of all SAEs, serious SAEs and SAE-related deaths per 1.000 doses were much less frequent and numbers of these SAEs per 1000 doses displayed considerably greater variability between batches, with lesser separation between the three trendlines (not shown).

Author(s): Max Schmeling, Vibeke Manniche, Peter Riis Hansen

Publication Date: 30 Mar 2023

Publication Site: European Journal of Clinical Investigation

Graphic:

Publication Date: 26 Apr 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 25 Apr 2023

Publication Site: Treasury Dept

Link: https://finance.yahoo.com/news/debt-ceiling-fears-push-cost-184617316.html

Excerpt:

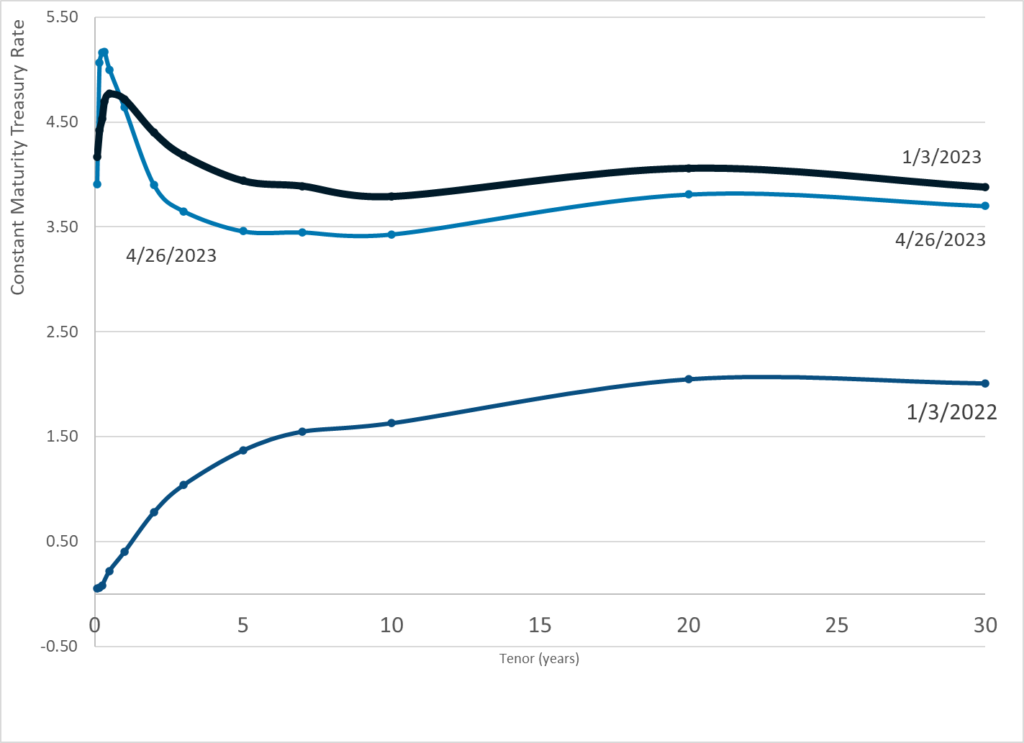

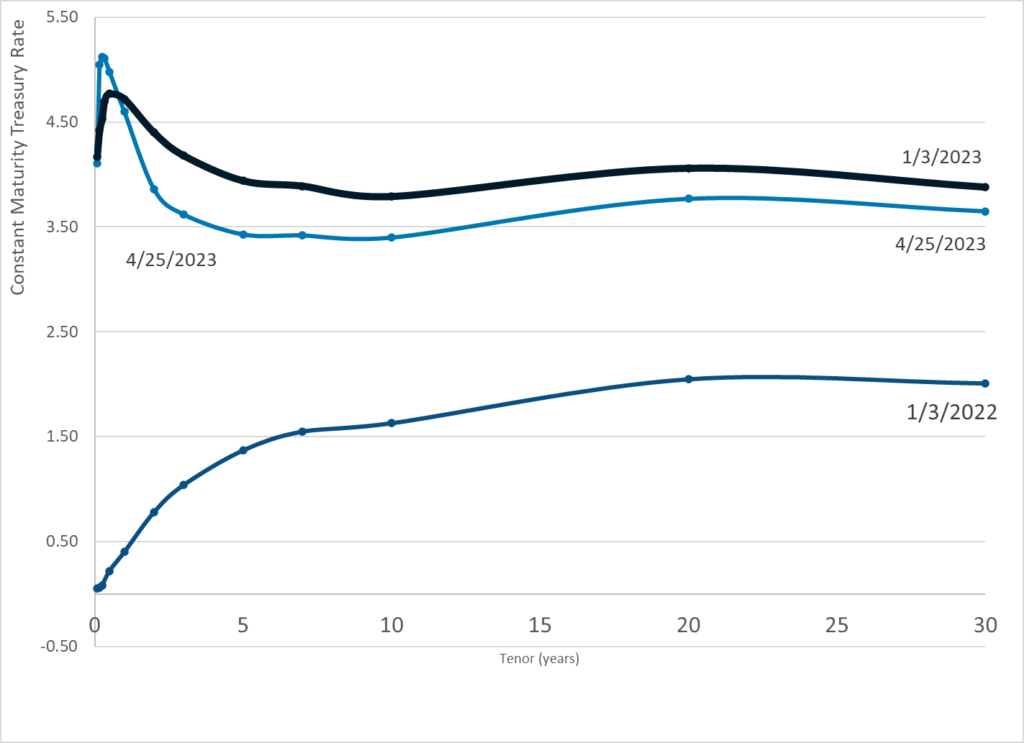

The cost of insurance against the US failing to repay its debts rose to its highest level since the financial crisis last week, as traders worried that political deadlock in Washington might lead to a default.

One-year government credit default swaps traded at 106 basis points Saturday – the most expensive they’ve been since 2008, according to a Financial Times report that cited Bloomberg data.

Credit default swaps – or CDSs – are a form of insurance against a borrower not making scheduled payments on their debt.

The price of one-year government CDSs has spiked 15 basis points in 2023 with traders spooked by the looming threat of a debt-ceiling crisis, the FT reported.

The debt ceiling is a limit on how much the government can borrow, set by Congress. The US hit its $31.4 trillion debt limit in January – and that means it could run out of money to pay its bills as soon as July if lawmakers don’t vote to raise the ceiling, according to the Congressional Budget Office.

Author(s): George Glover

Publication Date: 24 Apr 2023

Publication Site: Yahoo Finance

Excerpt:

Competition to claim a market that could be worth $100 billion a year for drugmakers alone has triggered a wave of advertising that has provoked the concern of regulators and doctors worldwide. But their tools for curbing the ads that go too far are limited — especially when it comes to social media. Regulatory systems are most interested in pharma’s claims, not necessarily those of doctors or their enthused patients.

Few drugs of this type are approved by the FDA for weight loss — they include Novo Nordisk’s Wegovy. But after shortages made that treatment harder to get, patients turned to other pharmaceuticals — like Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro — that are approved only for Type 2 diabetes. Those are often used off-label — though you wouldn’t hear that from many of their online boosters.

The drugs have shown promising clinical results, Jaisinghani and her peers emphasize. Patients can lose as much as 15% of their body weight. Novo Nordisk is sponsoring research to examine whether Wegovy causes reductions in the rate of heart attacks for patients with obesity.

The medications, though, come at a high price. Wegovy runs patients paying cash at least $1,305 a month in the Washington, D.C., area, according to a GoodRx search in late March. Insurers only sometimes cover the cost. And patients typically regain much of their lost weight after they stop taking it.

Author(s):Darius Tahir and Hannah Norman

Publication Date: 18 Apr 2023

Publication Site: KFF Health News

Link: https://www.ai-cio.com/news/ngo-study-ids-vanguard-blackrock-big-climate-change-villains/

Excerpt:

Guess who the largest investors in climate-harming energy companies are? That would be major asset managers, with BlackRock and Vanguard Group the biggest offenders. So says an environmentalists’ report, “Investing in Climate Chaos.”

