Graphic:

Publication Date: 29 Jun 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 29 Jun 2023

Publication Site: Treasury Dept

Excerpt:

Researchers in Japan have found a significant increase in the number of suicides among women and girls between the ages of 10 and 24 during the pandemic, while there was no significant change in the suicide rate for boys and men in the same age group.

The research team analyzed data on suicides by gender across three age groups — 10 to 14, 15 to 19 and 20 to 24 — comparing the number of suicides after July 2020 with the number of suicides before the pandemic began.

According to the health ministry, the number of suicides among women and girls age between 10 and 24 in 2022 was 745, an increase of 233 compared with the 2019 figure. The data also showed that the number of boys and men in that age range who committed suicide was 1,278, an increase of 100 cases from 2019.

The research was led by Nobuyuki Horita from Yokohama City University Hospital and Sho Moriguchi from the Department of Neuroscience at Keio University using data on deaths by suicide from July 2012 to June 2022 provided by the health ministry.

…..

Over the past 10 years, a total of 13,263 young people age 10 to 24 — 9,428 male and 3,835 female — died by suicide.

Author(s): KARIN KANEKO

Publication Date: 26 June 2023

Publication Site: Japan Times

Link:https://nrt.unl.edu/nrt-director-team-awarded-patent-fireball-dropping-drones

Excerpt:

Craig Allen recently accomplished a personal first as an ecology professor by getting listed on a patent for a fireball-dropping drone.

“For me, because I expect that I will probably never have another patent in my life, because I do science that’s generally not patentable and I really don’t have the capacity for that kind of thing, the patent is fully unique and, thus, will have a special place in my heart,” said Allen, director of the National Science Foundation Research Traineeship at Nebraska.

He worked with agronomy professor Dirac Twidwell, computer science professors Sebastian Elbaum and Carrick Detweiler, and former Nebraska students Christian Laney, James Higgins and Evan Michael Beachly in developing IGNIS, the drone product.

….

At first, the three discussed using drones as a less dangerous way to sample invasive species like zebra mussels in Nebraska waters. Then, when a person was injured on an ATV during a prescribed burn, the three professors turned to discussing using drones in prescribed burns.

Allen said about 40,000 acres of rangeland in Nebraska are invaded by trees every year and fire is the best way to control that.

Typically, firefighters on ATVs or in helicopters carry out prescribed burns, but both methods can be dangerous.

Publication Date: accessed 29 Jun 2023

Publication Site: University of Nebraska-Lincoln

Graphic:

Publication Date: 28 Jun 2023

Publication Site: Treasury Dept

Excerpt:

Indicted former Ald. Ed Burke (14th Ward) will collect an annual city taxpayer-funded pension of more than $96,000, even as he awaits trial on federal corruption charges, according to records obtained by WTTW News.

Burke, 79, who did not seek a 15th term on the Chicago City Council, left office after 54 years on May 15.

When he stepped down, Burke was the longest serving member of the City Council, earning more than $120,408 annually.

Burke will start receiving pension payments of $8,027 per month in sometime in August, and they will continue for the rest of his life, according to records obtained by WTTW News from the Municipal Employees’ Annuity and Benefit Fund of Chicago.

….

Burke is set to stand trial on Nov. 6 on 14 counts alleging the powerful politician repeatedly — and brazenly — used his elected office to force those doing business with the city to hire his private law firm. Burke has pleaded not guilty, and used millions of dollars of stockpiled campaign cash to fund his defense.

If Burke is convicted on those charges, he could lose his pension, since his conduct occurred as part of his official duties as an alderperson.

Author(s): Heather Cherone | Jared Rutecki

Publication Date: 15 Jun 2023

Publication Site: WTTW

Link: https://www.cato.org/blog/understanding-salt

Excerpt:

The SALT deduction is still distorting tax policy even in its limited form. For example, the poorly conceived temporary $4,000 bonus deduction proposed in the Tax Cuts for Working Families Act, part of the Republican economic tax package, is the result of SALT politics. The proposal attempts to give additional tax relief to taxpayers concerned by the SALT cap.As initially proposed by House Republicans in the lead‐up to 2017, the correct policy is to repeal the SALT deduction entirely. The $10,000 cap was a political compromise necessary to get enough votes for the bill. Raising or lifting the cap significantly reduces revenue, making it harder to extend or expand the tax cuts when they expire at the end of 2025.

