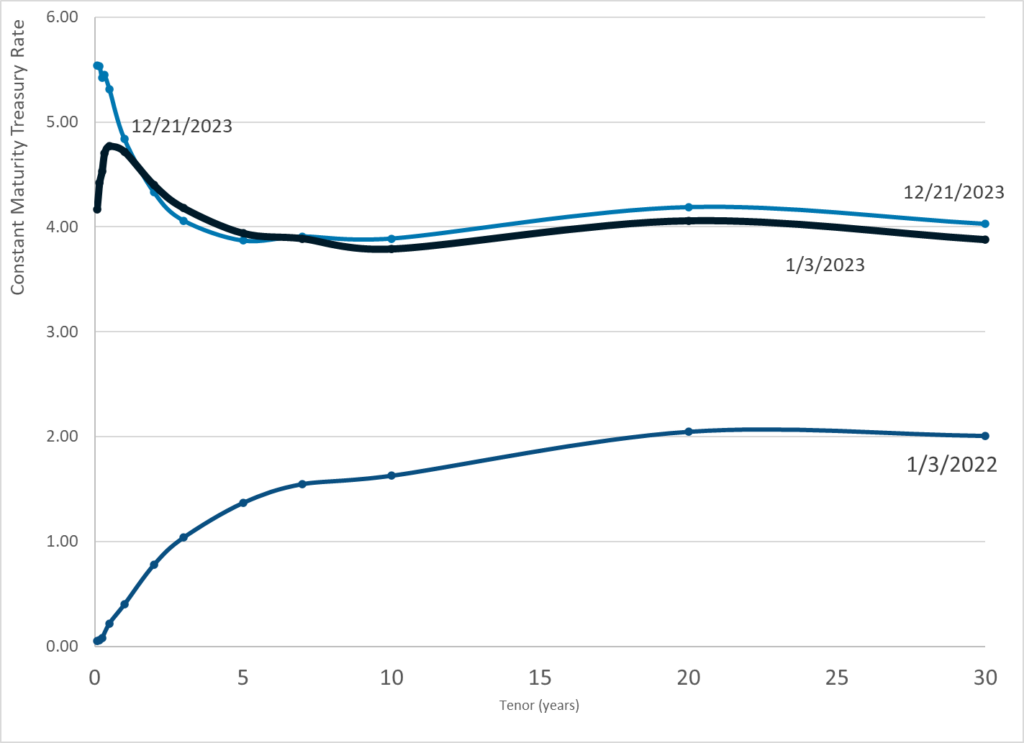

Graphic:

Publication Date: 21 Dec 2023

Publication Site: Treasury Dept

All about risk

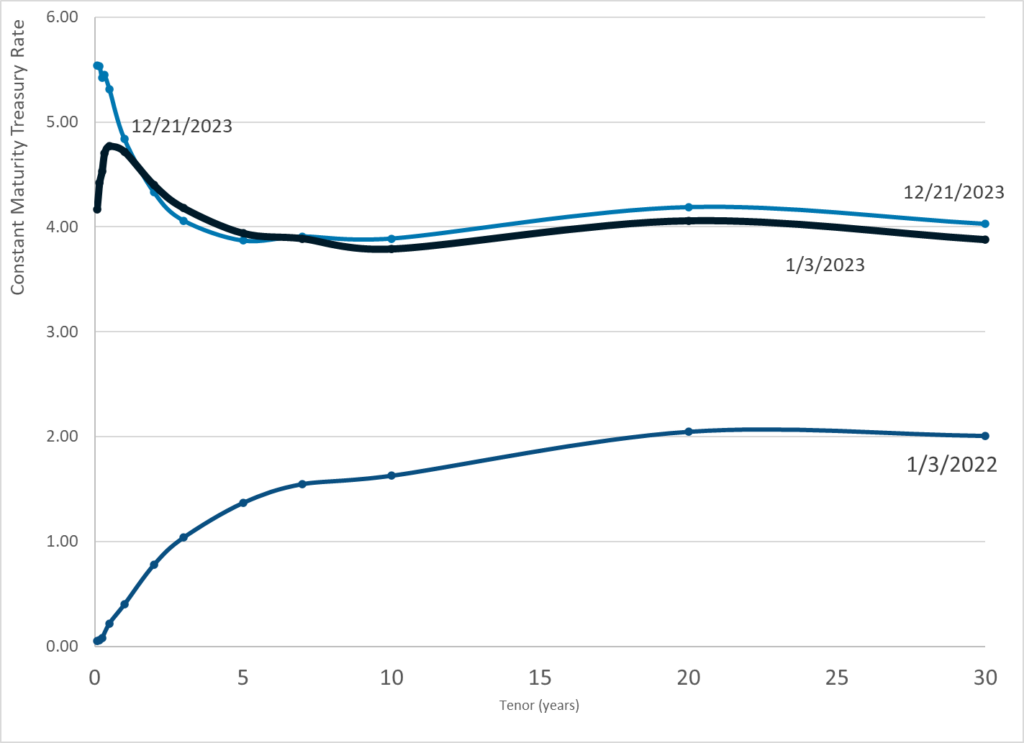

Graphic:

Publication Date: 21 Dec 2023

Publication Site: Treasury Dept

Link: https://govmoneynews.com/bills-blog/f/is-ed-kanes-gathering-crisis-still-gathering-steam

Excerpt:

Back in 1985, Ed Kane penned a prophetic volume identifying a blooming mess in financial markets. His book, The Gathering Crisis in Federal Deposit Insurance, reliably warned of taxpayer exposure to losses ultimately unleashed in the savings and loan crisis.

Cycles of ensuing regulatory reforms, crises and scandals have only reinforced the timeliness of the lessons that Kane offered us decades ago. Those lessons became particularly poignant in light of the failure of Silicon Valley Bank and several other large banks earlier this year.

Kane’s 1980s warnings remain worthy of scrutiny and reflection, and underscore questions whether industry and regulatory reforms have simply left us on the edge of another precipice. The financial conditions of the FDIC and the Federal Reserve – and their implications for the U.S. Treasury and American taxpayers – deserve close scrutiny, as well as recommendations for fundamental reform.

….

“In an economic environment in which deposit institutions are highly levered and entering new businesses every day and in which interest rates are highly volatile, systematically mispricing deposit insurance guarantees encourages deposit institution managers to position their firms on the edge of financial disaster. Metaphorically, deposit-insurance authorities are paying deposit-institution managers to overload the deposit-insurance jalopy, to drive it too fast, and even to break dance on its hood as it careens through interest rate mountains and over back-country roads. Reformers’ ultimate goals must be to confront institutions whose risk-taking imposes socially unacceptable risks on its federal guarantors with a combination of reduced coverages and increased fees sufficient to move them to adopt safer modes of operation.” (p. 147)

“Of course, just how safe, reliable, and comfortable a ride the nation enjoys depends also on the macroeconomic policies that the government follows. If Congress could bring government spending under long-run control, monetary policy would not have to push interest rates over so wide a cycle. Reducing the volatility of interest rates would relieve the car’s drivers of the need to take it over quite so dangerous a set of roads.” (p. 165)

Author(s): Bill Bergman

Publication Date: 20 Dec 2023

Publication Site: Bill’s Blog at GovMoneyNews

Excerpt:

planadvisor.com reports:

Department of Labor Inspector General Larry Turner issued a semi-annual report Tuesday arguing that the Employee Benefit Security Administration lacks both the resources and authority to fulfill its mandate to employee benefit plans. The report particularly emphasized EBSA’s limited authority to conduct thorough audits of workplace retirement plans.

My takeaways from the report:

The OIG remains concerned about the Employee Benefits Security Administration’s (EBSA) ability to protect the integrity of pension, health, and other benefit plans of about 153 million workers, retirees, and their families under the Employee Retirement Income Security Act of 1974 (ERISA). In particular, the OIG is concerned about the statutory limitations on EBSA’s oversight authority and inadequate resources to conduct compliance and enforcement. A decades-long challenge to EBSA’s compliance program, ERISA provisions allow billions of dollars in pension assets to escape full audit scrutiny. The act generally requires every employee benefit plan with more than 100 participants to obtain an audit of the plan’s financial statements each year. However, an exemption in the law allowed auditors to perform “limited-scope audits.” These audits excluded pension plan assets already certified by certain banks or insurance carriers and provided little to no confirmation regarding the actual existence or value of the assets. (page 23)

