Link:https://www.visualcapitalist.com/700-year-decline-of-interest-rates/

Graphic:

Excerpt:

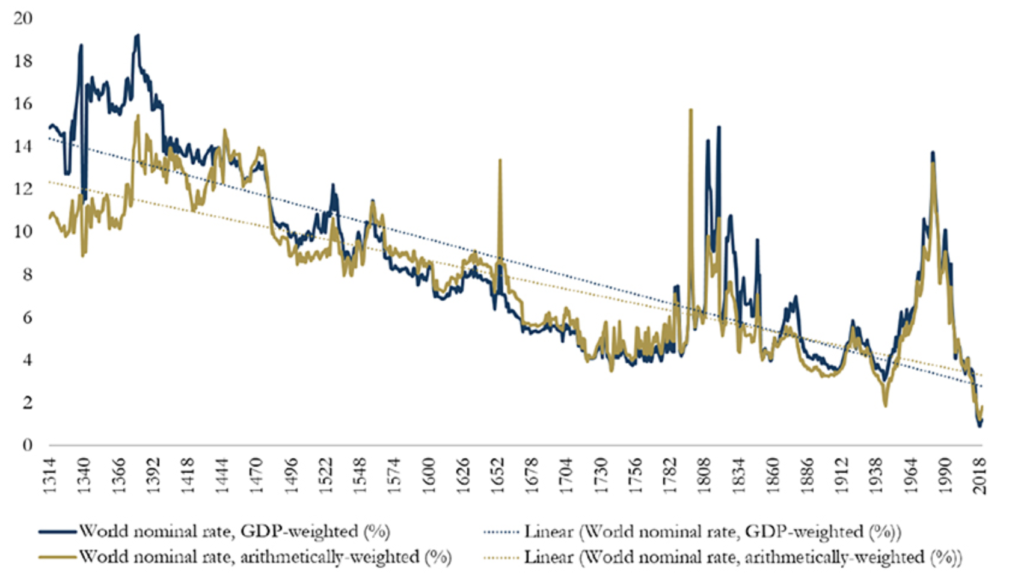

Today’s graphic from Paul Schmelzing, visiting scholar at the Bank of England (BOE), shows how global real interest rates have experienced an average annual decline of -0.0196% (-1.96 basis points) throughout the past eight centuries.

….

Starting in 1311, data from the report shows how average real rates moved from 5.1% in the 1300s down to an average of 2% in the 1900s.

The average real rate between 2000-2018 stands at 1.3%.

….

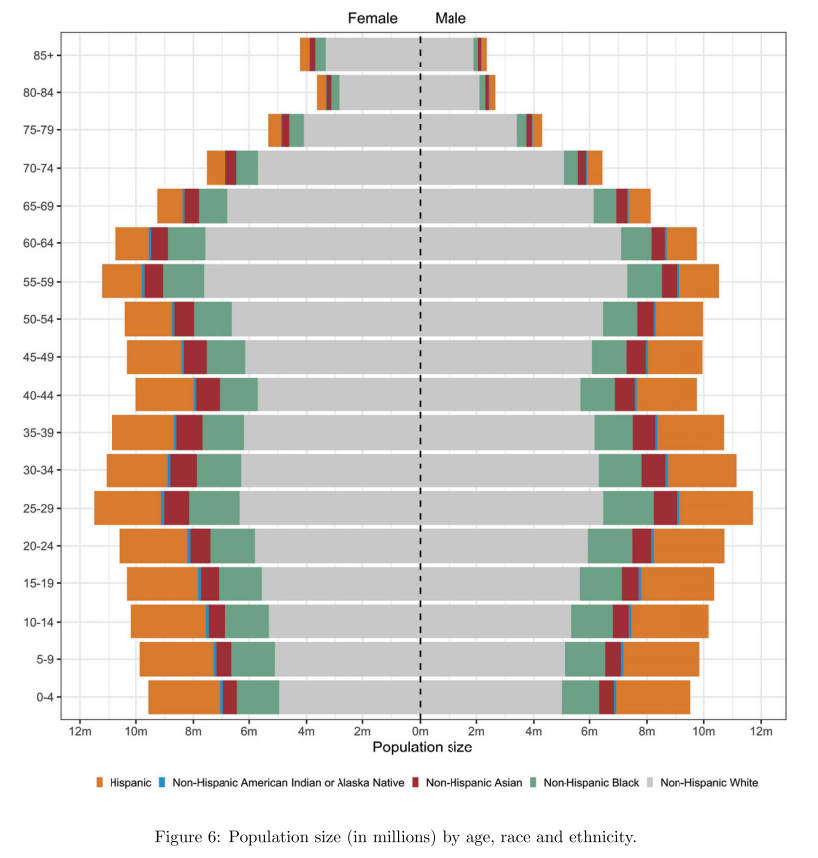

Demographics impact interest rates on a number of levels. The aging population—paired with declining fertility levels—result in higher savings rates, longer life expectancies, and lower labor force participation rates.

In the U.S., baby boomers are retiring at a pace of 10,000 people per day, and other advanced economies are also seeing comparable growth in retirees. Theory suggests that this creates downward pressure on real interest rates, as the number of people in the workforce declines.

Author(s): Dorothy Neufeld

Publication Date: 4 Feb 2020

Publication Site: Visual Capitalist