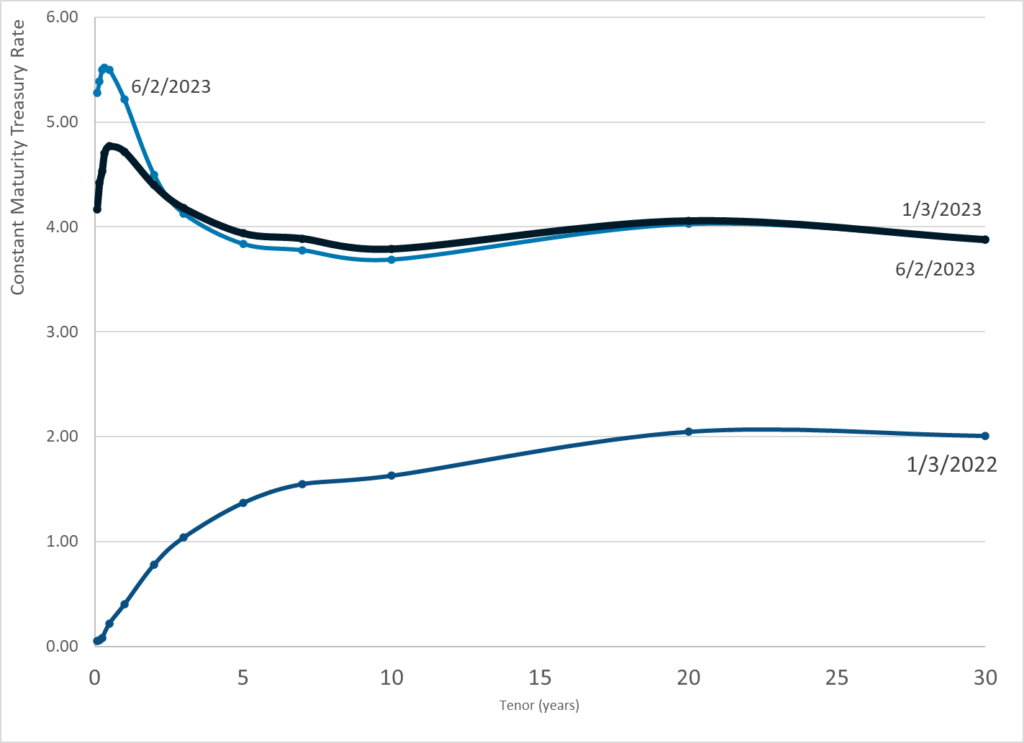

Graphic:

Publication Date: 2 June 2023

Publication Site: Treasury Dept

All about risk

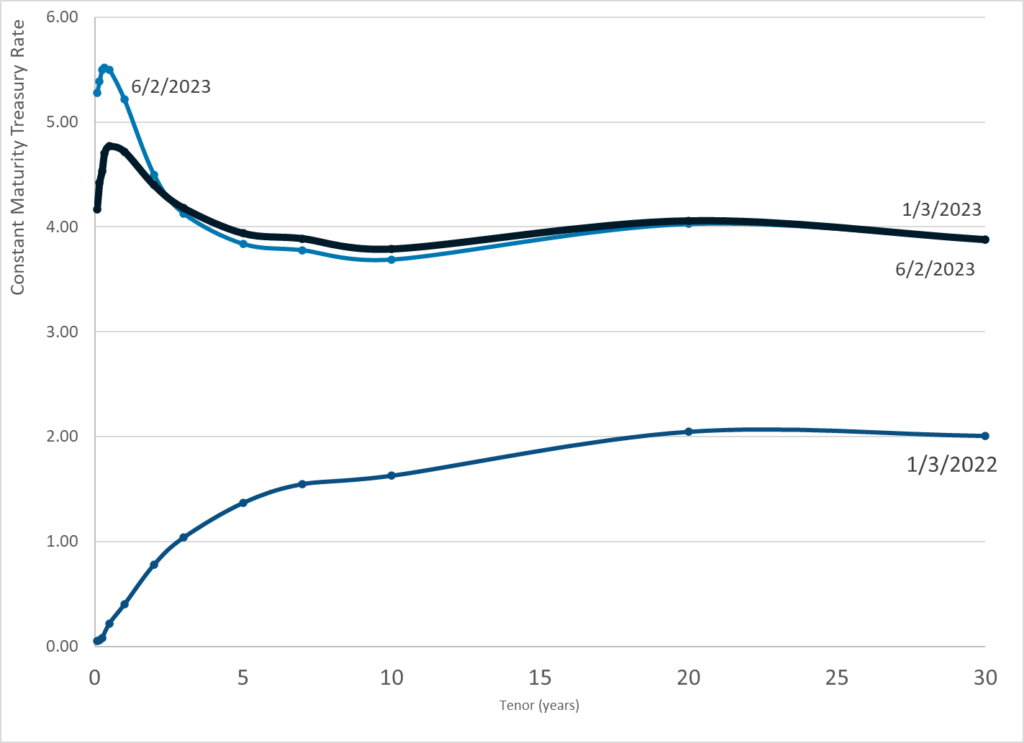

Graphic:

Publication Date: 2 June 2023

Publication Site: Treasury Dept

Excerpt:

I spoke to Rex Frazier, president of the Personal Insurance Federation of California, who cited several policies that no doubt contributed to State Farm’s decision to stop issuing policies, including various price controls that prevent insurers from raising prices to meet surging costs without the written approval of the California Department of Insurance.

“California is the only state in the country that doesn’t allow insurers’ rates to be based upon actual reinsurance costs,” Frazier said. “California’s regulations employ a legal fiction that each insurer uses its own capital to serve customers. As reinsurance costs go up, insurers cannot have their rates reflect those higher costs.”

Author(s): Jon Miltimore

Publication Date: 2 Jun 2023

Publication Site: Washington Examiner

Excerpt:

State Farm General Insurance Co. last week became the latest insurer to retreat from California’s homeowners market. The culprit isn’t climate change, as the media claims in parroting Sacramento talking points. The cause is the Golden State’s hostile insurance environment.

The nation’s top property and casualty insurer on Friday said it won’t accept new applications for homeowners insurance, citing “historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.”

In other words, State Farm can’t accurately price risk and increase its rates to cover ballooning liabilities. Other property and casualty insurers, including AIG and Chubb, have also been shrinking their California footprint after years of catastrophic wildfires, which are becoming more common owing to drought and decades of poor forest management.

