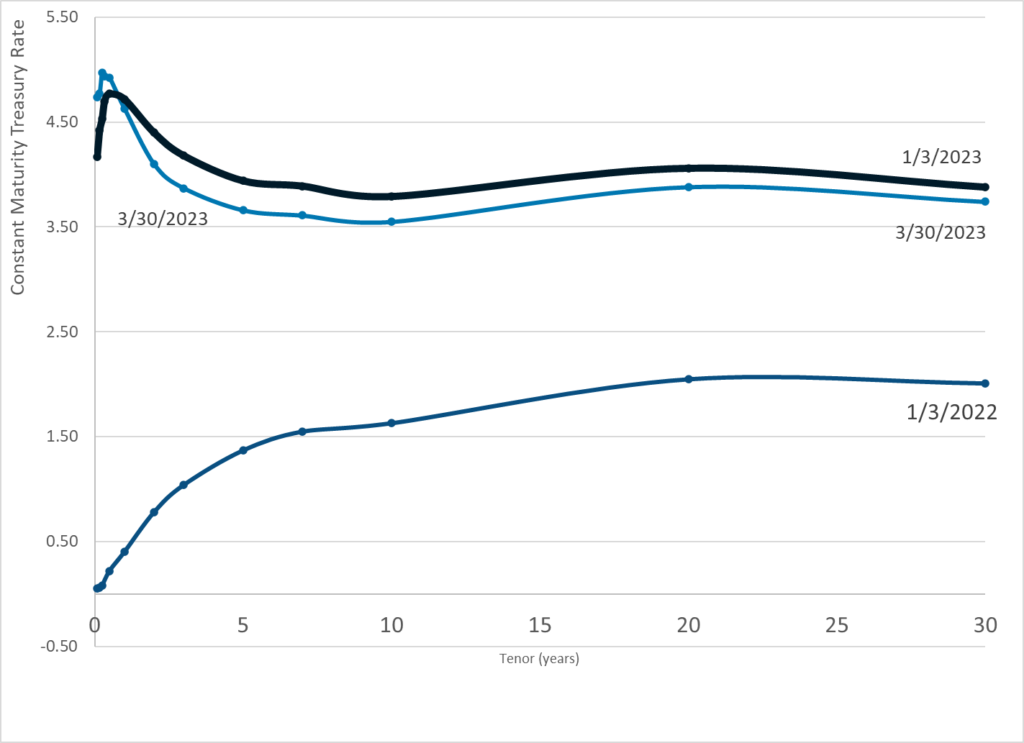

Graphic:

Publication Date: 30 Mar 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 30 Mar 2023

