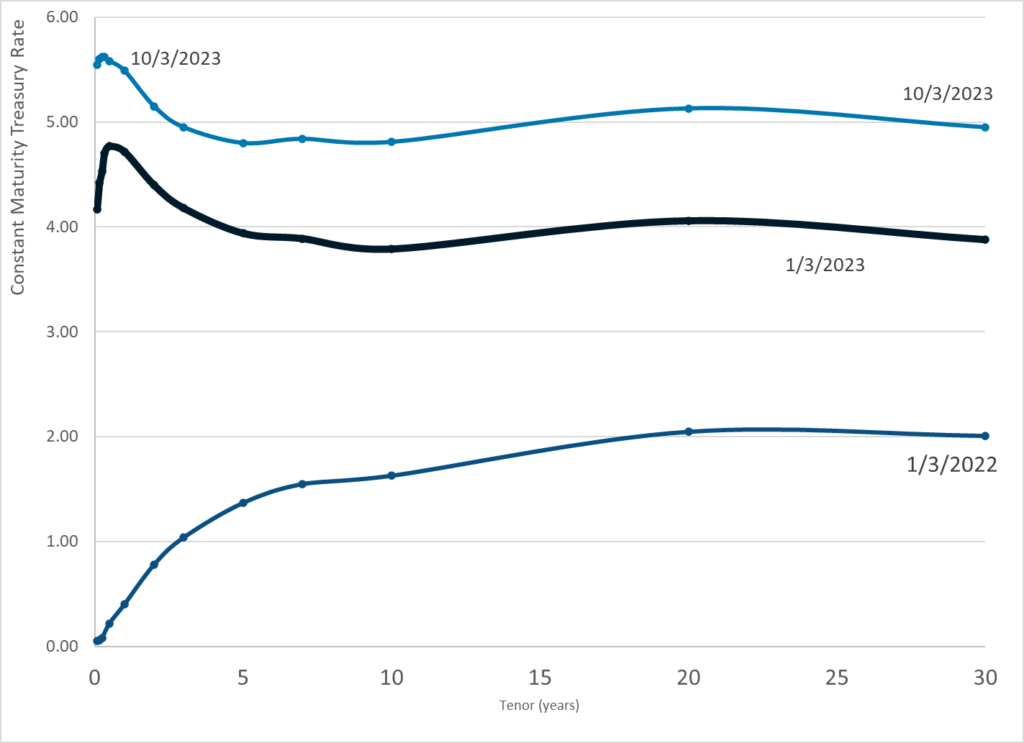

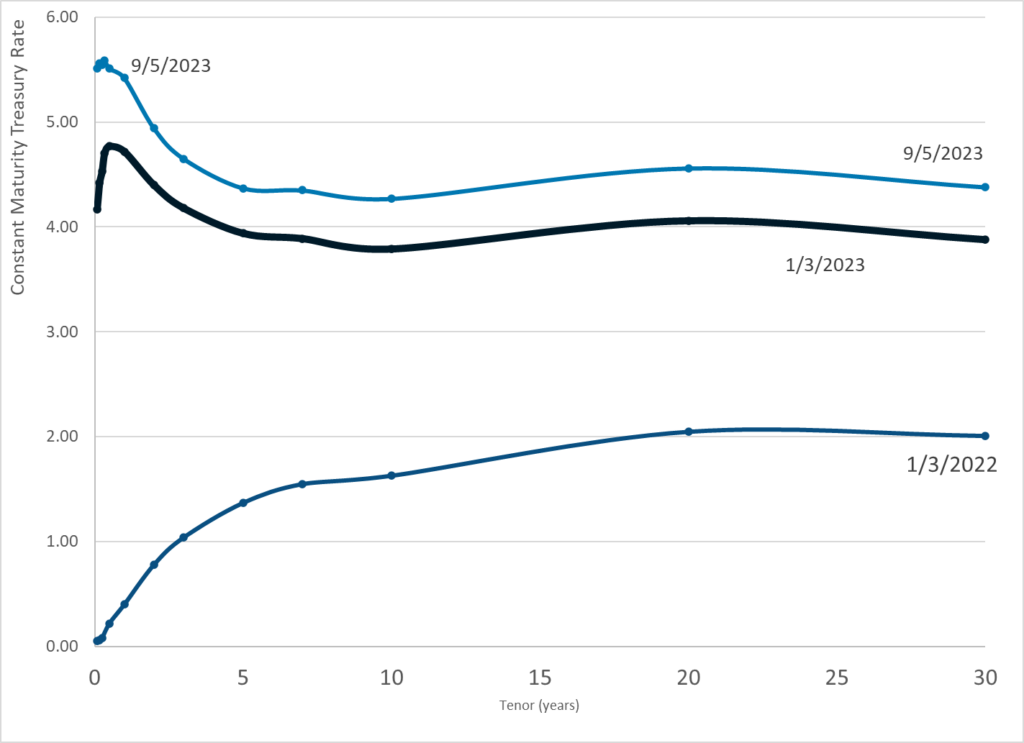

Graphic:

