Graphic:

Excerpt:

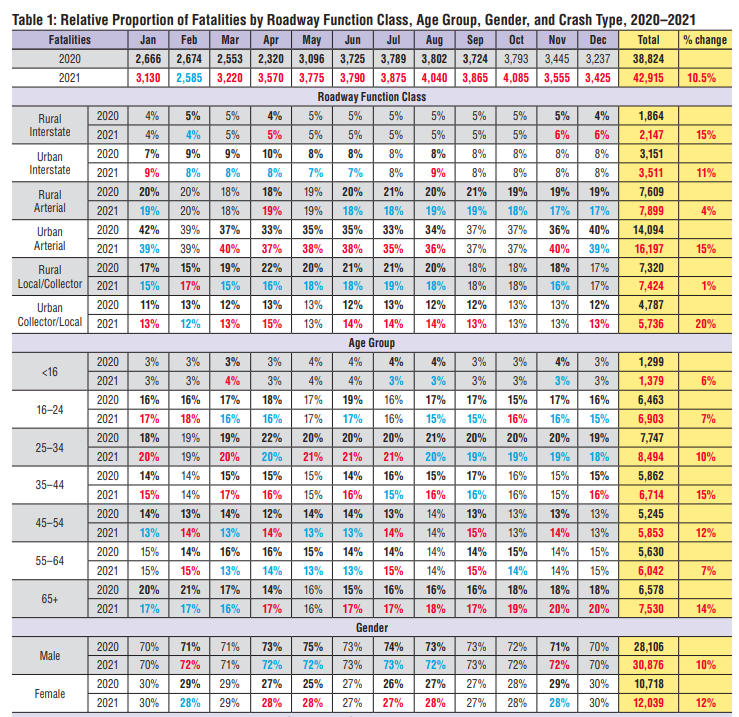

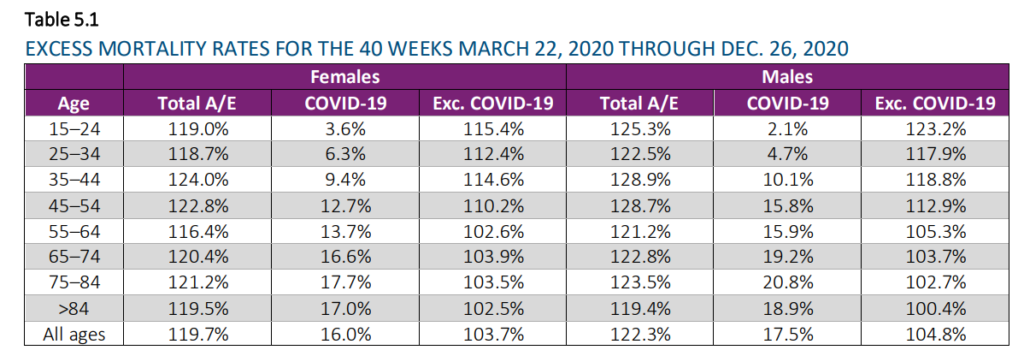

In the CDC ACIP meeting on June 17 to discuss childhood Covid vaccines, a table was presented showing Covid was a leading cause of death in US children as part of a slide deck on the epidemiology of Covid-19 in children and adolescents by Dr. Katherine Fleming-Dutra. The source was a pre-print written by a group of academics from the UK, including Dr. Deepti Gurdasani, who is well-known on Twitter for her strong views on Covid. I later learned that a very similar slide was also presented at the beginning of the FDA VRBPAC meeting earlier in the week.

The slide was shared on Twitter by Dr. Katelyn Jetelina (“Your Local Epidemiologist”), and retweeted by many influential people including Jerome Adams, Julia Raifman (tweet now deleted), Gregg Gonsalves, and Leana Wen. Only problem? It’s completely and utterly false. The pre-print it’s based on includes significant errors that invalidate the results. And the slide makes additional errors on top of the pre-print. It’s really disturbing that data this poor made its way into the meetings to discuss childhood Covid, and that it took me less that a few minutes to find a major flaw (and then I found many more as I looked deeper). I contacted the study’s corresponding author, Dr. Seth Flaxman, who originally said he’d get back to me on Monday, but responded early Sunday morning to get more information about the source of the Underlying Cause of Death data I used for Covid (the CDC WONDER database, Provisional Mortality Statistics, 2018-present). He later posted on Twitter to say than an updated pre-print would be available soon.

….

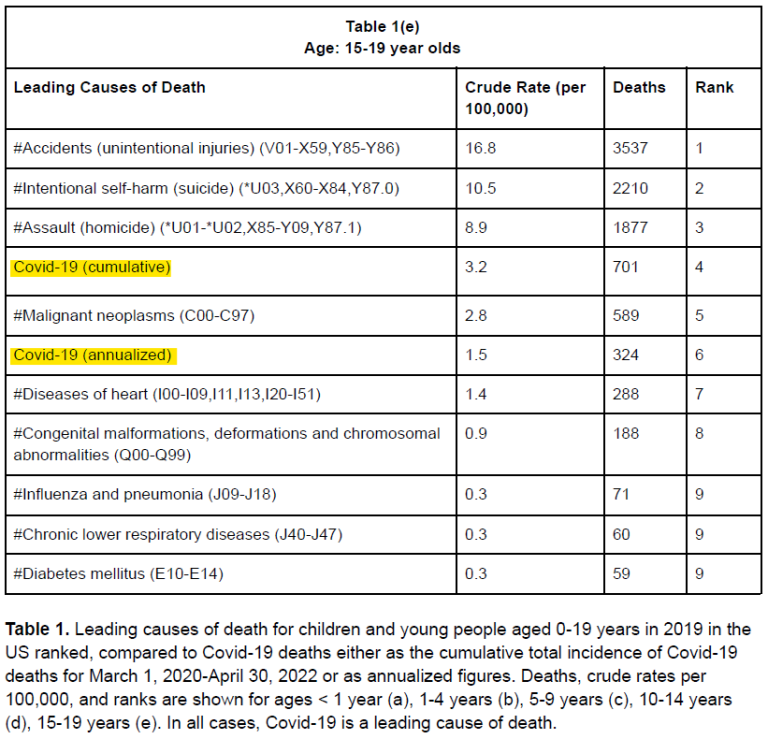

The second major issue with the pre-print are the time periods for the deaths. The underlying cause of death data is for a single year – 2019 (more on that later). However, the rankings of Covid deaths by age group in the pre-print include both cumulative (over 26 months) AND annualized deaths for some strange reason. That means Covid is inexplicably ranked twice for each age group.

Below is the table ranking leading causes of death for 15-19 year olds. Notice that Covid is listed both as the 4th AND the 6th leading cause of death. This is non-sensical and extremely misleading. It is completely inappropriate to compare the cumulative number of Covid deaths over 26 months to deaths from other causes over a one year period. The only way to make a fair comparison is to use an annualized number. There’s no good reason the cumulative number of Covid deaths over 26 months should be included on this list at all.

Author(s): Kelley in Georgia

Publication Date: accessed 22 Jun 2022

Publication Site: COVID-19 in Georgia