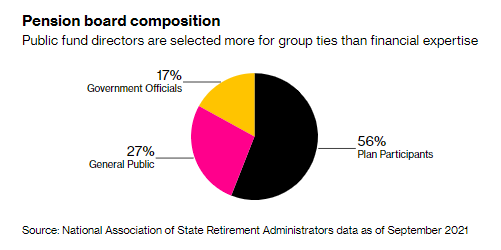

In the US, a lineup of unpaid union-backed reps, retirees and political appointees are the vanguards of a $4 trillion slice of the economy that looks after the nation’s retired public servants. They’re proving to be no match for a system that’s exploded in size and complexity.

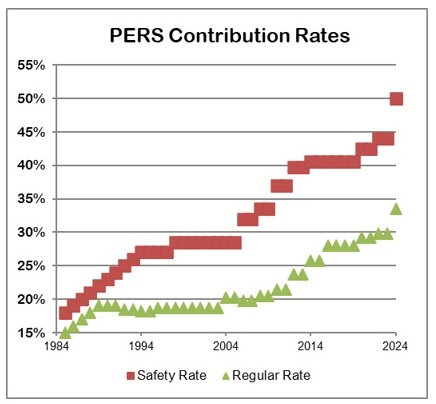

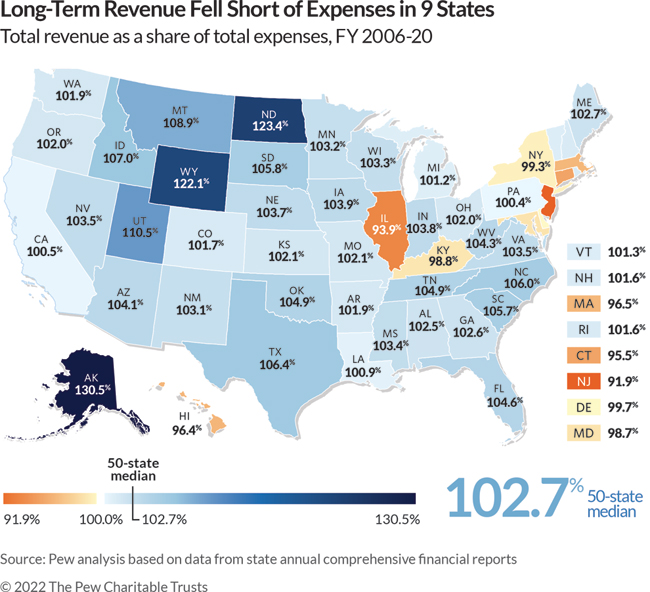

The disparity is dragging on state and local finances and — together with headwinds that include a growing ratio of retirees to workers and lenient accounting standards — gobbling up an increasing share of government budgets. Precisely how much it’s costing Americans is hard to say. But a Bloomberg News analysis of data from CEM Benchmarking, which tracks industry performance, indicates that the price tag over the past decade could run into the hundreds of billions of dollars.

….

The disconnect was on display at a 2021 investment committee meeting of the California Public Employees’ Retirement System, which provides benefits to more than 750,000 individuals. An external adviser warned board members that the boom in blank-check companies was a sign of froth in financial markets.

“I had never heard of those,” chairwoman Theresa Taylor told her fellow directors of the then-sizzling products known as SPACs, according to a transcript of the meeting.

….

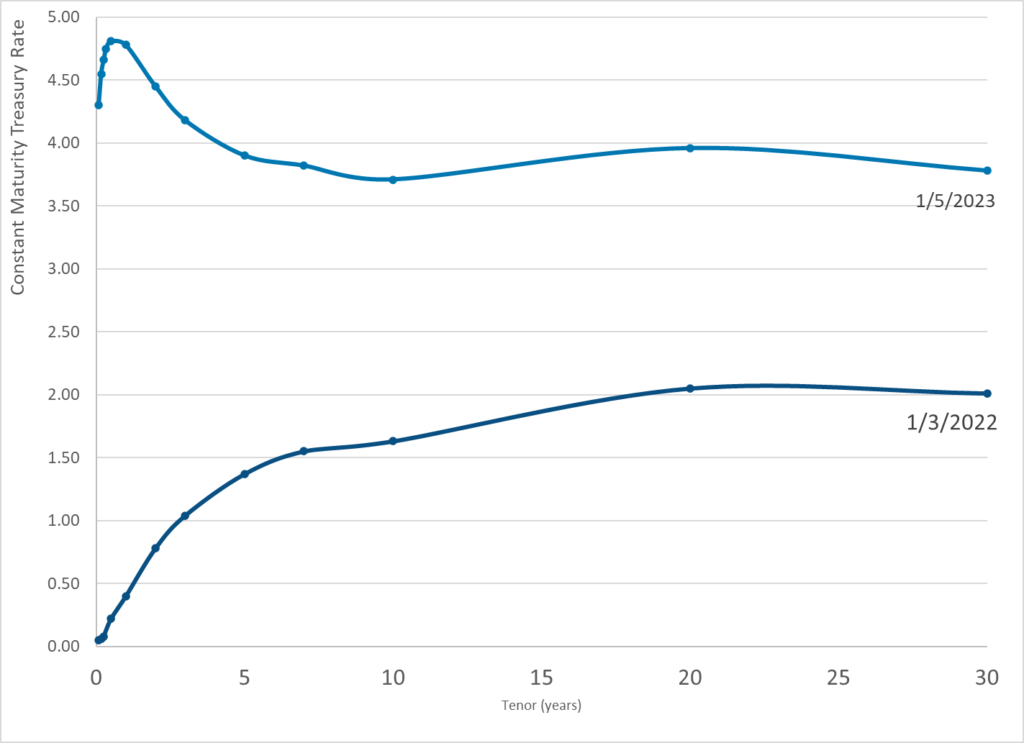

Systems are underfunded partly because public officials face greater pressure to fulfill today’s demands than to fund obligations 20 or 30 years away. And because hikes in taxes and contributions are unpopular, there’s an incentive to downplay the problem.