The report, spearheaded by Urgewald, a German environmental group, and conducted “in partnership” with more than 20 other nongovernmental organizations, comes down hard on two financial service stalwarts in particular: Vanguard, the mutual fund powerhouse, and BlackRock, the world’s largest asset manager.

Beyond those two, half of the stakes in fossil fuel companies identified in the report are held by just 23 investors. What’s more,18 of them are U.S.-based, the advocacy group stated, basing the report on data collected in January.….

BlackRock has positions in oil and gas companies that account for two-thirds of the world’s yearly hydrocarbon production, per Urgewald. Its single largest energy holding is also Exxon, which is the firm’s ninth biggest equity position overall. . Although the asset manager has a policy against investing in any business that gets at least one-quarter of its revenue from coal, the report charged that BlackRock exempts power companies that use coal. “As a result, BlackRock remains the world’s largest investor in coal developers,” it said.

….

In the past, BlackRock has responded to critics on the right and the left by saying that, while it supports ESG, is not about to “dictate how clients should invest.” In a statement, it declared that “transition to a low carbon is in the interest of realizing the best long-term financial results for our clients.”

Vanguard, also under GOP attack, has made much the same argument. It did raise environmentalists’ ire last year when it quit the investment-industry initiative on combating climate change, saying it wanted to “speak independently on matters of importance to our investors.” Some contended that Vanguard was just knuckling under to politicians’ pressure.

Author(s): Larry Light

Publication Date: 25 Apr 2023

Publication Site: ai-CIO

Excerpt:

It’s no surprise to anyone at this point that local governments are struggling to find workers. But finance departments are especially hard-hit when it comes to brain drain. A National Association of State Treasurers study found that 60% of public finance workers are over 45 while less than 20% are younger than 35.

The private sector is facing similar issues. According to the American Institute of Certified Public Accountants (AICPA), the accounting profession has an acute shortage of workers as the population of graduates with accounting degrees has declined over the years.

….

ACFRs, unlike quarterly or other interim reports, are the official account of a government’s finances for the previous year and show how those numbers compare with previous years. It takes some time for finance departments to gather the year-end data, but getting those numbers audited is the last and generally the most time-consuming step before publishing the annual financial report. In some cases, like in Indiana and Ohio, the audit is conducted or signed off by the state auditor’s office. In other instances, localities hire a firm to audit their financial statements.

According to new data published by the University of Illinois Chicago and Merritt Research Services, the last decade has seen a 13% increase in the median amount of time for local government audits to be completed. That means most governments are posting their ACFRs at least three weeks later in the year compared with a decade ago. Nearly half of the increase has occurred over the last two years. The research focuses on the median—rather than the average—because some governments are extreme outliers and take a year and a half or even more than two years to file their annual report.

Author(s): Liz Farmer

Publication Date: 18 Apr 2023

Publication Site: Route Fifty

Link:https://www.thecentersquare.com/illinois/article_6616e81a-e074-11ed-8a30-8b0b8fc31490.html

Excerpt:

Two bills in the Illinois legislature this session will require air conditioning, or at least a common room with air conditioning, in buildings housing seniors.

Last May, when a heat wave sent temperatures in Illinois soaring into the high 90s, three older women living in state-subsidized housing died of heat exposure in the Rogers Park neighborhood of Chicago. The three seniors, Delores McNeely, 76, Gwendolyn Osborne, 72, and Janice Reed, 68, were constituents of state Sen. Mike Simmons, D-Chicago. Two separate bills now aim to prevent these types of deaths,

Simmons sponsored a proposal that would require all state-funded affordable housing to have air conditioning. The bill passed the state Senate in March.

….

In March, the National Low Income Housing Coalition and Housing Action Illinois found that Illinois is lacking 300,000 affordable housing units for the 443,746 poorest households in the state. For every 100 extremely low-income renters, there are only 34 affordable and available units, the report found.

