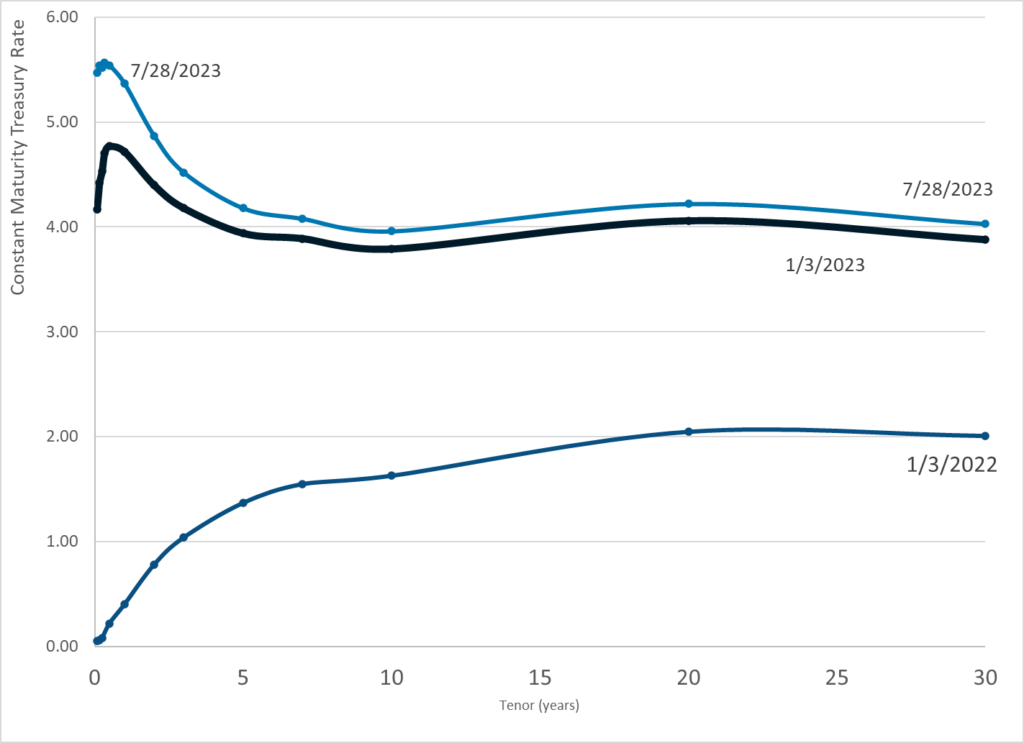

Graphic:

