Graphic:

Publication Date: 12 Jun 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 12 Jun 2023

Publication Site: Treasury Dept

Link: https://www.wsj.com/articles/the-moral-hazards-of-being-beautiful-94346e61

Excerpt:

Beauty has its privileges. Studies reliably show that the most physically attractive among us tend to get more attention from parents, better grades in school, more money at work and more satisfaction from life. A study published in January in the Journal of Economics and Business found that good-looking banking CEOs take in over $1 million more in total compensation, on average, than their lesser-looking peers. “Good looks pay off,” the authors write.

…..

Scientists attribute the human tendency to give attractive people better treatment to something called the halo effect. Basically, we tend to assume that good looks are a sign of intelligence, trustworthiness and good character and that ugliness is similarly more than skin deep. “Personal beauty is a greater recommendation than any letter of reference,” Aristotle observed. This may help explain why attractive people are less likely to be arrested or convicted, even after controlling for criminal involvement, according to a 2019 study of nationally representative data published in the journal Psychiatry, Psychology and Law.

….

Yet those of us who never got that genetic golden ticket should take heart: The halo effect appears to go both ways. A number of studies show that goodness often enhances our looks. A paper in PLOS One in February, for example, reports that people found faces in photos more attractive when they learned the subjects were honest, kind and not aggressive. The results suggest that “facial attractiveness is malleable,” the authors write. Or as Sappho observed: “What is beautiful is good and what is good will soon be beautiful.”

Author(s): Emily Bobrow

Publication Date: 10 June 2023

Publication Site: WSJ

Graphic:

Publication Date: 9 June 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 7 Jun 2023

Publication Site: Treasury Department

Link:https://danluu.com/nothing-works/

Excerpt:

It’s also true at the firm level that it often takes an unusually unreasonable firm to produce a really great product instead of just one that’s marketed as great, e.g., Volvo, the one car manufacturer that seemed to try to produce a level of structural safety beyond what could be demonstrated by IIHS tests fared so poorly as a business that it’s been forced to move upmarket and became a niche, luxury, automaker since safety isn’t something consumers are really interested in despite car accidents being a leading cause of death and a significant source of life expectancy loss. And it’s not clear that Volvo will be able to persist in being an unreasonable firm since they weren’t able to survive as an independent automaker. When Ford acquired Volvo, Ford started moving Volvos to the shared Ford C1 platform, which didn’t fare particularly well in crash tests. Since Geely has acquired Volvo, it’s too early to tell for sure if they’ll maintain Volvo’s commitment to designing for real-world crash data and not just crash data that gets reported in benchmarks. If Geely declines to continue Volvo’s commitment to structural safety, it may not be possible to buy a modern car that’s designed to be safe.

Most markets are like this, except that there was never an unreasonable firm like Volvo in the first place. On unreasonable employees, Yossi says

Who can, and sometimes does, un-rot the fish from the bottom? An insane employee. Someone who finds the forks, crashes, etc. a personal offence, and will repeatedly risk annoying management by fighting to stop these things. Especially someone who spends their own political capital, hard earned doing things management truly values, on doing work they don’t truly value – such a person can keep fighting for a long time. Some people manage to make a career out of it by persisting until management truly changes their mind and rewards them. Whatever the odds of that, the average person cannot comprehend the motivation of someone attempting such a feat.

It’s rare that people are willing to expend a significant amount of personal capital to do the right thing, whatever that means to someone, but it’s even rarer that the leadership of a firm will make that choice and spend down the firm’s capital to do the right thing.

Economists have a term for cases where information asymmetry means that buyers can’t tell the difference between good products and “lemons”, “a market for lemons”, like the car market (where the term lemons comes from), or both sides of the hiring market. In economic discourse, there’s a debate over whether cars are a market for lemons at all for a variety of reasons (lemon laws, which allow people to return bad cars, don’t appear to have changed how the market operates, very few modern cars are lemons when that’s defined as a vehicle with serious reliability problems, etc.). But looking at whether or not people occasionally buy a defective car is missing the forest for the trees. There’s maybe one car manufacturer that really seriously tries to make a structurally safe car beyond what standards bodies test (and word on the street is that they skimp on the increasingly important software testing side of things) because consumers can’t tell the difference between a more or less safe car beyond the level a few standards bodies test to. That’s a market for lemons, as is nearly every other consumer and B2B market.

