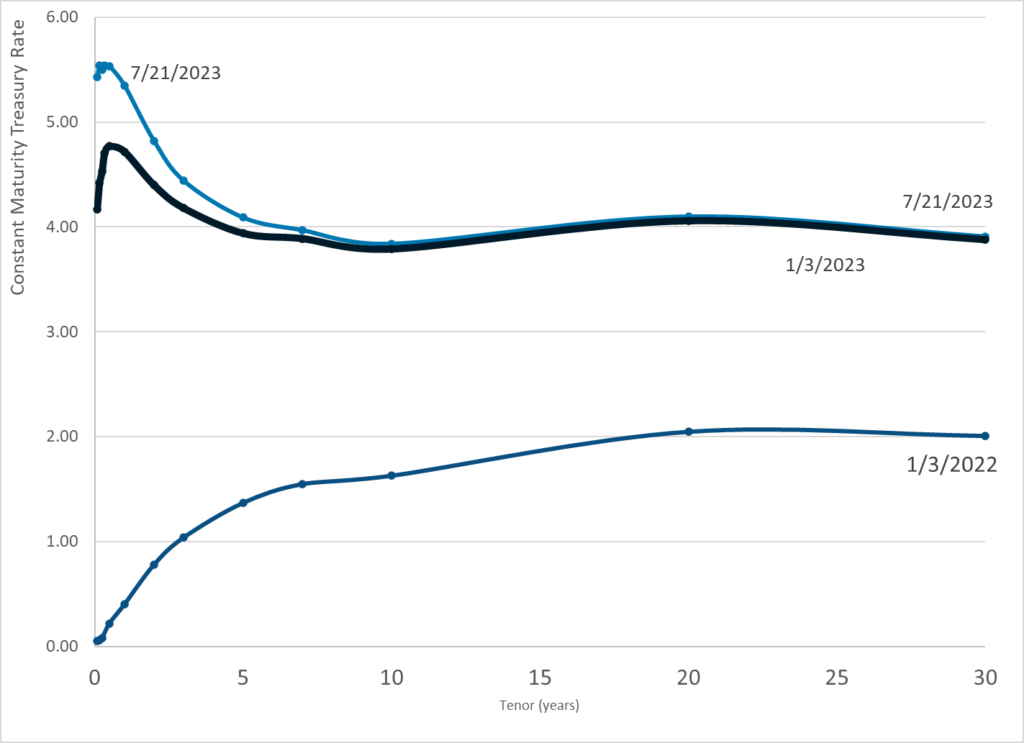

Graphic:

Publication Date: 27 July 2023

Publication Site: Treasury Dept

All about risk

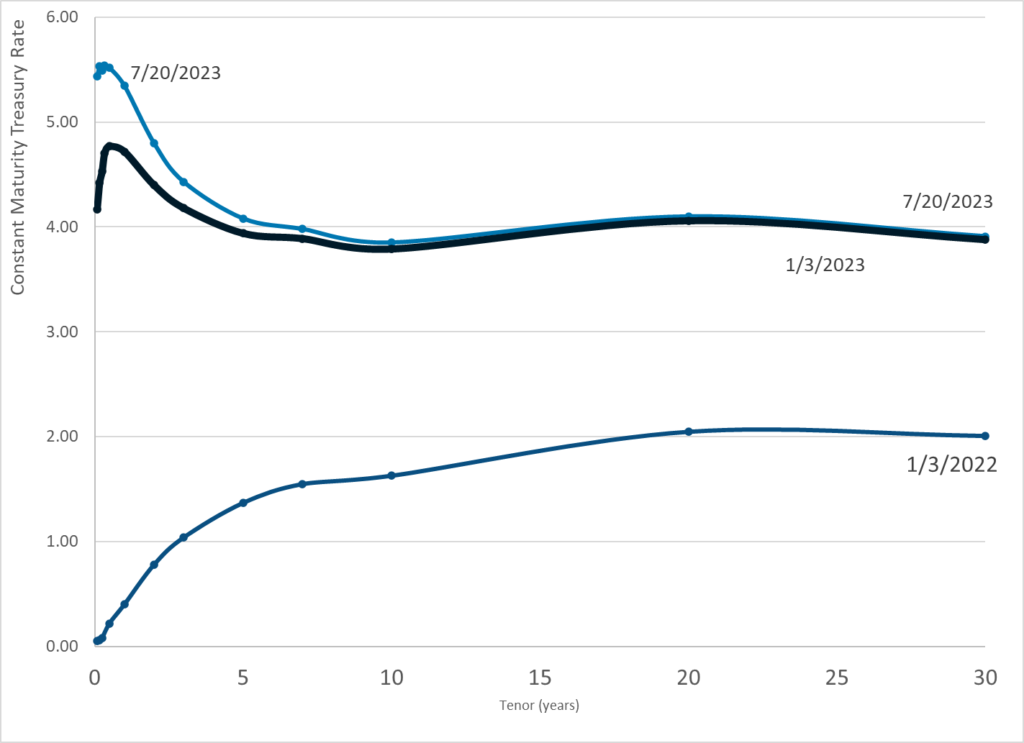

Graphic:

Publication Date: 27 July 2023

Publication Site: Treasury Dept

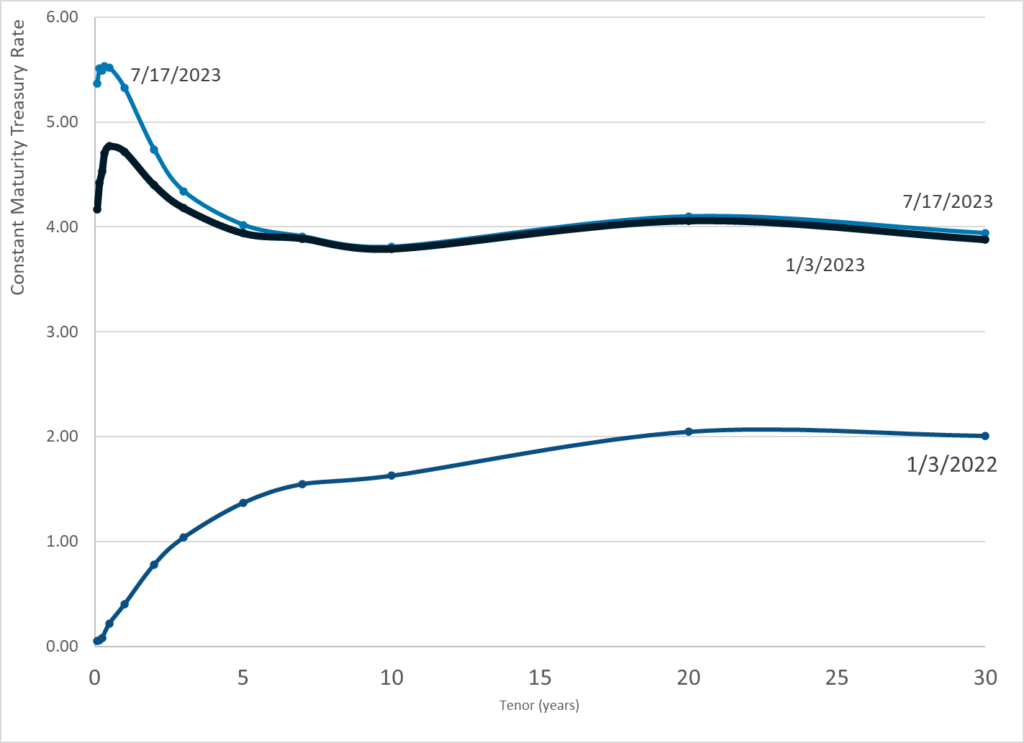

Graphic:

Publication Date: 21 July 2023

Publication Site: Treasury Dept

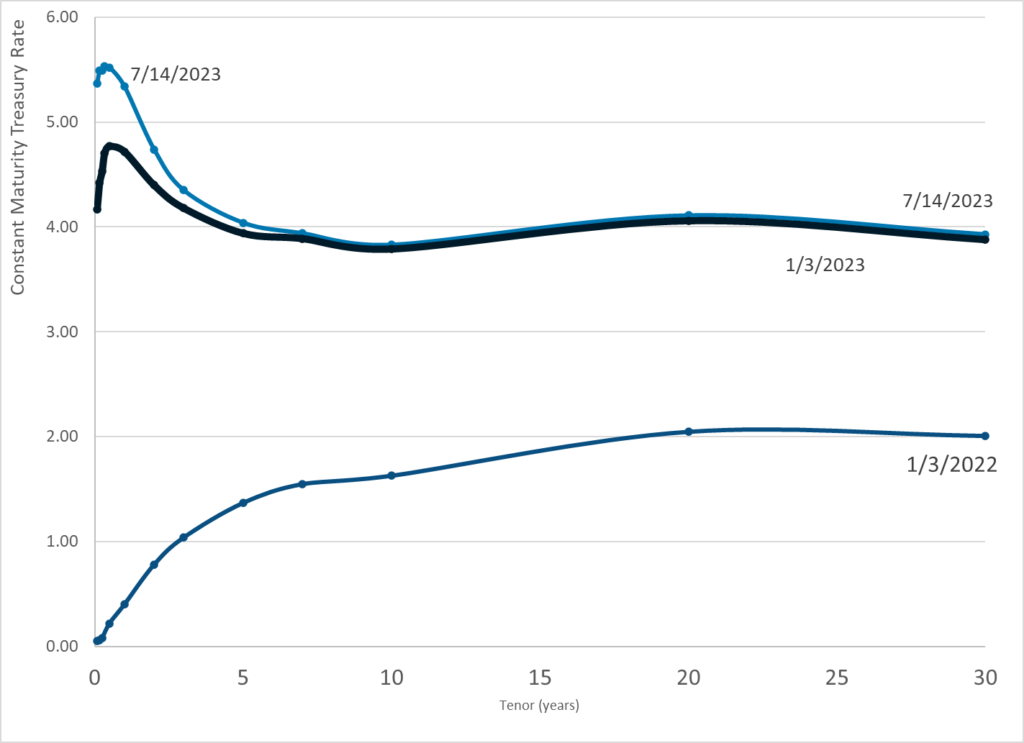

Graphic:

Publication Date: 20 July 2023

Publication Site: Treasury Dept

Excerpt:

Most of the media coverage of the collapse of Silicon Valley Bank was focused on the long lines of depositors who feared losing their money and the eventual bailout by the FDIC. The sequel to that story is that the failure of that bank and several others left a gaping void in the nation’s entrepreneurial economy — the place where new jobs spring out of the innovators’ alchemy of novel technologies, management skill and risk capital.

As a result, many early-stage growth companies in America are now stranded in a financing no man’s land between the highest-risk seed capital stage funded by individual angel investors and the multibillion-dollar private equity sector that still looks for eight- and nine-figure deals featuring companies already making sales on their way to a stock exchange listing. The startups’ cash cliff has been cited as the cause of a “mass extinction event” — a dead cylinder in the U.S. economy’s growth engine.

That’s where the idea of an “innovation fund” partnering with a dozen or so midsize local government pension funds could fill the void in this still-risky growth stage. Pension trustees could harvest lush investment returns on a nationally diversified portfolio with lower fees than the venture capital industry typically exploits. As a bonus, they could collectively fuel the engines of economic growth nationwide. Emergent businesses based in a state where a pension fund participates would have a fair shot at some of that capital if they could pass stringent due diligence reviews and fiduciary governance oversight by angel investment experts in their industries.

It’s a concept that originated years ago from the now-retired founder of one of the nation’s most prominent pension consulting firms. Today, the drawback on his original vision is that the larger public pension funds have outgrown the startup economy. As the chief investment officer of the California State Teachers’ Retirement System, the nation’s second-largest public pension fund, recently noted in a TV interview, they manage so many billions in each asset class, and with so many rules, requirements and restrictions, that it’s difficult for them to effectively put money into the venture capital marketplace. And even then, it’s got to be the chunkier, later-stage money earning a lower return than angel investors are seeking. Accordingly, my proposals here are a second-generation revision for which I alone am accountable.

What’s missing today is early-stage Series A and B funding. Putting money into promising firms raising $5 million to $20 million of fresh capital in these transition stages following their angel funding round would never move the dial on the Goliath pension portfolios’ investment returns. For their trustees and staffs, it’s just not worth the effort and headaches of monitoring hundreds of pubescent companies that are too young for them.

