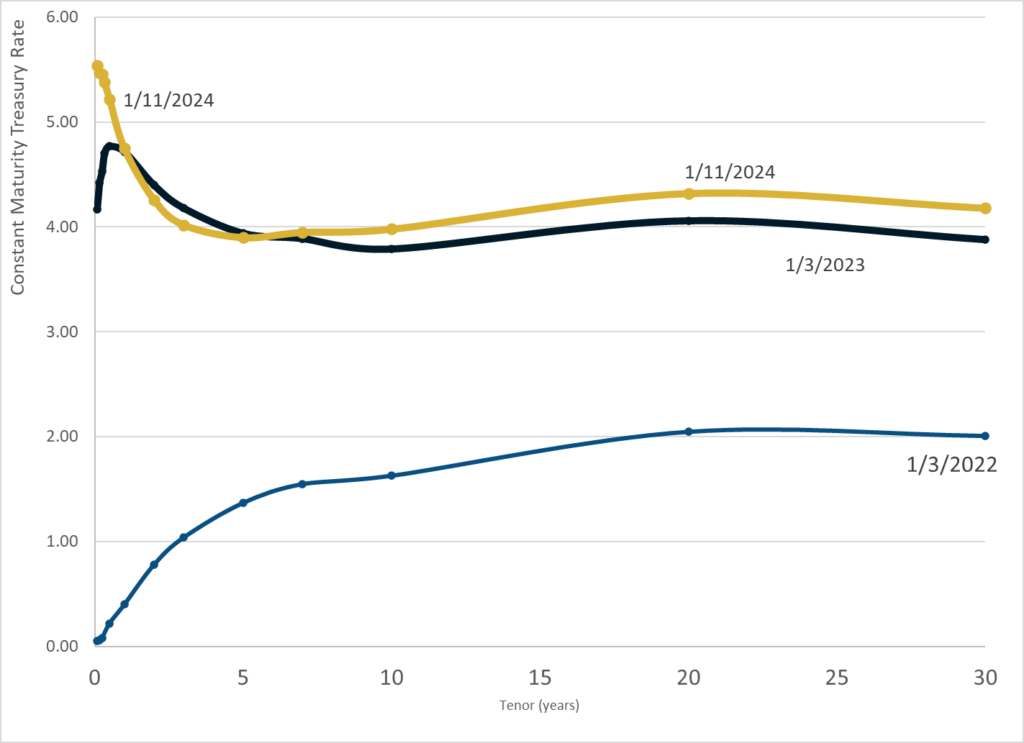

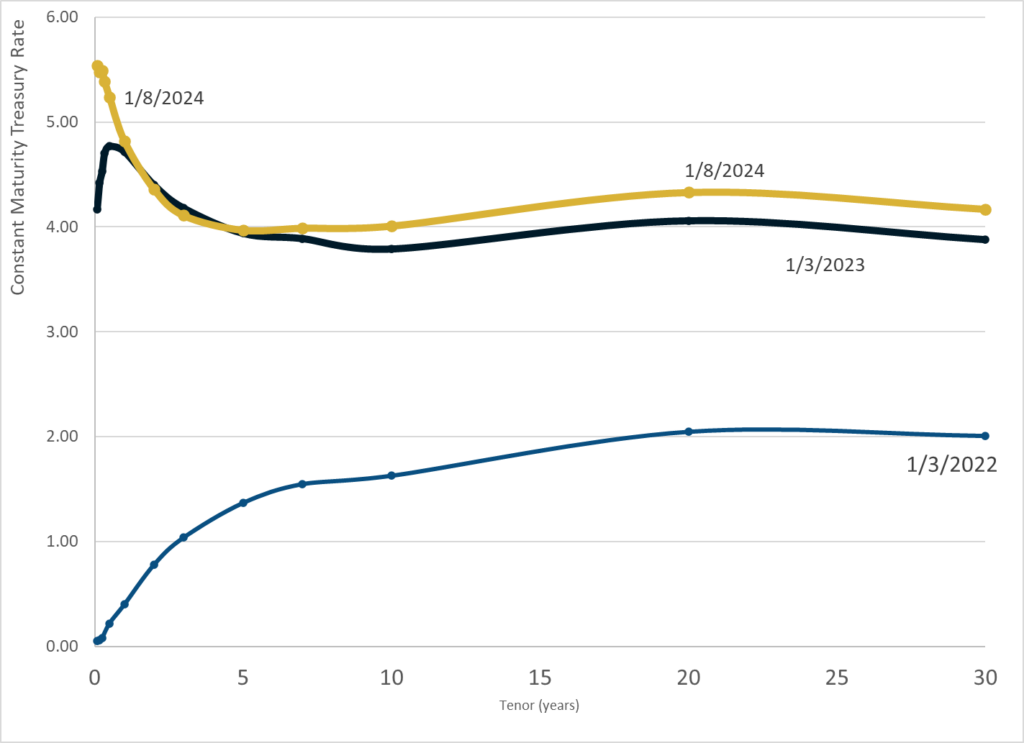

Graphic:

Publication Date: 11 Jan 2024

Publication Site: Treasury Dept

All about risk

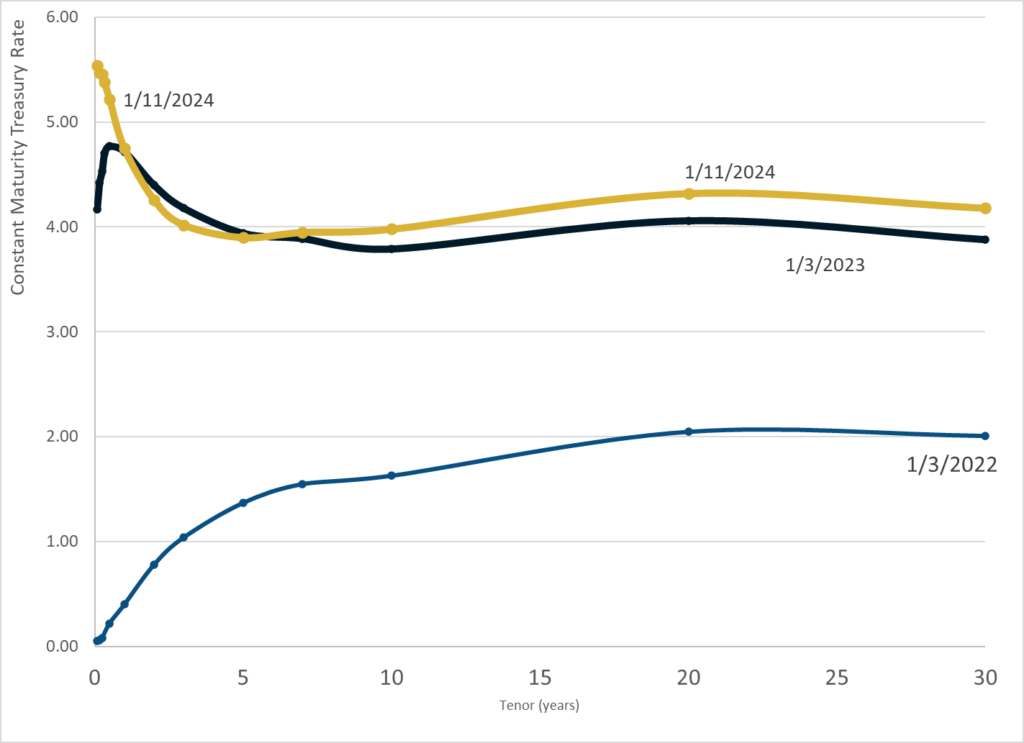

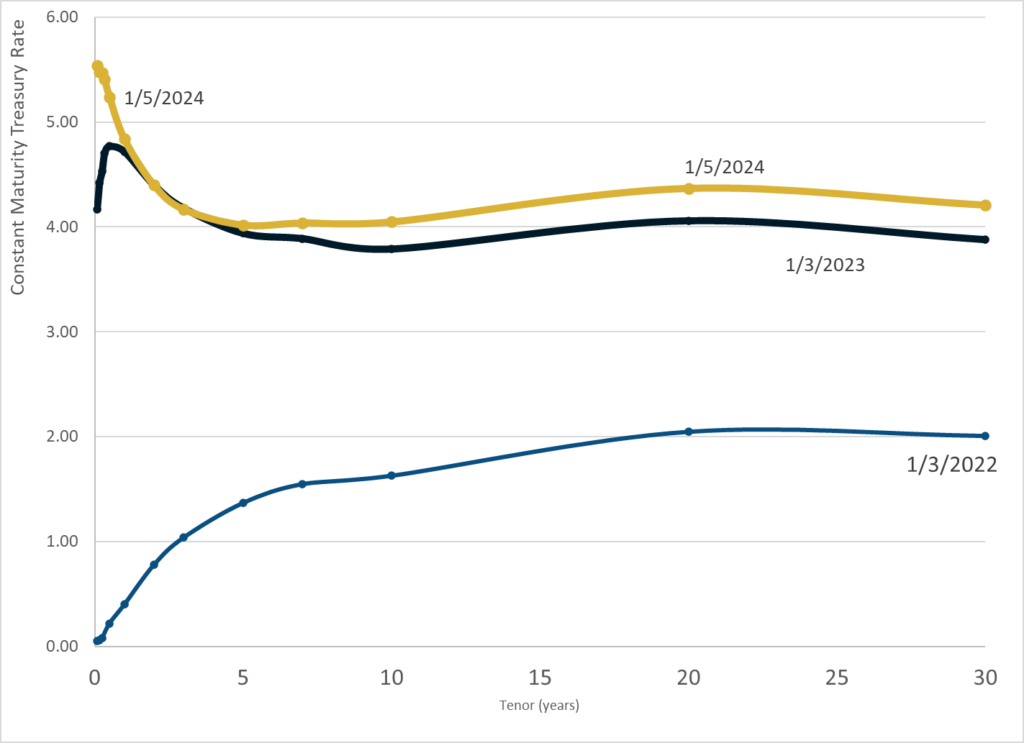

Graphic:

Publication Date: 11 Jan 2024

Publication Site: Treasury Dept

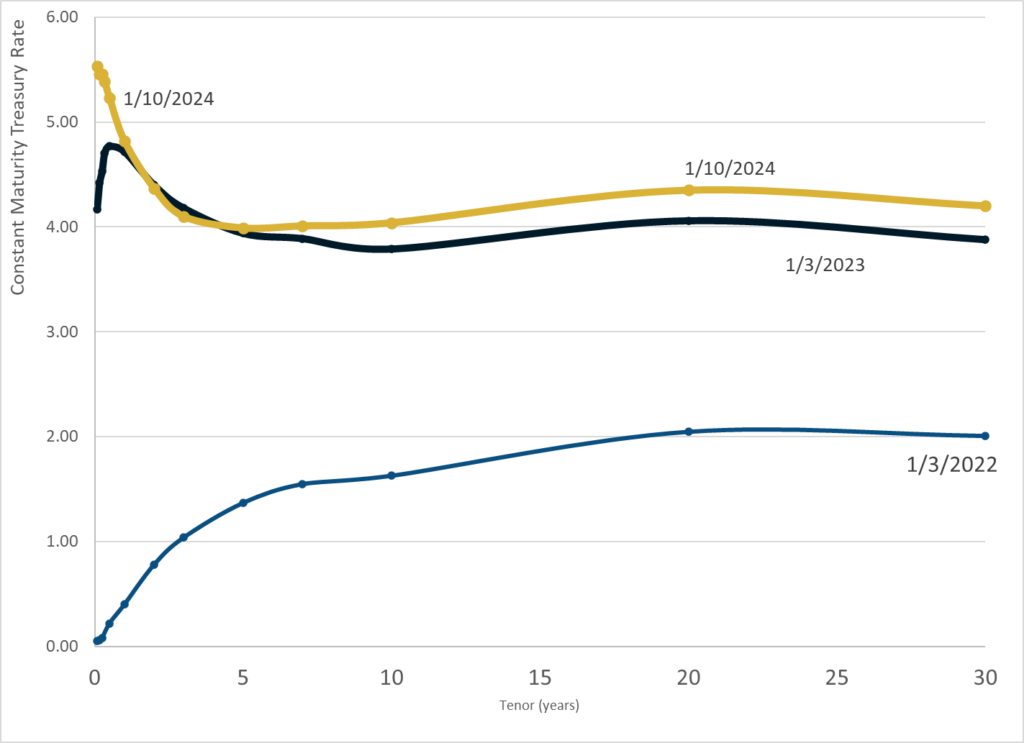

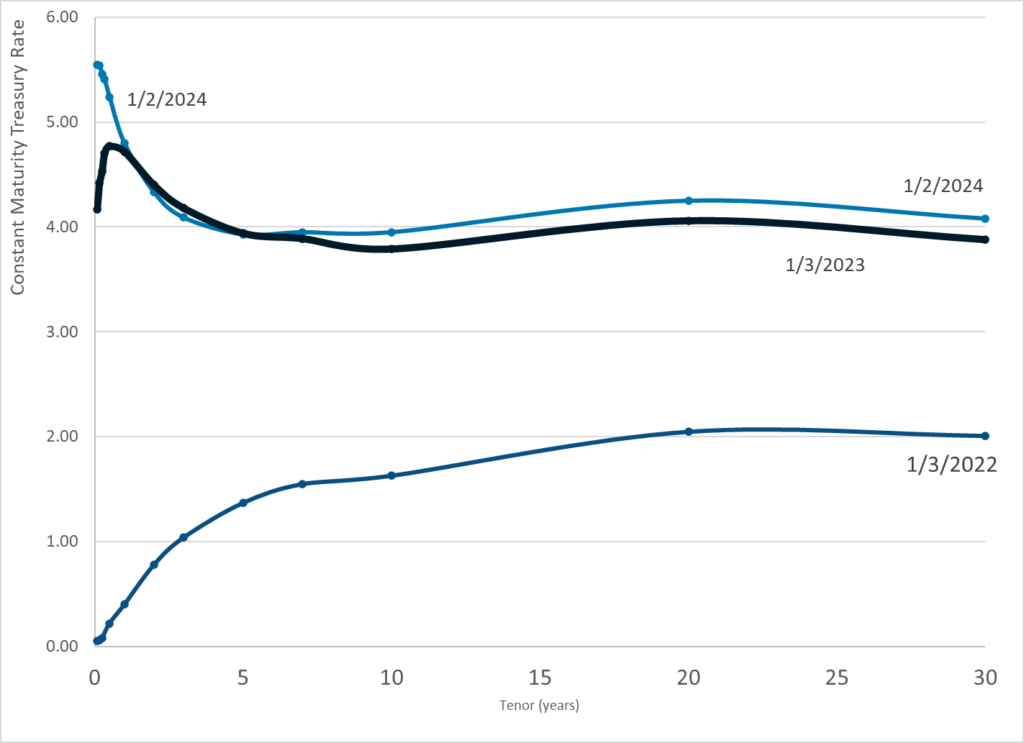

Graphic:

Publication Date: 10 Jan 2024

Publication Site: Treasury Dept

Excerpt:

The Labor Department lacks the legal authority to promulgate its new fiduciary rule, Brad Campbell, partner at Faegre Drinker, and former head of Labor’s Employee Benefits Security Administration, told House lawmakers Wednesday.

During testimony before the House Financial Services Capital Markets Subcommittee, Campbell maintained that the department “doesn’t have the legal authority to do what it is trying to do” because it cannot impose a fiduciary duty as it relates to individual retirement accounts.

“The reason we are here today is that the Proposals go well beyond DOL’s limited authority,” Campbell told lawmakers.

Labor’s plan ”would make DOL the primary financial regulator of $26 trillion, approximately half of which is held by individuals” in IRAs rather than employer-provided plans.