Author(s): Dan Luu

Publication Date: March 2022, accessed 7 Jun 2023

Publication Site: Dan Luu

Graphic:

Publication Date: 6 Jun 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

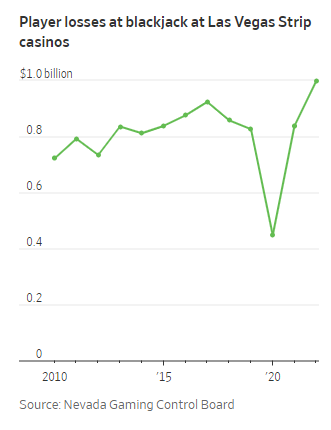

Casinos on the Vegas Strip are making it costlier to play and harder to win.

Payouts are lower for winning blackjack hands. Bets on some roulette wheels are riskier. And it is taking more cash to play at many game tables.

Blackjack players lost nearly $1 billion to casinos on the Strip last year, the second-highest loss on record, after 2007, according to data from the Nevada Gaming Control Board.

Some Las Vegas casinos cut back the number of blackjack tables with dealers, raised minimum bets during busy times and lifted their advantage over players in some games—doubling-down on a prepandemic practice of making subtle changes that favor the house, according to industry executives, researchers and gamblers.

….

Blackjack, a fast-paced card game, historically paid out a ratio of 3:2 when a player hit 21 on the first two cards. That means a gambler wins $15 for every $10 bet. Now, many blackjack tables on the Strip pay out at 6:5, which means that same $10 yields only $12.

John and Kristina Mehaffey, owners of gambling-news and data company Vegas Advantage, have been cataloging these changes since 2011, walking miles-long routes through casinos to record the number of blackjack and roulette tables set outside of VIP areas.

According to the Mehaffeys’ data, more than two-thirds of blackjack tables on the Strip currently offer 6:5 payouts, as opposed to 3:2.

….

Las Vegas visitors on vacation might not notice—or might not care—about the casinos’ increased advantage, says Bill Zender, a casino consultant who focuses on table-game management. But casinos risk losing business over time, he says.

“If you go into a casino and gamble, and you lose your money fairly quickly, almost every time, you don’t feel you’re getting the bang for your buck,” Zender said.

Author(s): Katherine Sayre

Publication Date:29 May 2023

Publication Site: WSJ

Link: https://allisonschrager.substack.com/p/paying-more-for-less

Excerpt:

Between the controversies at Disney, Bud Light, and Target, I think we need a return to shareholder primacy.

In 2019, many of the biggest American CEOs signed a manifesto declaring the end of shareholder primacy and embracing a new stakeholder model. With shareholder primacy, the main objective of a corporation is to maximize profits, both long- and short-term profits, because that is what boosts share prices and dividends, and shareholders like that. With the stakeholder model, a corporation has many other objectives: worker well-being, the environment, and the good of society. That may sound nice, but often, these stakeholders have competing objectives, and choosing who gets priority is a question of values.

When Milton Friedman argued for shareholder primacy, he said that a CEO should not forgo profits to exercise his personal values. It is not his money to spend, and not everyone shares his values, nor should they. And worse, I blame the multi-stakeholder model for making everything feel more political.

Now, I realize even before 2019, companies were getting more political, but it got ramped up several notches in 2020. And now, everything you buy feels like a political statement. And even innocuous well-intentioned marketing campaigns that aim to give visibility to marginalized groups are taken as an explicit endorsement of a more divisive political agenda. I think shooting Bud Light cans in protest is stupid. But I get that people feel frustrated that everything is political and often not their politics.

And even if corporations mostly did pursue profits after 2019, and the stakeholder manifesto was a cynical ploy to appease young workers, get ESG capital, or avoid regulation, rhetoric matters. Before 2019, people could shrug at corporate pandering because it all seemed like a marketing ploy, and who can argue with selling lawn chairs and beer to the trans community? It is a growing demographic.

But in the context of announcing that you are doing it to make the world a better place, it strikes a different tone. And since stakeholder capitalism is about choosing between competing values, it is political. And now everything is worse for profits and society, since it adds to division and rancor.

Milton Friedman was right; shareholder primacy is better for corporations and society.