Publication Site: Treasury Dept

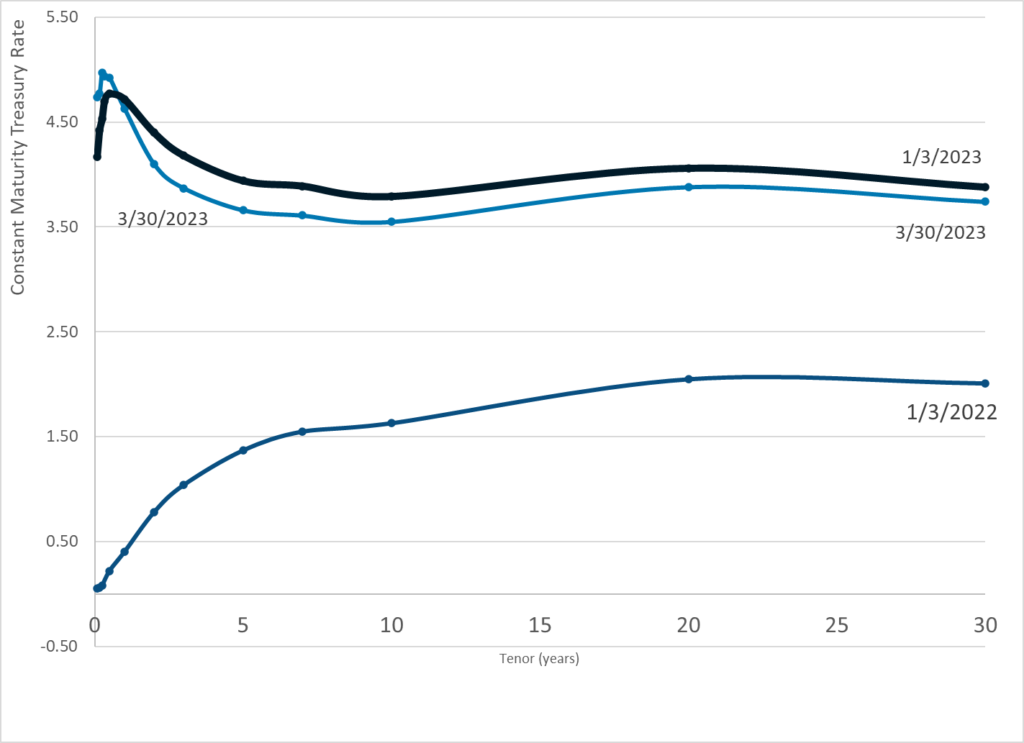

Link: https://www.cdc.gov/nchs/data/nvss/vsrg/vsrg03-508.pdf

Graphic:

Excerpt:

Certifying deaths due to post-acute sequelae of

COVID-19

In the acute phase, clinical manifestations and complications

of COVID-19 of varying degrees have been documented,

including death. However, patients who recover from the acute

phase of the infection can still suffer long-term effects (8).

Post-acute sequelae of COVID-19 (PASC), commonly referred

to as “long COVID,” refers to the long-term symptoms, signs,

and complications experienced by some patients who have

recovered from the acute phase of COVID-19 (8–10). Emerging

evidence suggests that severe acute respiratory syndrome

coronavirus 2 (SARS-CoV-2), the virus that causes COVID-19,

can have lasting effects on nearly every organ and organ system

of the body weeks, months, and potentially years after infection

(11,12). Documented serious post-COVID-19 conditions include

cardiovascular, pulmonary, neurological, renal, endocrine,

hematological, and gastrointestinal complications (8), as well as

death (13).Consequently, when completing the death certificate, certifiers

should carefully review and consider the decedent’s medical

history and records, laboratory test results, and autopsy report,

if one is available. For decedents who had a previous SARSCoV-2 infection and were diagnosed with a post-COVID-19

condition, the certifier may consider the possibility that the death

was due to long-term complications of COVID-19, even if the

original infection occurred months or years before death. If it is

determined that PASC was the UCOD, it should be reported on

the lowest line used in Part I with the condition(s) it led to on the

line(s) above in a logical sequence in terms of time and etiology.

If it is determined that PASC was not the UCOD but was still a

significant condition that contributed to death, then it should be

reported in Part II. Certifiers should use standard terminology,

that is, “Post-acute sequelae of COVID-19.” See Scenario IV in

the Appendix for an example certification. In accordance with

all death certification guidance, if the certifier determines that

PASC did not cause or contribute to death, then they should not

report it anywhere on the death certificate.

Author(s): National Vital Statistics System, National Center for Health Statistics

Publication Date: updated 27 Feb 2023

Publication Site: CDC

Link: https://www.city-journal.org/can-france-escape-its-pension-overhang

Excerpt:

In 2021, government spending accounted for 59 percent of GDP in France, compared with 45 percent in the United States. Spending on public pensions accounts for much of that gap: it’s 15 percent of GDP in France, but only 7 percent in the U.S. This greatly inflates associated payroll taxes, which alone took 28 percent of workers’ incomes in France, compared with just 11 percent in the U.S.

President Macron argues that the cost of financing pensions is dragging down the whole economy, and that reform is necessary to make France an attractive venue for investment and employment. Whereas workers’ incomes in 1975 were 46 percent higher than those of retirees, by 2016 they were 2 percent lower. Many economists see it as senseless to redistribute so much from the young to the elderly, who seldom have childrearing expenses and whose mortgages are often paid off.

Pension reform is seen as necessary by 61 percent of French voters, but only 32 percent support raising the retirement age. Macron argues that the only alternatives to his reforms would involve cutting benefit levels, hiking taxes, or cutting public spending on other items such as education, health care, or defense. France already has close to the highest taxes in the developed world.

Median incomes for French residents aged 65 and over ($20,116) are little different than those for Americans ($19,704). The main effects of France’s extra pension spending are to crowd out private savings for retirement (which amount to 12 percent of GDP versus 170 percent in the U.S), and to cause French citizens to retire much earlier (at an average age of 60.4, vs 64.9 in the states).