Author(s): Editorial Board

Publication Date: 30 May 2023

Publication Site: Wall Street Journal

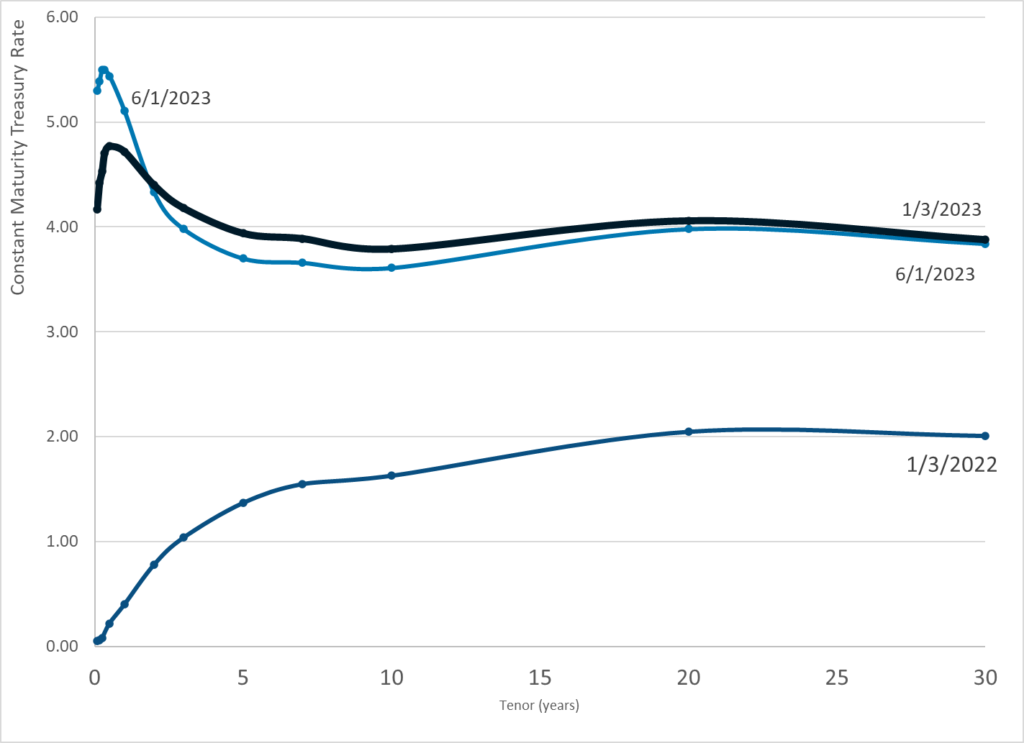

Graphic:

Publication Date: 1 Jun 2023

Publication Site: Treasury Dept

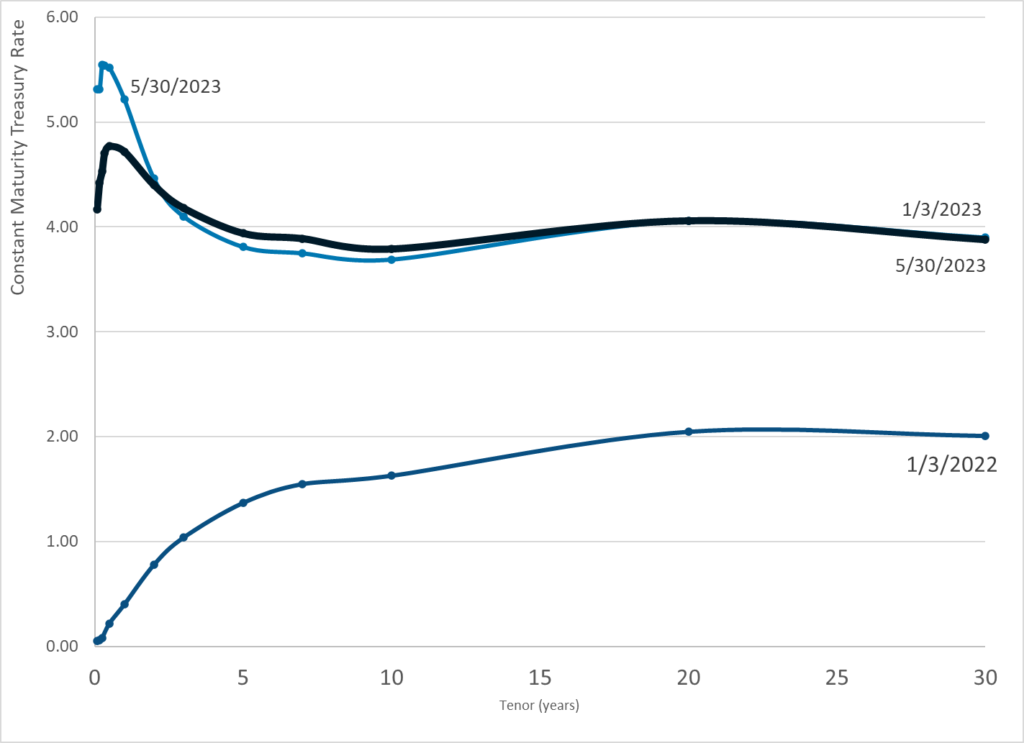

Graphic:

Publication Date: 30 May 2023

Publication Site: Treasury Dept

Graphic:

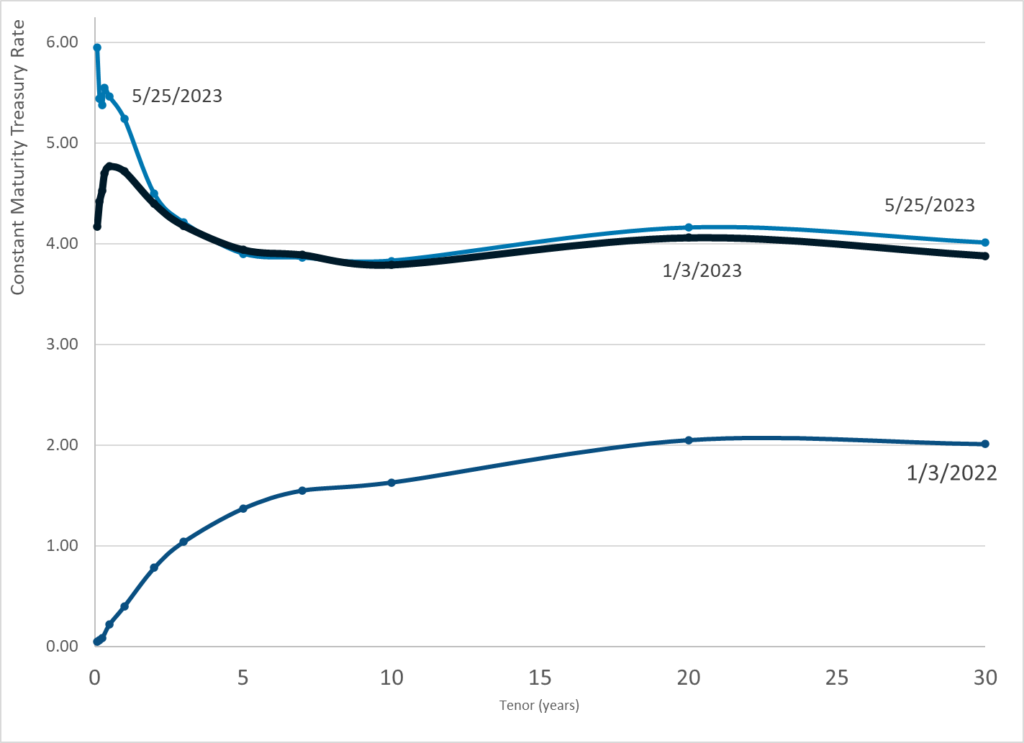

Publication Date: 25 May 2023

Publication Site: Treasury Dept

Graphic:

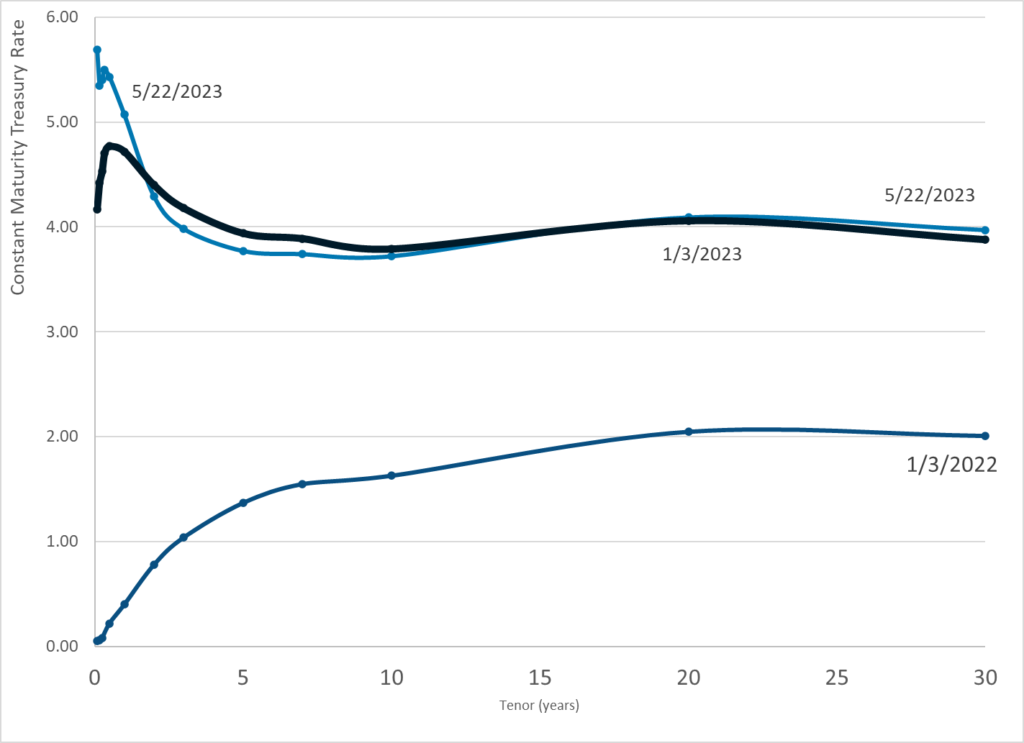

Publication Date: 22 May 2023

Publication Site: Department of Treasury

Graphic:

Excerpt:

First, we need to simplify our rules while strengthening them. Too many areas of regulation across our economy have become so complicated with weird formulas, dizzying methodologies, and endless loopholes and carveouts. We need simpler rules to prevent future disasters. A better alternative is to create bright line limits, with clear sanctions, including size caps and growth restrictions. Clearly observable metrics make it easier to monitor and increase consistency.