Publication Date: 3 Oct 2023

Publication Site: Treasury Dept

All about risk

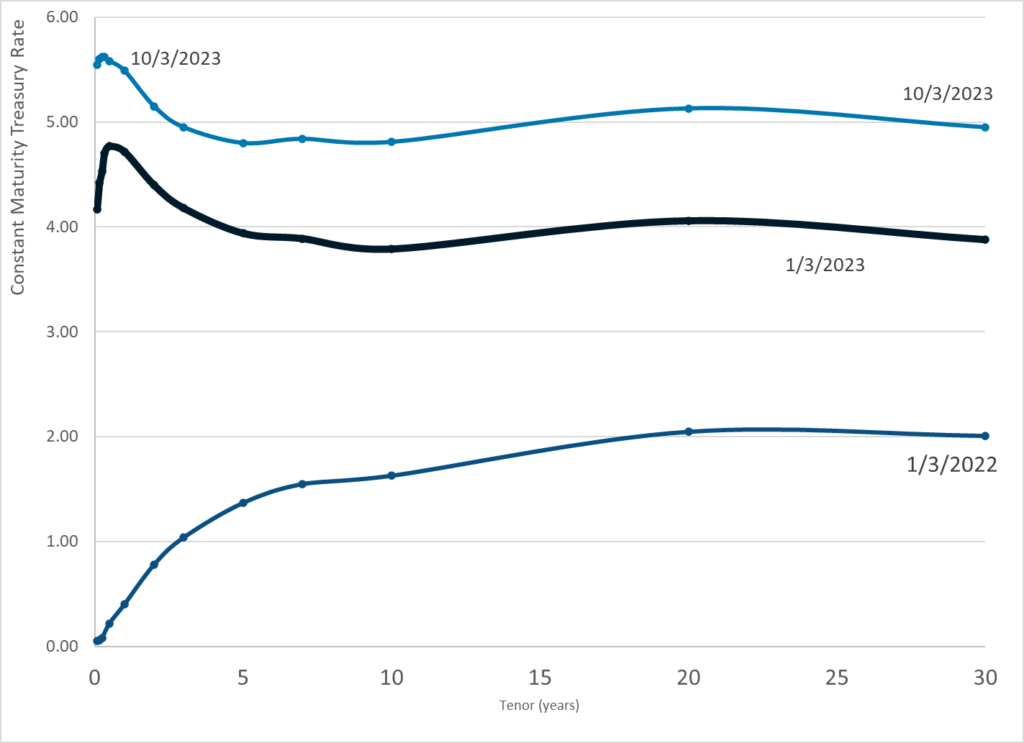

Graphic:

Publication Date: 3 Oct 2023

Publication Site: Treasury Dept

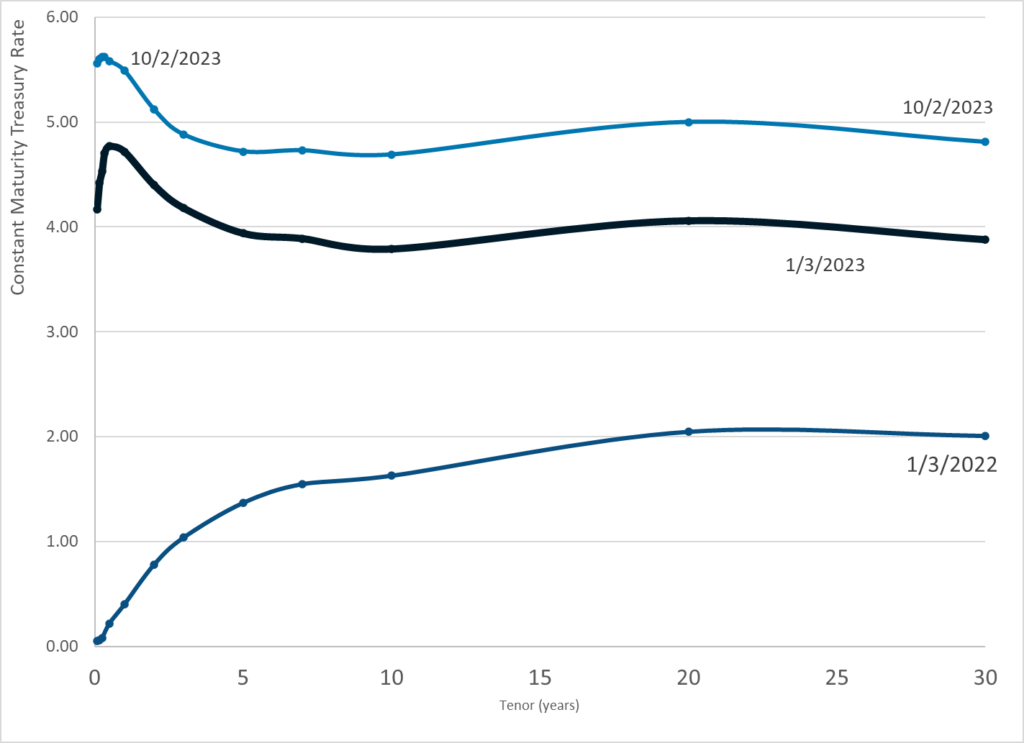

Graphic:

Publication Date: 2 Oct 2023

Publication Site: Treasury Department

Link: https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202309

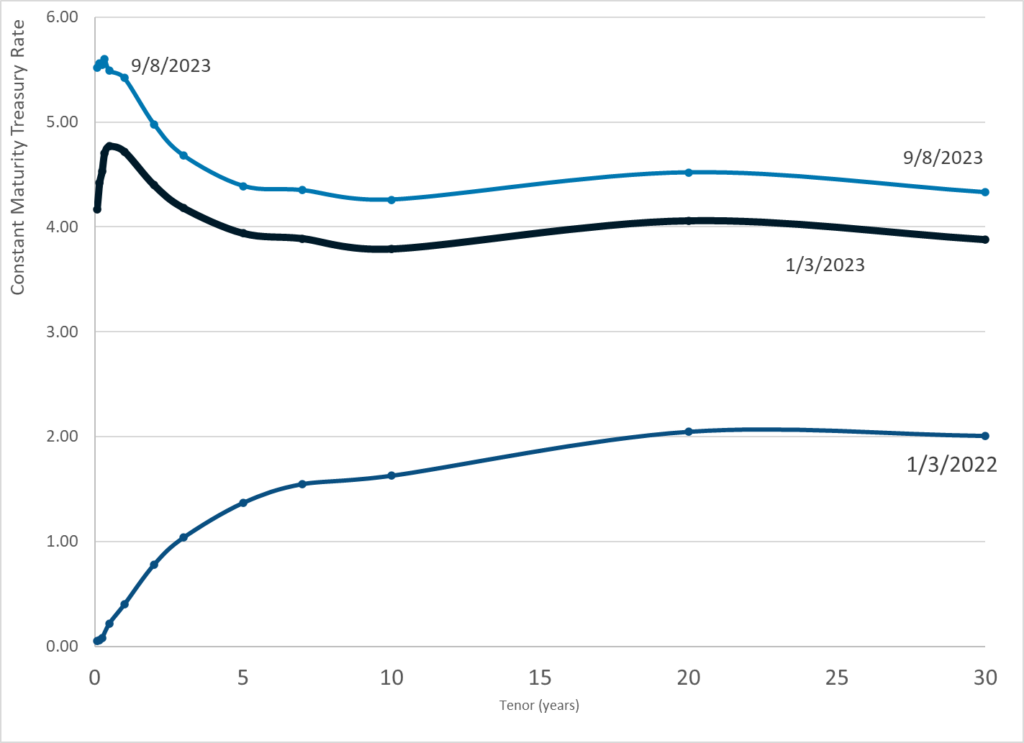

Graphic:

Publication Date: 20 Sept 2023

Publication Site: Dept of Treasury

Graphic:

Publication Date: 19 Sept 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 13 Sept 2023

Publication Site: Treasury Dept

Link: https://www.washingtonpost.com/investigations/2023/09/12/us-overdose-deaths-opioid-crisis/

Excerpt:

The number of prescription opioid pain pills shipped in the United States plummeted nearly 45 percent between 2011 and 2019, new federal data shows, even as fatal overdoses rose to record levels as users increasingly used heroin, and then illegal fentanyl.

The data confirms what’s long been known about the arc of the nation’s addiction crisis: Users first got hooked by pain pills saturating the nation, then turned to cheaper and more readily available street drugs after law enforcement crackdowns, public outcry and changes in how the medical community views prescribing opioids to treat pain.