Author(s): John Bury

Publication Date: 6 Dec 2023

Publication Site: burypensions

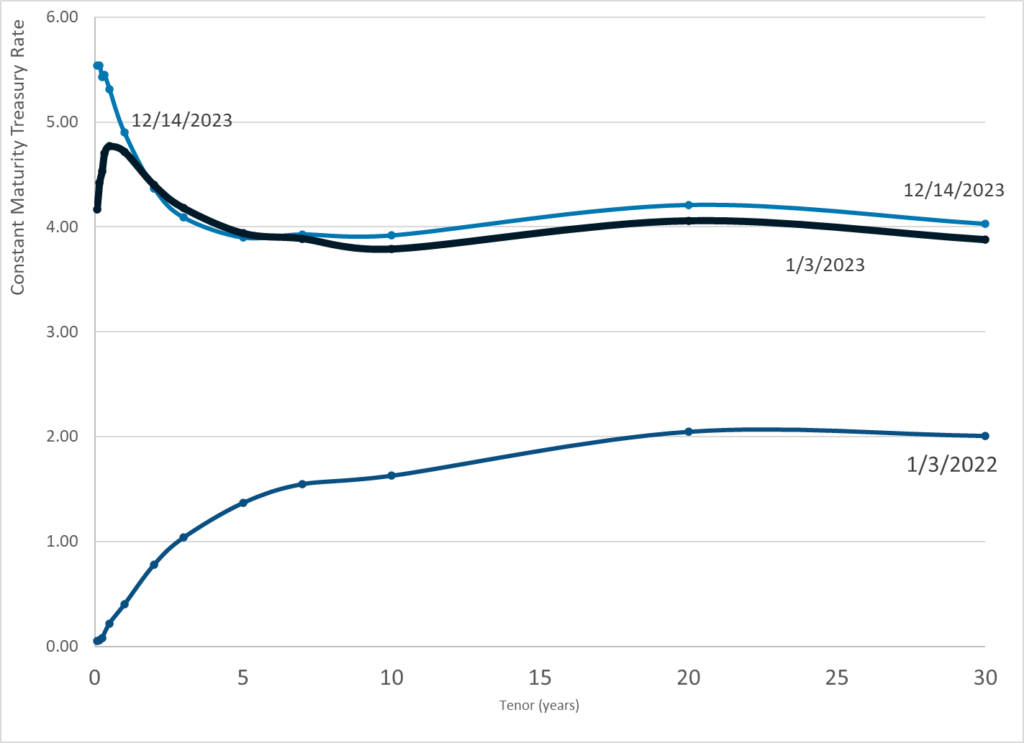

Graphic:

Publication Date: 14 Dec 2023

Publication Site: Treasury Dept

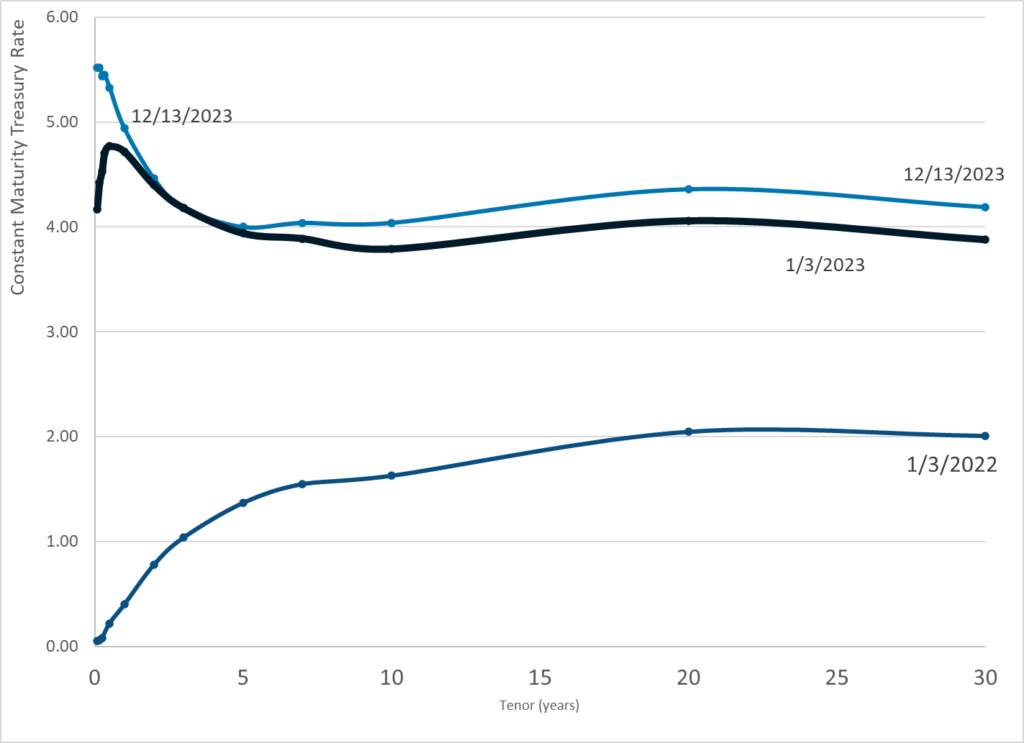

Graphic:

Publication Date: 13 Dec 2023

Publication Site: Treasury Dept

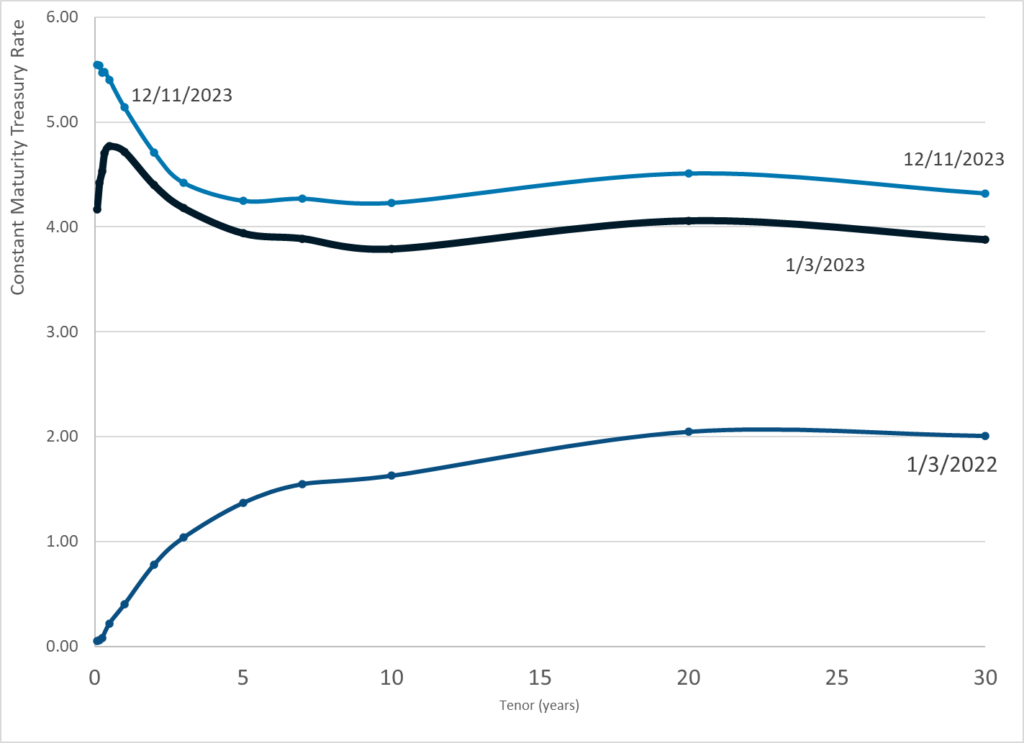

Graphic:

Publication Date: 11 Dec 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 8 Dec 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 6 Dec 2023