Second, we need to stop subsidizing the largest and riskiest banks by giving out free deposit insurance. When small banks fail, they rarely lead to much cost to the FDIC’s Deposit Insurance Fund, since they can be fairly easily wound down or sold. But when large banks fail, the costs to the Deposit Insurance Fund and broader economy can be steep. To make matters worse, those institutional clients with the biggest deposits feel they can get around insurance limits by going to the biggest banks. In other words, people perceive that the biggest banks get free deposit insurance over the legal limits by way of their too-big-to-fail status.

Fixing our deposit insurance pricing structure is just one small step that could help address this problem. Large, riskier banks should pay more and small, simpler banks should pay less. We should also make the framework countercyclical, so that we aren’t in the position of raising rates when banking conditions are weak.

While today’s proposed special assessment will not fall on small, local banks, the failure of First Republic Bank will be a direct hit to the Deposit Insurance Fund that is not being recouped through this special assessment. It’s a reminder that we need to fix the fund’s pricing over the long term.

Finally, as Swiss policymakers made clear regarding the recent turmoil involving Credit Suisse, more people are saying the quiet part out loud: the current resolution plans filed by the largest financial institutions in the world, which purport to show how the firms could fail without a government bailout or economic chaos, are essentially a fairy tale.5

The latest failures are another reminder that we must work to eliminate the unfair advantages bestowed upon too-big-to-fail banks. New laws and old laws alike provide a roadmap to end too-big-to-fail and the resulting risks to financial stability, fair competition, and the rule of law.6

Author(s): Rohit Chopra

Publication Date: 11 May 2023

Publication Site: Consumer Finance Protection Bureau

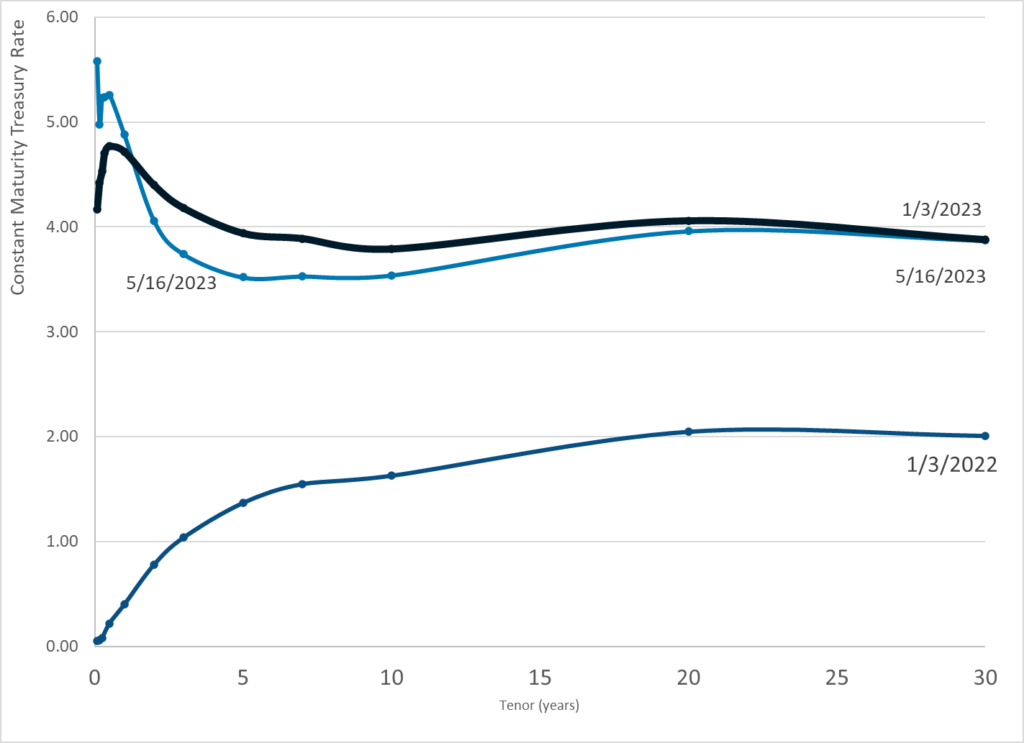

Graphic:

Publication Date: 16 May 2023

Publication Site: Treasury Dept

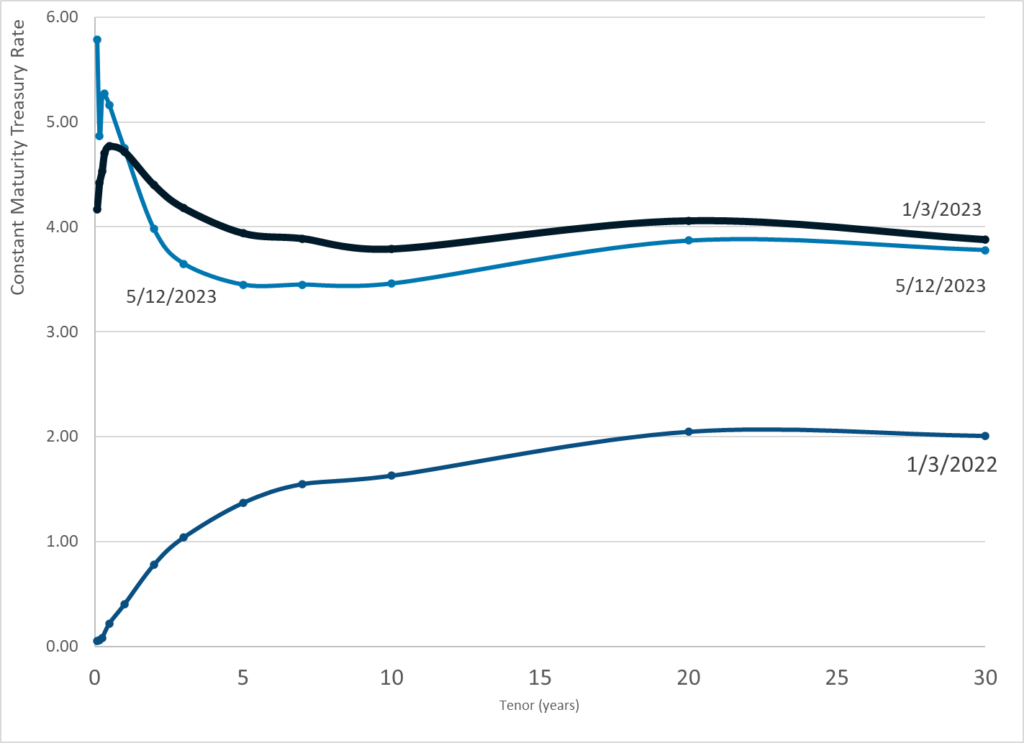

Graphic:

Publication Date: 12 May 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 11 May 2023

Publication Site: Treasury Department

Graphic:

Excerpt:

The five biggest auto insurers in Illinois have raised automobile insurance rates a whopping $527 million since January, an analysis by two consumer groups shows.

That follows about $1.1 billion in rate increases last year by the top 10 Illinois car insurers.

The analysis by the nonprofit Illinois Public Interest Research Group and Consumer Federation of America looked at auto insurance rate increases by the five largest companies in Illinois: State Farm, Allstate, Progressive, Geico and Country Financial, which together make up 62% of the Illinois market.

…..

Now, state Rep. Will Guzzardi, D-Chicago, has introduced legislation to address those issues and crack down on insurers. Guzzardi’s bill would:

It’s already illegal to use race, ethnicity and religion in setting rates. That would continue under Guzzardi’s proposal.

Author(s): Stephanie Zimmermann | Chicago Sun-Times

Publication Date: 6 May 2023

Publication Site: WBEZ in Chicago