Link: https://www.city-journal.org/article/d-c-to-silicon-valley-drop-dead

Graphic:

Excerpt:

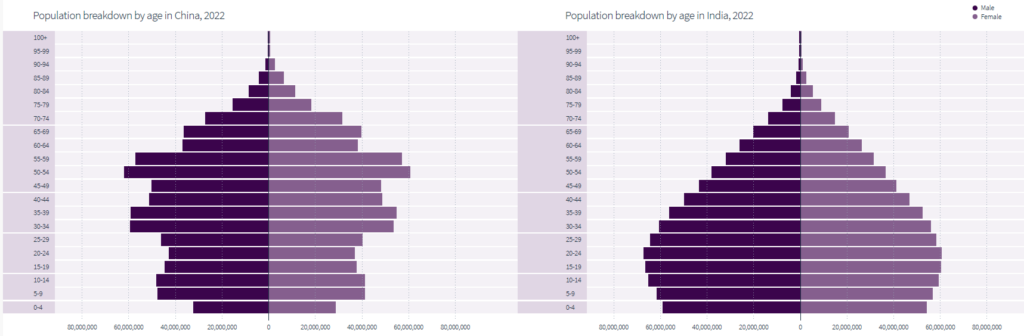

For venture capitalists and startup entrepreneurs, 2023 was a year dedicated to the destructive phase of Joseph Schumpeter’s notion of creative destruction. Silicon Valley Bank collapsed in the second-largest bank failure in American history, 400,000 tech jobs were eliminated in what Wired dubbed “The Great Tech Layoffs,” and dozens of high-potential startups transformed from unicorns into “zombies.”

…..

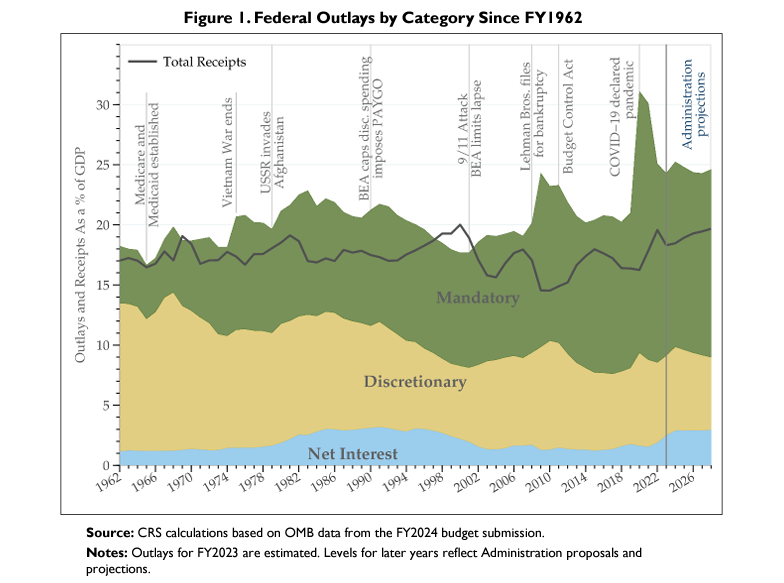

It’s no surprise that the startup industry needed to retrench—that’s been clear to observers for some time. What is surprising, however, is the reaction of policymakers in Washington, D.C., who apparently see this moment of tech-industry weakness as an opportune time to hobble the innovation economy. Take the mess that’s become of Section 174 of the Internal Revenue Code. For decades, this section has allowed companies to expense their research and development costs for software in the current year, which means that salaries paid to software engineers are entirely deductible upfront. That’s a critical calculation for early-stage tech startups, since development costs are high and revenues are low at inception.

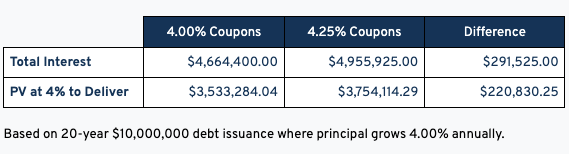

But as negotiators were finalizing the 2017 tax reform, they ran into a quandary: they needed to find an accounting gimmick that would add revenue to the bill so that it would be budget-neutral in the ensuing decade and pass muster with Congress’s arcane budget reconciliation process. Among other components, negotiators settled on a poison pill: five years on, starting in 2023, Section 174 accounting benefits would radically shrink, suddenly choking off the cash flow for America’s most innovative companies.

