Link:https://www.washingtonpost.com/business/young-versus-old-will-define-fight-over-public-pensions/2022/10/06/d4fae69a-4566-11ed-be17-89cbe6b8c0a5_story.html

Excerpt:

Younger workers are mostly excluded from those benefits, and few believe pension funds will be around to pay them at retirement time anyway. So younger workers want salary increases rather than promises. Also, portable, employee-directed accounts like 401(k)s rather than large and ever-increasing contributions to black-hole public pension systems. The fight in 2023 may be more between younger and older public employees than between united public employees and taxpayers.I think young employees will score their first victory after many years of getting pushed down. It will be short-term inflation then that applies lethal pressure in a tight labor market, not stock prices, interest rates or even longer-term expectations of price increases. Wages will have to be raised for public employees, who will refuse burdens from past underfunding or benefit cuts that apply only to them. The alternative is unacceptable declines in public services as the best employees quit, job openings go unfilled and qualifications for new hires are lowered.The most heavily indebted states, with the worst credit ratings and biggest pension funding shortfalls, may not be able to pay these increases. While 2022 should be a good revenue year for a majority of state and local governments, heavily indebted states with big pension-funding gaps need to brace for some serious headwinds. Illinois already spends 11% of its revenue to service debt. Increased yields on its bonds could double that to 22% as debt is refinanced, even if the state runs balanced budgets.

The temptation to cut benefits for retirees may be overwhelming. While these people can (and will) yell and scream, that’s easier to accept than a teachers’ strike or a police slowdown. Current employees can be offered generous wage increases and portable pensions. Reducing actuarial pension liabilities will please creditors and rating agencies. Taxpayers will appreciate being spared. In many states, cutting benefits will require a constitutional amendment or other legal heavy lifting, but with enough incentive, that can be done.

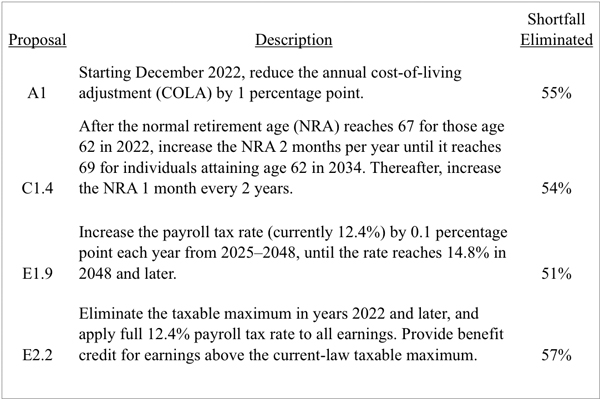

I expect something like Social Security reforms. A cap will cut benefits for people receiving the highest pensions, and states will put tax surcharges on benefits for high-income people even if they have moved out-of-state. Copays and deductibles will be increased for health coverage.

The first state to try this will face strong legal challenges, a nationwide union counteroffensive and significant in-state political resistance. But with enough fiscal pressure it may happen. If state administrations can keep current public employees on the sidelines, via wage increases and benefit restructuring, it might succeed.

Author(s): Aaron Brown, Bloomberg

Publication Date: 6 Oct 2022

Publication Site: Washington Post