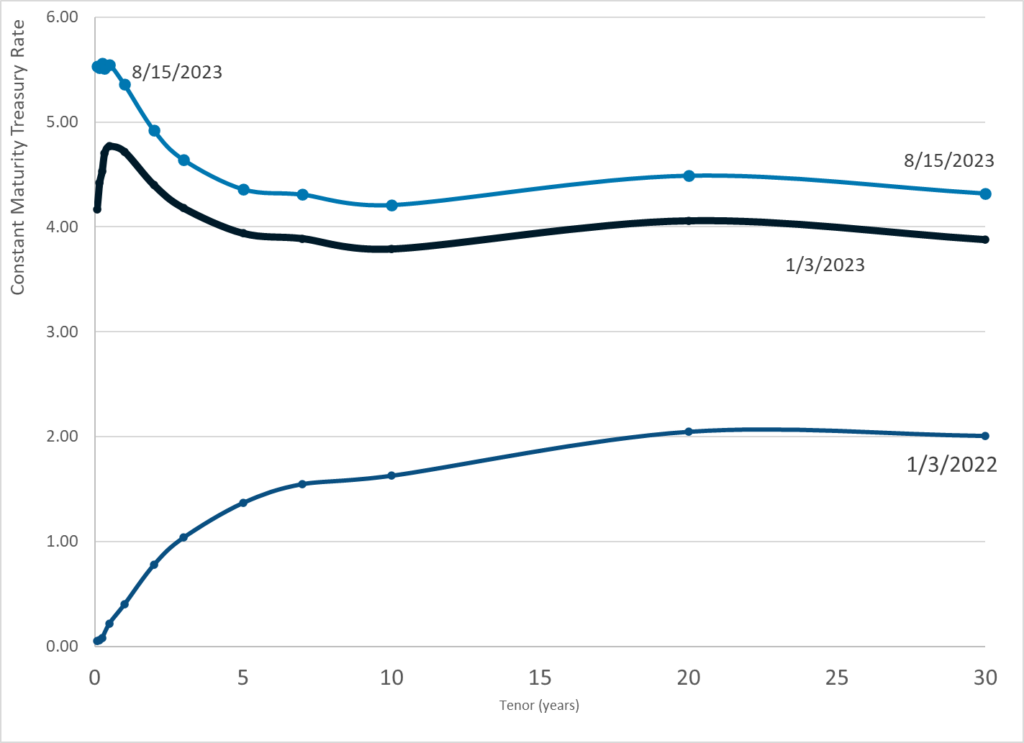

Graphic:

Publication Date: 15 Aug 2023

Publication Site: Treasury Department

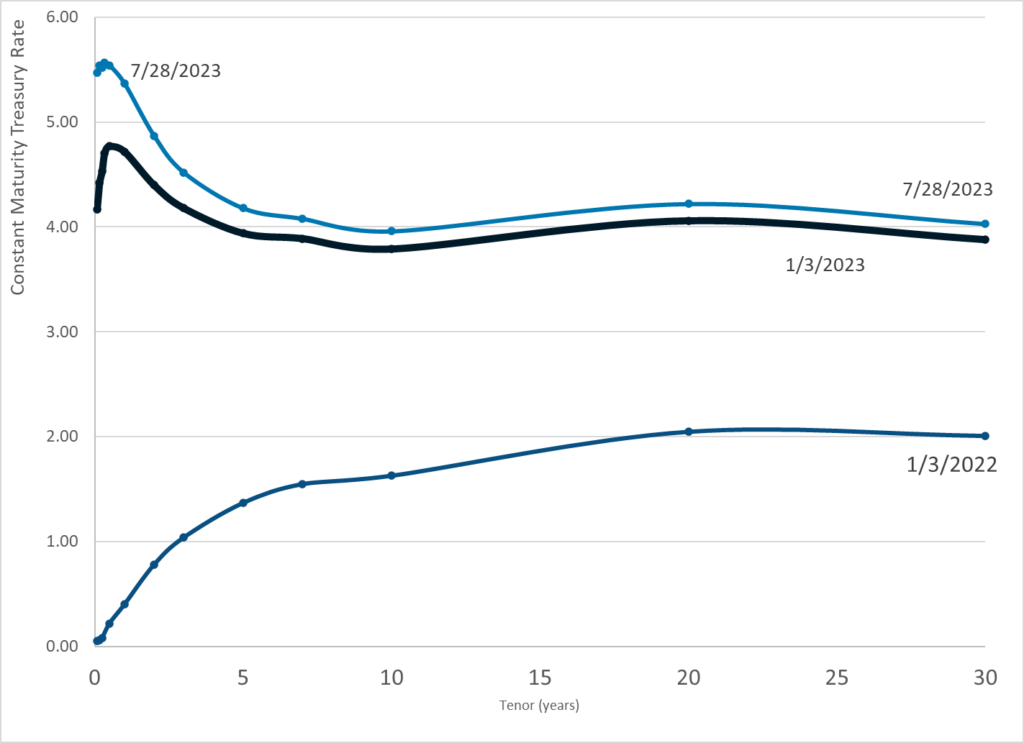