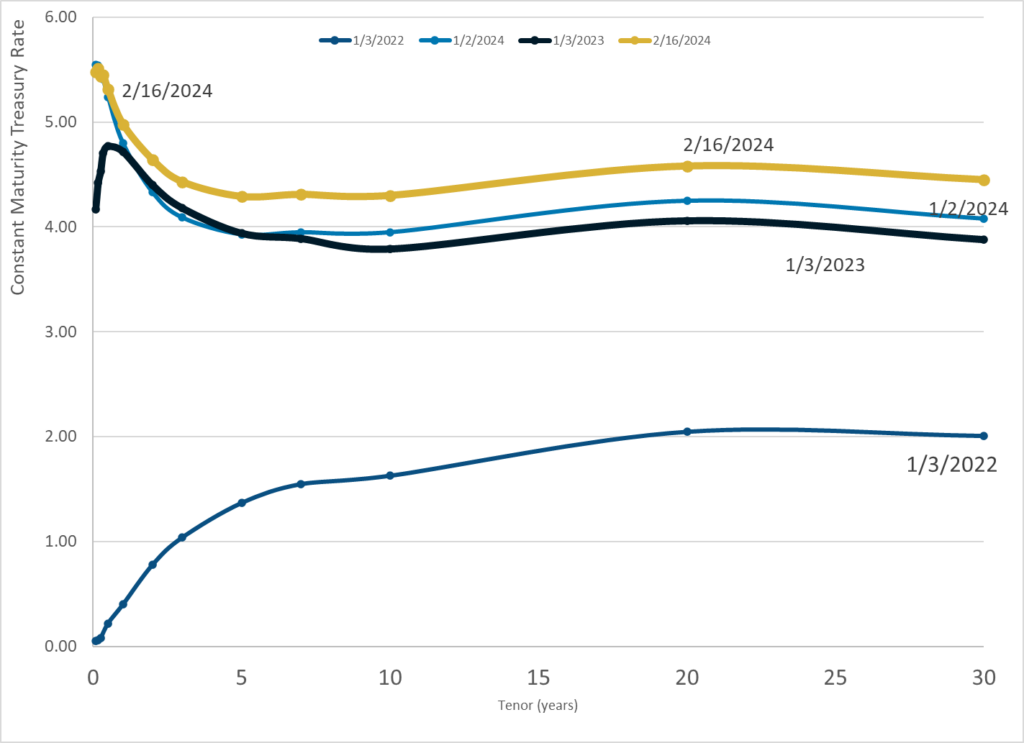

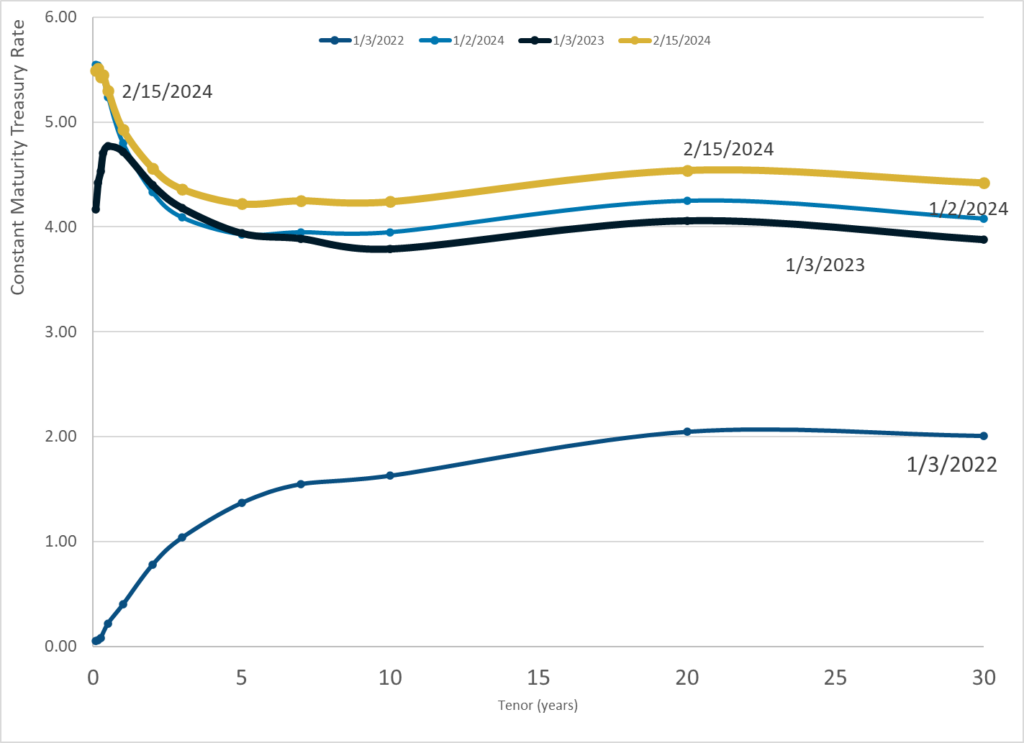

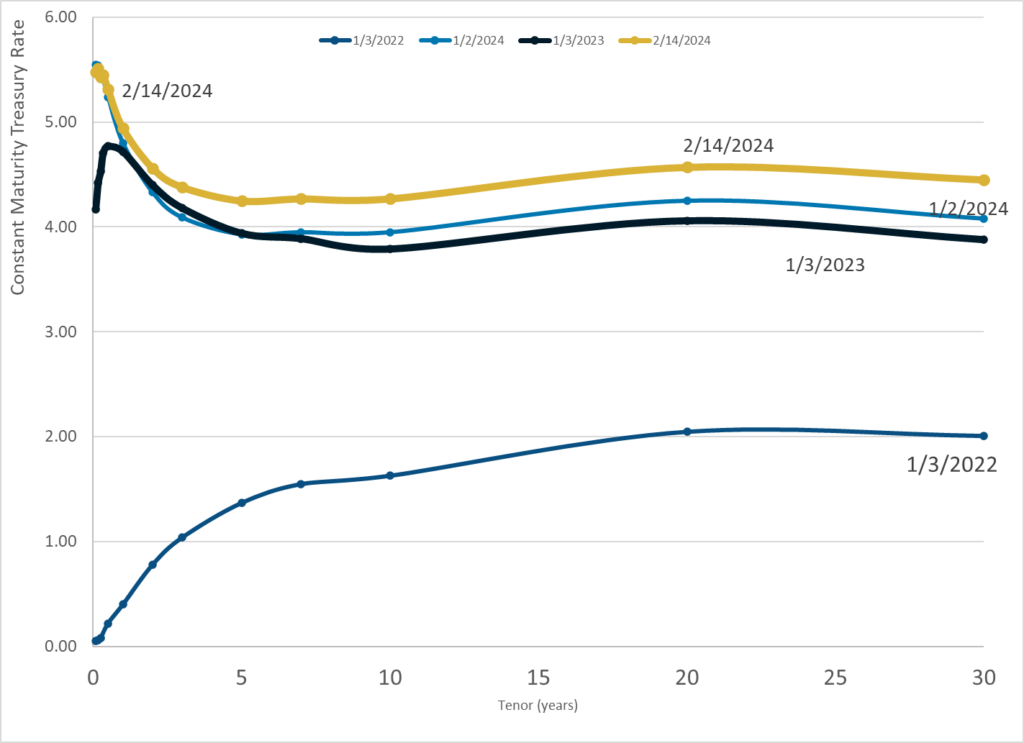

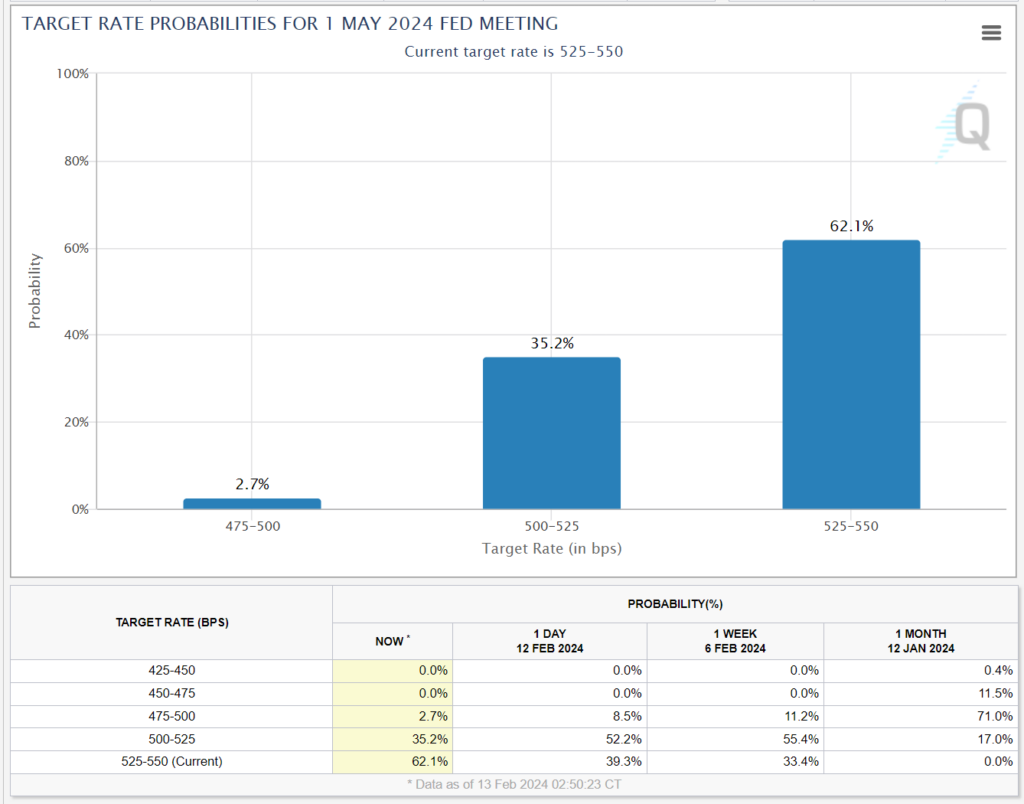

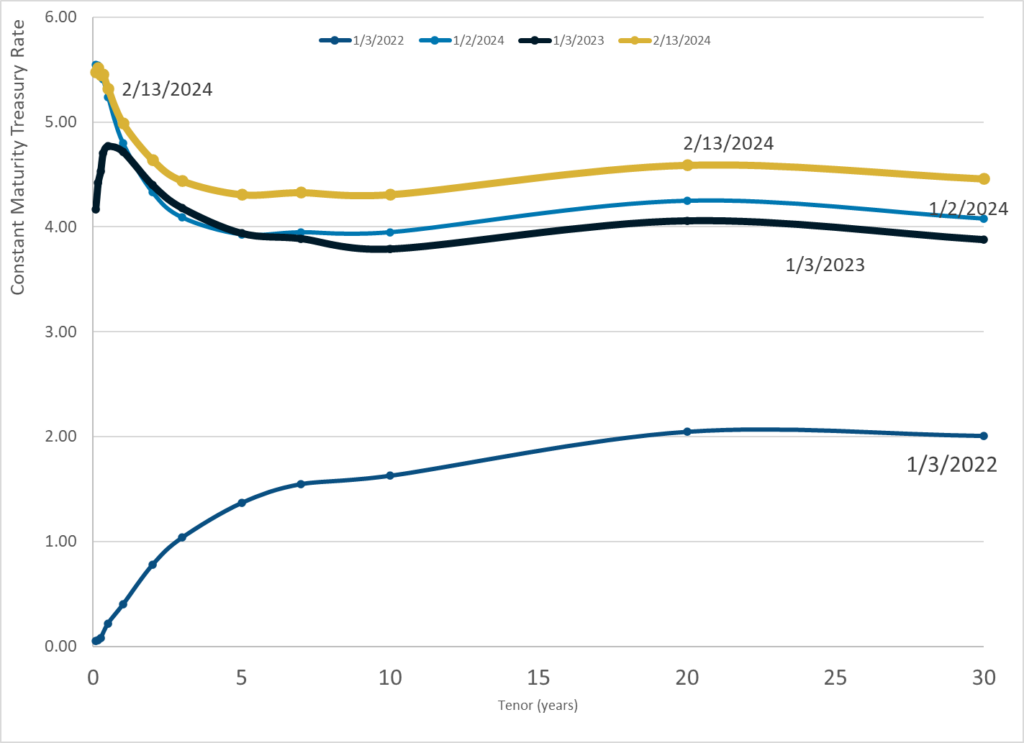

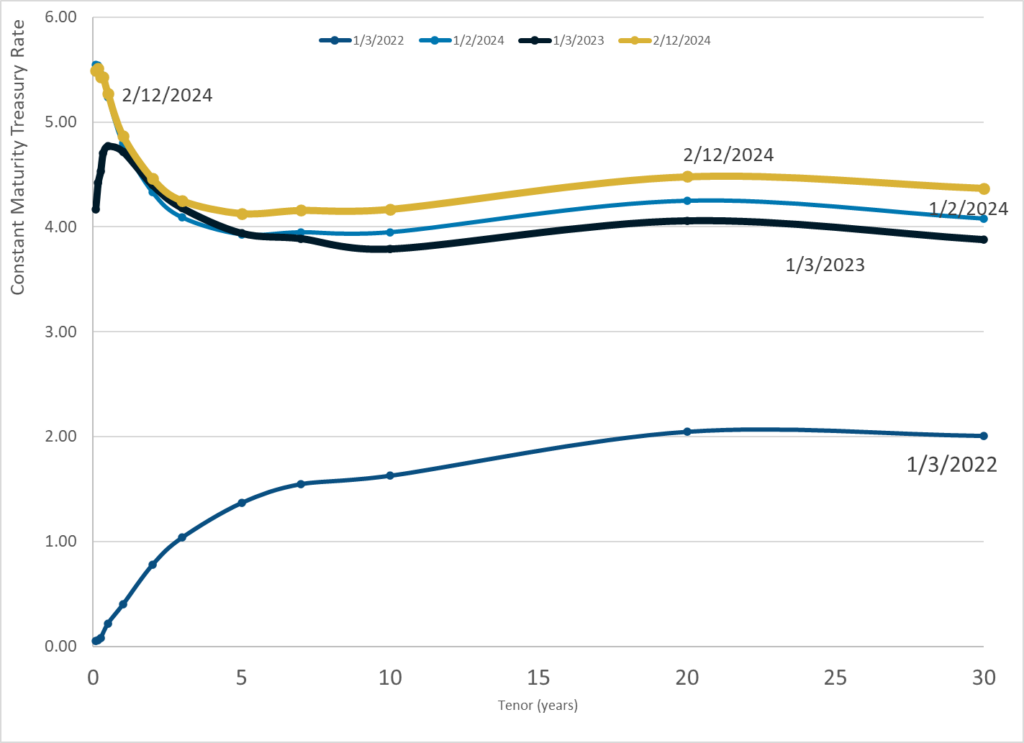