If Labor’s proposals “were limited to redefining fiduciary advice within the department’s actual authority — which is to administer the fiduciary standard expressly created by Congress to regulate employee benefit plans sponsored by private sector employers under Title I of ERISA — we wouldn’t be here today,” Campbell opined.

Author(s): Melanie Waddell

Publication Date: 10 Jan 2024

Publication Site: Think Advisor

Link: https://reason.com/2024/01/10/the-feds-shouldnt-subsidize-fancy-risky-beach-houses/

Graphic:

Excerpt:

Sen. John Kennedy (R–La.) is upset because Sen. Rand Paul (R–Ky.) wants to limit federal flood insurance.

But Paul is right. In my new video, Paul says, “[It] shouldn’t be for rich people.”

That should be obvious. Actually, federal flood insurance shouldn’t be for anyone. Government has no business offering it. That’s a job for the insurance business.

Of course, when actual insurance businesses, with their own money on the line, checked out what some people wanted them to insure, they said, “Heck no! If you build in a dangerous place, risk your own money!”

Politically connected homeowners who own property on the edges of rivers and oceans didn’t like that. They whined to congressmen, crying, “We can’t get insurance! Do something!”

Craven politicians obliged. Bureaucrats at the Federal Emergency Management Agency even claim they have to issue government insurance because, “There weren’t many affordable options for private flood insurance, especially for people living in high-risk places.”

But that’s the point! A valuable function of private insurance is to warn people away from high-risk places.

Author(s): John Stossel

Publication Date: 10 Jan 2024

Publication Site: Reason

Excerpt:

Traditionally, many life insurance agents, brokers and advisors have preferred to operate as independent contractors to benefit from the federal income tax rules for self-employed people and to enjoy the privilege of not having a boss.

But some financial professionals have argued that they would be better off if life insurers classified them as employees. In 2009, for example, three former Northwestern Mutual Life representatives sued in a federal court in California over allegations that the company had deprived them of FLSA protections by classifying them as independent contractors.

In 2019, representatives for Uber drivers and other gig workers persuaded California lawmakers to pass Assembly Bill 5, legislation that established a broader definition of “employee” for California employers.

Federal efforts: The National Association of Insurance Commissioners and other agent and broker groups joined with the American Council of Life Insurers to oppose efforts by members of Congress to set a federal definition for employee that would be similar to the California definition.

During the administration of former President Donald Trump, the Labor Department tried to address the concerns about worker classification by adopting a new, shorter “core factors” test. Those regulations took effect in January 2021.

In October 2022, after Joe Biden became president, the department announced in a notice that it was planning to rescind and replace the new regulations because the new regulations were not fully compatible with the FLSA and conflicted with decades of court decisions based on the economic reality test.

