Link: https://marypatcampbell.substack.com/p/movember-2022-men-and-drug-overdoses

Graphic:

Excerpt:

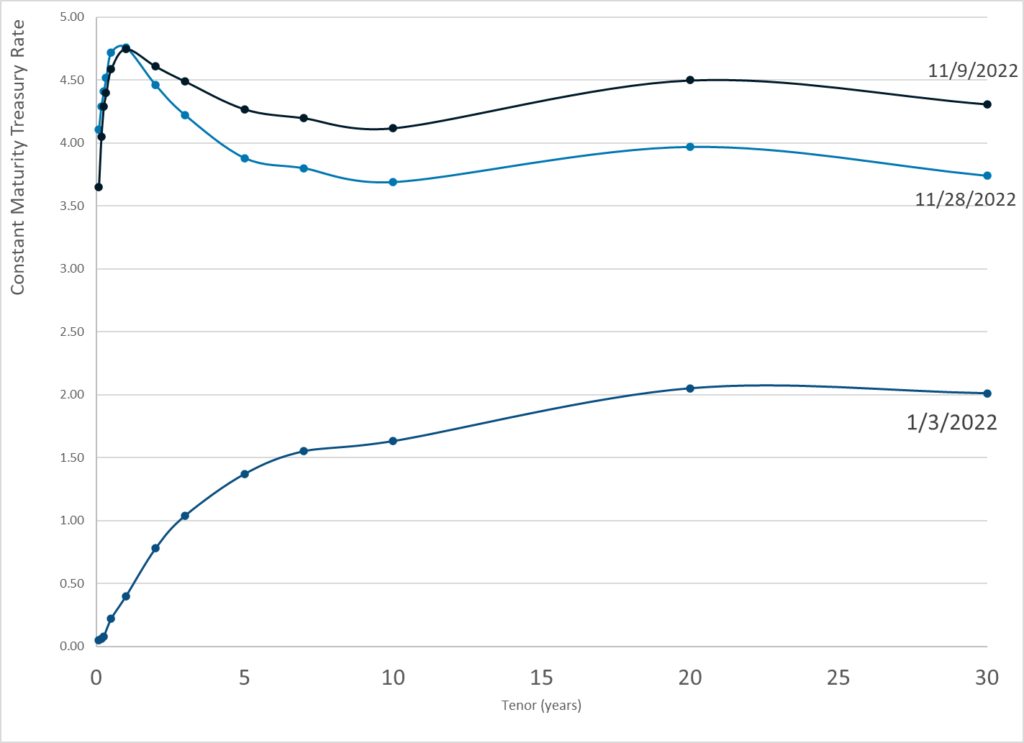

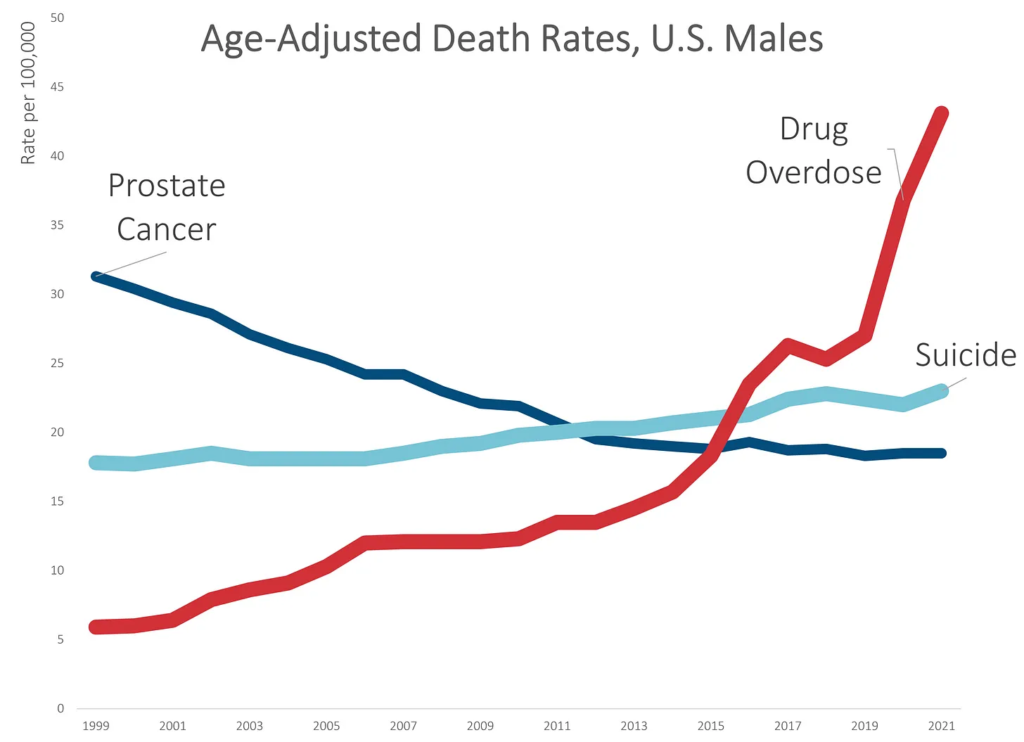

Remember the graph I made showing the suicide trend for men crossing over from prostate cancer?

Let me layer on unintentional drug overdoses:

Yeah, it’s as bad as it looks.

While death rates due to suicide increased by about 30% over the 20-year period, death rates due to unintentional drug overdoses increased by over 500%.

None of this is really a surprise. I’ve written about the drug OD problem many times before, which had a horrible trend before the pandemic and got much, much worse during the pandemic.

Much of the increase came in 2020 and 2021 — over 30% in 2020, and 17% in 2021. These are huge increases on rates that were already bad.

Author(s): Mary Pat Campbell

Publication Date: 29 Nov 2022

Publication Site: STUMP at substack