All about risk

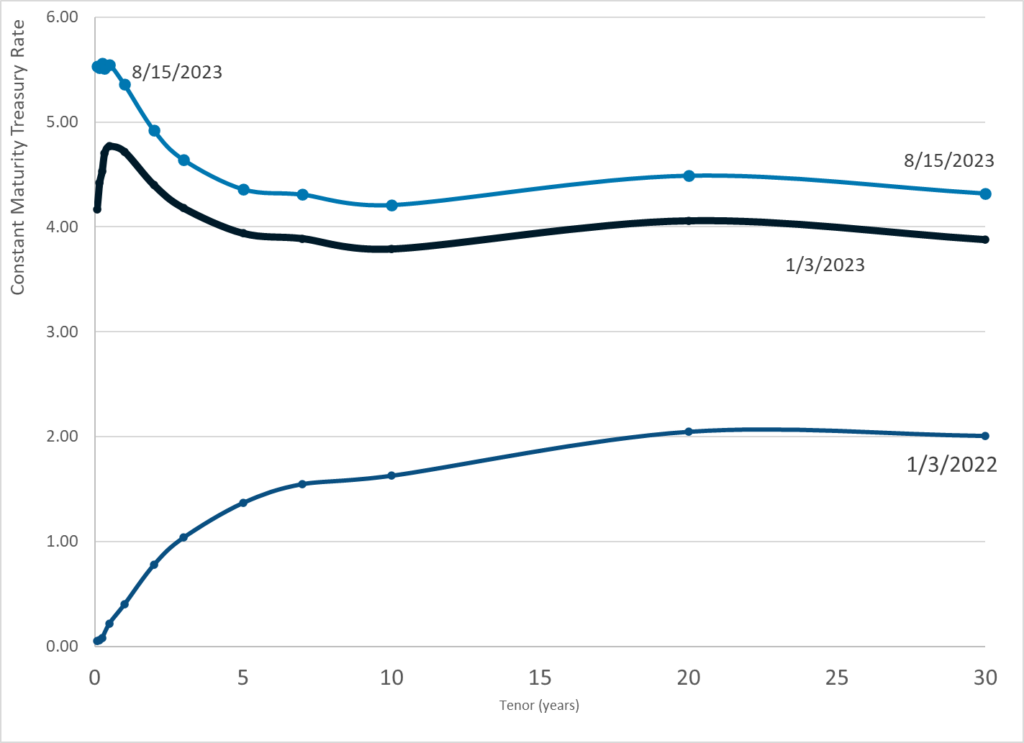

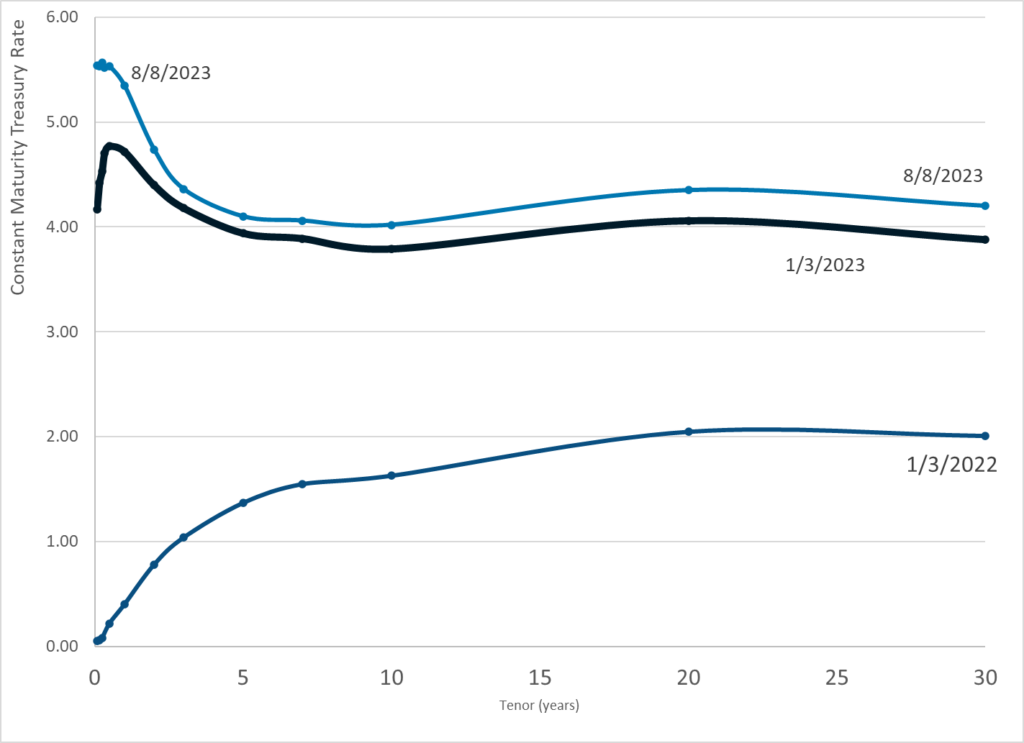

Graphic:

Publication Date: 15 Aug 2023

Publication Site: Treasury Department

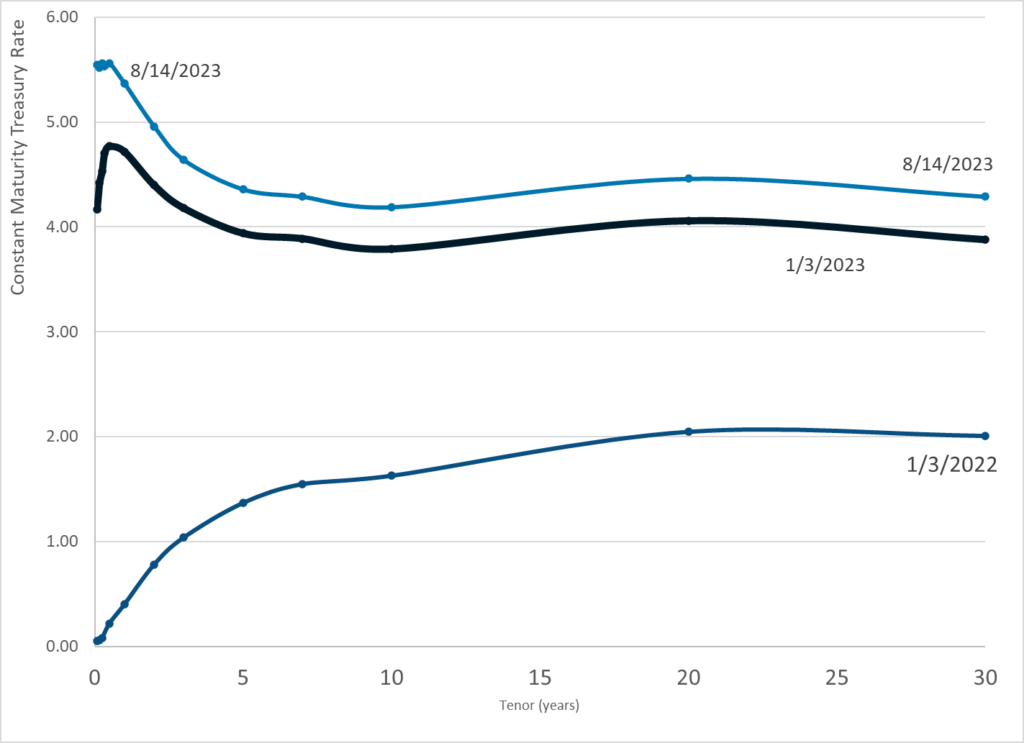

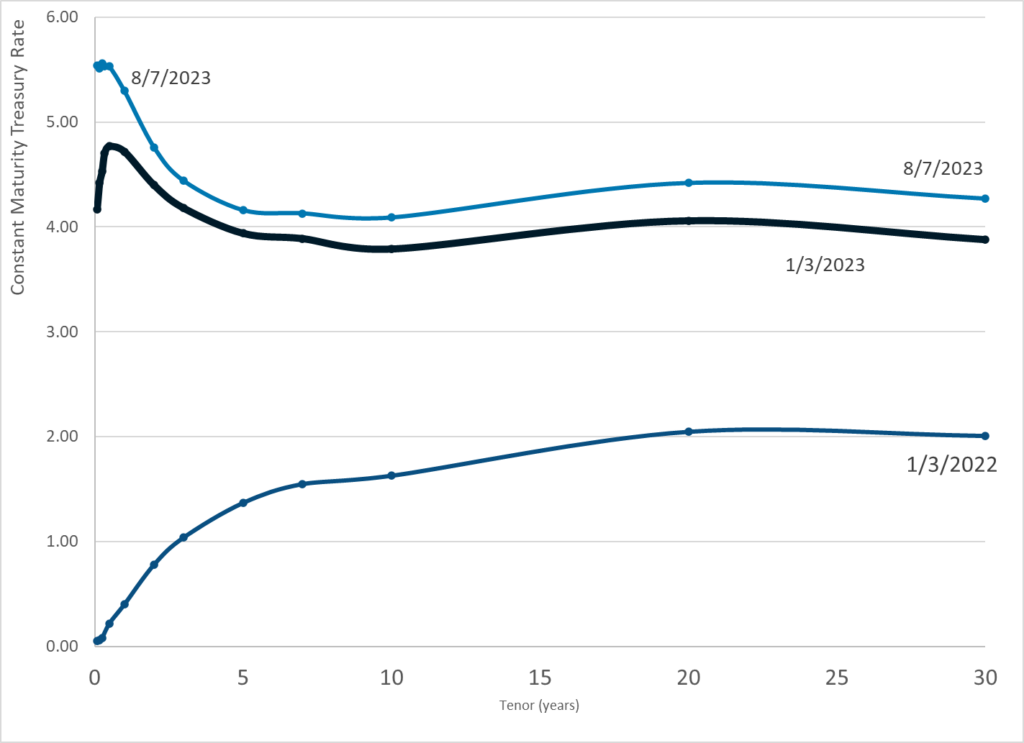

Graphic:

Publication Date: 14 Aug 2023

Publication Site: Treasury Dept

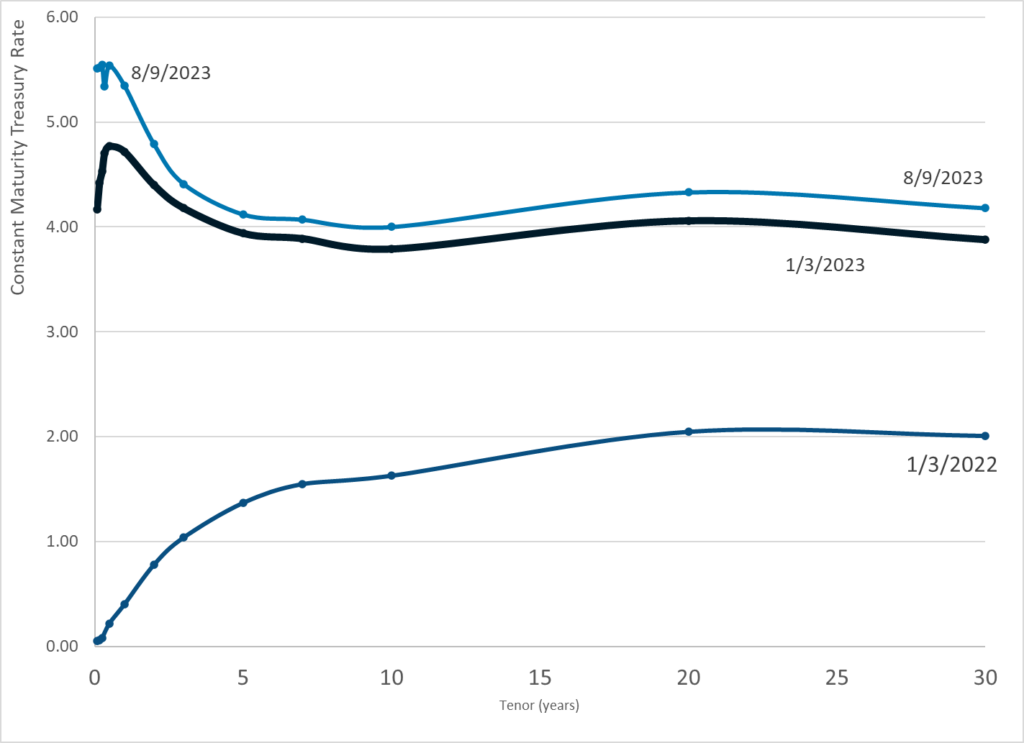

Graphic:

Publication Date: 9 Aug 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 8 Aug 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 7 Aug 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 4Aug 2023

Publication Site: Treasury Dept

Graphic:

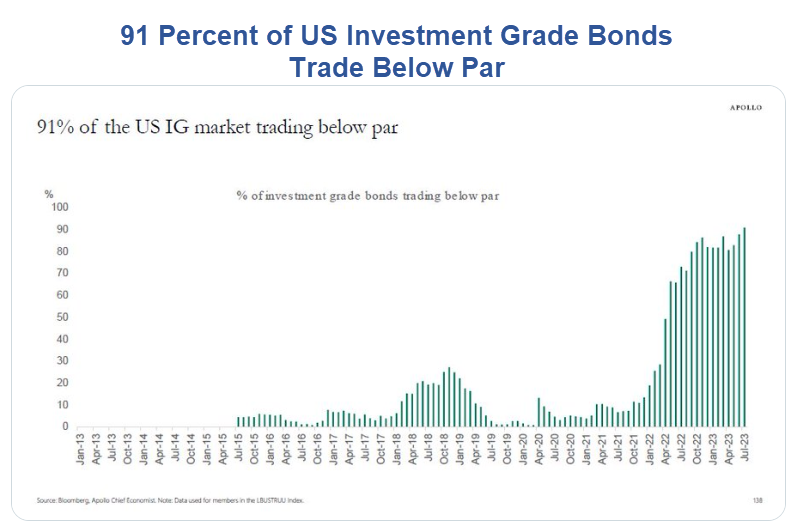

Excerpt:

Everyone knows, or at least should know, that the “Big 3” rating agencies that rate about 98 percent of all debt all issue trash ratings. Here’s the background on how that happened.

