Link: https://www.dig-in.com/news/allstate-and-john-hancock-partner-safe-driving-telematics

Excerpt:

John Hancock and Allstate have announced a partnership to reward John Hancock Vitality members with points for safe driving. The partnership is the first of its kind, and comes in response to an increase in vehicle crash-related injuries. Customers will benefit from understanding how their choices, including driving behavior, impact their overall health, John Hancock believes.

….

The Vitality Program, which combines life insurance with education, incentives and rewards to help members lead healthier, longer lives, will allow members to submit proof of safe driving status in Allstate’s usage-based insurance program through a cashback reward email or by submitting a recent bill to show a safe-driving discount.

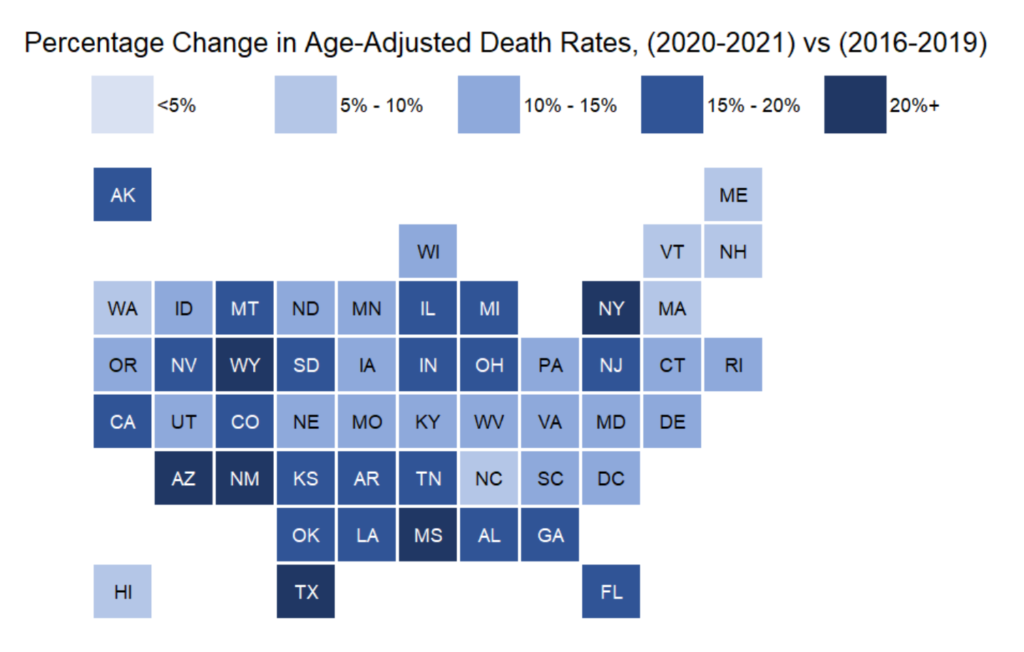

Motor vehicle deaths in the U.S. rose 18.4% in the first six months of 2021 over 2020, according to data from the U.S. Department of Transportation’s National Highway Traffic Safety Administration. An estimated 20,160 people died in motor vehicle crashes in the first half of 2021, the largest number of projected fatalities since the same period in 2006. Research into driving behavior from March 2020 through June 2021, shows that speeding and traveling without a seatbelt remain higher than pre-pandemic times, according to findings from NHTSA.

Author(s): Kaitlyn Mattson

Publication Date: 24 January 2022

Publication Site: Digital Insurance