Graphic:

Excerpt:

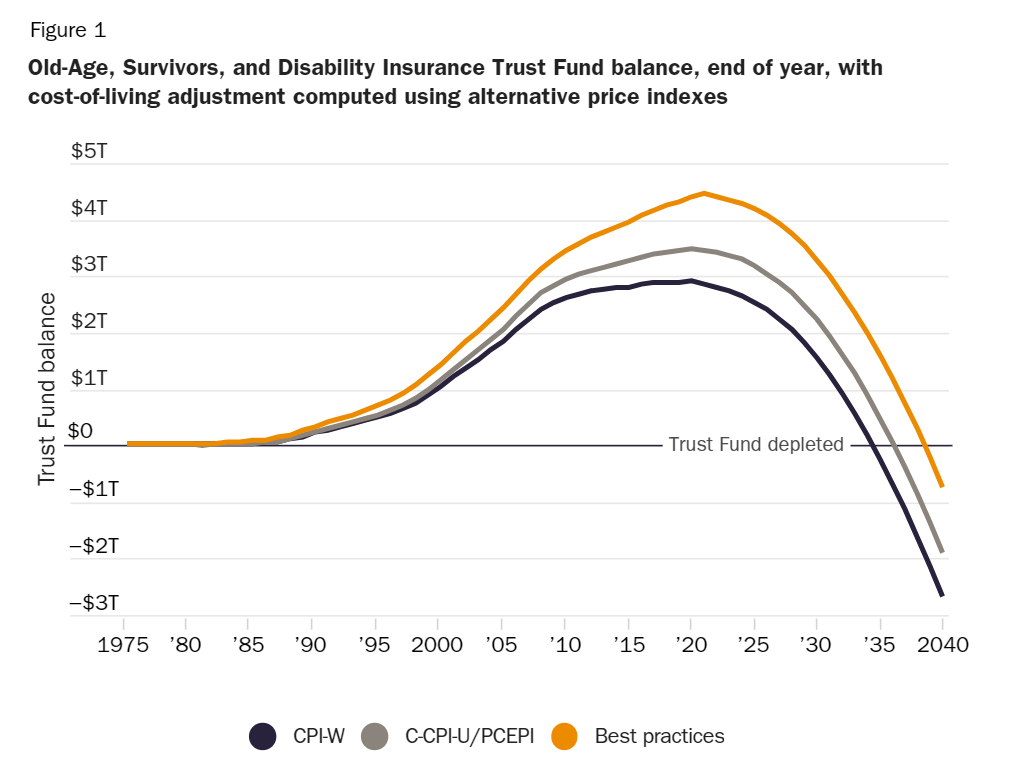

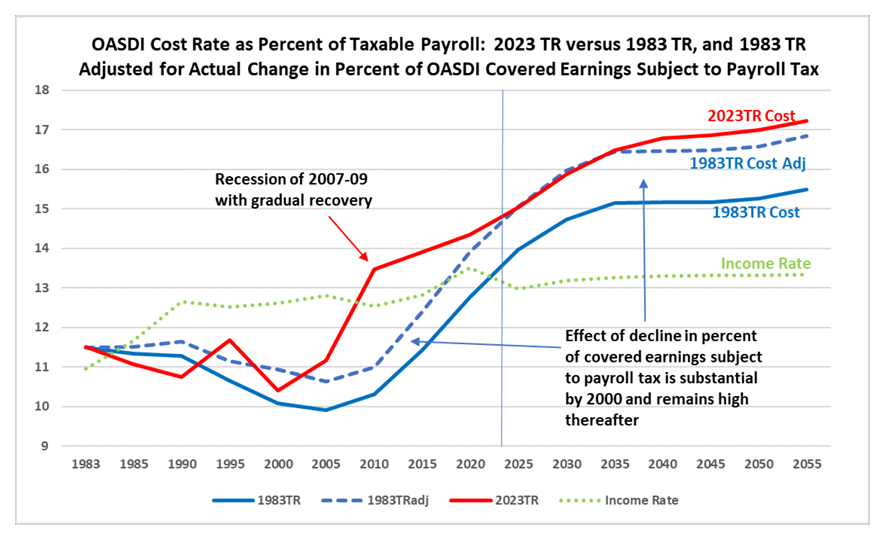

First, the 1983 Amendments were an interim solution to the well-understood changing of the age distribution due to the drop in birth rate after 1965. These Amendments were expected to extend the ability to pay scheduled benefits from 1982 to the mid-2050s, with the clear understanding that further changes would be needed by then.

Second, the redistribution of earned income to the highest earners was not anticipated in 1983. This shift resulted in about 8 percent less payroll tax revenue by 2000 than had been expected, with this reduced level continuing thereafter. The severity of the 2007-09 recession was also not anticipated.

Third, with the passage of 40 years since 1983, we clearly see the shortcomings of the 1983 Amendments in achieving “sustainable solvency” for Social Security. We are now in a position to formulate further changes needed, building on the start made in 1983.

Fourth, the long-known and understood shift in the age distribution of the US population will continue to increase the aged dependency ratio until about 2040, and in turn increase the cost of the OASDI program as a percentage of taxable payroll and GDP. Once this shift, which reflects the drop in the birth rate after 1965, is complete, the cost of the program will be relatively stable at around 6 percent of GDP. The unfunded obligation for the OASDI program over the next 75 years represents 1.2 percent of GDP over the period as a whole.

Author(s): Stephen C. Goss, Chief Actuary, Social Security Administration

Publication Date: 12 July 2023

Publication Site: Senate Budget Committee