Rating agencies used to get paid by investors on the basis of how well they did at estimating the likelihood of default. The better your ratings, the more sought out your opinions.

In the mid 1970s, the SEC created nationally recognized statistical ratings organizations (NRSROs). Following that idiotic regulation, the rating agencies got paid on the basis of how much debt they rated, not how accurate their ratings were. Fees come from corporations issuing debt, not investors seeking true default risk.

The more stuff you rate AAA, the more business you get from companies who want their debt rated. The new model is ass backward, and why ratings are trash. A genuine fiasco happened with ratings during the Great Financial Crisis with tons of garbage rated AAA went to zero.

There should not be NRSROs. The SEC made matters much worse, except of course for the Big 3 who have a a captured, mandated audience, coupled with massive conflicts of interest.

Author(s): Mike Shedlock

Publication Date: 5 Aug 2023

Publication Site: Mish Talk

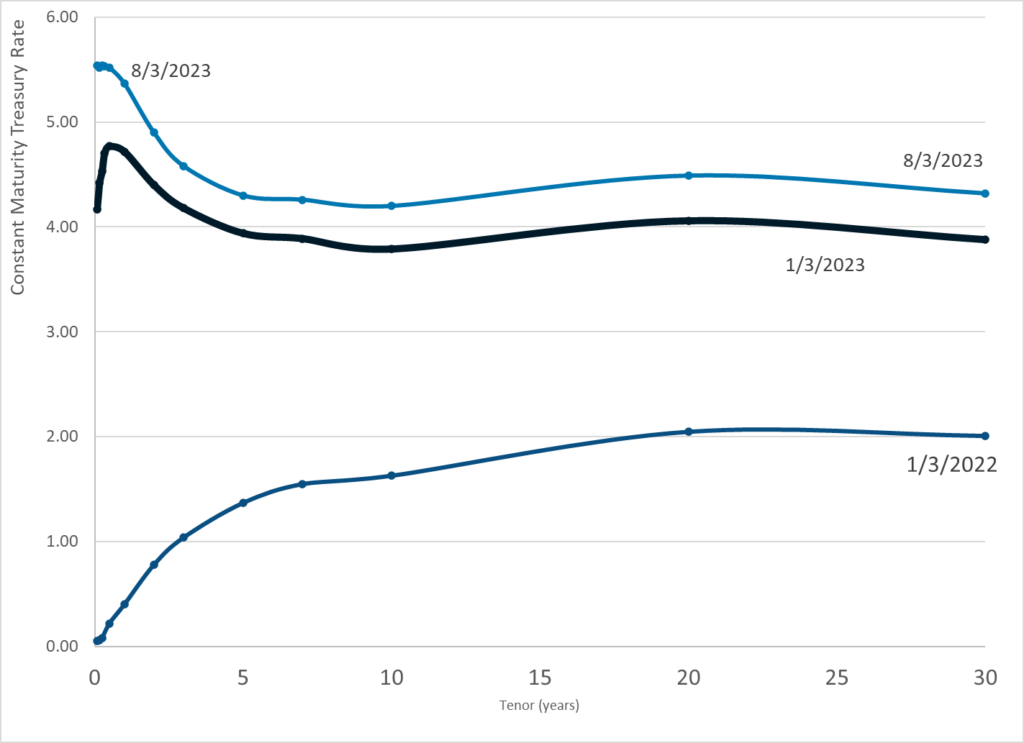

Graphic:

Publication Date: 3 Aug 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 2 Aug 2023

Publication Site: Treasury Department

Link: https://www.wsj.com/articles/fitch-downgrades-u-s-credit-rating-56c73b89?mod=hp_lead_pos1

Excerpt:

Fitch Ratings downgraded the U.S. government’s credit rating weeks after President Biden and congressional Republicans came to the brink of a historic default, warning about the growing debt burden and political dysfunction in Washington.