The report defines “very low income” in the Chicago area as households that earn less than $31,250 a year for a family of four, and $22,000 a year for a single person. Many seniors on Social Security live on half of that, Palmer said.

Author(s): Zeta Cross

Publication Date: 22 Apr 2023

Publication Site: The Center Square

Graphic:

Publication Date: 24 Apr 2023

Publication Site: Treasury Dept

Graphic:

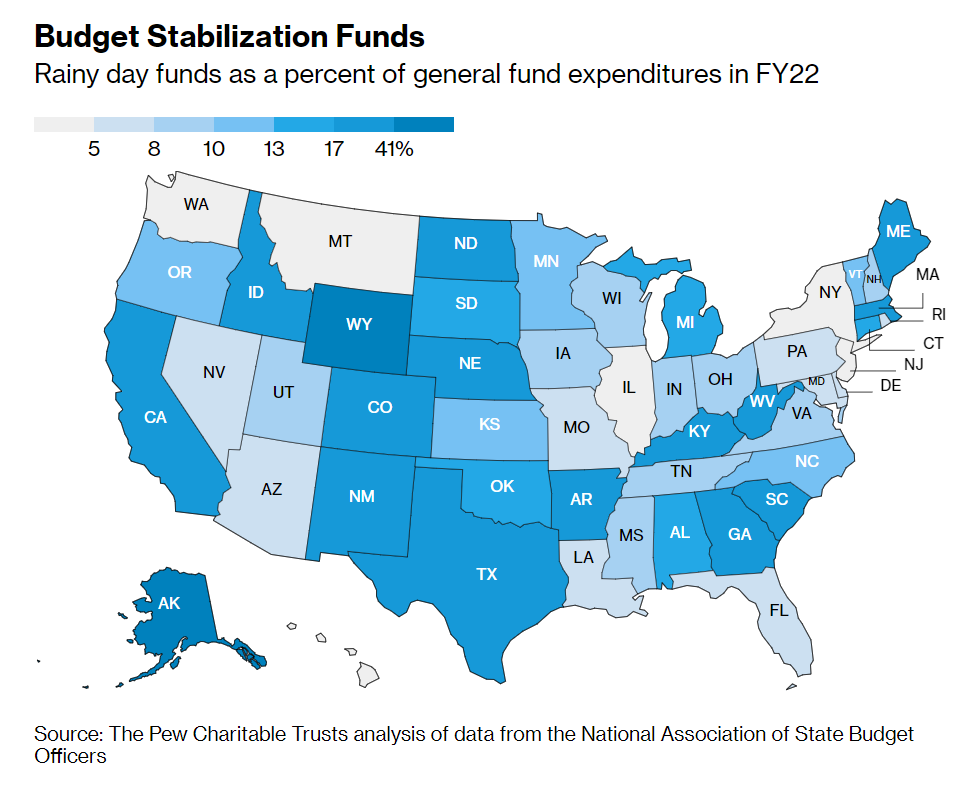

Excerpt:

Illinois, Massachusetts and New Jersey this year have garnered higher credit scores from rating companies, including brighter outlooks for the states as well. The upgrades also helped shrink bond yield spreads in the primary and secondary municipal markets, signaling investor perception of state debt is improving.

The better state ratings are due in part to the positive effect of federal pandemic aid, which some states used for one-time expenses while others set cash aside for the future. State treasuries also saw an influx of tax revenue from residents — bolstered by US stimulus money sent to individuals — who spent on services at home at the height of the pandemic, and on travel after Covid lockdowns were eased.

Still, a slowdown in the US economy this year is causing concern that states can no longer expect a cash haul. The likelihood that the economy in the next 12 months will slide into a recession is greater now than a month earlier, according to a March 20-27 Bloomberg survey of 48 economists.

The poll, conducted after several bank closures roiled financial markets, put the odds of a contraction at 65%, up from 60% in February, amid interest-rate hikes by the Federal Reserve and growing risks of tighter credit conditions.

Author(s): Skylar Woodhouse

Publication Date: 19 Apr 2023

Publication Site: Bloomberg