The drug industry transaction data, collected by the Drug Enforcement Administration and released Tuesday by attorneys involved in the massive litigation against opioid industry players, reveals that the number of prescription hydrocodone and oxycodone pills peaked in 2011 at 12.8 billion pills, and dropped to fewer than 7.1 billion by 2019. Shipments of potent 80-milligram oxycodone pills dropped 92 percent in 2019 from their peak a decade earlier.

Many of the counties with the highest fentanyl death rates — in hard-hit states such as West Virginia, Kentucky and Ohio — started out with alarmingly high doses of prescription pills per capita, according to a Washington Post analysis of the DEA data and federal death records.

Counties with the highest average doses of legal pain pills per person from 2006 to 2013 suffered the highest death rates in the nation over the subsequent six years.

….

Annual overall overdose deaths reached a grim milestone in 2021, surpassing 100,000 for the first time in U.S. history. More than 110,000 people died of drug overdoses in 2022, two-thirds of whom succumbed to synthetic opioids such as fentanyl, according to estimates by the Centers for Disease Control and Prevention.

Author(s): Rich, Steven; Ovalle, David

Publication Date: 12 Sep 2023

Publication Site: Washington Post

Graphic:

Publication Date: 8 Sept 2023

Publication Site: Department of Treasury

Graphic:

Publication Date: 5 Sept 2023

Publication Site: Treasury Dept

Link: https://www.osha.gov/fatalities

Archive data: https://www.osha.gov/fatalities/reports/archive

Excerpt:

This page provides data on work-related fatalities that occurred under Federal OSHA and State Plan jurisdiction for cases that have been closed or citations issued on or after January 1, 2017.

Employers must report worker fatalities to OSHA within eight hours. OSHA investigates all work-related fatalities in all covered workplaces. The agency has up to six months to complete an investigation and determine whether citations will be issued.

The table below can be modified or searched by inserting additional information in the boxes above each column.

COVID-19-related fatalities are provided in the “COVID-19” tab below, and are not included in the CY 2017-22 list.

Publication Date: accessed 5 Sep 2023

Publication Site: OSHA, Department of Labor

Excerpt:

The Oregon Public Employee Retirement System (PERS) pension fund has been in the national spotlight recently because of risks from private investments hidden from the public. What risks? Risk to public employees’ retirement, risk to taxpayers who have to pick up the shortfall, risk to workers as private equity asset managers rake in huge profits at Oregonians’ expense, risk to all Oregonians as private equity undermines our communities, and risk to the climate as private equity firms are uniquely exposed to fossil fuel companies.

A recent article in the business section of The New York Times, “The Risks Hidden in Public Pension Funds,” focuses on the Oregon treasury’s unusually large private investments in PERS. The treasury has long hailed its private equity investments for producing high rates of return, overlooking warning signs that the managers report earnings that turn out to be overstated. The Times reported, “they aren’t taking account of the true risks embedded in private equity. Oregon’s pension fund is over 40% more volatile than its own reported statistics show.”

…..

Divest Oregon’s 2022 report, “Oregon Treasury’s Private Investment Transparency Problem,” documents that more than 50% of PERS is in private investments, with various labels (“private equity,” “alternatives,” “opportunity,” even real estate).

These private funds are heavily invested in coal, oil and gas. The treasury increased its investments in fossil fuels in private investments from 2021 to 2022 (the most recent data released by the state) and continues to invest billions in the fossil fuel industry in 2023, for example in the private investment firm GNP. While Divest Oregon applauds Treasurer Tobias Read in his work to create a “decarbonization plan” for PERS, the treasurer must respond to calls to stop new private investments that fund the climate crisis.