Publication Site: Treasury Department

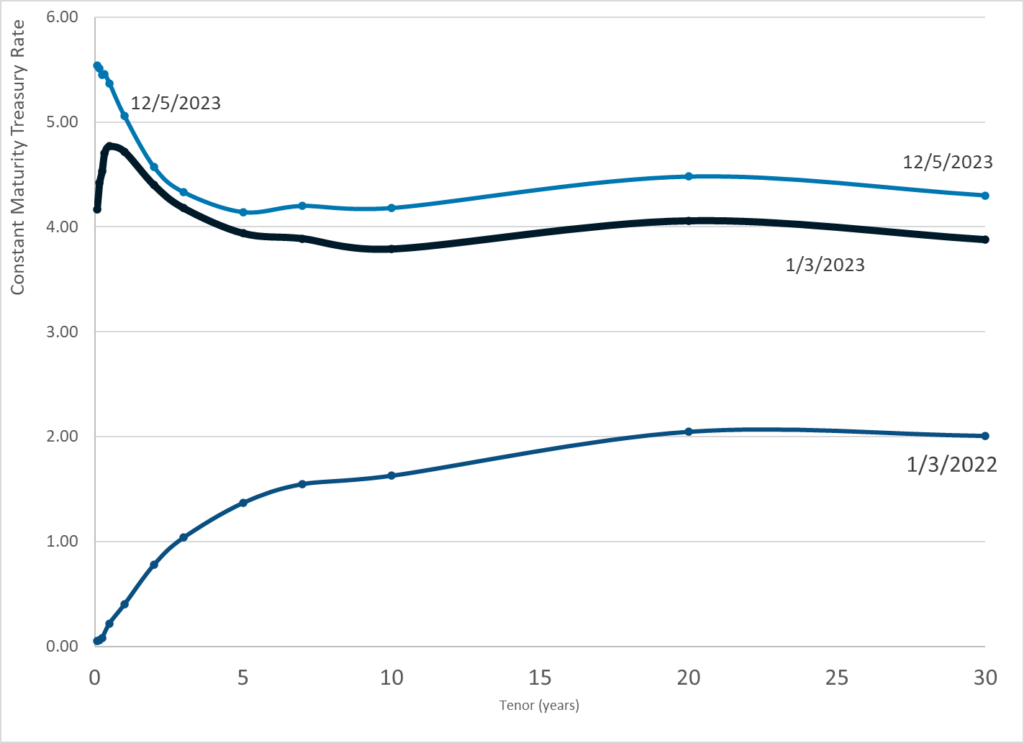

Graphic:

Publication Date: 5 Dec 2023

Publication Site: Treasury Dept

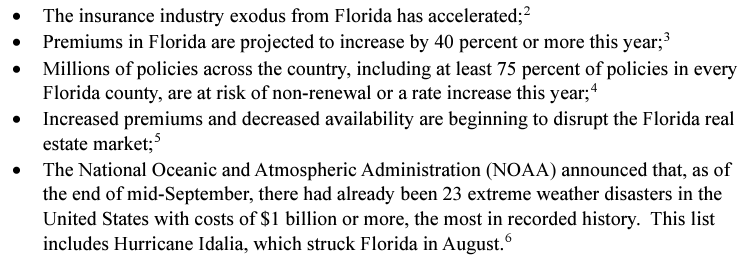

Excerpt:

The federal government has launched an investigation into Florida’s largest home insurance company.

Citizens Insurance, the governor, and other state leaders received a letter informing them that a Senate budget committee is looking into the state-run company.

Here’s why a Senate budget committee is looking into the company.

Citizens insure $586 billion worth of property, and they have just over $15 billion in their reserves to pay out on claims. If a major hurricane hit the state, they could be short over $571 billion, leaving everyone in the state on the hook to pay the shortfall.

The letter from the Senate committee investigating the state backed company expresses concern it may be unable to cover its losses. A claim the governor confirmed while visiting Fort Myers last year.

….

Mark Friedlander with the Insurance Information Institute said a private insurer would not be allowed to operate in the State of Florida with those financial dynamics.

Seven private companies went insolvent in the last year and a half in Florida.

“Citizens, unlike a private insurer, could never go insolvent,” Friedlander noted.

That’s because the state could initiate a hurricane tax to cover its costs which would require everyone who owns property or a car to pay a hurricane tax.

Author(s): Dave Elias

Publication Date: 4 Dec 2023

Publication Site: NBC 2, Florida Weekly

Link: https://www.budget.senate.gov/imo/media/doc/letter_to_citizens.pdf

Graphic:

Excerpt:

As of 2022, Citizens’ market share for homeowners multi-peril policies was approaching 20 percent, having more than doubled since 2020. As private insurers in Florida continue to go insolvent or exit the state, Citizens’ market share will likely continue to grow. At 20 percent market share, Citizens’ losses could be as high as $36 billion in the scenario studied by Swiss Re or $162 billion in the scenario studied by Cambridge and Munich Re (assuming that 60 percent of total losses are insured). If Citizens had to raise $162 billion to cover losses, that would result in an approximately $20,000 assessment for every homeowners insurance policyholder in Florida.

….