The downgrade, the first by a major ratings firm in more than a decade, is evidence that increasingly frequent political skirmishes over the U.S. government’s finances are clouding the outlook for the $25 trillion global market for Treasurys. Fitch’s rating on the U.S. now stands at “AA+”, or one notch below the top “AAA” grade.

….

Few investors believe that Fitch’s downgrade will immediately challenge that role. Still, it is the first time a ratings firm lowered its headline assessment of the U.S. government’s propensity to pay its bills on time since Standard & Poor’s in 2011 lowered its rating one notch below the top grade. That decision followed another tense debt-ceiling standoff in Congress.

Moody’s, the other member of the three big U.S. ratings firms, continues to give the U.S. its strongest assessment.

Fitch said Tuesday that the downgrade reflects an “erosion of governance” in the U.S. relative to other top-tier economies over the last two decades.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” Fitch said.

Author(s): Matt Grossman and Andrew Duehren

Publication Date: 1 Aug 2023

Publication Site: WSJ

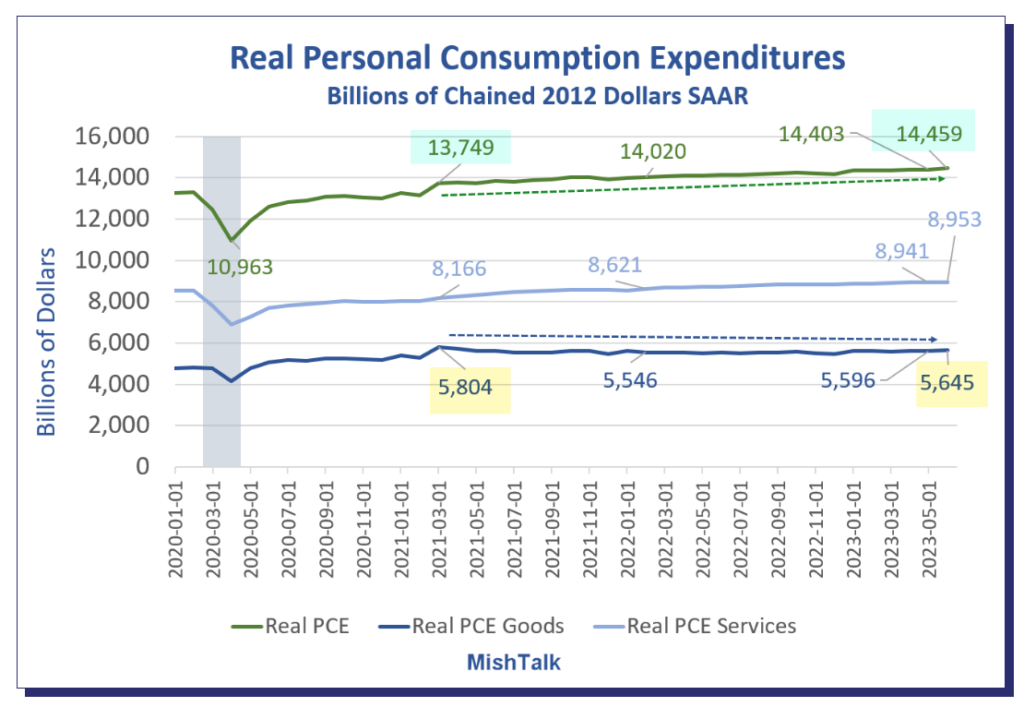

Link:https://mishtalk.com/economics/real-personal-spending-rises-twice-as-much-as-income-in-june/

Graphic:

Excerpt:

Real (inflation-adjusted) consumer spending rose 0.4 percent in June. Real disposable income rose 0.2 percent.

….

Real PCE goods peaked in March of 2021. All of the growth in consumer spending for 27 months is due to an increase in demand for services.

Author(s): Mike Shedlock

Publication Date: 28 July 2023

Publication Site: Mish Talk

Graphic:

Publication Date: 28 July 2023

Publication Site: Treasury Dept