Author(s): Chris Pope

Publication Date: 28 Mar 2023

Publication Site: City Journal

Link: https://finance.yahoo.com/news/blackrock-t-compete-free-advil-000000028.html

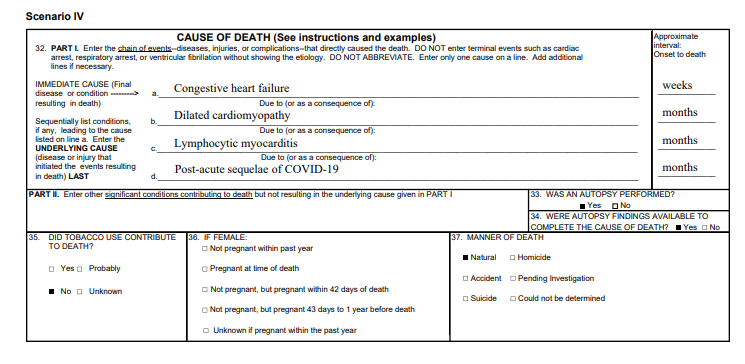

Graphic:

Excerpt:

China launched private pension plans for the first time last year and Beijing has ensured that domestic banks and fund managers win the vast majority of the new business in a market that may eventually grow to $1.7 trillion. Global companies including BlackRock and Fidelity International Ltd have been off to a slow start.

Given their tiny asset bases in China, most foreign money managers have so far been excluded from pilot trials in 36 cities, allowing banks like Industrial & Commercial Bank of China Ltd. and China Merchants Bank Co. to grab all the inflows. To cement their lead, the banks are offering everything from cash incentives to free ibuprofen for each new account.

“The first bite at the cake here won’t be easy” for foreign companies, said Zhou Yiqin, president of GuanShao Information Consulting Center, a financial regulations specialist.

While it’s still early days for the new pension scheme, the head start for domestic companies illustrates the daunting challenges for global firms eyeing a piece of China’s $60 trillion financial services sector. From mergers advice to stock sales and trading, Wall Street is struggling in a market that combines endless potential with stiff local competition and regulatory roadblocks.

China’s fledging private pension system is loaded with promise, as Beijing desperately tries to entice retirement savings to support an aging population. The number of people over 60 is expected to jump more than 50% by 2040, according to the World Health Organization. China’s population shrank last year for the first time in six decades.

To address the problem, China has launched three pension pillars. The first two — a compulsory state-backed plan and a voluntary corporate matching option — don’t come close to meeting the future needs of most pensioners. Savings in the government-led program covering urban employees may run out by 2032 and face a shortfall of more than 7 trillion yuan by 2035, according to Citic Securities Co. estimates.

Author(s): Bloomberg News

Publication Date: 28 Mar 2023

Publication Site: Yahoo Finance

Link: https://www.npr.org/2023/03/28/1166436439/france-protest-strike-pension-retirement

Excerpt:

Protests and strikes against unpopular pension reforms gripped France again Tuesday, with many thousands marching and the Eiffel Tower closed and police ramping up security amid government warnings that radical demonstrators intended “to destroy, to injure and to kill.”

Concerns that violence could mar the demonstrations prompted what Interior Minister Gérald Darmanin described as an unprecedented deployment of 13,000 officers, nearly half of them concentrated in the French capital.

After months of upheaval, an exit from the firestorm of protest triggered by President Emmanuel Macron ‘s changes to France’s retirement system looked as far away as ever. Despite fresh union pleas hat the government pause its hotly contested push to raise France’s legal retirement age from 62 to 64, Macron seemingly remained wedded to it.

Author(s): Associated Press

Publication Date: 28 Mar 2023

Publication Site: NPR

Link: https://nypost.com/2023/03/26/new-york-seeing-tranq-drug-related-deaths-schumer/

Graphic:

Excerpt:

Tranq – the deadly “zombie” drug formally known as xylazine – is circulating across New York and has been tied to dozens of deaths in the state, Senate Majority Leader Chuck Schumer warned Sunday.

Use of the flesh-rotting substance is “spreading” in Syracuse, Albany, Rochester and the Greater New York City area, Schumer said, as he called on increased federal funding for the state to help fight the disturbing trend.

….

Tranq, a veterinary drug, is Narcan-resistant, meaning its effects cannot be reversed in the event of an overdose.

It is said to cause skin and bone to deteriorate or rot over time.

The US Drug Enforcement Administration recently issued a public safety alert, announcing that the agency had seized mixtures of xylazine and fentanyl in 48 of the 50 states.