Author(s): Girard Miller

Publication Date: 11 July 2023

Publication Site: Governing

Graphic:

Publication Date: 17 July 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 14 July 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

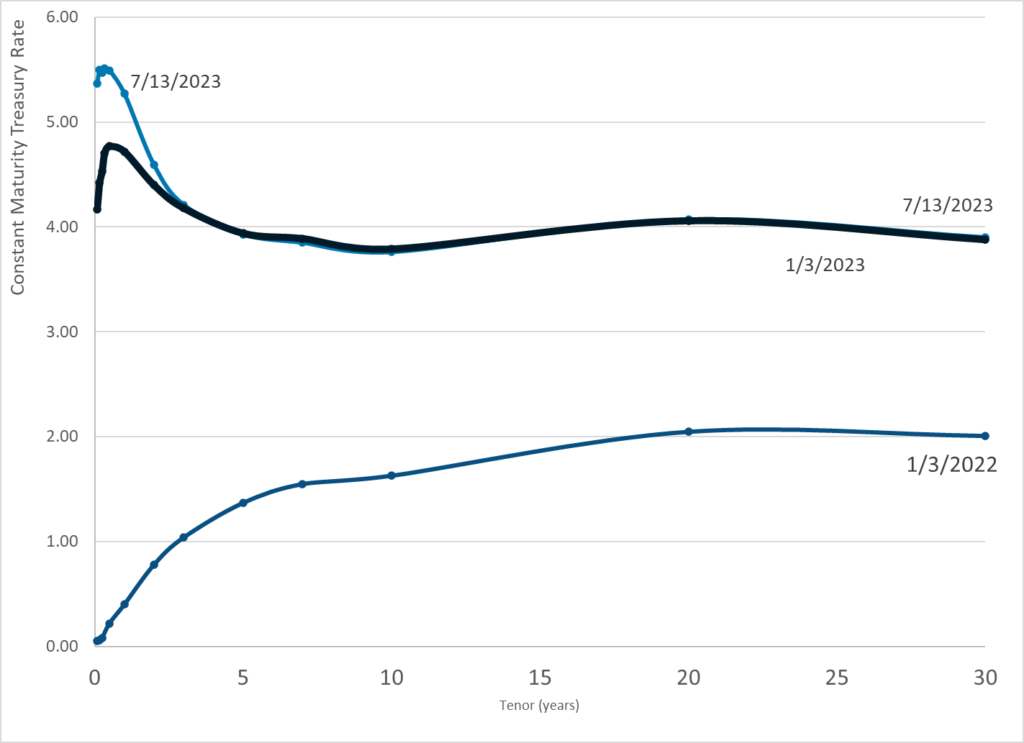

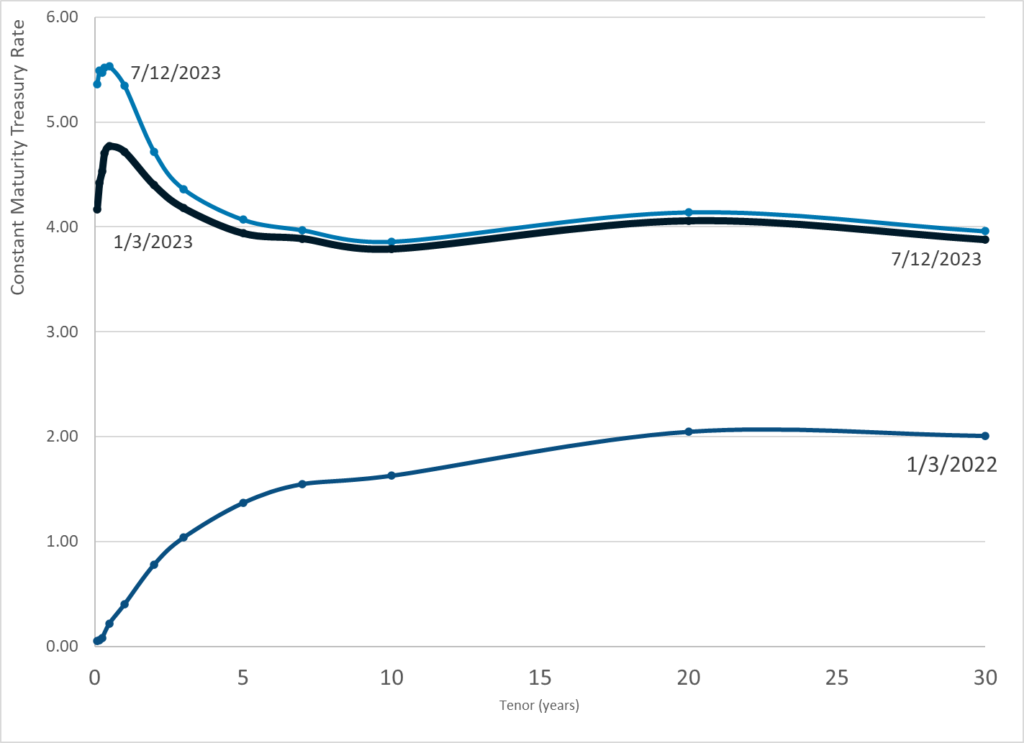

Two things on the Fed’s mind are the core rate of inflation (all items excluding food and energy) and rent. Both have proven stubborn.

Despite constant talk of falling rent prices please note that Rent of primary residence has gone up at least 0.4 percent, every month for 23 straight months!

The falling rent meme has been wrong for at least a full year.

Author(s): Mike Shedlock

Publication Date: 12 July 2023

Publication Site: Mish Talk

Graphic:

Excerpt:

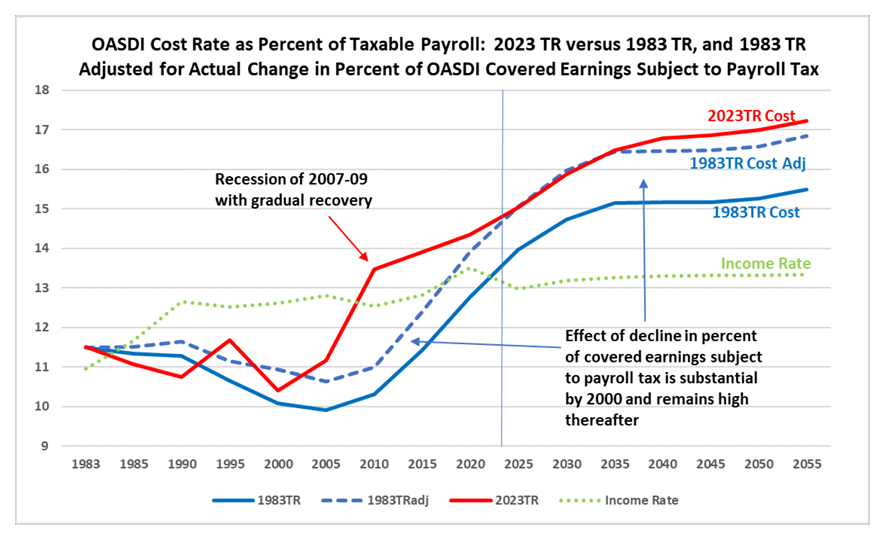

First, the 1983 Amendments were an interim solution to the well-understood changing of the age distribution due to the drop in birth rate after 1965. These Amendments were expected to extend the ability to pay scheduled benefits from 1982 to the mid-2050s, with the clear understanding that further changes would be needed by then.

Second, the redistribution of earned income to the highest earners was not anticipated in 1983. This shift resulted in about 8 percent less payroll tax revenue by 2000 than had been expected, with this reduced level continuing thereafter. The severity of the 2007-09 recession was also not anticipated.

Third, with the passage of 40 years since 1983, we clearly see the shortcomings of the 1983 Amendments in achieving “sustainable solvency” for Social Security. We are now in a position to formulate further changes needed, building on the start made in 1983.

Fourth, the long-known and understood shift in the age distribution of the US population will continue to increase the aged dependency ratio until about 2040, and in turn increase the cost of the OASDI program as a percentage of taxable payroll and GDP. Once this shift, which reflects the drop in the birth rate after 1965, is complete, the cost of the program will be relatively stable at around 6 percent of GDP. The unfunded obligation for the OASDI program over the next 75 years represents 1.2 percent of GDP over the period as a whole.

