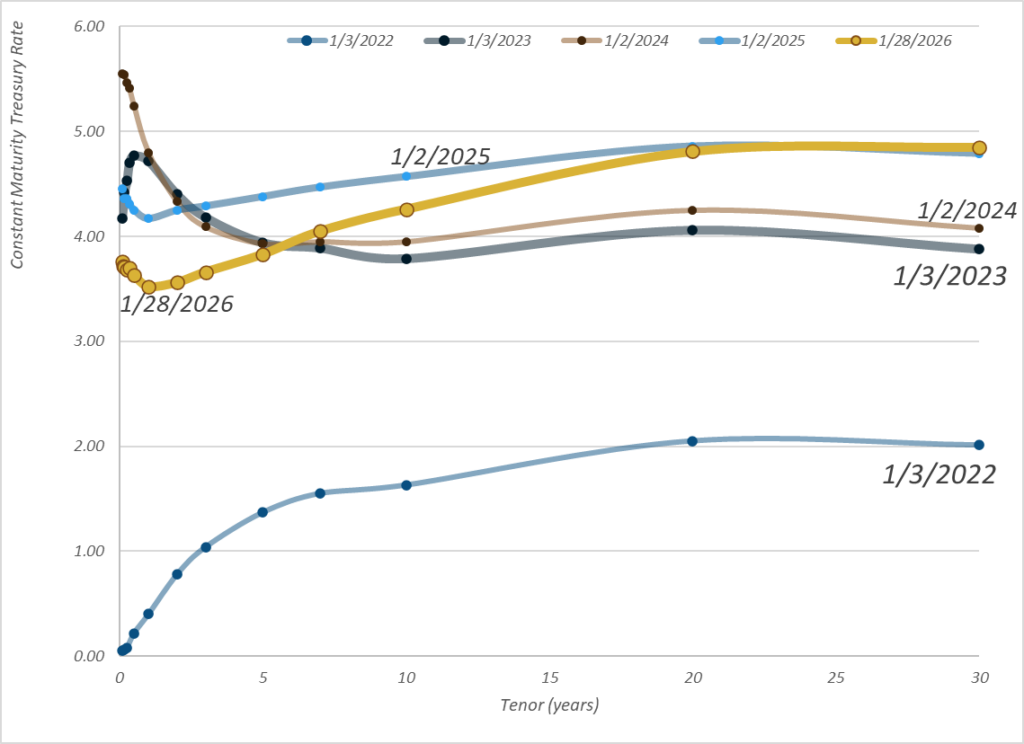

Graphic:

Publication Date: 28 Jan 2026

Publication Site: Treasury Dept

All about risk

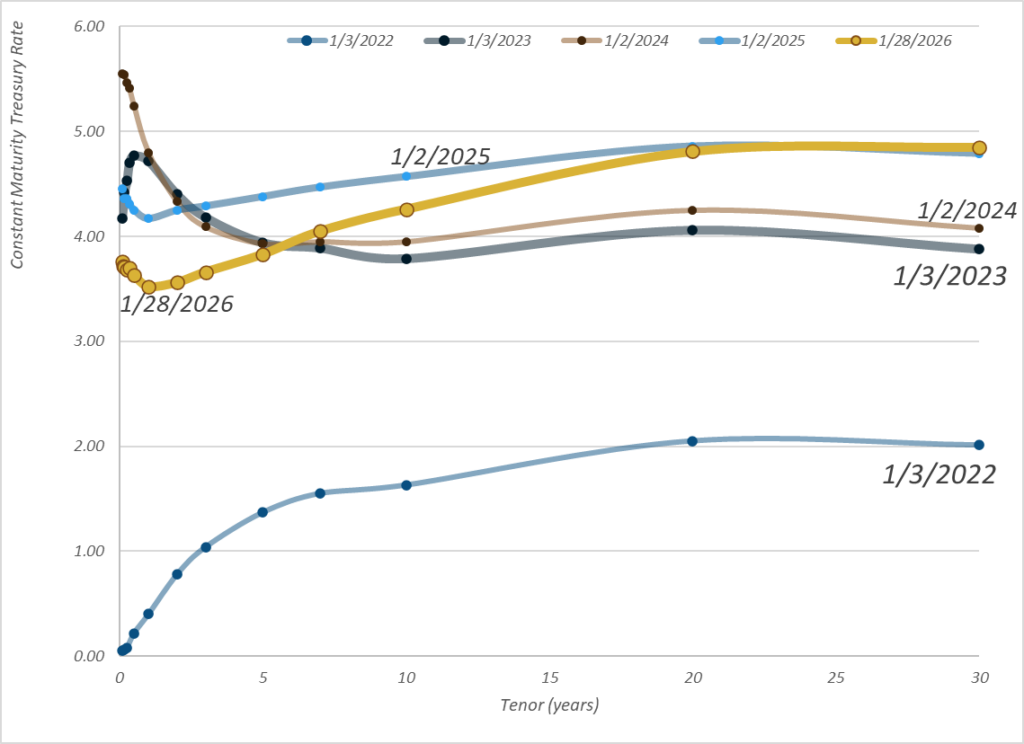

Graphic:

Publication Date: 28 Jan 2026

Publication Site: Treasury Dept

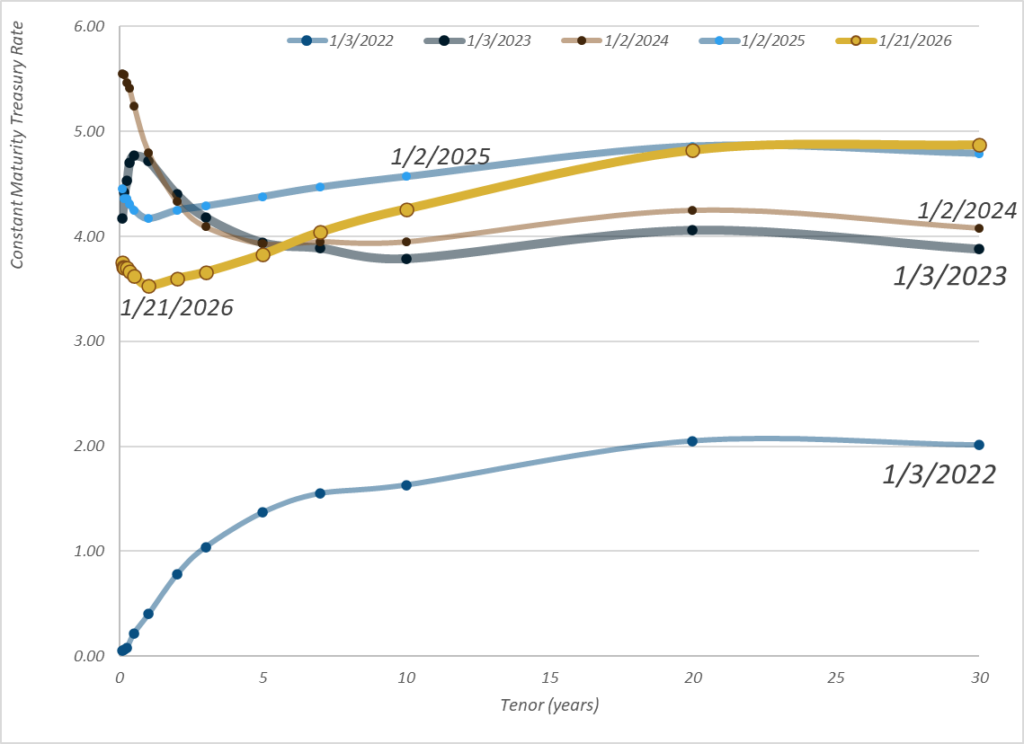

Graphic:

Publication Date: 21 Jan 2026

Publication Site: Treasury Department

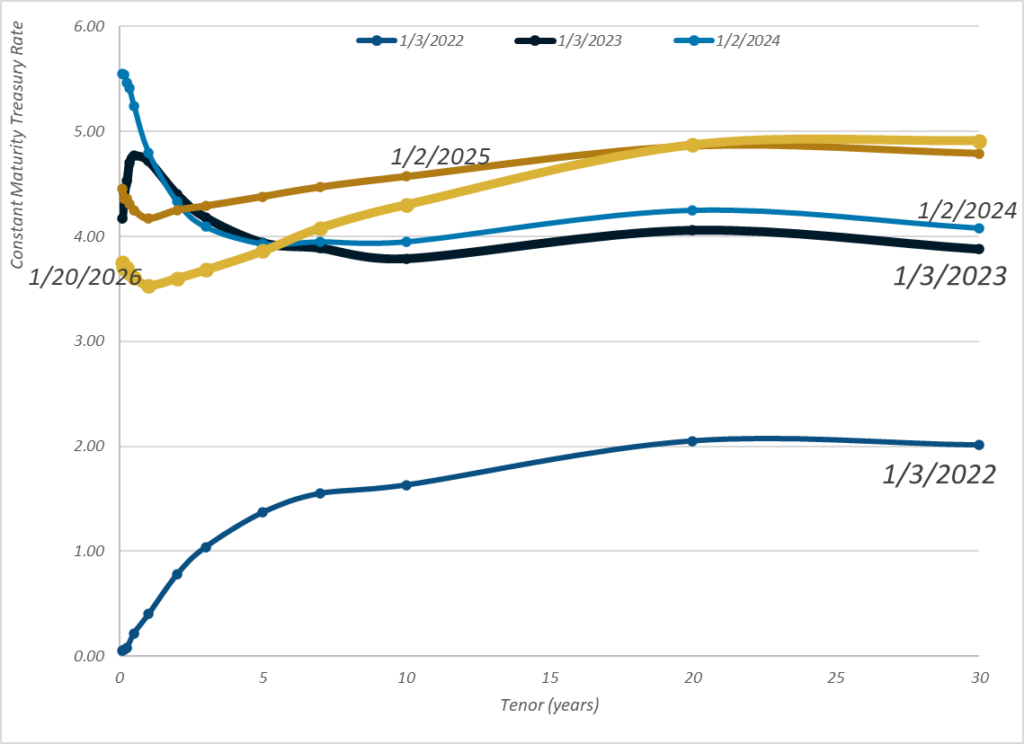

Graphic:

Publication Date: 20 Jan 2026

Publication Site: Treasury Dept

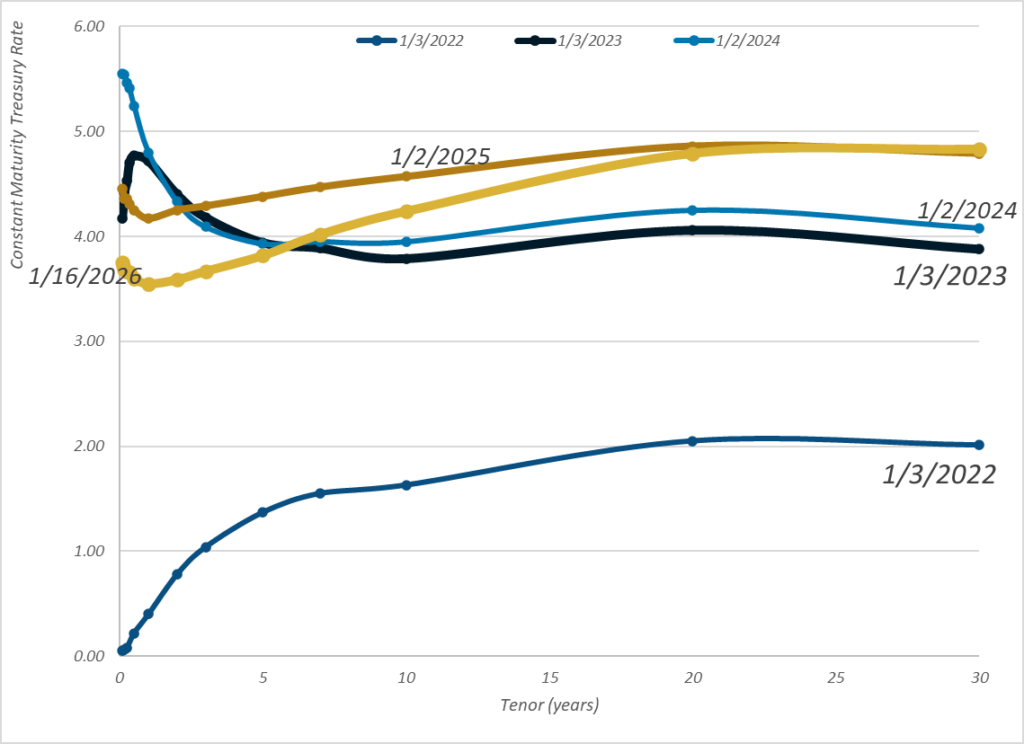

Graphic:

Publication Date: 16 Jan 2026

Publication Site: Treasury Department

Graphic:

Publication Date: 5 Jan 2026

Publication Site: Treasury Dept

Graphic:

Publication Date: 18 Dec 2025

Publication Site: Treasury Dept

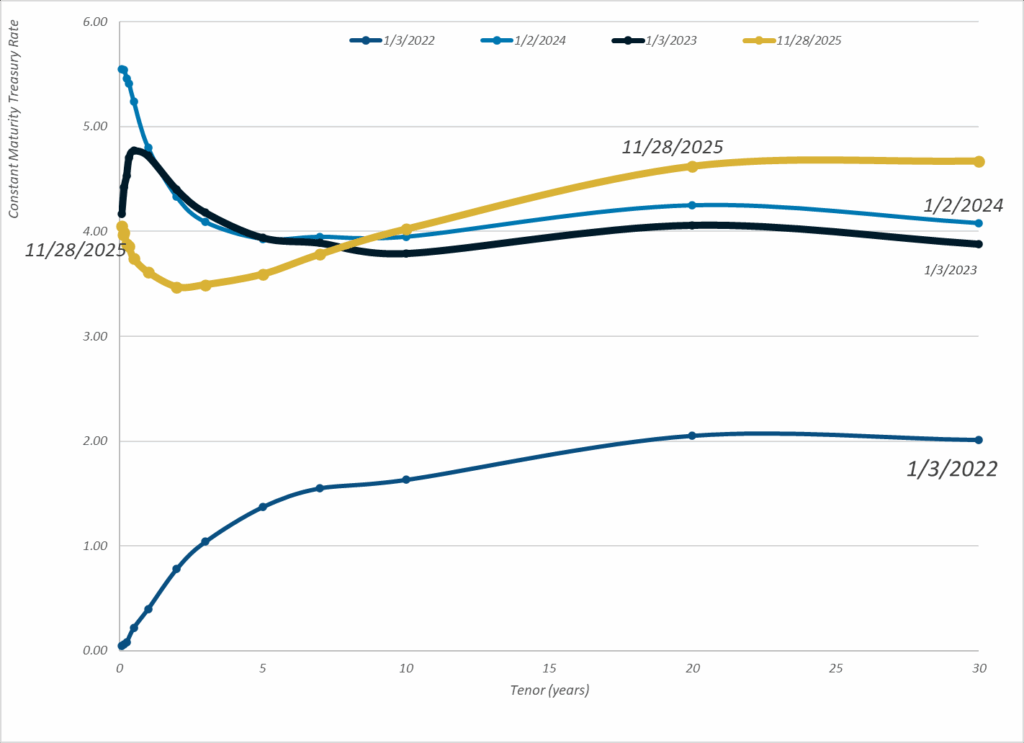

Graphic:

Publication Date: 28 Nov 2025

Publication Site: Treasury Dept

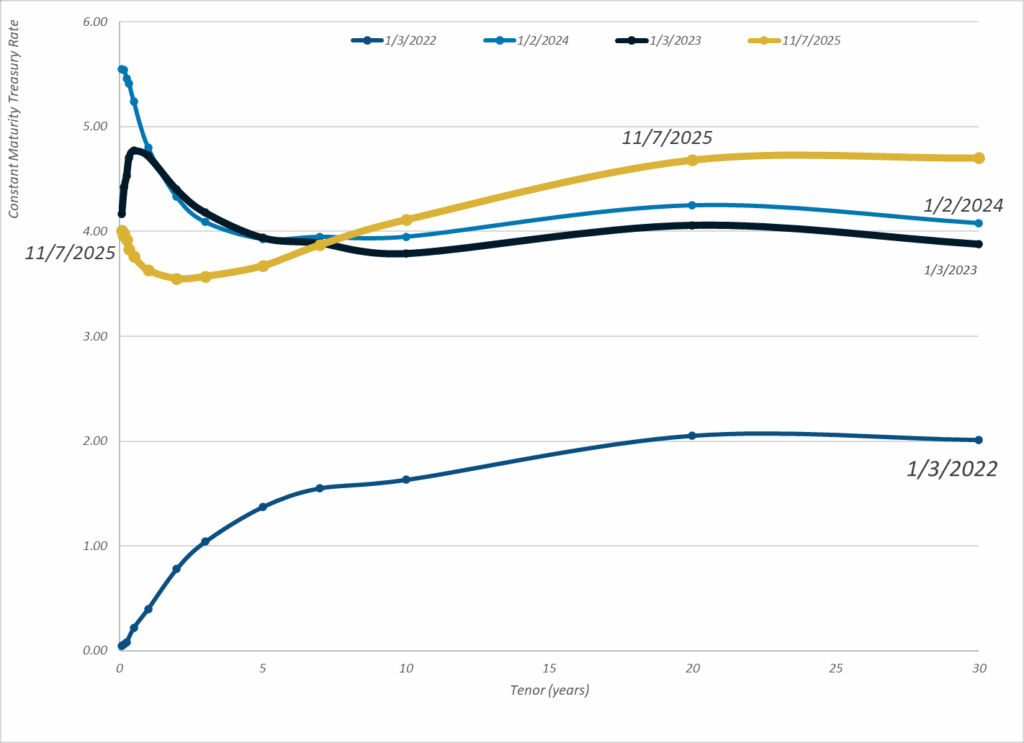

Graphic:

Publication Date: 7 Nov 2025

Publication Site: Treasury Dept

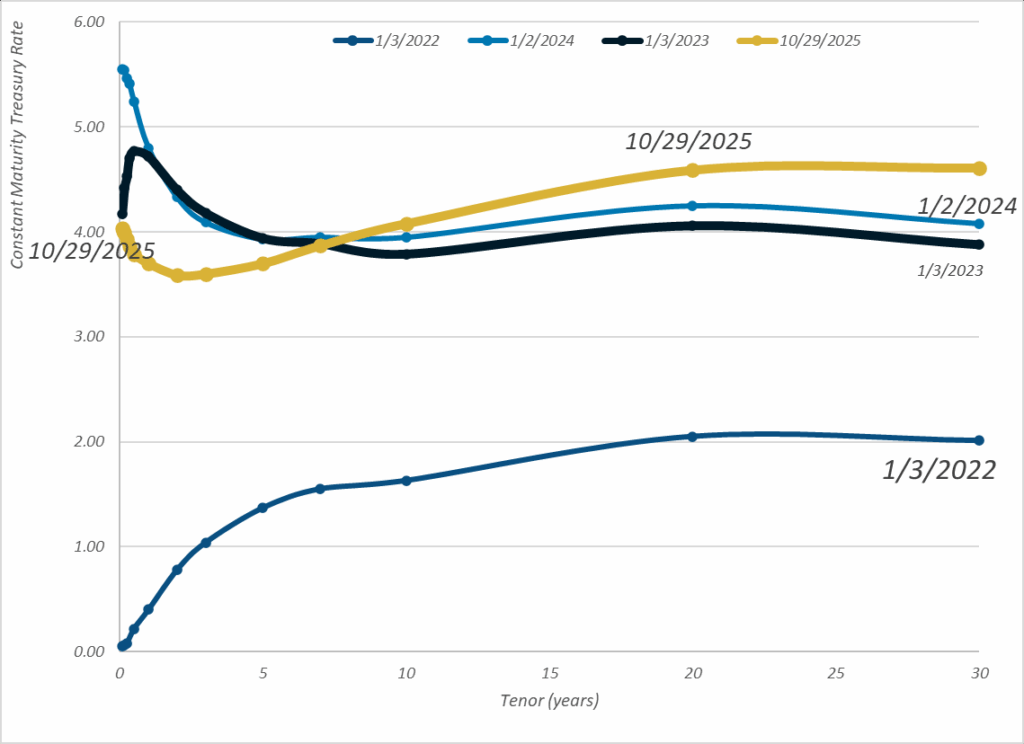

Graphic:

Publication Date: 29 Oct 2025

Publication Site: Treasury Dept

Graphic:

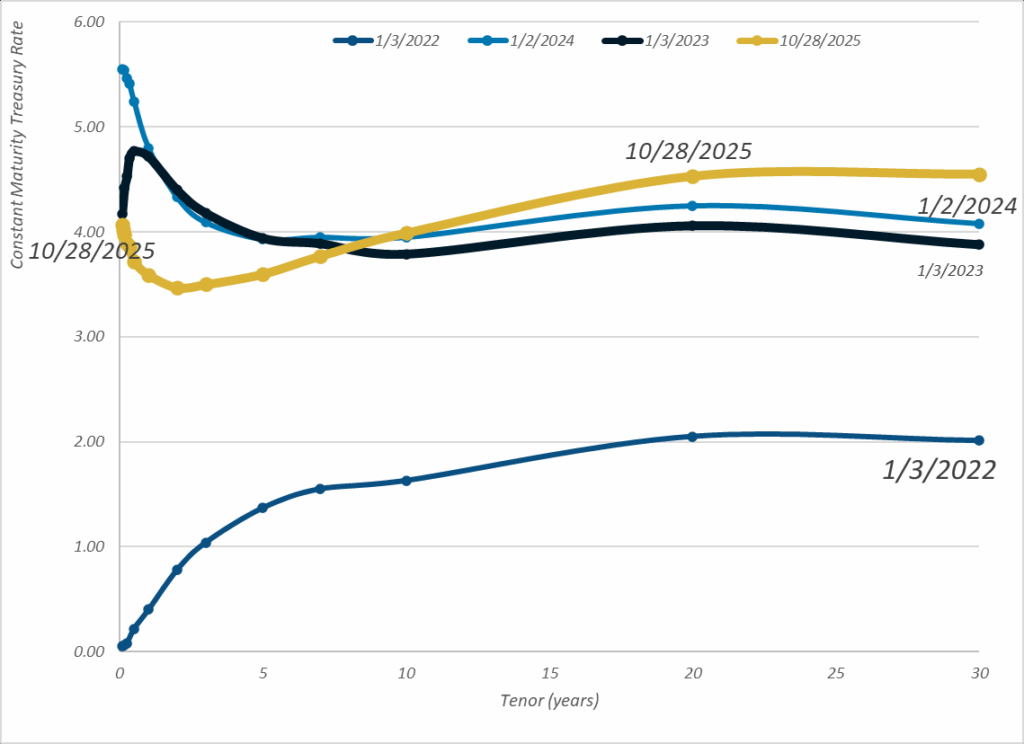

Publication Date: 28 Oct 2025

Publication Site: Treasury Dept

Graphic:

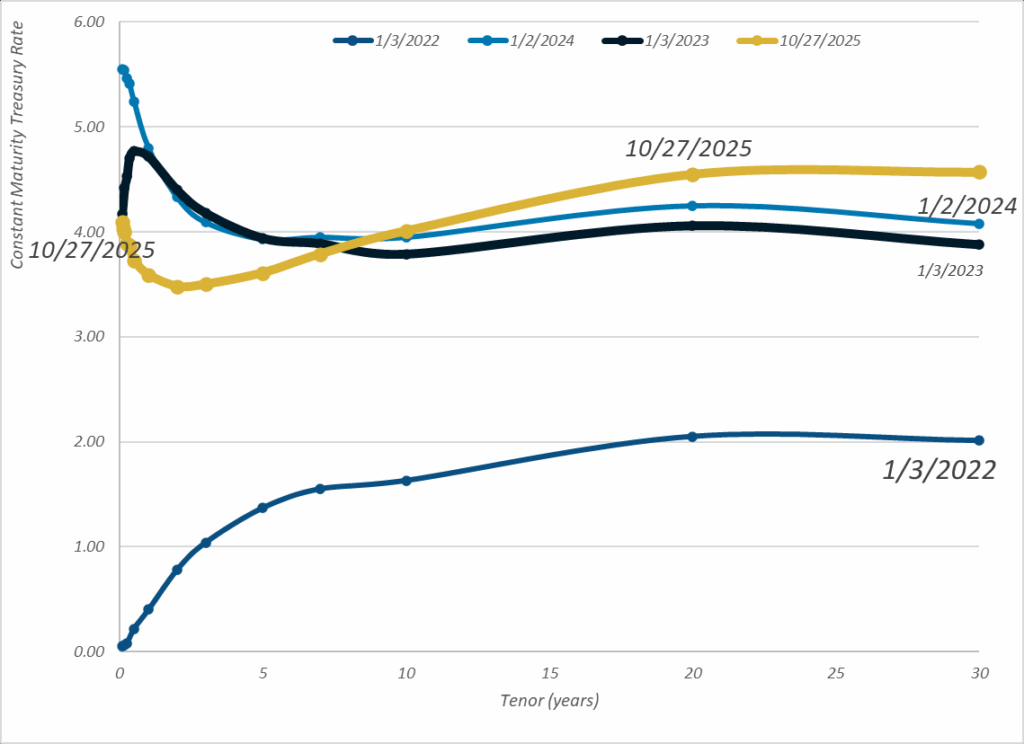

Publication Date: 27 Oct 2025

Publication Site: Treasury Dept

Graphic:

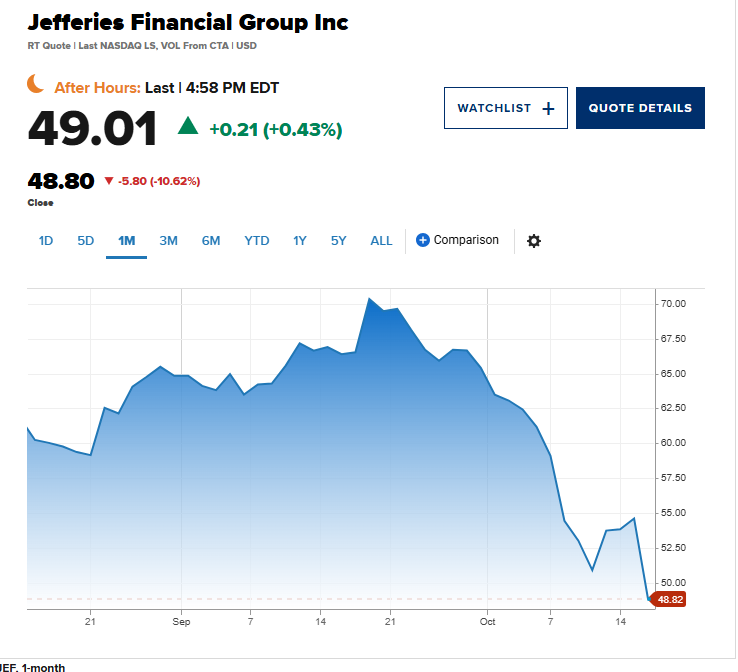

Excerpt:

Shares of regional banks and investment bank Jefferies tumbled on Thursday as fears mounted around some bad loans lurking on Wall Street.

Zions Bancorporation dropped more than 10% midday, as did Western Alliance Bancorp. The SPDR S&P Regional Banking ETF (KRE) lost around 4%, with all but one member of the popular fund on track to end Thursday’s session in the red.

….

The worries about the health of the banking industry originated with the bankruptcies of companies related to the auto sector: First Brands and Tricolor Holdings.

Shares of Jefferies, which has exposure to First Brands, fell more than 9% on Thursday. The investment bank’s stock has lost around 23% in October, making it poised to record its worst month since the Covid pandemic took hold in March 2020.

Jefferies said that hedge funds it runs are owed $715 million from companies tied to First Brands, while UBS said that it has about $500 million in exposure.

“When you see one cockroach, there are probably more,” JPMorgan CEO Jamie Dimon said on the company’s earnings conference call earlier this week in relation to First Brands and Tricolor Holdings fallout.

Author(s): Alex Harring, Sarah Min

Publication Date:16 Oct 2025

Publication Site: CNBC