Publication Date: 28 July 2023

Publication Site: Treasury Dept

All about risk

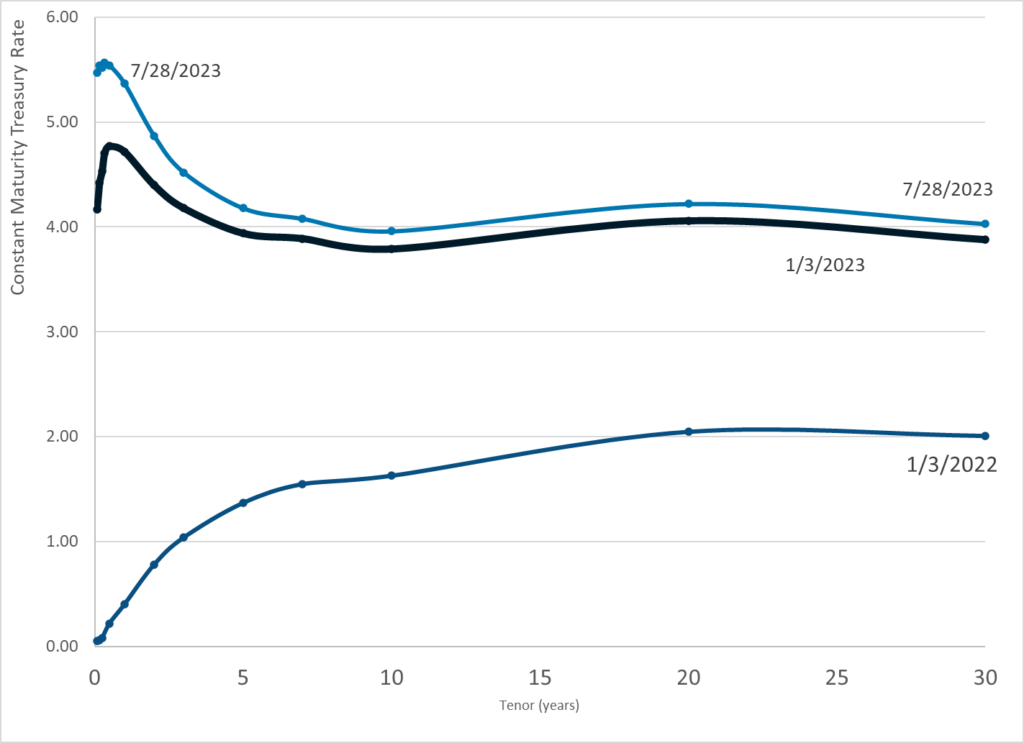

Graphic:

Publication Date: 28 July 2023

Publication Site: Treasury Dept

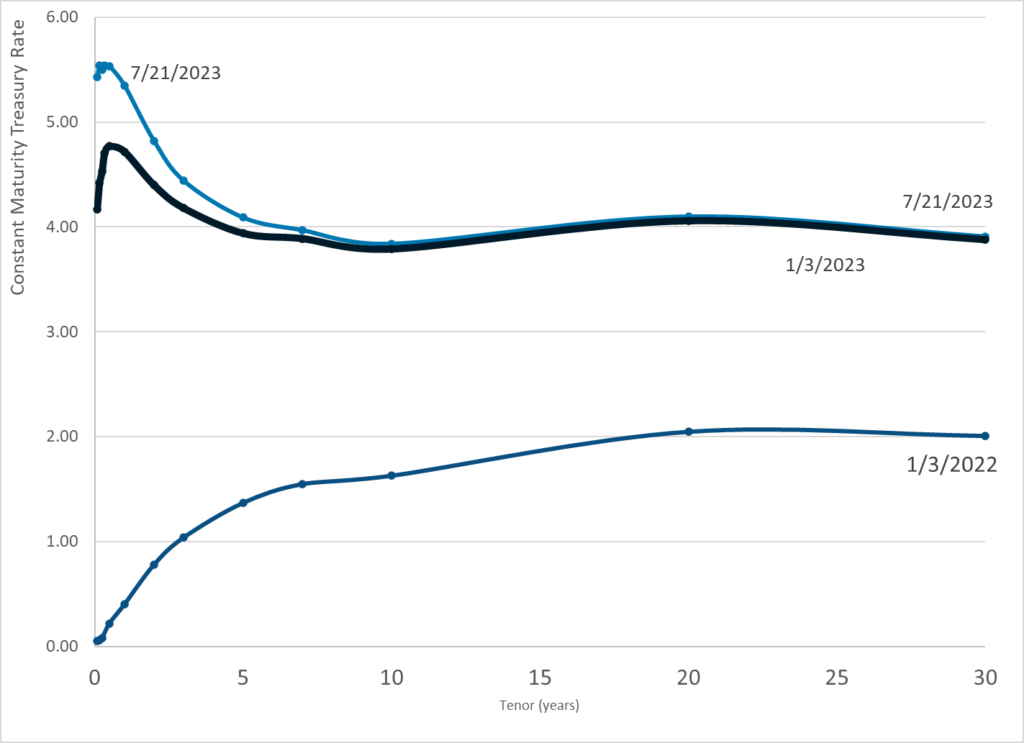

Graphic:

Publication Date: 27 July 2023

Publication Site: Treasury Dept

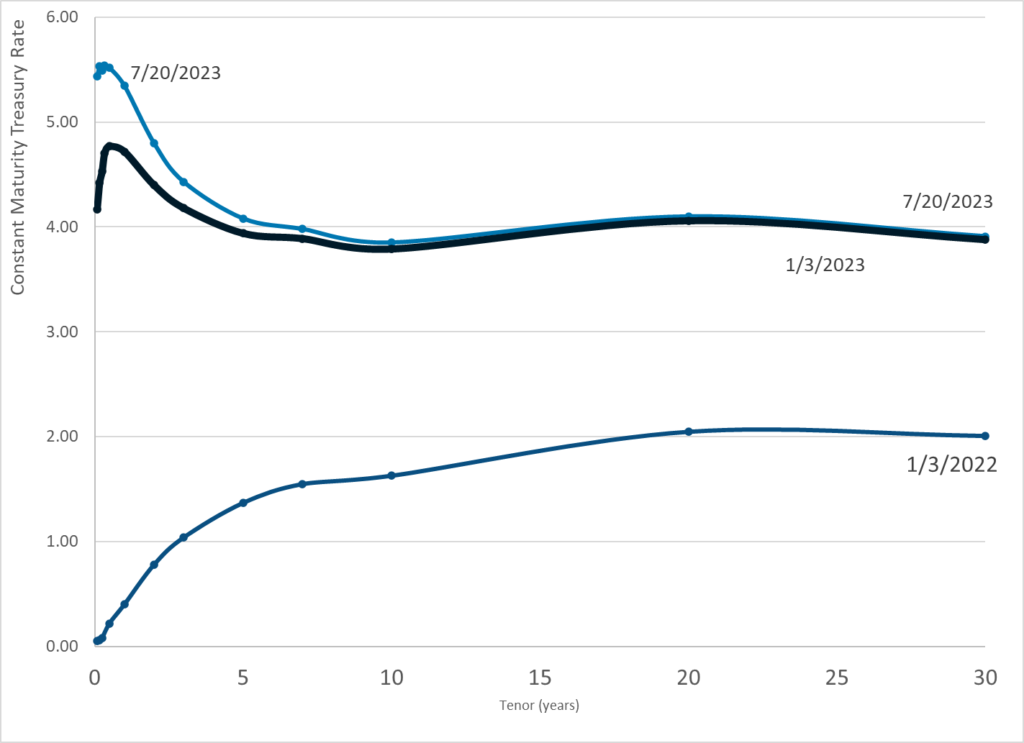

Graphic:

Publication Date: 21 July 2023

Publication Site: Treasury Dept

Executive Summary:

Fiduciaries are people responsible for managing money on behalf of others. The fundamental fiduciary duty of loyalty evolved over centuries, and in the context of pension plans sponsored by state and local governments (“public pension plans”) requires investing solely in plan members’ and taxpayers’ best interests for the exclusive purpose of providing pension benefits and defraying reasonable expenses. This duty is based on the notion that investing and spending money on behalf of others comes with a responsibility to act with an undivided loyalty to those for whom the money was set aside.

But the approximately $4 trillion in the trusts of public pension plans may tempt public officials and others who wish to promote—or, alternatively, punish those who promote— high-profile causes. For example, in recent years, government officials in both California and Texas, political polar opposites, have acted to undermine the fiduciary principle of loyalty. California Gov. Gavin Newsom’s Executive Order N-19-19 describes its goal “to leverage the pension portfolio to advance climate leadership,” and a 2021 Texas law prohibits investing with companies that “boycott” energy companies to send “a strong message to both Washington and Wall Street that if you boycott Texas Energy, then Texas will boycott you.” Both actions and others like them, attempt to use pension assets for purposes other than to provide pension benefits, violating the fundamental fiduciary principle of loyalty.

