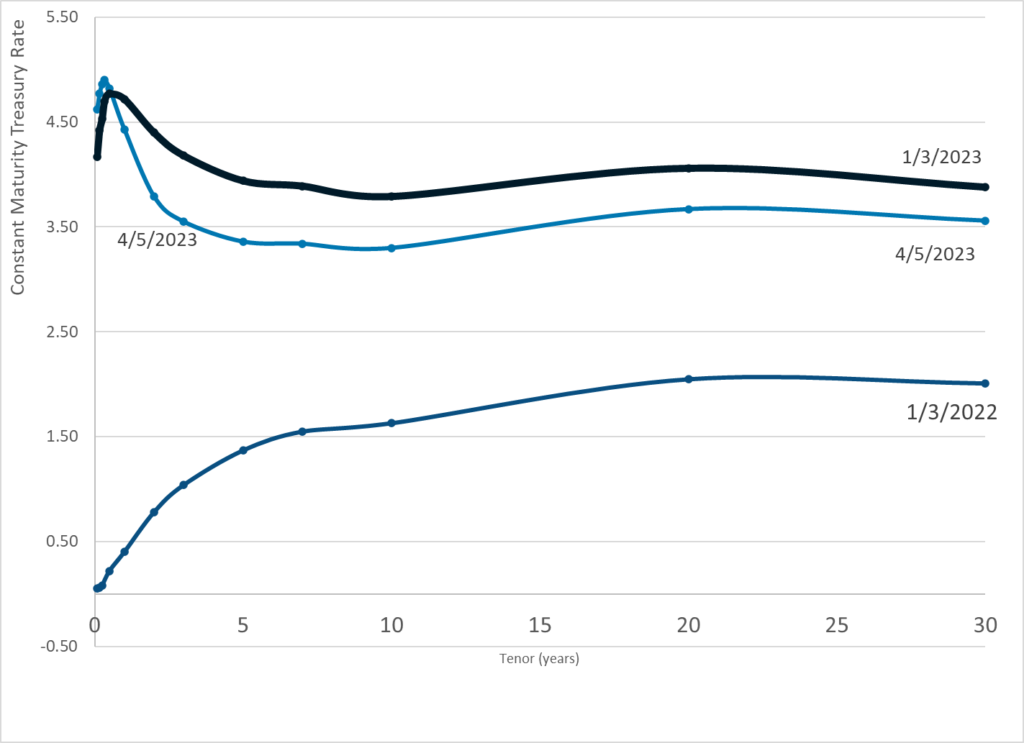

Graphic:

Publication Date: 5 April 2023

Publication Site: Treasury Department

All about risk

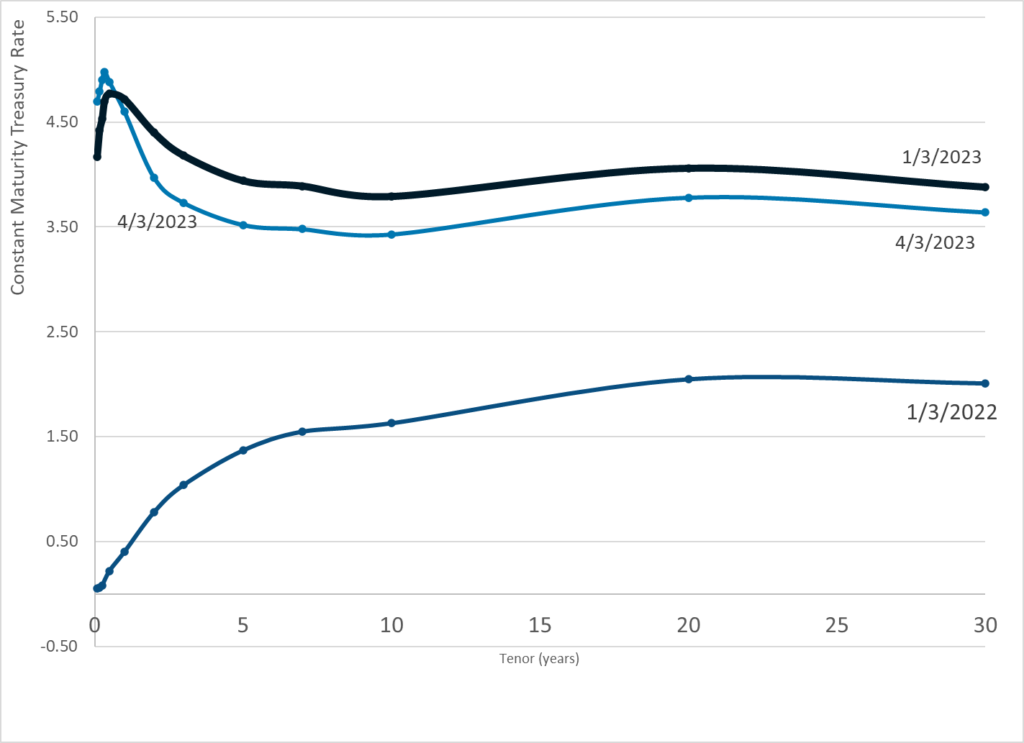

Graphic:

Publication Date: 5 April 2023

Publication Site: Treasury Department

Maestas, Nicole, Kathleen J. Mullen and David Powell. 2023. “The Effect of Population Aging on Economic Growth, the Labor Force, and Productivity.” American Economic Journal: Macroeconomics, 15 (2):306-32.

DOI: 10.1257/mac.20190196

Replication package link: https://www.openicpsr.org/openicpsr/project/173781/version/V1/view

Online appendix: https://assets.aeaweb.org/asset-server/files/18416.pdf

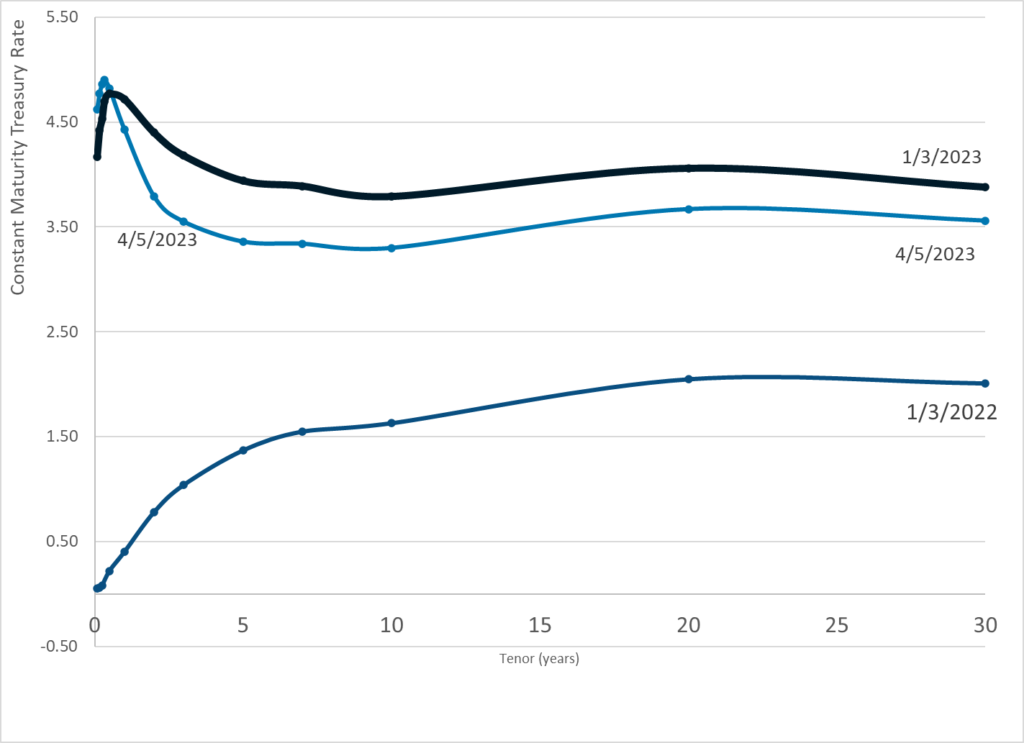

Graphic:

Abstract:

Population aging is expected to slow US economic growth. We use variation in the predetermined component of population aging across states to estimate the impact of aging on growth in GDP per capita for 1980–2010. We find that each 10 percent increase in the fraction of the population age 60+ decreased per capita GDP by 5.5 percent. One-third of the reduction arose from slower employment growth; two-thirds due to slower labor productivity growth. Labor compensation and wages also declined in response. Our estimate implies population aging reduced the growth rate in GDP per capita by 0.3 percentage points per year during 1980–2010.

