Link: https://www.wsj.com/articles/china-is-facing-a-moment-of-truth-about-its-low-retirement-age-5ed9b57f

Graphic:

Excerpt:

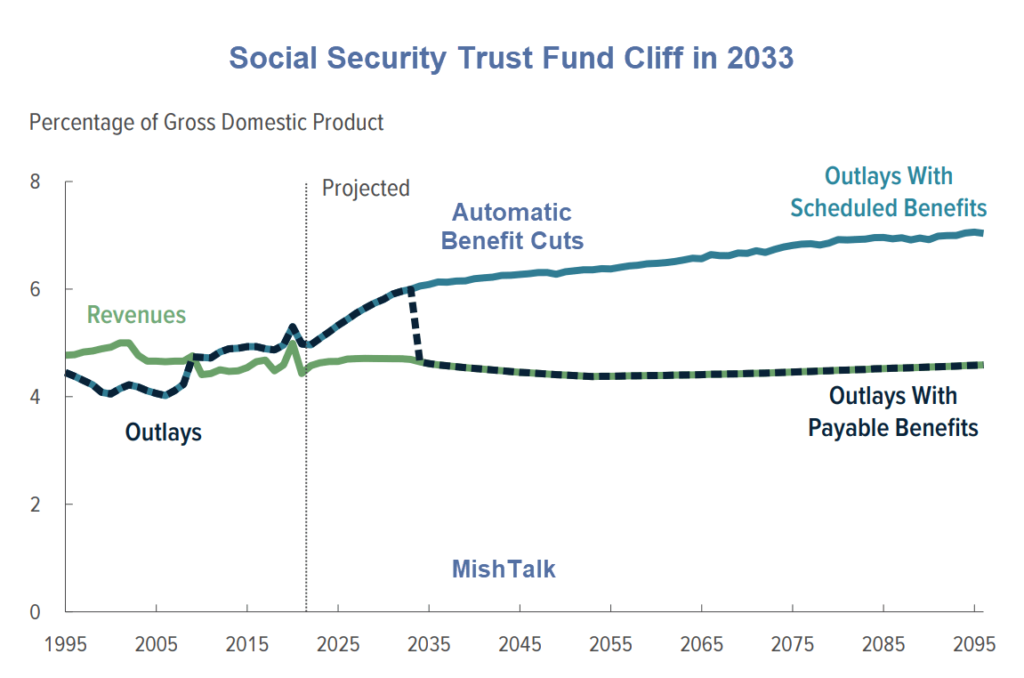

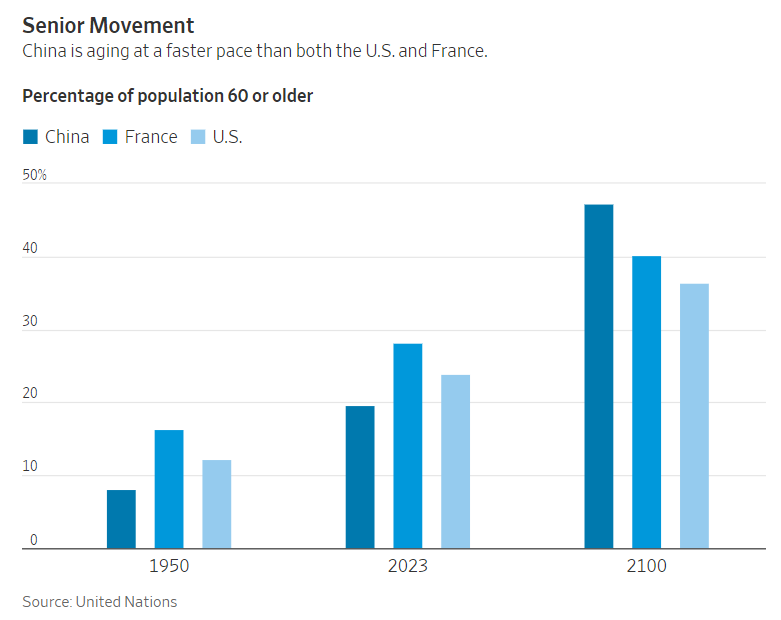

China has one of the lowest retirement ages among major economies. Under a policy unchanged since the 1950s, it allows women to retire as early as at age 50 and men at 60. Now, local governments are running out of money just as a wave of retirees hits. That is leaving Beijing with little choice but to ask people to work longer—a move economists say is long overdue but one still likely to meet with resistance.

China’s version of “baby boomers”—those born after China emerged from devastating starvation in the early 1960s—are retiring in droves. Even with government subsidies, by 2035 China’s state-led urban pension fund will run out of money accumulated over the previous two decades, leaving it to rely entirely on new workers’ contributions, according to projections made in 2019 by the Chinese Academy of Social Sciences, a government think tank.

Former central bank Gov. Zhou Xiaochuan warned in a February speech that China must address its pension shortfall and communicate that many Chinese may need to rely on private pension savings

Author(s): Livan Qi

Publication Date: 11 April 2023

Publication Site: Wall Street Journal