Author(s):Haley Brown and Stephanie Pagones

Publication Date: 26 Mar 2023

Publication Site: NY Post

Link: https://www.thinkadvisor.com/2023/03/28/12-states-where-working-age-death-counts-are-still-high/

Graphic:

Excerpt:

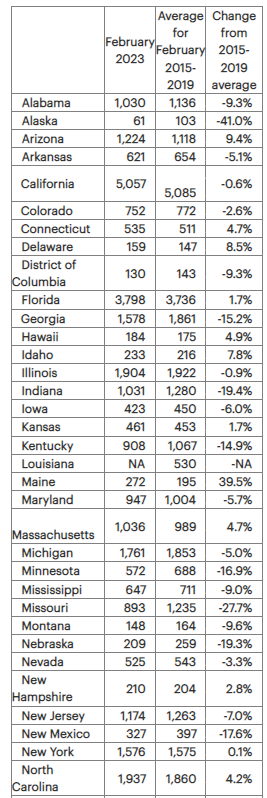

Death finally seemed to ease up on U.S. residents ages 25 through 64 in February.

The total number of deaths of working-age people in that age group, from all causes, was 5.5% lower than the February average for the period from 2015 through 2019, according to the very earliest mortality data available from the U.S. Centers for Disease Control and Prevention.

But all-cause death counts for working-age people were more than 4.5% higher than the 2015-2019 baseline in 12 states and New York City, and up by almost 40% in one state.

Before the start of the COVID-19 pandemic, anything that increased the death rate for a large group of people by more than 2% was considered a major news story.

….

Limitations

One concern is whether the apparent drop in working-age mortality is due partly to state data submission delays.

At press time, for example, Louisiana had sent the CDC only four days of mortality data for February. Other states might also be slower to send the CDC their numbers.

Author(s): Allison Bell

Publication Date: 28 March 2023

Publication Site: Think Advisor

Link: https://www.dig-in.com/opinion/chatgpt-a-conversation-about-underwriting-life-insurance

Excerpt:

RGA decided to put ChatGPT to the test by posing three questions related to underwriting and the future of life insurance. The answers from ChatGPT that follow are entirely AI-generated. Following those responses is a brief FAQ that further explores this emerging topic.

How will COVID-19 affect U.S. long-term mortality?

It is difficult to predict the long-term effects of COVID-19 on mortality in the United States. The pandemic has already had a significant impact on mortality, with over 1.1 million COVID-attributed deaths reported in the country. However, it is possible that the mortality rate from COVID-19 could decline over time as more people become immune to the virus and as effective vaccines are developed and distributed.

There are also other factors that could affect the long-term mortality rate from COVID-19. For example, the effectiveness of public health measures, such as mask-wearing and social distancing, in controlling the spread of the virus could have a significant impact on the number of deaths. In addition, the availability of effective treatments for COVID-19 could also play a role in reducing the mortality rate from the virus.

It is important to continue monitoring the situation and taking steps to control the spread of the virus to minimize the impact on mortality.

Author(s): ChatGPT, Jeff Heaton, Dave Rengachary

Publication Date: 14 Feb 2023

Publication Site: Digital Insurance

Link: https://www.casact.org/sites/default/files/2021-03/9_Panning.pdf

Graphic:

Excerpt:

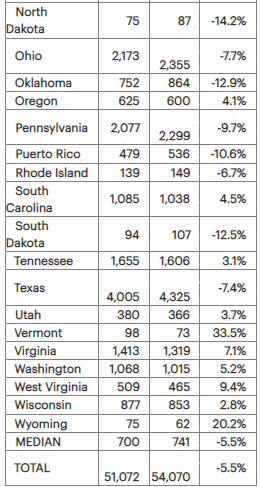

Fortunately, there is a solution to the dilemma just posed. It

consists in adopting a pricing strategy that substantially alters the

sensitivity of a firm’s total economic value to changes in interest

rates. In the example give earlier, where

a = 15% and

b = 0, the

duration of the firm’s franchise value and total economic value are

17.62 and 6.70, respectively. But suppose we alter the firm’s

pricing policy by changing these parameters to

a = 10% and

b = 1.