Author(s): Adam N. Michel

Publication Date: 22 Jun 2023

Publication Site: Cato

Excerpt:

Prescribed burns are a proven way to reduce the impact of destructive wildfires, but they still come with risks to the firefighters who carry them out. That was the impetus behind a project from the National Science Foundation’s National Research Traineeship (NRT) program at the University of Nebraska-Lincoln (UNL) that uses a drone to drop fireballs to ignite prescribed burns, keeping firefighters out of harm’s way.

Publication Date: Jun 2023

Publication Site: govTech

Graphic:

Excerpt:

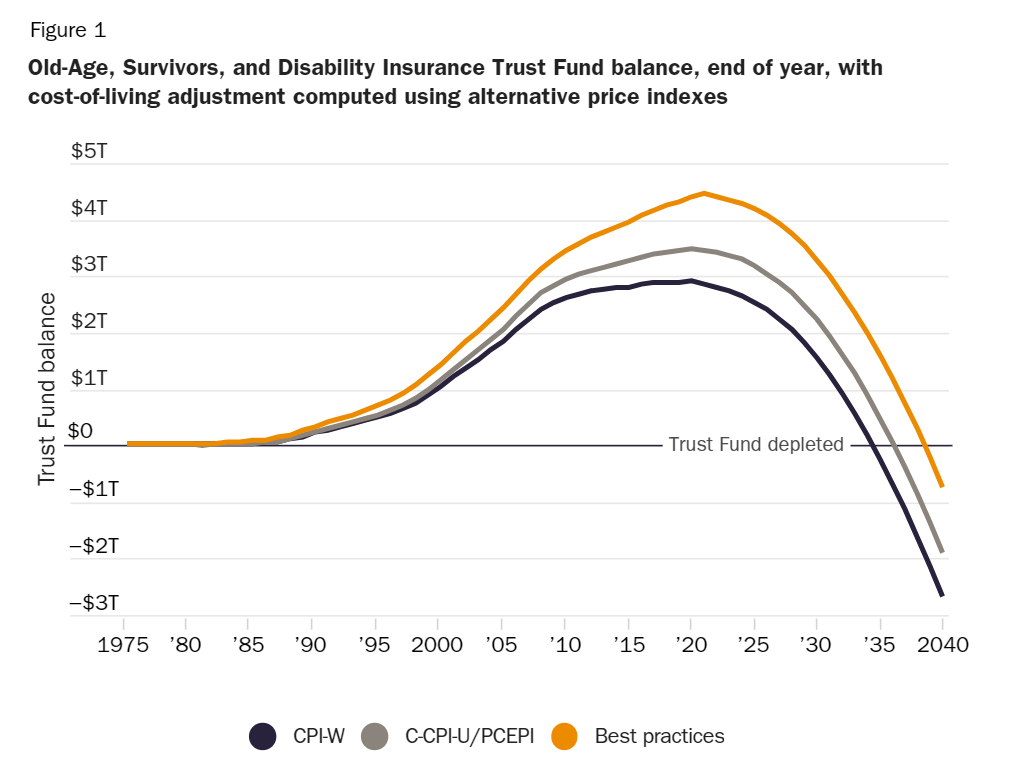

COLAs for Social Security’s OASDI have had an additional significant fiscal effect. Until recently, the payroll taxes paid for Social Security each year have usually exceeded the cost of benefits paid in that year. This balance was transferred to the general fund of the U.S. Treasury, which in turn issued special Treasury bonds to the Social Security Trust Fund to be redeemed later when taxes collected were less than the benefits paid. The fund balance reached $2.9 trillion at the end of 2020. Then in 2021, the Social Security Trust Fund had to redeem $56.3 billion of those bonds to pay OASDI benefits. Social Security actuaries have calculated that increasingly larger withdrawals will continue until the Trust Fund is fully depleted in early 2035.36 Under current law, once the Trust Fund balance is fully depleted, payments to beneficiaries must be reduced to the level supported by current Social Security taxes.

If Social Security COLAs had been calculated using the combination of C‑CPI‑U and PCEPI, then the Trust Fund balance in 2020 would have been $3.5 trillion, and full depletion of the Trust Fund would have been delayed two more years to 2037. If the price indexes had also been improved to minimize new‐item bias (the best‐practices index), the balance in 2020 would have been $4.4 trillion, and full depletion of the fund would have been delayed until 2039 (see Figure 1).

