Link: https://taxfoundation.org/cigarette-taxes-cigarette-smuggling-2022/

Graphic:

Excerpt:

Key Findings:

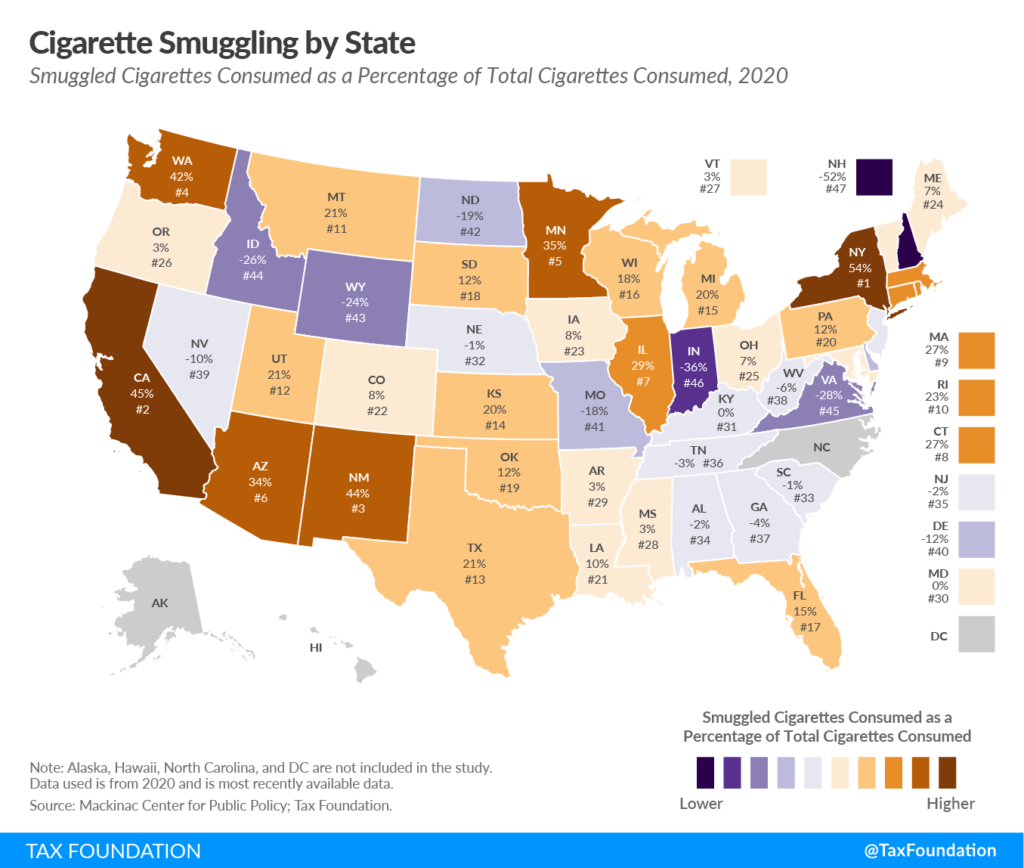

- Excessive tax rates on cigarettes induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources.

- New York has the highest inbound smuggling activity, with an estimated 53.5 percent of cigarettes consumed in the state deriving from smuggled sources in 2020. New York is followed by California (44.8 percent), New Mexico (45.5 percent), Washington (41.5 percent), and Minnesota (34.8 percent).

- New Hampshire has the highest level of net outbound smuggling at 52.4 percent of consumption, likely due to its relatively low tax rates and proximity to high-tax states in the northeastern United States. Following New Hampshire is Indiana (35.6 percent), Virginia (27.6 percent), Idaho (25.8 percent), Wyoming (24.4 percent), and North Dakota (18.6 percent).

- Illinois and New Mexico significantly increased their cigarette tax rate from 2019 to 2020. Both states saw major increases in cigarette smuggling.

- Policymakers interested in increasing tax rates should recognize the unintended consequences of high taxation rates. Criminal distribution networks are well-established and illicit trade will grow as tax rates rise.

Author(s): Adam Hoffer

Publication Date: 6 Dec 2022

Publication Site: Tax Foundation