Graphic:

Excerpt:

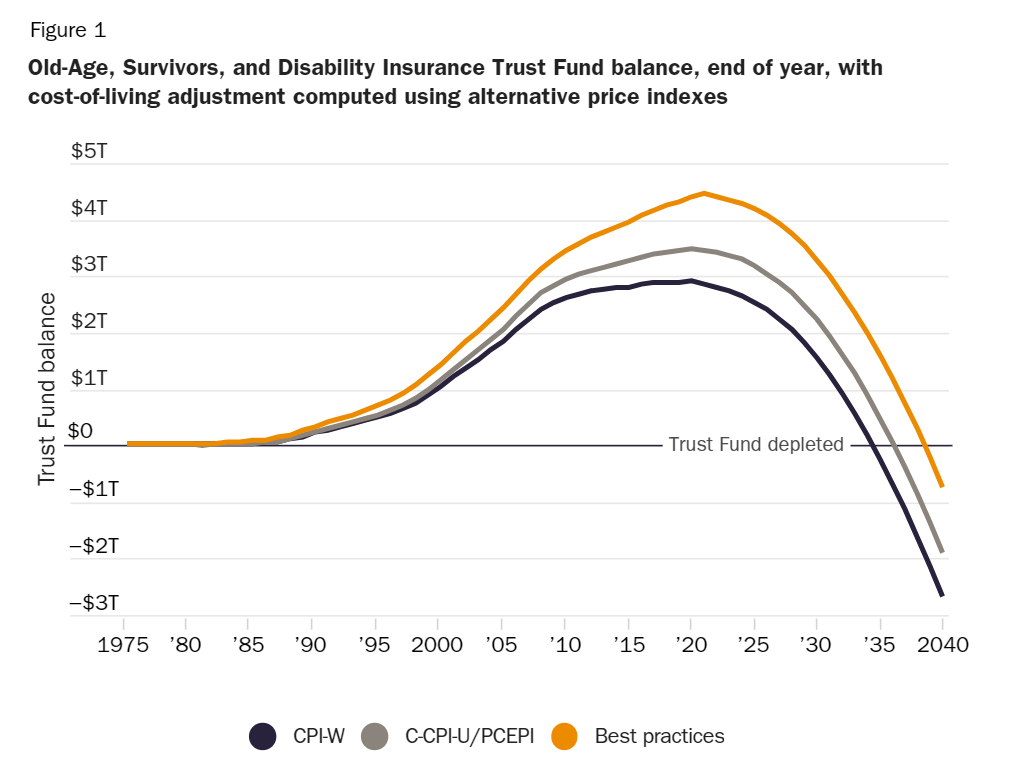

COLAs for Social Security’s OASDI have had an additional significant fiscal effect. Until recently, the payroll taxes paid for Social Security each year have usually exceeded the cost of benefits paid in that year. This balance was transferred to the general fund of the U.S. Treasury, which in turn issued special Treasury bonds to the Social Security Trust Fund to be redeemed later when taxes collected were less than the benefits paid. The fund balance reached $2.9 trillion at the end of 2020. Then in 2021, the Social Security Trust Fund had to redeem $56.3 billion of those bonds to pay OASDI benefits. Social Security actuaries have calculated that increasingly larger withdrawals will continue until the Trust Fund is fully depleted in early 2035.36 Under current law, once the Trust Fund balance is fully depleted, payments to beneficiaries must be reduced to the level supported by current Social Security taxes.

If Social Security COLAs had been calculated using the combination of C‑CPI‑U and PCEPI, then the Trust Fund balance in 2020 would have been $3.5 trillion, and full depletion of the Trust Fund would have been delayed two more years to 2037. If the price indexes had also been improved to minimize new‐item bias (the best‐practices index), the balance in 2020 would have been $4.4 trillion, and full depletion of the fund would have been delayed until 2039 (see Figure 1).

Author(s): John F. Early

Publication Date: 22 Jun 2023

Publication Site: Cato