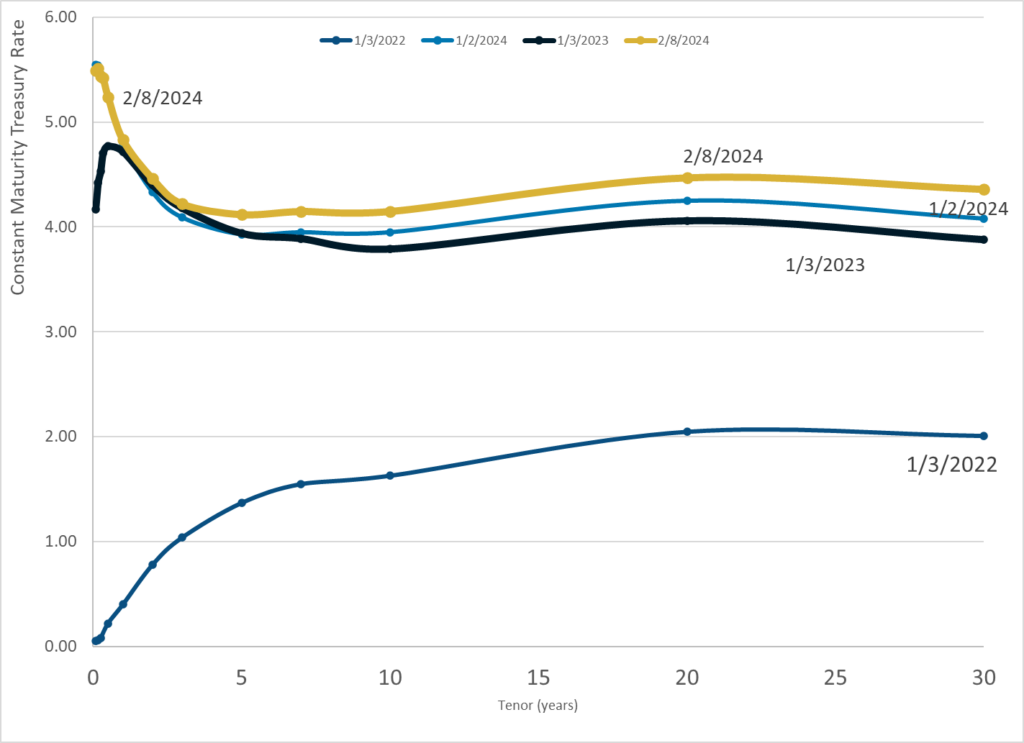

No one considered that the punishing provision would arrive just when startup innovation is shriveling in the face of higher Fed interest rates after the inflation-stoking over-exuberance of the Covid-19 economy. Industry publications and commentators have warned about the impending doom for more than a year. This week, a bipartisan group of legislators offered a path forward, coupling an antidote to the R&D poison pill with an expansion of child tax credits. But with days to go before companies must start calculating their taxes, the prospects are dim that Congress will pass the fix.

Author(s): Danny Crichton

Publication Date: 18 Jan 2024

Publication Site: City Journal