If CEOs really want to save the world, they should do the brave thing: announce an end to stakeholder capitalism and go back to just worrying about profits.

Author(s): Allison Schrager

Publication Date: 5 Jun 2023

Publication Site: Known Unknowns at substack

Link: https://thehill.com/opinion/finance/4028654-esg-tug-of-war-leaves-taxpayers-shortchanged/

Excerpt:

The whole ordeal picked up steam years ago with efforts initiated by progressives in states like California, which has repeatedly imposed politically motivated restrictions on its largest pension funds, CalPERS and CalSTRS. In 2000, the state forced the funds to divest from tobacco companies, a move that cost nearly $3.6 billion in investment earnings. The pension funds have faced frequent — and occasionally successful — demands from activists and legislators on the left to divest of other progressive bogeymen, like firearms, oil and gas, and private prisons.

These politically motivated demands to place social goals above the fiduciary responsibility to pensioners persist, not just in California but also in Maine, Vermont, Massachusetts and many other blue states. At a time when many state pension funds are facing enormous fiscal imbalances, these policies are worsening the problem and shifting massive burdens onto taxpayers, who will have to foot the bill for the progressive aims of policymakers.

Indeed, research shows that putting social policies ahead of fiduciary responsibility can come at a hefty cost. A study found that public pension funds with ESG investment mandates have investment returns that are 70 to 90 basis points lower than those that do not — meaning retirees are financially hurt by these investment strategies.

Not to be outdone, conservatives in red states have been fighting back with anti-ESG policies of their own. Unfortunately, rather than establishing an environment that ensures taxpayers are best served, many of these policies elevate conservative cultural preferences above fiscal considerations. Like the pro-ESG policies of the left, these anti-ESG policies have cost taxpayers considerably.

Author(s): Brandon Arnold

Publication Date: 1 Jun 2023

Publication Site: The Hill

Link: https://www.city-journal.org/multimedia/can-states-and-cities-dig-themselves-out

Excerpt:

David Schleicher: Yeah, absolutely. There’s an old joke that says, “The federal government is an insurance company with an army.” But anything you actually touch, can physically touch, any infrastructure of any sort, or services you consume and need to care about in one way or another are almost all directly provided by the state and local governments. They’re often funded sometimes with money from the federal government, but they are directly private and partially funded by state and local governments. The fiscal health of state and local governments is extremely important to, say, the question of state capacity in America.

Allison Schrager: It seems like we don’t talk about it until you’re Illinois or if you’re a municipality, Detroit, but it seems like we’ve been talking about this big shoe to drop on state municipal bankruptcies for a while and it doesn’t come, but that doesn’t mean we should be complacent.

David Schleicher: Yeah, absolutely. Two things. One is that it definitely would’ve come in the last couple of years had the federal government not dropped a ton of money on state and local governments. The pandemic created huge fiscal problems for a number of jurisdictions. The federal government responded by providing a huge amount of aid. The effect of that is that has had benefits and costs, which I’m sure we’ll talk about, but you can’t just look through the defaults or absence of defaults, to ask the question of “Are states and cities in fiscal trouble?” State and fiscal budgets are very procyclical. We end up cutting really important things during recessions and spending too much during non-recessions. Then we have the question of federal bailouts.

Allison Schrager: Yeah, it’s a very complicated issue, so what to do about this. But you have a very sort of organized, clean way to think about it. You describe it as this trilemma.

David Schleicher: Yeah. When a state or city faces a fiscal problem, fiscal crisis, take New York City in the 1970s or Detroit, or Puerto Rico or whatever it is. We’ve had, over the course of American history from Hamilton’s assumption of state debts, we’ve had a series of state and local fiscal crises. We have a lot of governments and some of them are going to have crises. The question is, what should the federal government do? Well, the federal government has three things it would like to achieve, which are, it doesn’t want to have too severe cuts during recessions, because that creates even bigger recessions. It doesn’t want to encourage state and local governments to think that the federal government will always stand behind them, a problem we call moral hazard. It wants federal state and local governments to be able to continue to borrow because state and local governments need to borrow to build infrastructure.

Author(s): David N. Schleicher, Allison Schrager

Publication Date: 2 Jun 2023

Publication Site: City Journal

Graphic:

Publication Date: 2 June 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 1 Jun 2023

Publication Site: Treasury Dept