Author(s): State Sen. Jeff Golden and state Reps. Khanh Pham and Mark Gamba

Publication Date: 29 Aug 2023

Publication Site: Portland Tribune

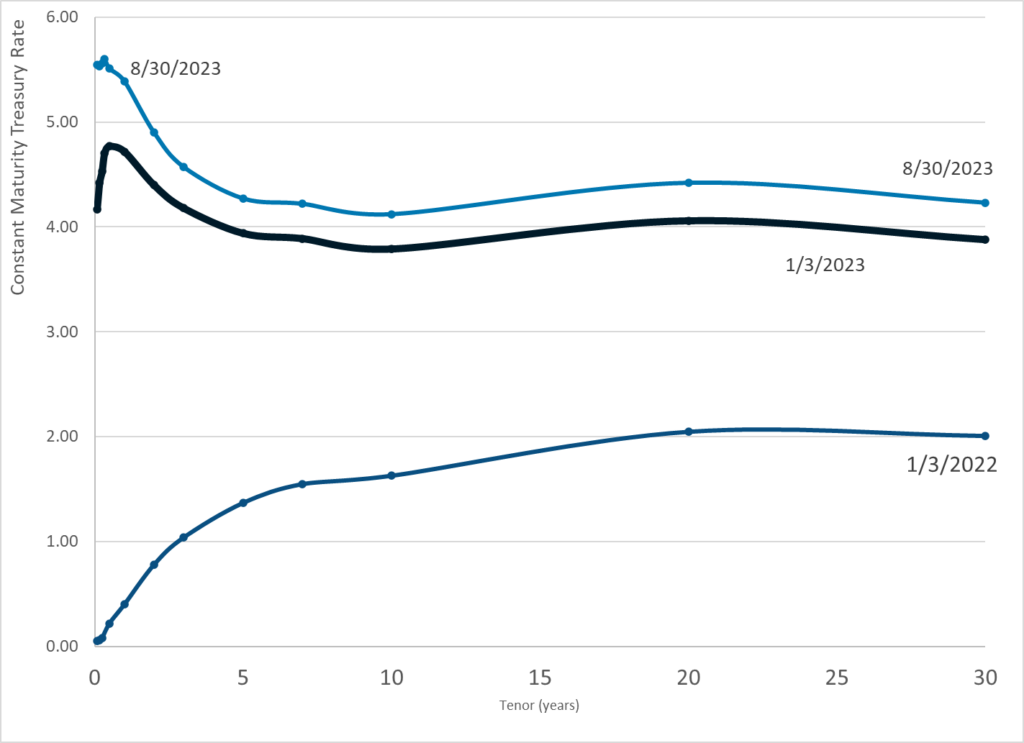

Graphic:

Publication Date: 30 Aug 2023

Publication Site: Treasury Department

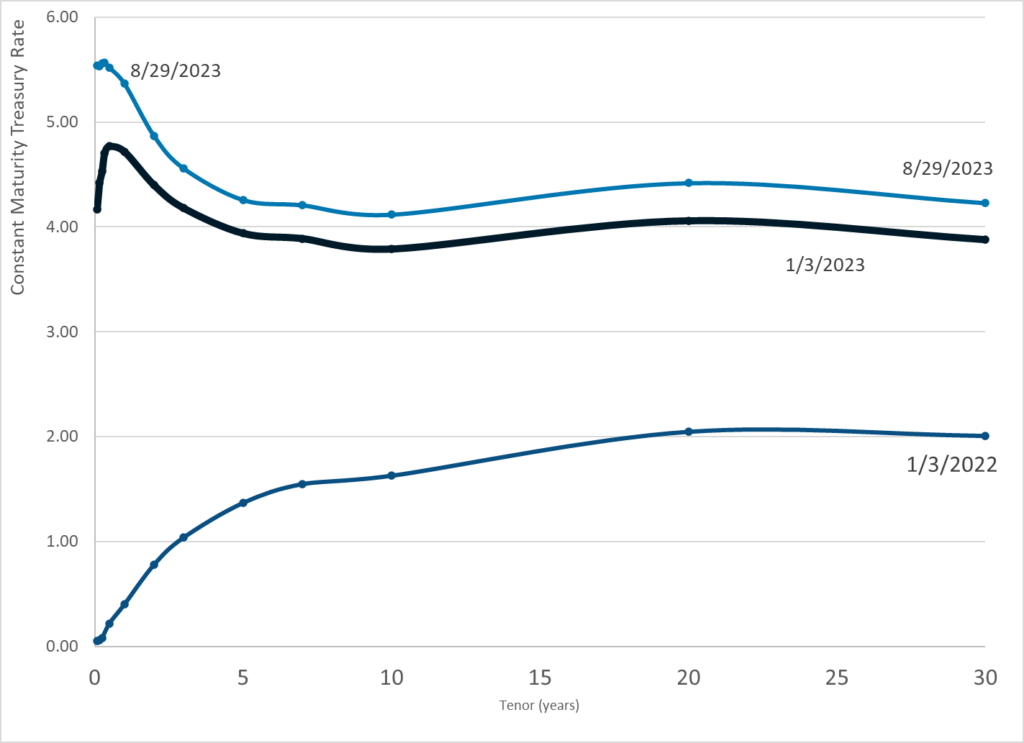

Graphic:

Publication Date: 29 Aug 2023

Publication Site: Dept of Treasury