Graphic:

Excerpt:

More than $50 billion in settlement funds is being delivered to thousands of state and local governments from companies accused of flooding their communities with opioid painkillers that have left millions addicted or dead.

….

Most of the settlements stipulate that states must spend at least 85% of the money they will receive over the next 15 years on addiction treatment and prevention. But defining those concepts depends on stakeholders’ views — and state politics. To some, it might mean opening more treatment sites. To others, buying police cruisers.

….

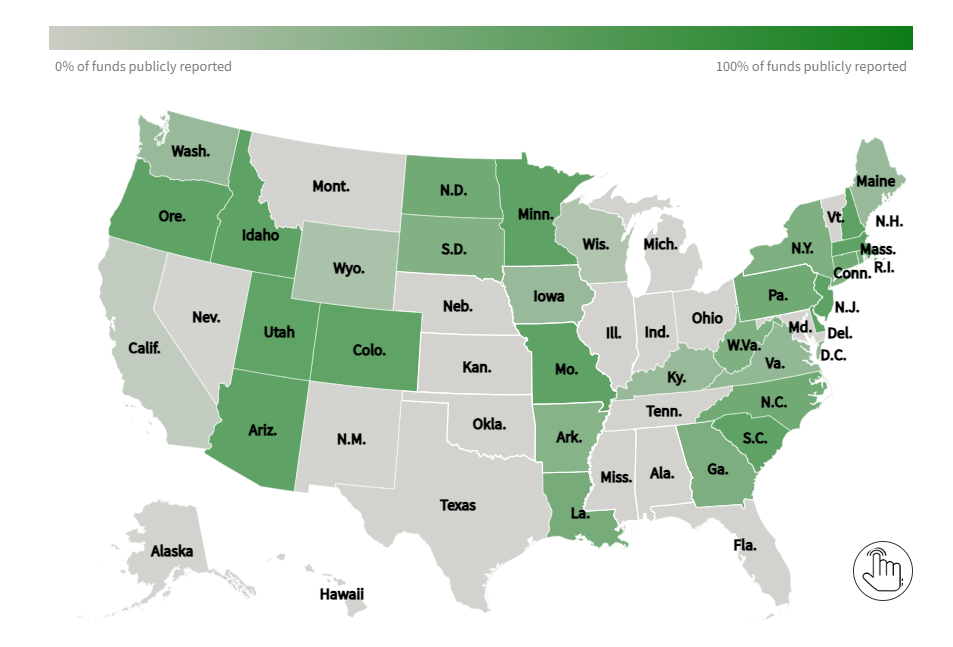

What’s more, many states are not being transparent about where the funds are going and who will benefit. An investigation by KHN and Christine Minhee, founder of OpioidSettlementTracker.com, concluded only 12 states have committed to detailed public reporting of all their spending.

The analysis involved scouring hundreds of legal documents, laws, and public statements to determine how each state is divvying up its settlement money among state agencies, city and county governments, and councils that oversee dedicated trusts. The next step was to determine the level and detail of public reporting required. The finding: Few states promise to report in ways that are accessible to the average person, and many are silent on the issue of transparency altogether.

More than $3 billion has gone out to state and local governments so far. KHN will be following how that cash — and the billions set to arrive in coming years — is used.

Author(s): Aneri Pattani

Publication Date: 30 March 2023

Publication Site: Kaiser Health News