Author(s): Allison Bell

Publication Date: 10 Jan 2024

Publication Site: Think Advisor

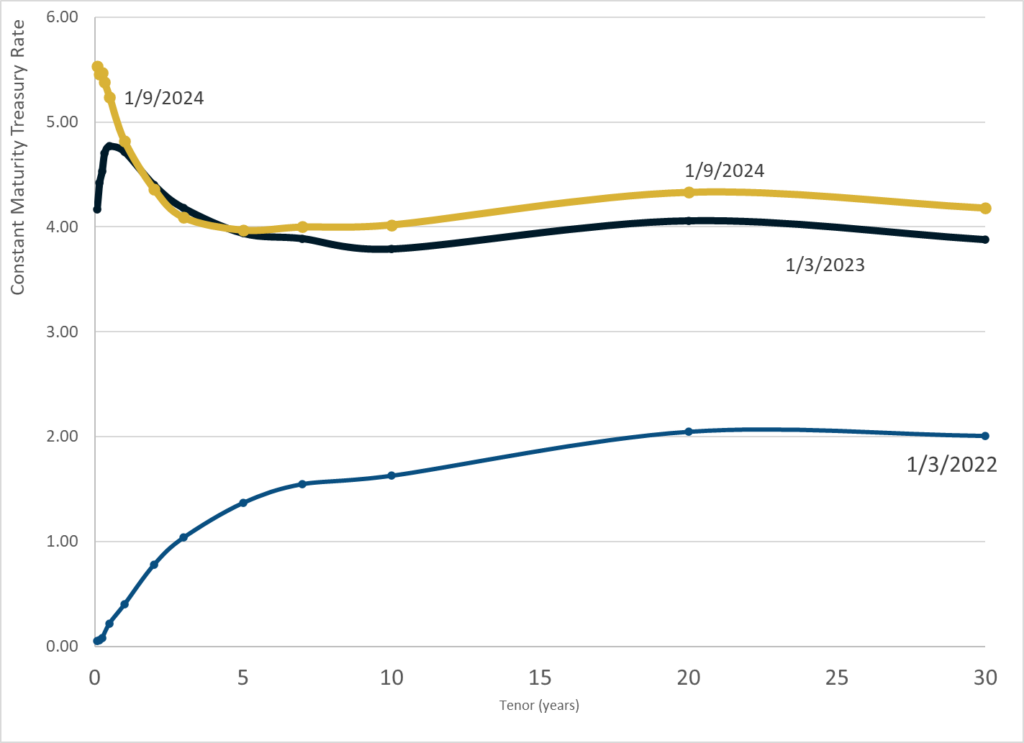

Graphic:

Publication Date: 9 Jan 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 8 Jan 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 5 Jan 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 4 Jan 2024

Publication Site: Treasury Dept

Graphic:

Publication Date: 1 Jan 2024

Publication Site: Treasury Dept

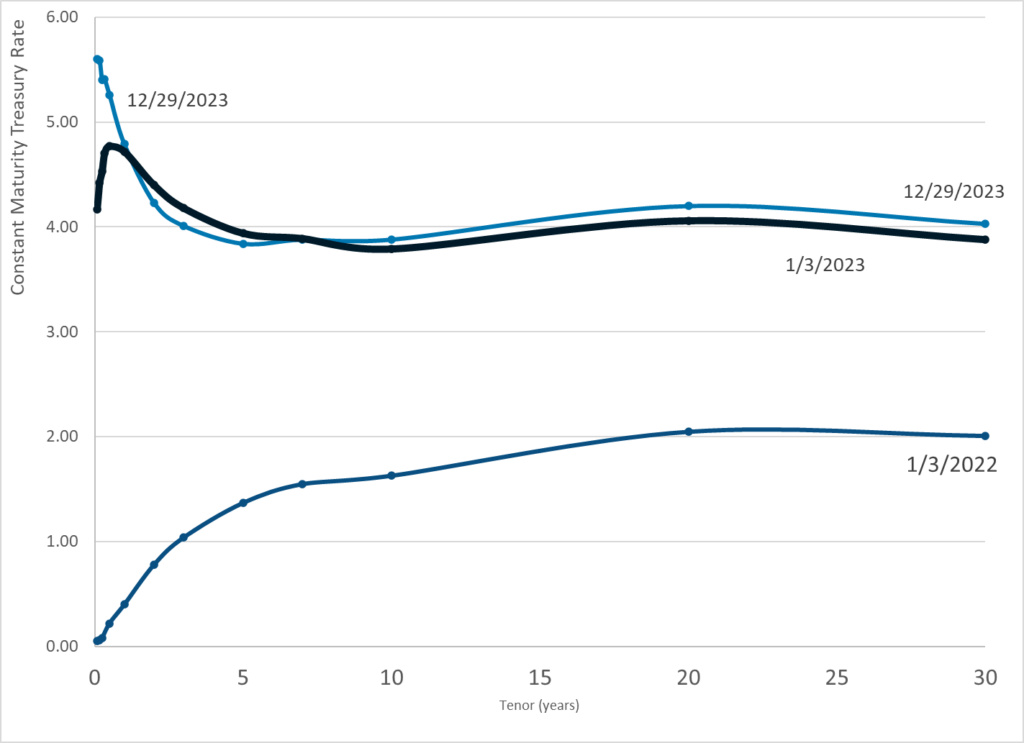

Graphic:

Publication Date: 29 Dec 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 27 Dec 2023

Publication Site: Treasury Dept