In this case the target return on surplus remains at 15% (given that

the risk-free yield remains at 5%), but the durations change from

17.62 to 7.62 for franchise value, and from 6.70 to 3.27 for total

economic value. The key insight here is that a firm’s pricing

strategy can significantly affect the duration of its franchise

value and, consequently, the duration of its total economic

value.This insight suggests a more systematic approach to managing the

duration of total economic value: find a combination of the

strategy parameters

a and

b such that the return on surplus and the

duration of total economic value are both acceptable. This can be done either by systematic numerical search or by constrained optimization procedures. For example, if the firm in our example

wanted a target return on equity of 15% but a total economic value with a duration of zero, it should implement a pricing strategy with the parameters

a = 6.2% and

b = 1.763 to achieve

those objectives. The consequences of this and the two previously

mentioned pricing strategies are shown in Figure 3 for the three

different pricing strategies just described.

Author(s): William H. Panning

Publication Date: 2006

Publication Site: Casualty Actuarial Society (for exams)

Excerpt:

The 52-year-old executive [Greg Lindberg] was indicted last month on federal charges that he defrauded his insurers by lending $2 billion of their funds to companies in his private conglomerate, while allegedly siphoning off huge sums to finance his lavish lifestyle. He has pleaded not guilty and is out on bail.

Until last July, Mr. Lindberg was in federal prison on bribery charges related to the insurers. He was released after 21 months when an appeals court overturned the conviction. A retrial is scheduled for November.

The executive also is fighting a drawn-out court battle with North Carolina regulators, who seized his insurers in 2019 and now say they should be liquidated. Mr. Lindberg, who previously lived in North Carolina and was the subject of investigative articles in The Wall Street Journal in 2019, says the insurers are healthy and he has a plan to rescue them.

What rankles Mr. Zintel and others is that they believe Mr. Lindberg is using their money to fight his legal entanglements, allowing him to continue living extravagantly even as they cut back. Among the alleged extravagances: The divorced executive has spent millions of dollars on gifts for women, according to court documents, including paying some women to produce offspring for him.

Some 70,000 holders of annuities totaling $2.2 billion are unable to withdraw their money, filings show. Many are retirees or conservative investors who bought five- to seven-year annuities in 2017 and 2018. Financial advisers typically marketed them as a safe, higher-yielding alternative to bank CDs.

Author(s): Mark Maremont, Leslie Scism

Publication Date: 26 Mar 2023

Publication Site: WSJ

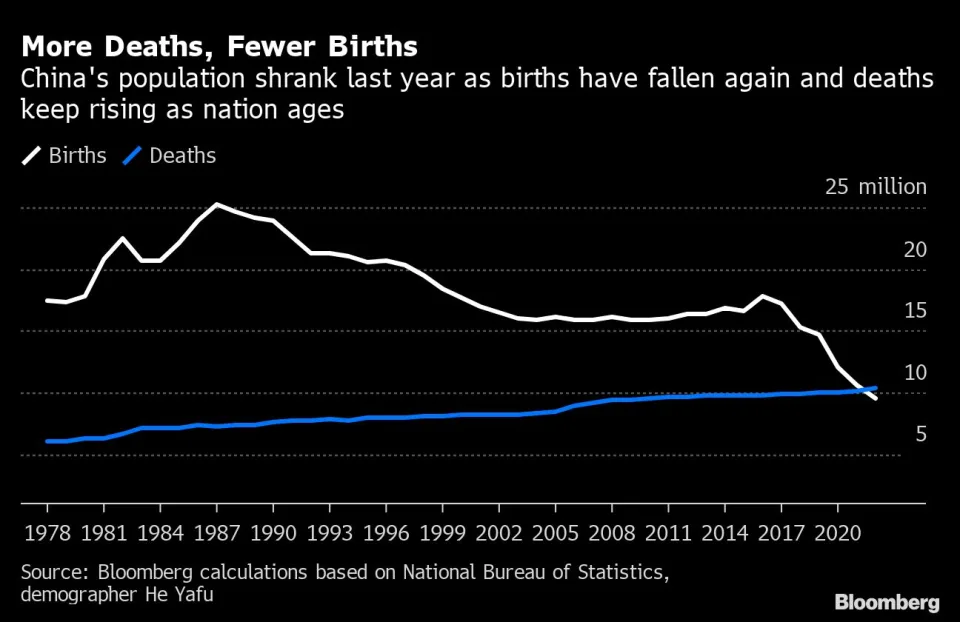

Graphic:

Publication Date: 27 Mar 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 24 Mar 2023

Publication Site: Treasury Dept