Author(s): John F. Early

Publication Date: 22 Jun 2023

Publication Site: Cato

Graphic:

Publication Date: 26 Jun 2023

Publication Site: Treasury Dept

Excerpt:

On February 3, 2022, Bill C-228 was introduced as a private members bill and has now made its way to the third reading in Canada’s Senate. The purpose of Bill C-228 is to greatly expand the pension liabilities that are afforded super priority status by amending bankruptcy and insolvency legislation. As currently drafted, the Bill will grant priority for a pension plan’s unfunded liability or solvency deficiency claims over the claims of the majority of creditors — including secured creditors — unless specifically enumerated otherwise in the statutes.

The “unfunded liability” is the amount necessary to enable the fund to continuously pay member benefits as they come due, on the assumption that the fund will operate for an indefinite period of time. The “solvency deficiency” includes the amount necessary to ensure the fund meets its obligations if wound up. As these amounts are constantly fluctuating, a fixed value cannot be ascribed to either of these requirements other than through a single point in time calculation by an actuary.

Clearly, Bill C-228 would substantially increase the opportunity for recovery of pension entitlements within insolvency proceedings by way of super priority. The issue is whether it remains viable for lenders to provide capital to borrowers with defined benefit pension plans given the increased risk profile that may be created by Bill C-228 expanding the pension claims that take priority over a secured creditor in an insolvency case.

In all likelihood, Bill C-228 will minimally effect borrowers that have defined-contribution pension plans as the employer’s liability is restricted to predefined contributions. As this type of plan is subject only to ordinary course known contribution requirements, and given that the employer does not guarantee a certain amount of income in retirement, the liability afforded super priority in insolvency proceedings should be predictable in most circumstances.

Conversely, Bill C-228 will significantly impact defined-benefit pension plans. These types of plans commit to providing a specified level of income in retirement based on a variety of factors. As such, an employer must diligently manage the pension fund to ensure it is in a position to pay the benefit to the employee for the remainder of their life, once retired. The inherent challenge with these plans is the uncertainty of the liability of the employer at any given time and the potentially large scope of that liability based in part on external factors such as interest rate fluctuations.

Bill C-228 has therefore created a conundrum. Although the intention of the Bill is to protect pension plans, it may potentially cause a shift that results in even more employers moving from a defined-benefit pension plan to a defined-contribution pension plan. Plainly, this shift may be caused by lenders’ concerns regarding the uncertainty surrounding the amount necessary to liquidate an unfunded liability or solvency deficiency at any given time. In other words, a lender will not be able to determine prior to the lending decision, with any great certainty, the amount of the unfunded liability or solvency deficiency in a future insolvency proceeding. At a minimum, a secured creditor wants to know the quantum of obligations that will take priority over their interests. This is essential information in deciding the quantum of a loan, the terms of such loan, any reserves and whether the creditor will agree to loan any money to the borrower.

Author(s): Candace Formosa

Publication Date: 2023Q2

Publication Site: Norton Rose Fulbright

Link: https://www.ai-cio.com/news/calpers-calstrs-genworth-among-those-affected-by-moveit-data-breach/

Excerpt:

The California Public Employees’ Retirement System, the California State Teachers Retirement System and Genworth Financial Inc. revealed that some of their clients’ personal information was involved in a data breach that hit third-party vendor PBI Research Services’ Moveit Transfer Application, used by thousands of organizations.

PBI provides services to pension funds to identify member deaths so that proper payments are made to retirees and beneficiaries and to prevent overpayments or other errors. For life insurance firms like Genworth, the company helps identify the possible eligibility of beneficiaries for death benefits or for policies beneficiaries may not know exist.

According to CalPERS, while the data breach did not impact its information systems, it did impact the personal information of approximately 769,000 members, including retired members, some of whom are inactive members and may soon be eligible for benefits. The pension fund is offering free credit monitoring to retirees and beneficiaries with impacted personal information and is also mailing tips on how to protect their information. CalPERS is also providing information on its website and through its customer contact center.

….

Genworth declined to elaborate on its June 22 SEC filing, in which it said it was notified by PBI of the breach and that it “believes that the personal information of a significant number of insurance policyholders or other customers of its life insurance businesses was unlawfully accessed.” Genworth stated it is “working to ensure that protection services are provided to those impacted individuals” and that it believes the breach did not impact any of its information systems, including its financial systems, and that there has not been any material interruption of its business operations.

Author(s): Michael Katz

Publication Date: 26 Jun 2023

Publication Site: ai-CIO

Graphic:

Publication Date: 23 Jun 2023

Publication Site: Treasury Dept