Author(s): Maestas, Nicole, Kathleen J. Mullen and David Powell

Publication Date: 2023

Publication Site: American Economic Journal: Macroeconomics, AEAweb

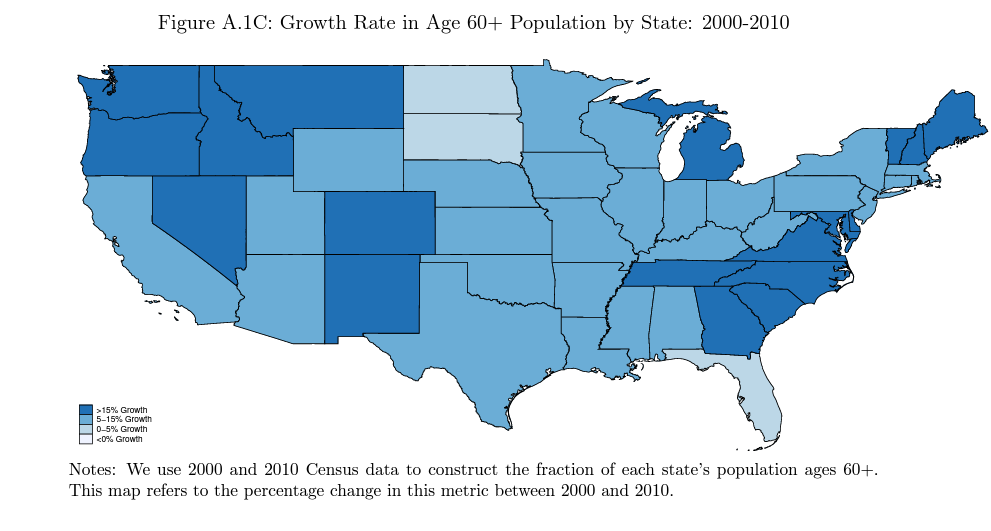

Graphic:

Publication Date: 3 Apr 2023

Publication Site: Treasury Dept

Graphic:

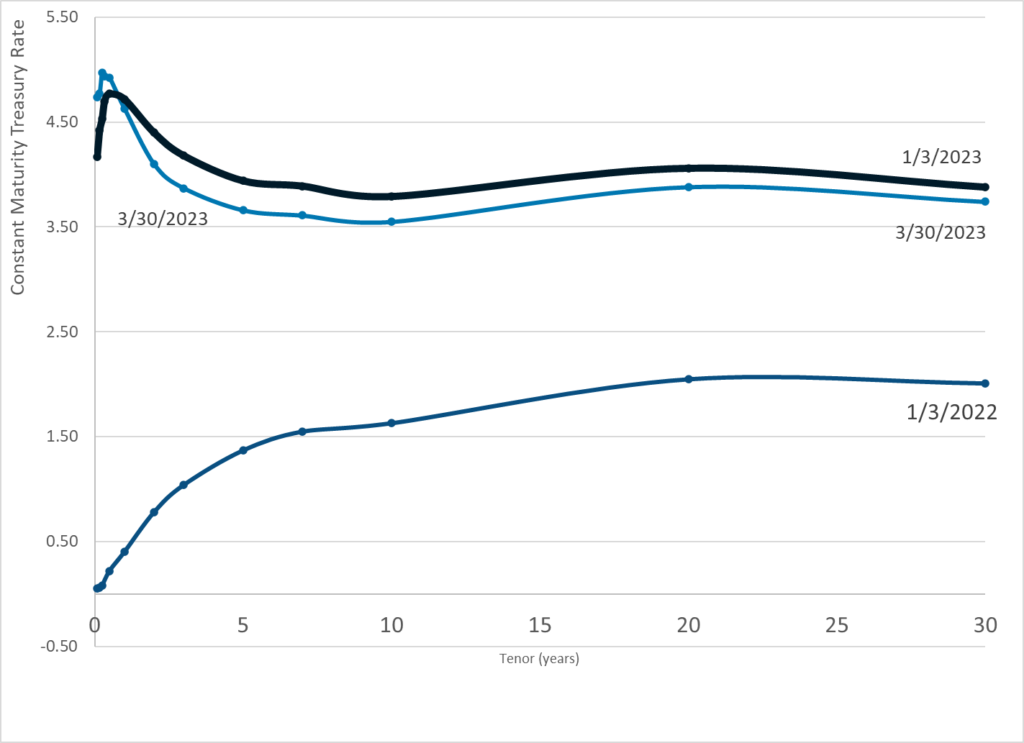

Publication Date: 30 Mar 2023

Publication Site: Treasury Dept

Link: https://www.city-journal.org/can-france-escape-its-pension-overhang

Excerpt:

In 2021, government spending accounted for 59 percent of GDP in France, compared with 45 percent in the United States. Spending on public pensions accounts for much of that gap: it’s 15 percent of GDP in France, but only 7 percent in the U.S. This greatly inflates associated payroll taxes, which alone took 28 percent of workers’ incomes in France, compared with just 11 percent in the U.S.