Author(s): Stephen C. Goss, Chief Actuary, Social Security Administration

Publication Date: 12 July 2023

Publication Site: Senate Budget Committee

Graphic:

Publication Date: 13 July 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 12 July 2023

Publication Site: Treasury Department

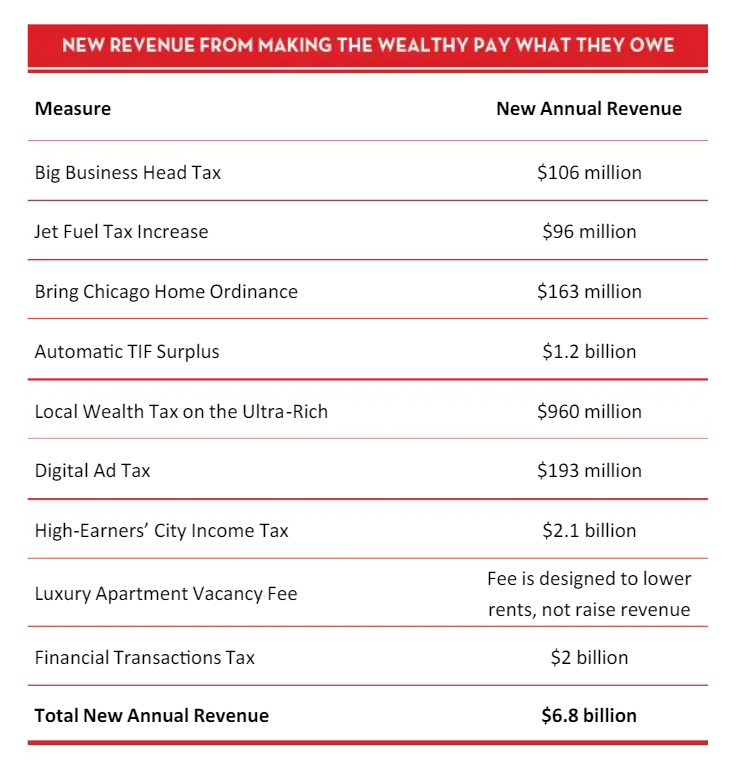

Link: https://www.scribd.com/document/645874607/First-We-Get-the-Money-FINAL-v3#

Graphic:

Excerpt:

Reinstitute the big business head tax: Mayor Johnson should reinstitute the big business head tax to make large corporations pay what they owe for benefiting from the city’s public infrastructure. The head tax existed previously in Chicago, until Mayor Rahm Emanuel eliminated it as a handout to corporations.3 Reinstating the head tax at a level of $33 per employee per year would generate $106 million a year in new revenue.4

….

Institute a city income tax on high earners: Mayor Johnson should lobby Springfield to give the city the authority to institute a municipal income tax on high earners who live or work in the city. A 3.5% tax on household income above $100,000 would bring in an estimated $2.1 billion a year in new revenue, of which $1.6 billion would be from high-earning Chicagoans and $490 million from high-earning commuters.16 By way of comparison, New York and Philadelphia both have municipal income taxes with top rates above 3.7%.17 By exempting the first $100,000 of income from the tax, the city could ensure the tax is progressive without a change in the state constitution.

Institute a luxury apartment vacancy fee: Mayor Johnson should work withstate officials to implement a vacancy fee on large, luxury apartment buildings with units that sit vacant for more than 12 months at a time. Landlords who own more than 20 units and are asking for a monthly rental price that exceeds the 75th percentile in the city (based on the number of bedrooms) must pay a fee equal to the median rental price in the city on each unit that sits vacant for more than 12 consecutive months, if more than three units in the building sit vacant for more than 12 consecutive months. This would encourage luxury developers to charge more affordable rents that can maintain higher occupancy rates. This policy is designed to encourage landlords to lower rents to avoid having to pay the fee; thus, if it works as intended, we hope that it would eventually not produce any revenue for the city but that it would increase affordable housing options.

Author(s): Saqib Bhatti, Gabriela Noa Betancourt

Publication Date: May 2023

Publication Site: Scribd

Graphic:

Publication Date: 10 July 2023

Publication Site: Treasury Dept