The misuse of pension money in the public and private sectors has a long history. The Employee Retirement Income Security Act (ERISA), signed into law by President Gerald Ford in 1974, codified fiduciary principles for U.S. private sector retirement plans nearly 50 years ago and is used as a prototype for pension fiduciary rules in state law and elsewhere. Dueling sets of ERISA regulations issued within a two-year period during the Trump and Biden administrations consistently reinforced the principle of loyalty. State legislation and executive actions, however, have weakened and undermined it, even where it is codified elsewhere in state law.

Thirty million plan members rely on public pension funds for financial security in their old age. The promises to plan members represent an enormous financial obligation of the taxpayers in the states and municipalities that sponsor these plans. If investment returns fall short of a plan’s goals, then taxpayers and future employees will be obligated to make up the difference through higher contribution rates.

The exclusive purpose of pension funds is to provide pension benefits. Using pension funds to further nonfinancial goals is not consistent with that purpose, even if it happens to be a byproduct. This basic understanding has been lost in the recent politically polarized public debates around ESG investing—investing that takes into account environmental, social, and governance factors and not just financial considerations.

It is critically important that fiduciary principles be reaffirmed and strengthened in public pension plans. The potential cost of not doing so to taxpayers, who are ultimately responsible for making good on public pension promises, runs into trillions of dollars. Getting on track will likely require a combination of ensuring the qualifications of plan fiduciaries responsible for investing, holding fiduciaries accountable for acting in accordance with fiduciary principles, limiting the ability of nonfiduciaries to undermine and interfere with fiduciaries, and separating the fiduciary function of investment management from settlor functions like setting funding policy and determining benefit levels.

Author(s): Larry Pollack

Publication Date: 11 May 2023

Publication Site: Reason

Graphic:

Publication Date: 20 July 2023

Publication Site: Treasury Dept

Excerpt:

State Comptroller Thomas P. DiNapoli, United States Attorney for the Northern District of Georgia Ryan K. Buchanan and Inspector General for the Social Security Administration Gail S. Ennis today announced that Sandra Smith, a resident of Georgia, has pleaded guilty to the federal crime of theft of government funds and must pay back $459,050 in New York state pension and Social Security payments that were issued to her deceased mother-in-law.

“Exploiting the death of a family member for personal profit is a heinous crime,” DiNapoli said. “The defendant took advantage of our state pension fund and the Social Security Administration but as a result of our joint investigation her crimes were discovered. She now faces the consequences of her actions. My thanks to U.S. Attorney Buchanan and the Social Security Administration Office of the Inspector General for their partnership in ensuring justice was served and restitution was made in this case.”

Smith pleaded guilty to two counts of theft of government funds. Under her plea agreement, she will pay $264,699 in restitution to the state pension system and $194,351 to the SSA.

The defendant’s late-mother-in-law, Minnie Smith, was an employee of the New York State Insurance Fund for 20 years until retiring in 2005. To be closer to family, she moved from Brooklyn to Georgia afterward and passed away there on Sept. 14, 2006.

As her mother-in-law’s caretaker, Sandra Smith had access to her bank account, which she kept open after her mother-in-law’s death to enable the theft of continued payments from the New York state pension system and Social Security. The thefts were discovered and investigated by the Comptroller’s Division of Investigations and the SSA-OIG.

Smith, 49, pleaded before Judge Eleanor Ross of the United States District Court for the Northern District of Georgia.

Author(s): press release

Publication Date: 11 July 2023

Publication Site: Office of the NY State Comptroller

Graphic:

Publication Date: 17 July 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 14 July 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

