Graphic:

Excerpt:

This research paper’s main objective is to inspire and generate discussions

about algorithmic bias across all areas of insurance and to encourage

actuaries to be involved. Evaluating financial risk involves the creation of

functions that consider myriad characteristics of the insured. Companies utilize

diverse statistical methods and techniques, from relatively simple regression

to complex and opaque machine learning algorithms. It has been alleged that

the predictions produced by these mathematical algorithms have

discriminatory effects against certain groups of society, known as protected

classes.

The notion of discriminatory effects describes the disproportionately adverse

effect algorithms and models could have on protected groups in society. As a

result of the potential for discriminatory effects, the analytical processes

followed by financial institutions for decision making have come under greater

scrutiny by legislators, regulators, and consumer advocates. Interested parties

want to know how to quantify such effects and potentially how to repair such

systems if discriminatory effects have been detected.

This paper provides:

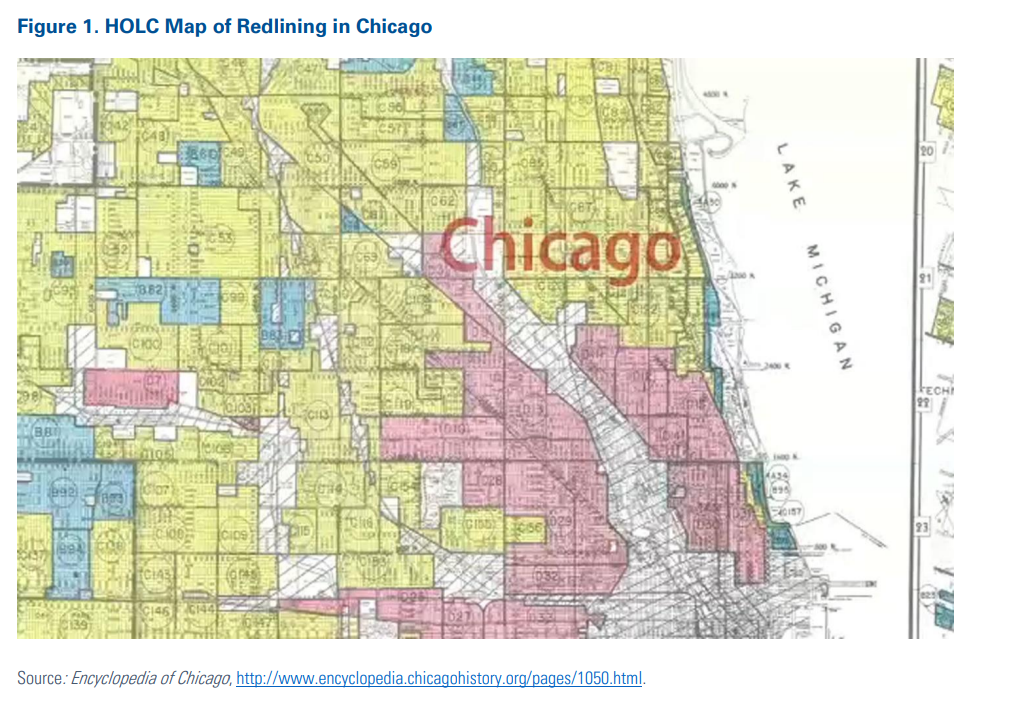

• A historical perspective of unfair discrimination in society and its impact

on property and casualty insurance.

• Specific examples of allegations of bias in insurance and how the various

stakeholders, including regulators, legislators, consumer groups and

insurance companies have reacted and responded to these allegations.

• Some specific definitions of unfair discrimination and that are interpreted

in the context of insurance predictive models.

• A high-level description of some of the more common statistical metrics

for bias detection that have been recently developed by the machine

learning community, as well as a brief account of some machine learning

algorithms that can help with mitigating bias in models.

This paper also presents a concrete example of an insurance pricing GLM

model developed on anonymized French private passenger automobile data,

which demonstrates how discriminatory effects can be measured and

mitigated.

Author(s): Roosevelt Mosley, FCAS, and Radost Wenman, FCAS

Publication Date: March 2022

Publication Site: CAS