Graphic:

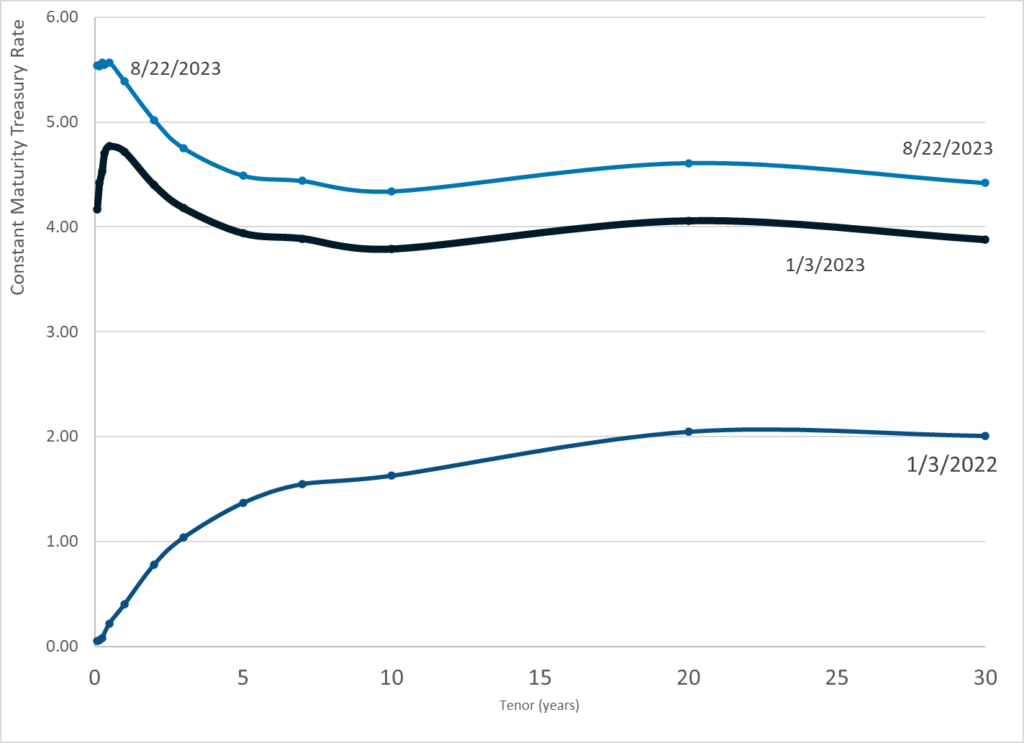

Publication Date: 22 Aug 2023

Publication Site: Treasury Dept

All about risk

Graphic:

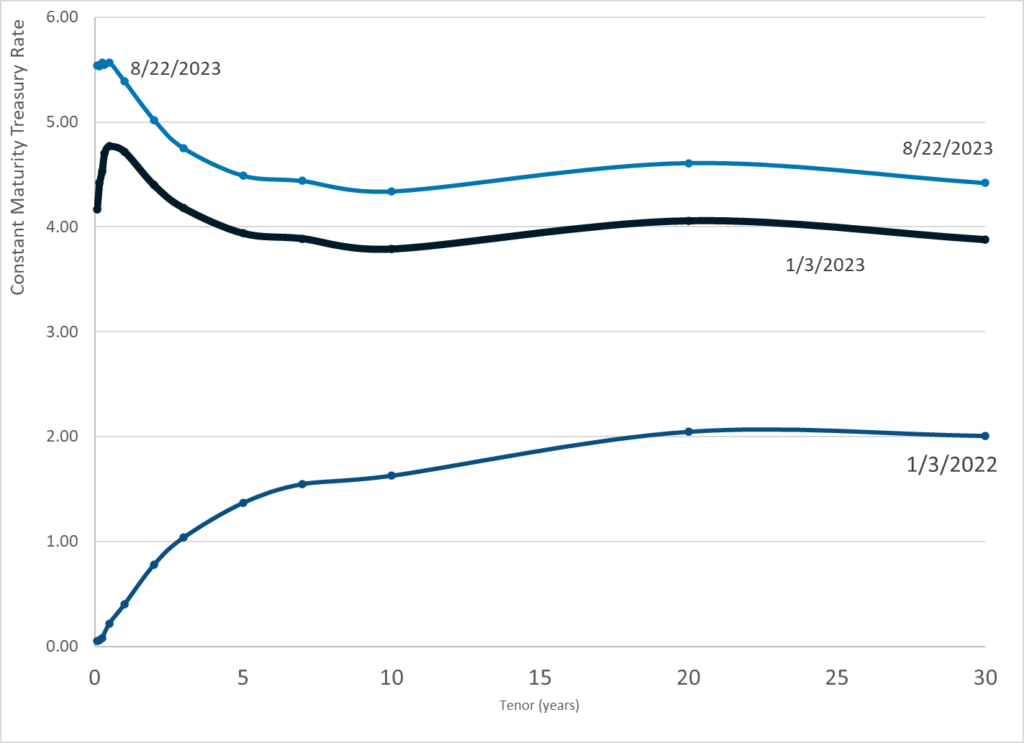

Publication Date: 22 Aug 2023

Publication Site: Treasury Dept

Graphic:

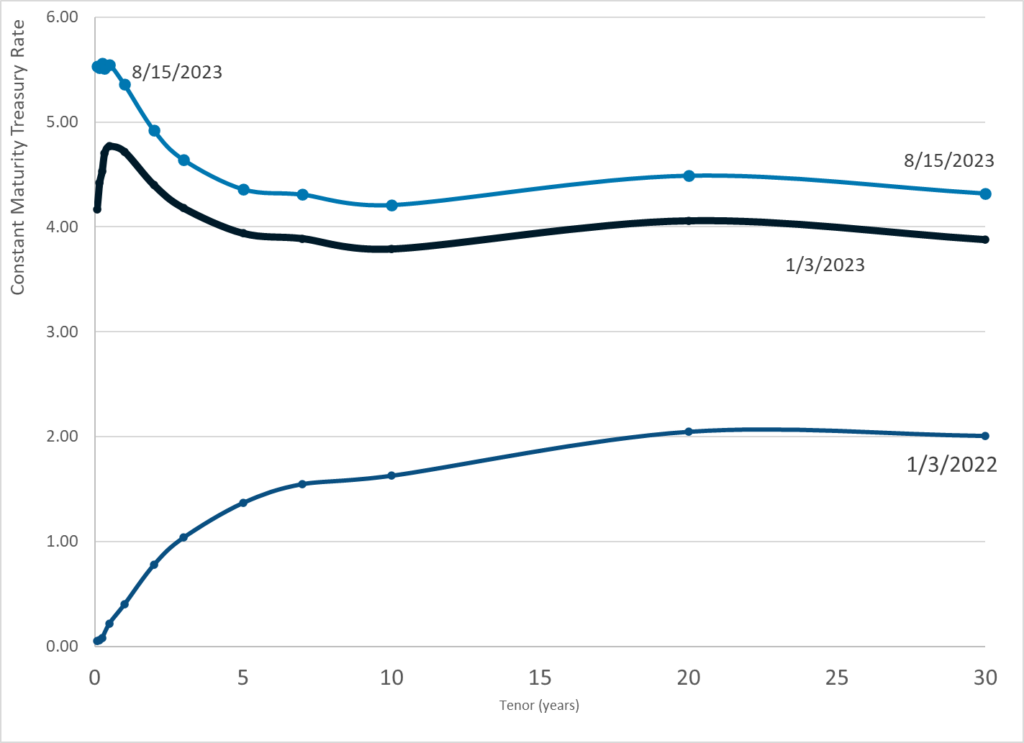

Publication Date: 15 Aug 2023

Publication Site: Treasury Department

Graphic:

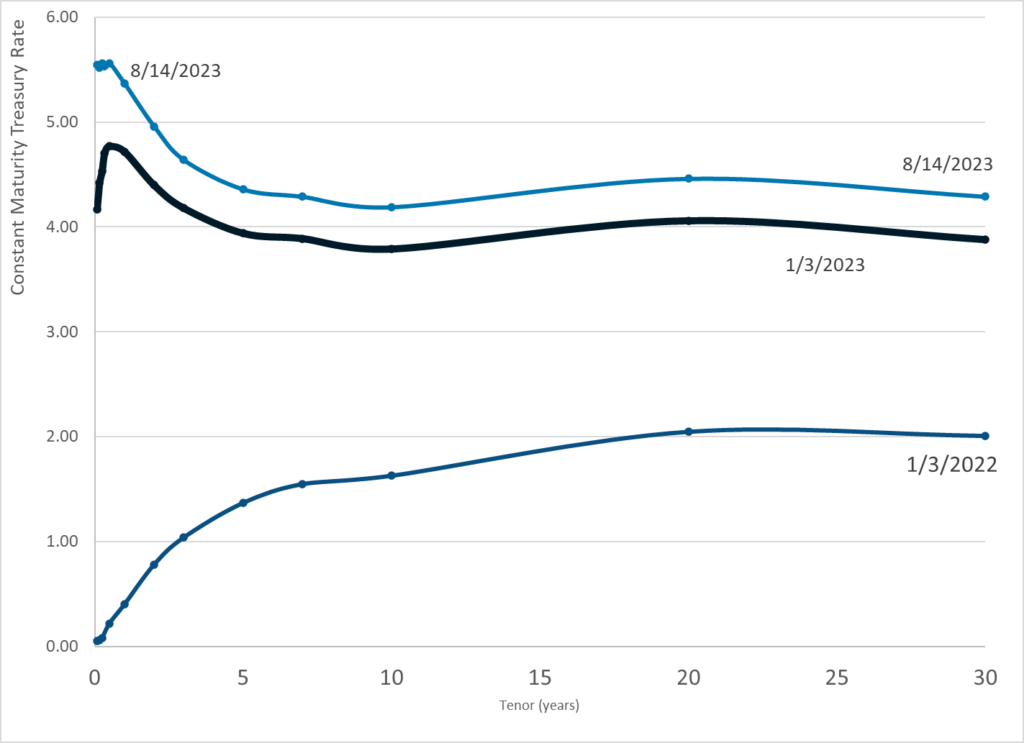

Publication Date: 14 Aug 2023

Publication Site: Treasury Dept

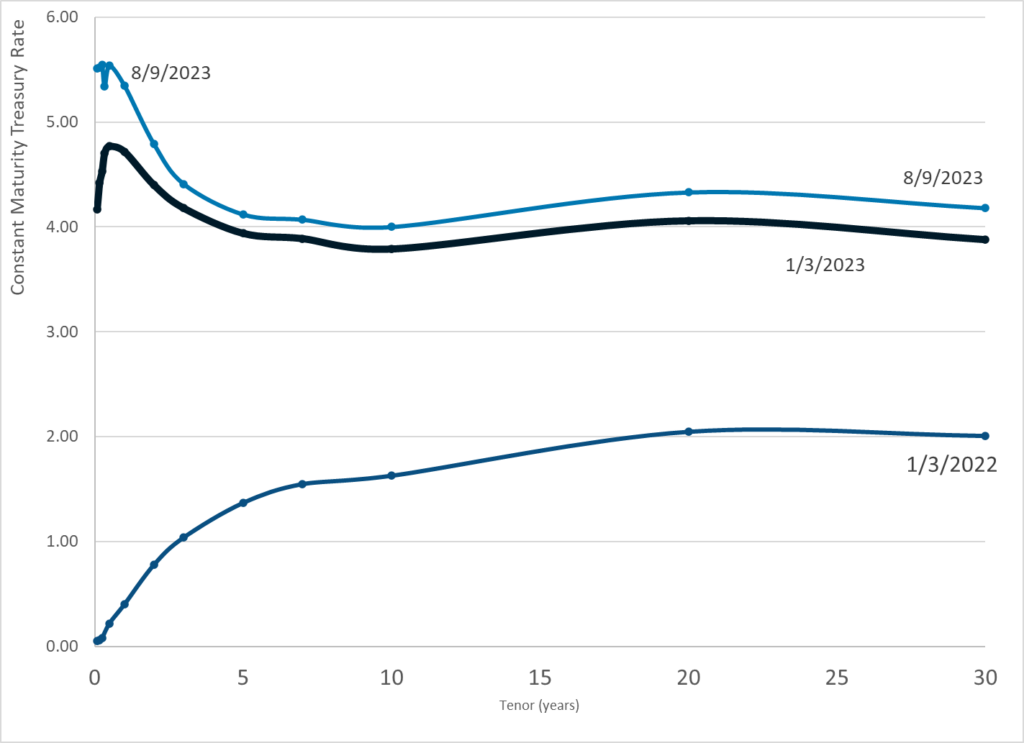

Graphic:

Publication Date: 9 Aug 2023

Publication Site: Treasury Dept

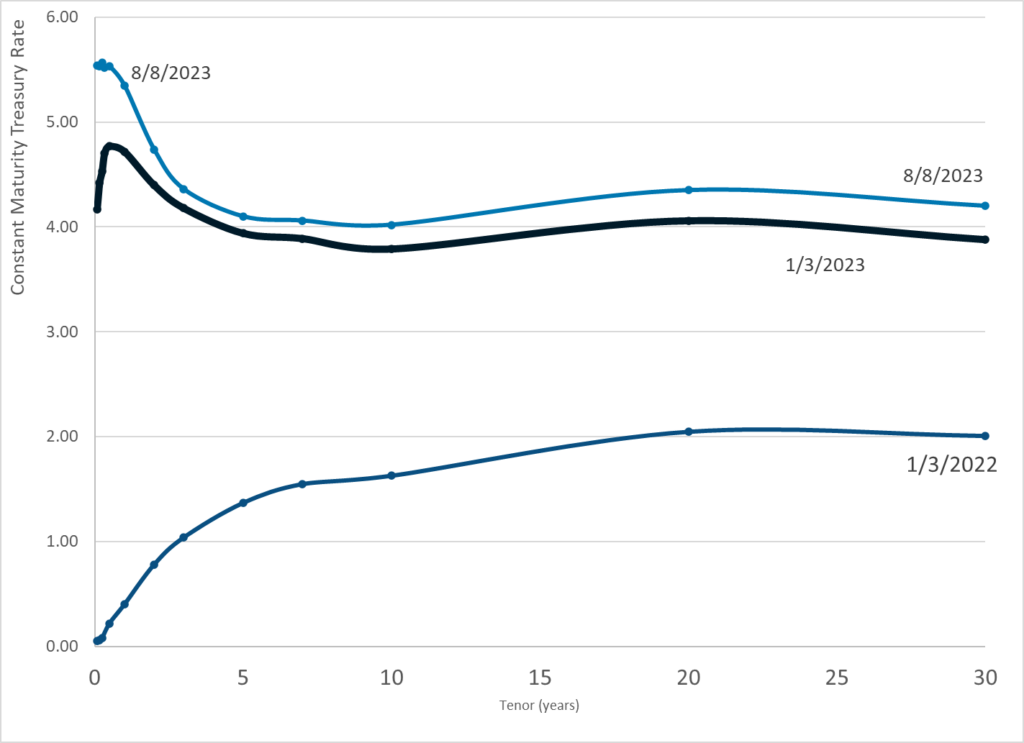

Graphic:

Publication Date: 8 Aug 2023

Publication Site: Treasury Department

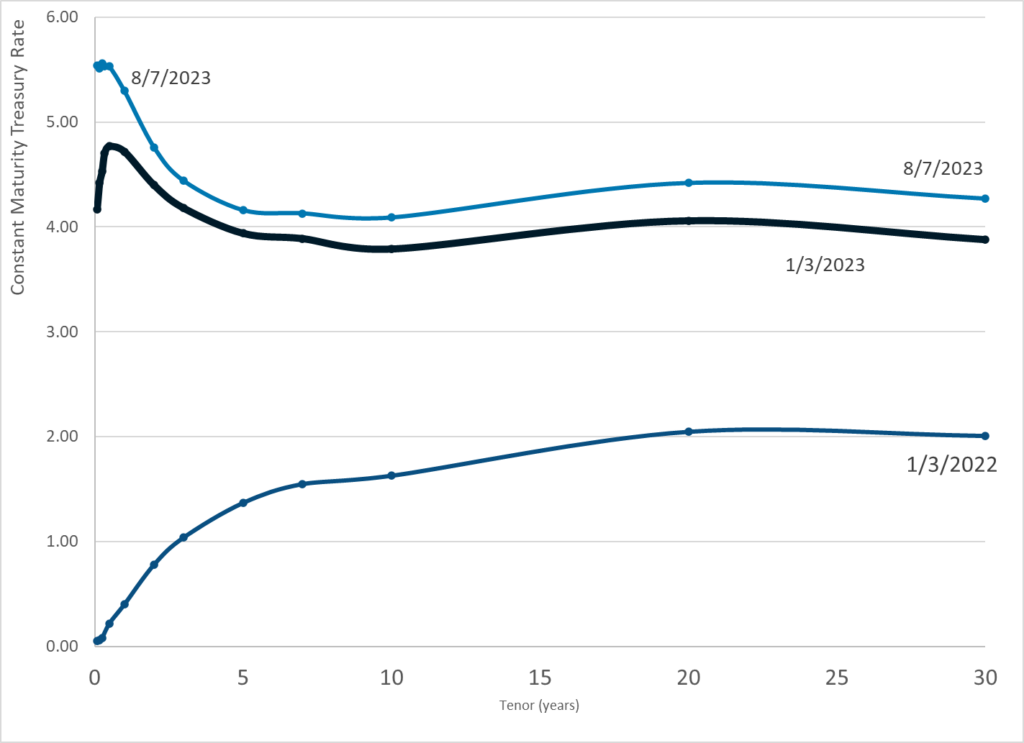

Graphic:

Publication Date: 7 Aug 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 4Aug 2023

Publication Site: Treasury Dept

Graphic:

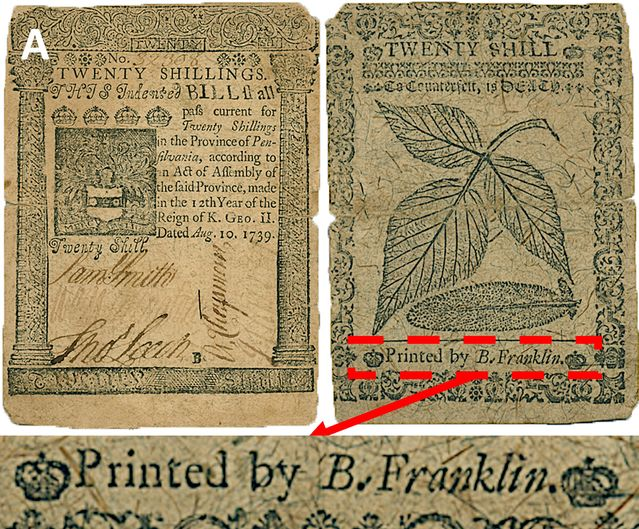

Excerpt:

Franklin, who was a printer, among his other roles, was known for marking his early paper money with images of intricately veined leaves that were nearly impossible for counterfeiters to copy, using a variety of fonts, some available only to him, and intentionally lacing the text with misspellings.

But scientists say Franklin took things a step further to stave off fraudsters. Other distinguishing characteristics of Franklin’s money—the new research revealed through advanced atomic-level imaging methods—were more subtle. He used a unique black ink. His paper glimmered. Blue threads decorated the surface, and finer fibers were woven throughout.

Researchers detailed the innovations in a paper published Monday in the journal Proceedings of the National Academy of Sciences. The findings describe previously unknown methods Franklin developed to safeguard printed money notes against counterfeiting.

Author(s): Jo Craven McGinty

Publication Date: 17 July 2023

Publication Site: WSJ

Graphic:

Excerpt:

Everyone knows, or at least should know, that the “Big 3” rating agencies that rate about 98 percent of all debt all issue trash ratings. Here’s the background on how that happened.

Rating agencies used to get paid by investors on the basis of how well they did at estimating the likelihood of default. The better your ratings, the more sought out your opinions.

In the mid 1970s, the SEC created nationally recognized statistical ratings organizations (NRSROs). Following that idiotic regulation, the rating agencies got paid on the basis of how much debt they rated, not how accurate their ratings were. Fees come from corporations issuing debt, not investors seeking true default risk.

The more stuff you rate AAA, the more business you get from companies who want their debt rated. The new model is ass backward, and why ratings are trash. A genuine fiasco happened with ratings during the Great Financial Crisis with tons of garbage rated AAA went to zero.

There should not be NRSROs. The SEC made matters much worse, except of course for the Big 3 who have a a captured, mandated audience, coupled with massive conflicts of interest.

Author(s): Mike Shedlock

Publication Date: 5 Aug 2023

Publication Site: Mish Talk

Graphic:

Publication Date: 3 Aug 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 2 Aug 2023

Publication Site: Treasury Department

Excerpt:

Attention #actuaries: with voting underway for the #ifoa Council elections, I share in this short video some thoughts and concerns about the Institute and Faculty of Actuaries. I touch on current problems, what I learned from my time with the Continuous Mortality Investigation and the COVID-19 Actuaries Response Group, and I stumble into the elephant in the room – the recent media coverage of the IFoA (with implications of procedural subterfuge).

Whoever you decide to vote for, please do take the time to engage with the election process, consider what each candidate can contribute to move the profession forwards, and whether you want an active council or a passive council: make your vote count for the sake of your profession.

Author(s): Matthew Edwards

Publication Date: 26 July 2023

Publication Site: LinkedIn