President Macron argues that the cost of financing pensions is dragging down the whole economy, and that reform is necessary to make France an attractive venue for investment and employment. Whereas workers’ incomes in 1975 were 46 percent higher than those of retirees, by 2016 they were 2 percent lower. Many economists see it as senseless to redistribute so much from the young to the elderly, who seldom have childrearing expenses and whose mortgages are often paid off.

Pension reform is seen as necessary by 61 percent of French voters, but only 32 percent support raising the retirement age. Macron argues that the only alternatives to his reforms would involve cutting benefit levels, hiking taxes, or cutting public spending on other items such as education, health care, or defense. France already has close to the highest taxes in the developed world.

Median incomes for French residents aged 65 and over ($20,116) are little different than those for Americans ($19,704). The main effects of France’s extra pension spending are to crowd out private savings for retirement (which amount to 12 percent of GDP versus 170 percent in the U.S), and to cause French citizens to retire much earlier (at an average age of 60.4, vs 64.9 in the states).

Author(s): Chris Pope

Publication Date: 28 Mar 2023

Publication Site: City Journal

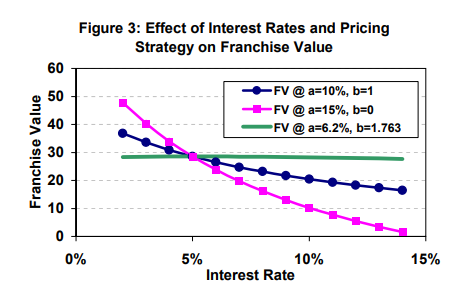

Link: https://www.casact.org/sites/default/files/2021-03/9_Panning.pdf

Graphic:

Excerpt:

Fortunately, there is a solution to the dilemma just posed. It

consists in adopting a pricing strategy that substantially alters the

sensitivity of a firm’s total economic value to changes in interest

rates. In the example give earlier, where

a = 15% and

b = 0, the

duration of the firm’s franchise value and total economic value are

17.62 and 6.70, respectively. But suppose we alter the firm’s

pricing policy by changing these parameters to

a = 10% and

b = 1.

In this case the target return on surplus remains at 15% (given that

the risk-free yield remains at 5%), but the durations change from

17.62 to 7.62 for franchise value, and from 6.70 to 3.27 for total

economic value. The key insight here is that a firm’s pricing

strategy can significantly affect the duration of its franchise

value and, consequently, the duration of its total economic

value.This insight suggests a more systematic approach to managing the

duration of total economic value: find a combination of the

strategy parameters

a and

b such that the return on surplus and the

duration of total economic value are both acceptable. This can be done either by systematic numerical search or by constrained optimization procedures. For example, if the firm in our example

wanted a target return on equity of 15% but a total economic value with a duration of zero, it should implement a pricing strategy with the parameters

a = 6.2% and

b = 1.763 to achieve

those objectives. The consequences of this and the two previously

mentioned pricing strategies are shown in Figure 3 for the three

different pricing strategies just described.

Author(s): William H. Panning

Publication Date: 2006

Publication Site: Casualty Actuarial Society (for exams)

Graphic:

Publication Date: 27 Mar 2023

Publication Site: Treasury Dept

Graphic:

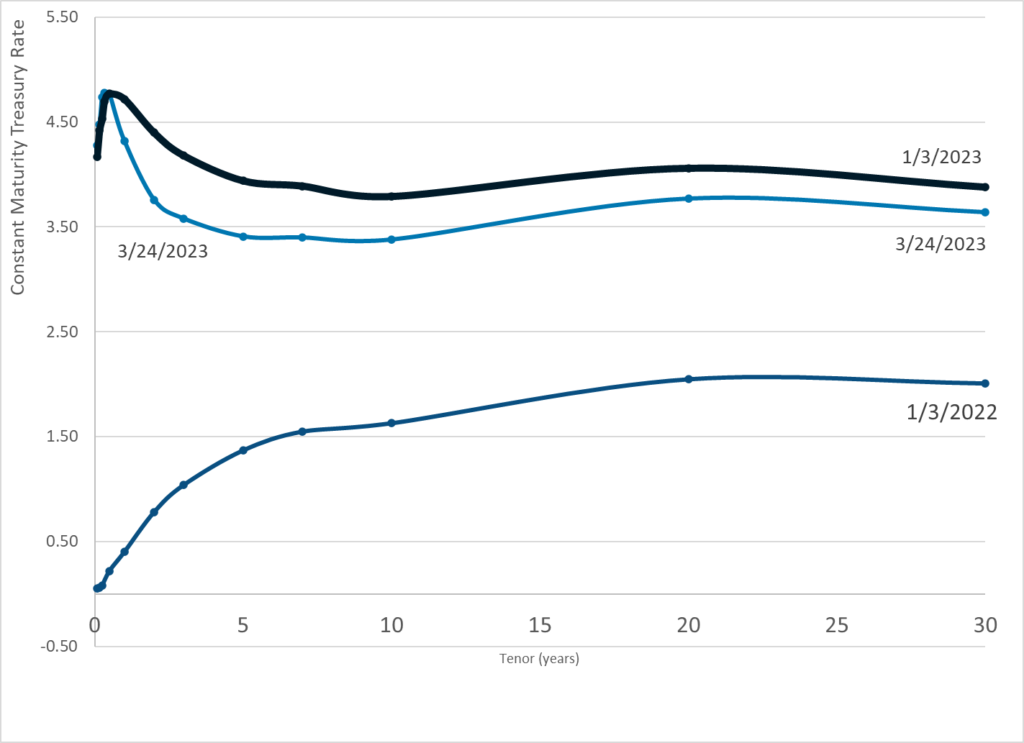

Publication Date: 24 Mar 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 23 Mar 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 22 Mar 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 21 Mar 2023

Publication Site: Treasury Departmet

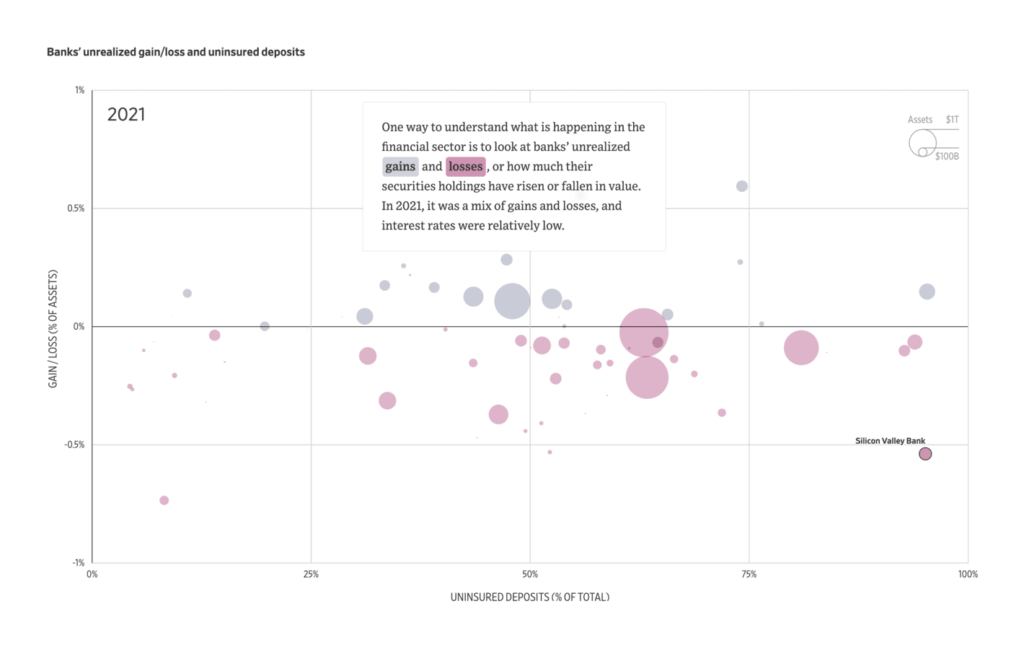

Link: https://www.wsj.com/articles/the-banking-sector-turmoil-in-charts-52bb6095?mod=e2twg

Graphic:

Excerpt:

It has been a wild ride for banks. Silicon Valley Bank, which catered to venture capitalists and startups, collapsed March 10 after a run on deposits that was preceded by a plunging share price and a money-losing bond sale as the bank tried to raise capital. Two days later, Signature Bank SBNY -22.87%decrease; red down pointing triangle was closed by federal regulators following a run. Then, First Republic Bank FRC 29.47%increase; green up pointing triangle, at risk of a run as its share price plummeted, was flooded with cash in an extraordinary action by some of the largest U.S. banks—but its shares resumed their plunge a day later.

Here is how some banks ended up in the market’s crosshairs.

Author(s): Nate Rattner, Alana Pipe

Publication Date: 18 Mar 2023

Publication Site: WSJ