To that end, please respond to the following requests for information and documents by December 21, 2023:

1. What modeling or other analysis has Citizens done to estimate its total potential exposure to various worst case hurricane scenarios? What is the upper range of Citizens’ potential losses? Please provide all documents and communication relating to modeling, analysis, and estimates of Citizens’ potential losses.

2. What modeling or other analysis has Citizens done to estimate its market share over the next decade? What does Citizens project its market share to be in each of the next 10 years? Please provide all documents and communication relating to modeling, analysis, and estimates of Citizens’ future market share.

3. What modeling or other analysis has Citizens done to determine its ability to fully pay out claims resulting from various loss scenarios? Please provide all documents and communication relating to modeling, analysis, and estimates of Citizens’ financial position and (in)solvency under such scenarios.

4. What are Citizens’ current assets? What is Citizens’ total reinsurance coverage? What are the maximum total claims Citizens would be able to pay out without having to levy an assessment on Florida policyholders? Please provide all documents and communication relating to modeling, analysis, and estimates of Citizens’ current assets, reinsurance, and ability to pay claims.

5. What communications has Citizens had with Governor DeSantis, Insurance Commissioner Michael Yaworsky, their staffs, or any other state officials regarding Citizens’ current or future solvency? Please provide copies of these communications.

6. What communications has Citizens had with Governor DeSantis, Insurance Commissioner Yaworsky, their staffs, or any other state officials regarding what Citizens and/or the State would do if Citizens were unable to cover its losses? Please provide copies of these communications.

7. Has Citizens contemplated asking for a federal bailout if it were unable to cover its losses? Has Citizens discussed the possibility of a federal bailout with Governor DeSantis, Insurance Commissioner Yaworsky, their staffs, or any other state officials? Please provide copies of these communications.

Author(s): Sheldon Whitehouse

Publication Date: 30 Nov 2023

Publication Site: Senate website

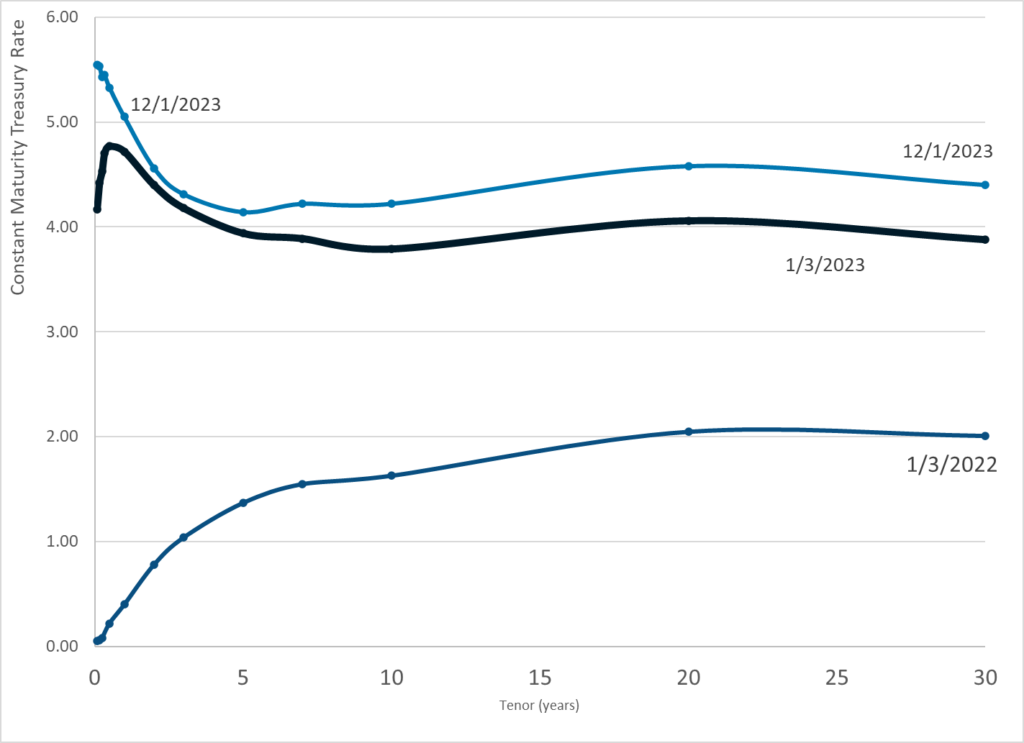

Graphic:

Publication Date: 1 Dec 2023

Publication Site: Treasury Dept