Link: https://angrybearblog.com/2023/06/107367

pdf report: https://chqpr.org/downloads/Rural_Hospitals_at_Risk_of_Closing.pdf

Graphic:

Excerpt:

Things are changing more rapidly. Smaller hospitals are under an attack of high costs and less revenue. As a result, many are closing leaving the small town and rural residents without medical care or having to drive long distances in emergencies. As reported by Healthcare Quality and Payment Reform:

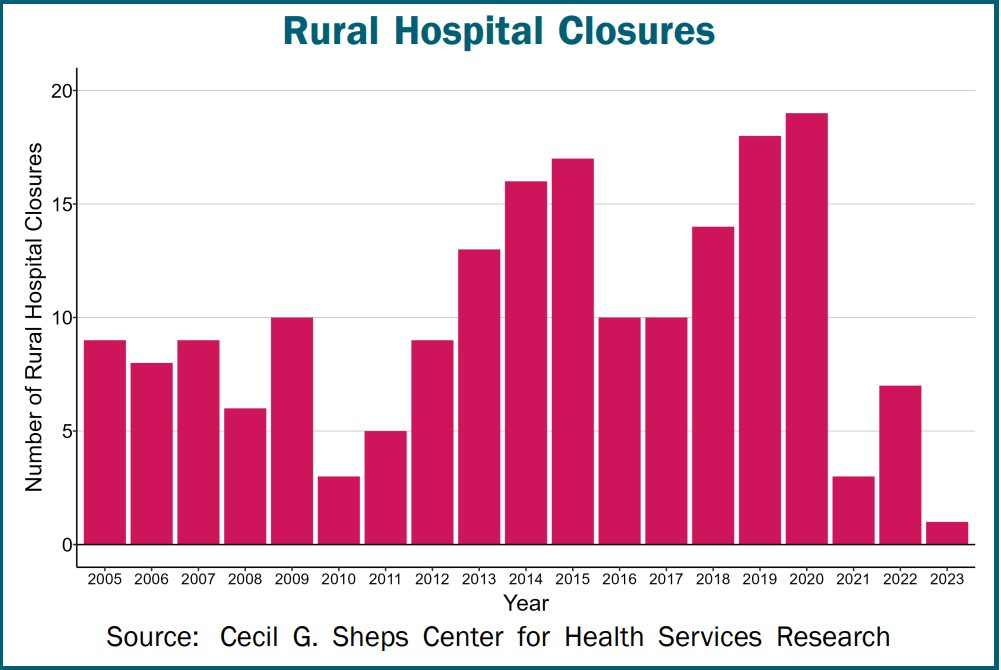

Many people across the country could not receive hospital care in their community when the pandemic began. Over 150 rural hospitals closed between 2005 and 2019. An additional 19 rural hospitals closed in 2020, more than any year in the previous decade. The closures are not resulting from the pandemic, but by financial losses in previous years. Ten more rural hospitals closed in 2021 and 2022. The closures decreased in 2019 due to the special financial assistance hospitals received during the pandemic. The pandemic aid has ended and closures are likely to increase.

Hundreds of Hospitals are at Risk of Closing

Six hundred rural hospitals or ~ 30% of all rural hospitals in the country are at risk of closing. At risk because of the serious financial problems, they are experiencing:

Author(s): Center for Healthcare Quality and Payment Reform

Publication Date: 7 Jun 2023 on blog, accessed 14 Jun 2023

Publication Site: Angry Bear Blog