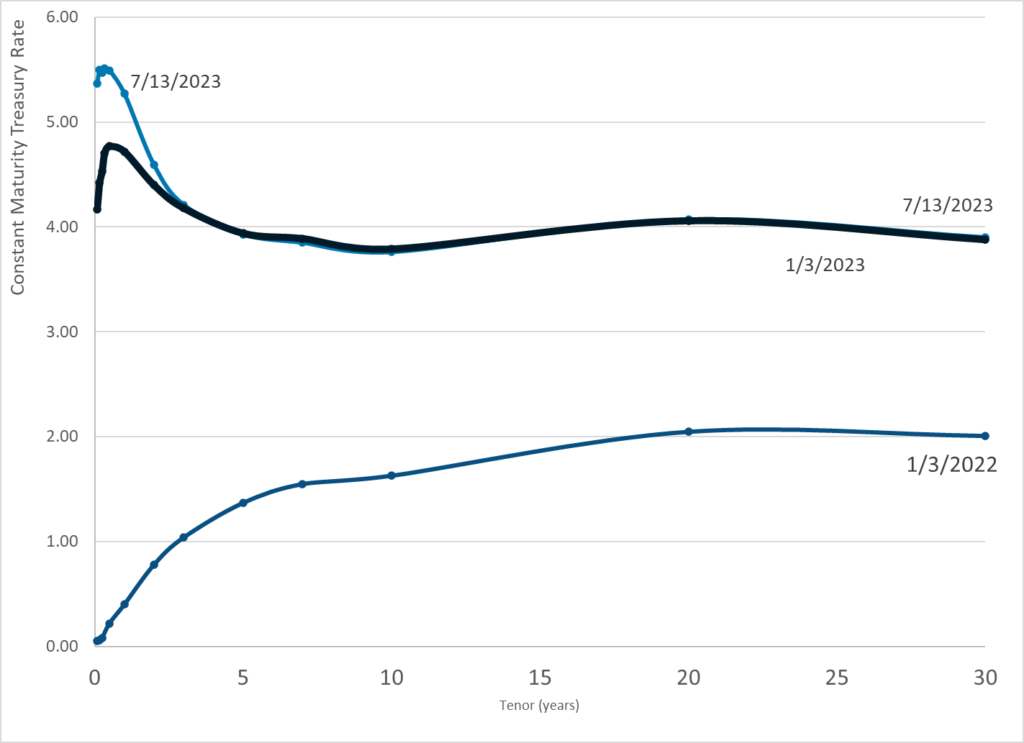

Two things on the Fed’s mind are the core rate of inflation (all items excluding food and energy) and rent. Both have proven stubborn.

Despite constant talk of falling rent prices please note that Rent of primary residence has gone up at least 0.4 percent, every month for 23 straight months!

The falling rent meme has been wrong for at least a full year.

Author(s): Mike Shedlock

Publication Date: 12 July 2023

Publication Site: Mish Talk

Graphic:

Publication Date: 13 July 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 12 July 2023

Publication Site: Treasury Department

Link: https://www.bloomberg.com/opinion/articles/2023-07-12/it-s-easy-to-make-oil-companies-esg#xj4y7vzkg

Excerpt:

You can do this with anything! Absolutely anything:

- Horrible Coal Inc. wants to raise money.

- It sets up a special purpose vehicle, Hypertechnical Investments Ltd.

- Horrible Coal issues bonds to Hypertechnical Investments.

- Hypertechnical issues its own bonds to ESG funds: “We are just a little old investment firm, just two traders and two computers, no carbon emissions here! And our credit is very good, because we have no other liabilities and our assets are all investment-grade bonds. ‘Which investment-grade bonds,’ did you ask? Sorry, I’m not sure I heard you right, you’re breaking up. Anyway we’ll look for your check, bye!”

Though my made-up names are silly, and in the actual Aramco case one of the not-an-oil-company SPVs is named “GreenSaif Pipelines Bidco.” “Pipelines” is right in the name! The only way you would think that GreenSaif Pipelines Bidco “had no direct links to the fossil-fuel industry” is if (1) you started reading the name but stopped after you got to the “Green” part (plausible!) or (2) you never read the name at all, never thought about it, just looked at the balance sheet and saw only shares of stock, not pipelines or oil wells, and said “ah, stock, well, that’s green enough.”

Author(s): Matt Levine

Publication Date: 12 July 2023

Publication Site: Money Stuff at Bloomberg