Link: https://www.thelancet.com/journals/lanplh/article/PIIS2542-5196(17)30156-0/fulltext

Graphic:

Excerpt:

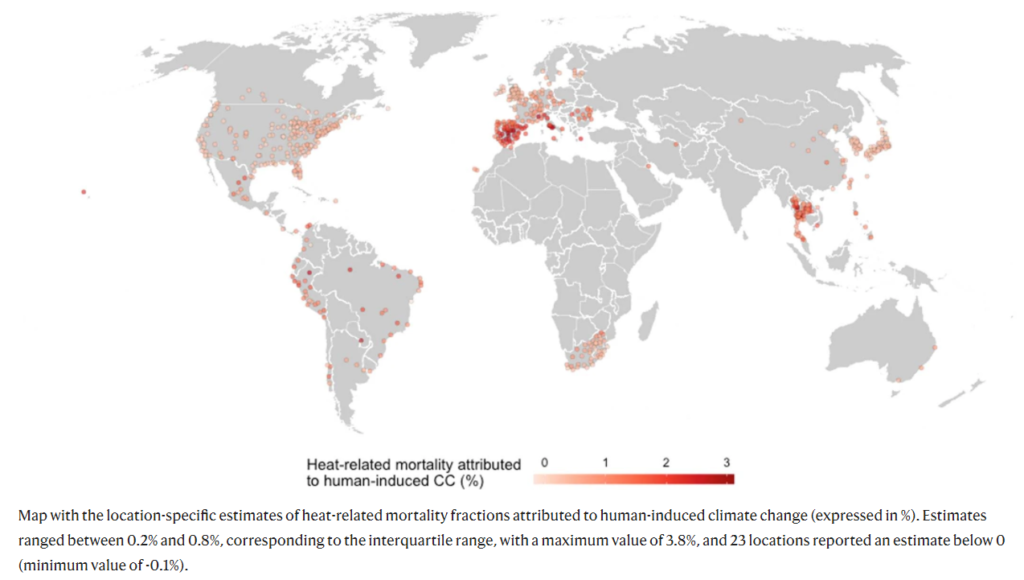

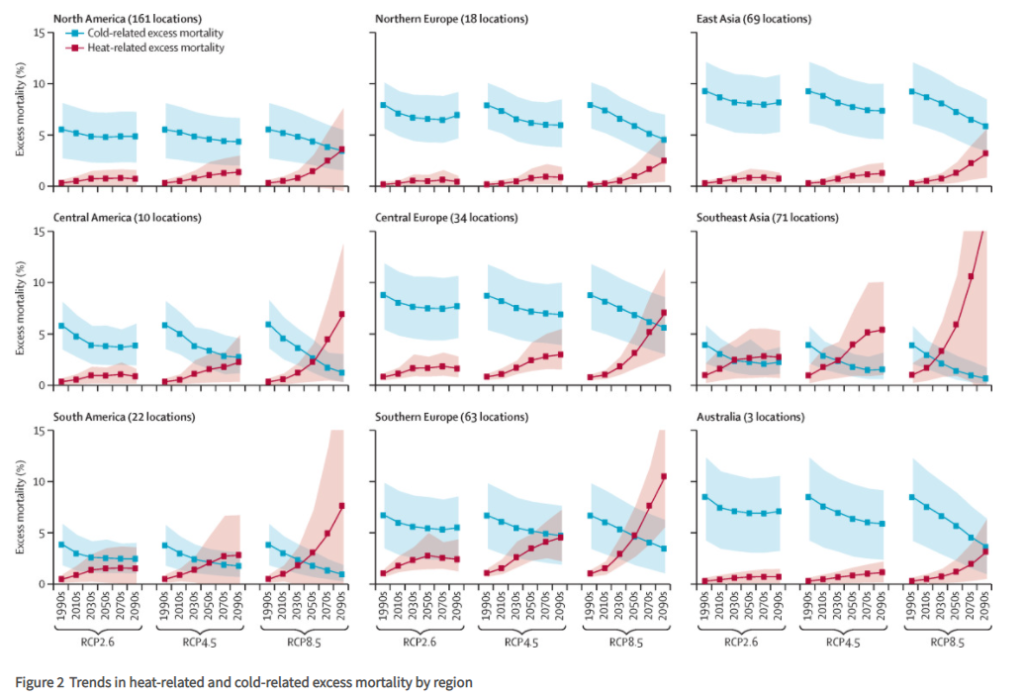

Our dataset comprised 451 locations in 23 countries across nine regions of the world, including 85 879 895 deaths. Results indicate, on average, a net increase in temperature-related excess mortality under high-emission scenarios, although with important geographical differences. In temperate areas such as northern Europe, east Asia, and Australia, the less intense warming and large decrease in cold-related excess would induce a null or marginally negative net effect, with the net change in 2090–99 compared with 2010–19 ranging from −1·2% (empirical 95% CI −3·6 to 1·4) in Australia to −0·1% (−2·1 to 1·6) in east Asia under the highest emission scenario, although the decreasing trends would reverse during the course of the century. Conversely, warmer regions, such as the central and southern parts of America or Europe, and especially southeast Asia, would experience a sharp surge in heat-related impacts and extremely large net increases, with the net change at the end of the century ranging from 3·0% (−3·0 to 9·3) in Central America to 12·7% (−4·7 to 28·1) in southeast Asia under the highest emission scenario. Most of the health effects directly due to temperature increase could be avoided under scenarios involving mitigation strategies to limit emissions and further warming of the planet.

Author(s):

Antonio Gasparrini, PhD

Yuming Guo, PhD

Francesco Sera, MSc

Ana Maria Vicedo-Cabrera, PhD

Veronika Huber, PhD

Prof Shilu Tong, PhD

Micheline de Sousa Zanotti Stagliorio Coelho, PhD

Prof Paulo Hilario Nascimento Saldiva, PhD

Eric Lavigne, PhD

Patricia Matus Correa, MSc

Nicolas Valdes Ortega, MSc

Haidong Kan, PhD

Samuel Osorio, MSc

Jan Kyselý, PhD

Aleš Urban, PhD

Prof Jouni J K Jaakkola, PhD

Niilo R I Ryti, PhD

Mathilde Pascal, PhD

Prof Patrick G Goodman, PhD

Ariana Zeka, PhD

Paola Michelozzi, MSc

Matteo Scortichini, MSc

Prof Masahiro Hashizume, PhD

Prof Yasushi Honda, PhD

Prof Magali Hurtado-Diaz, PhD

Julio Cesar Cruz, MSc

Xerxes Seposo, PhD

Prof Ho Kim, PhD

Aurelio Tobias, PhD

Carmen Iñiguez, PhD

Prof Bertil Forsberg, PhD

Daniel Oudin Åström, PhD

Martina S Ragettli, PhD

Prof Yue Leon Guo, PhD

Chang-fu Wu, PhD

Antonella Zanobetti, PhD

Prof Joel Schwartz, PhD

Prof Michelle L Bell, PhD

Tran Ngoc Dang, PhD

Prof Dung Do Van, PhD

Clare Heaviside, PhD

Sotiris Vardoulakis, PhD

Shakoor Hajat, PhD

Prof Andy Haines, FMedSci

Prof Ben Armstrong, PhD

Publication Date: 1 December 2017

Publication Site: The Lancet