Link: https://www.soa.org/resources/experience-studies/2022/us-ind-life-covid-q4/

Graphic:

Description:

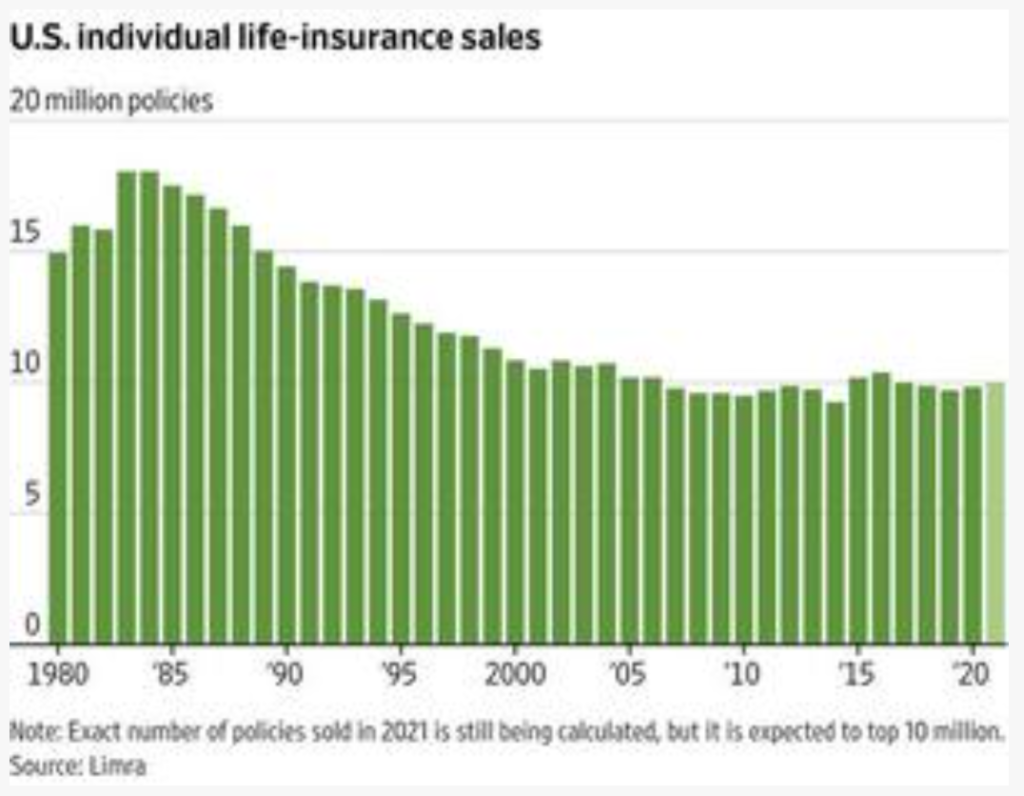

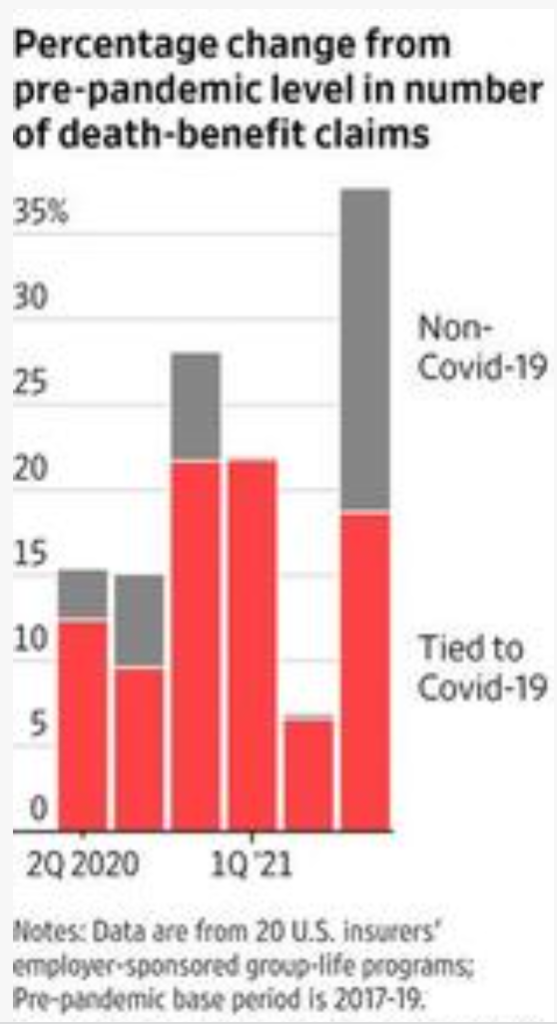

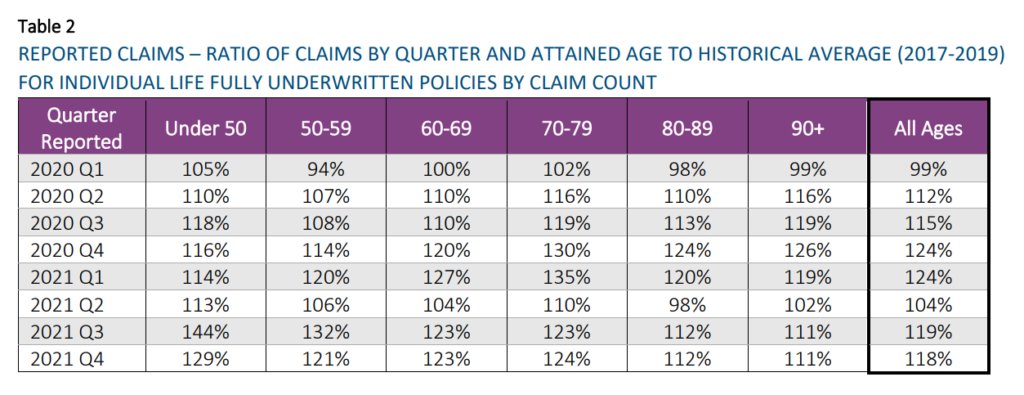

LIMRA, Reinsurance Group of America (RGA), the Society of Actuaries Research Institute (SOA), and TAI have collaborated on an ongoing effort to analyze the impact of COVID-19 on the individual life insurance industry’s mortality experience and share the emerging results with the insurance industry and the public. This report documents a high-level analysis of the claims that have been reported through December 31, 2021. The results presented here are based on data from 32 companies representing approximately 72% of the individual life insurance in force for the experience period of the study.

Author(s): Individual Life COVID-19 Project Work Group

Publication Date: May 2022, accessed 21 May 2022

Publication Site: Society of Actuaries