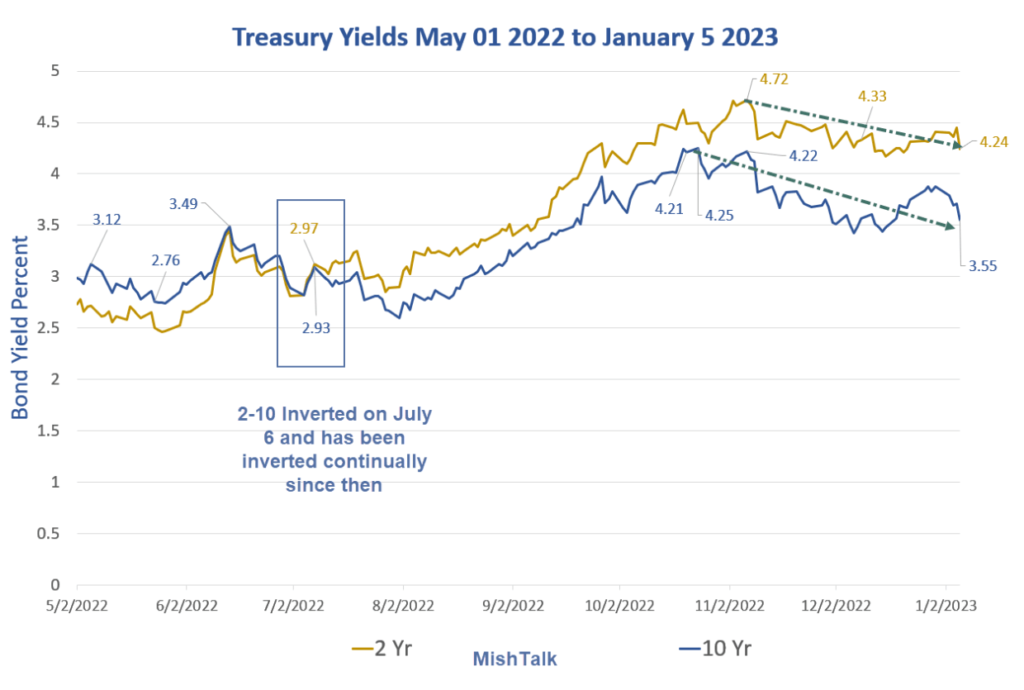

Instead, plans are investing in higher risk assets, which make up about one-third of holdings, according to data from Preqin. That allocation has more than doubled since just before the 2008 financial crisis as plans have poured $1 trillion into alternatives.

….

Many pension advisers make smart recommendations: the guidance that CalPERS should stay away from SPACs, for one, was proven sound once regulators ramped up scrutiny of that market, which has all but ground to a halt. Yet it remains unclear how closely individual directors evaluate investments that get put in front of them.

“I served with one director for about 15 years and never saw him ask a question” about his system’s investments, said Herb Meiberger, a finance professor who sat on the board of the $36 billion San Francisco Employees’ Retirement System until 2017. A spokesman for the system said it takes governance and fiduciary duty very seriously, and that board members receive training to help them execute their duties.

Harvard finance professor Emil Siriwardane has researched why some US plans have put more money into alternatives. It wasn’t the worst-funded or those with the most aggressive performance targets. “By a factor of eight-to-ten,” the closest correlation is the investment consultants that pension plans hire, Siriwardane found.

….

Canada’s detour from the American-style model began in the late 1980s, when Ontario’s government and teacher federation decided to reboot a plan that was invested in non-marketable provincial bonds. They set up the Ontario Teachers’ Pension Plan in 1990, concluding the province could save $1.2 billion over a decade by operating more like a business.

Ontario Teachers’ first board chairman was a former Bank of Canada governor and its first finance chief was a corporate finance veteran. It soon began investing directly in private markets and infrastructure, opened offices in Europe and Asia and acquired a large real estate firm. The system pays its board members close to what corporate directors make, and manages 80% of its investments internally. Those practices have put it on a solid financial base: Ontario Teachers’ says it’s been fully funded for the past nine years, with a current funding ratio of 107%.

Until the 2008 financial crisis, boards in the Netherlands — where traditional public sector pensions are common — looked a lot like those in the US. Then the country’s central bank was given authority to assess candidates. It looked at directors’ combined risk management, actuarial and other expertise.

Many smaller Dutch funds didn’t make the cut. The regulatory hurdles helped set off a wave of mergers that, over the past decade, has reduced the number of plans by over two-thirds. The system has sprouted professional directors who serve more than one at a time.

Few US boards are following suit. Only 19 of 113 funds studied made changes to their board composition from 1990 to 2012, a paper published in The Review of Financial Studies in 2017 found.

“A lot of funds in the US like the idea of transforming, want to transform, but don’t have the political fortitude to do it,” said Brad Kelly of Global Governance Advisors, a Toronto-based firm that works with US and Canadian pension funds.