Graphic:

Publication Date: 9 May 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 9 May 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 5 May 2023

Publication Site: Treasury Department

Link: https://rajivsethi.substack.com/p/the-new-mortgage-fee-structure

Graphic:

Excerpt:

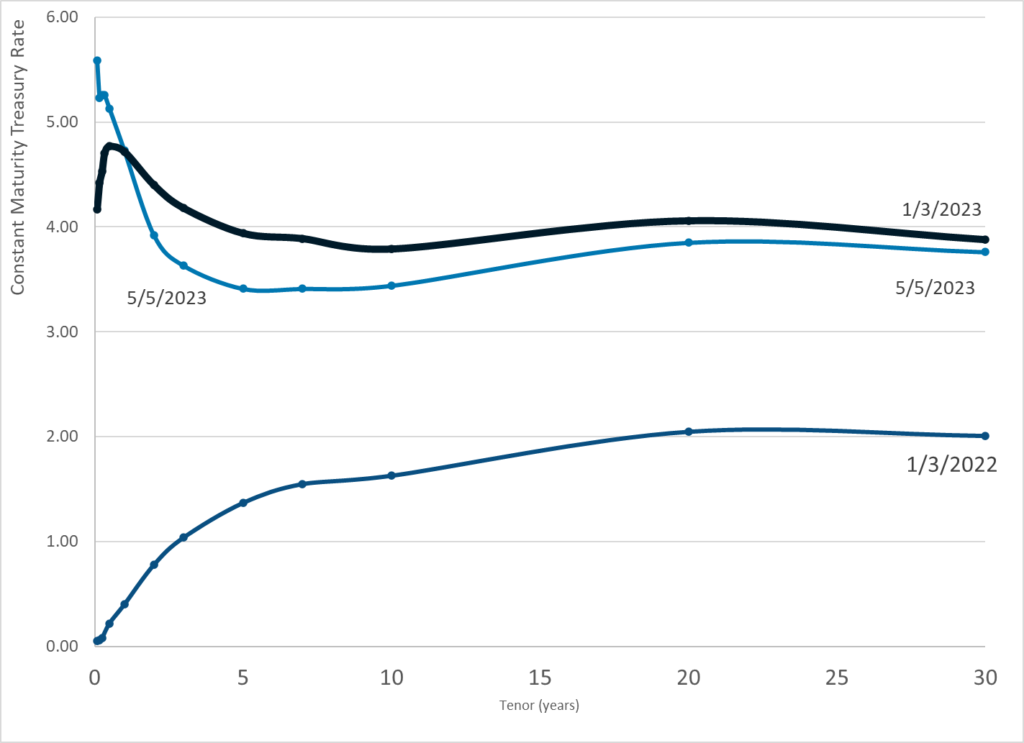

Notice that credit scores below 639 have been consolidated into a single row, and those above 740 have been split into three. In addition, loan-to-value ratios at 60% and below are now in two separate columns rather than one. This makes direct visual comparisons a little difficult, but one thing is clear—at no level of the loan-to-value ratio does someone with a lower credit score pay less than someone with a higher score. That is, one cannot gain by sabotaging one’s own credit rating.

In general, there are two types of borrowers who stand to gain under the new fee structure: those with low credit scores, and those with low down payments. In fact, those at the top of the credit score distribution gain under the new structure if they have down payments less than 5% of the value of the home. The following table shows gains and losses relative to the old structure, with reduced fees in green and elevated ones in red (a comparable color-coded chart with somewhat different cells may be found here):

What might the rationale be for rewarding those making especially low down payments? Perhaps the goal is to make housing more affordable for people without substantial accumulated savings or inherited wealth. But there will be an unintended consequence as those with reasonably high credit scores and substantial wealth choose to lower their down payments strategically in order to benefit from lower fees. They may do so by simply borrowing more for any given property, or buying more expensive properties relative to their accumulated savings. The incentive to do so will be strongest for those hit hardest by the changes, with credit scores in the 720-760 range and down payments between 15% and 20%.

Author(s): Rajiv Sethi

Publication Date: 23 Apr 2023

Publication Site: Imperfect Information at Substack

Graphic:

:

Publication Date: 3 May 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 1 May 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 27 Apr 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 26 Apr 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 25 Apr 2023

Publication Site: Treasury Dept

Link: https://finance.yahoo.com/news/debt-ceiling-fears-push-cost-184617316.html

Excerpt:

The cost of insurance against the US failing to repay its debts rose to its highest level since the financial crisis last week, as traders worried that political deadlock in Washington might lead to a default.

One-year government credit default swaps traded at 106 basis points Saturday – the most expensive they’ve been since 2008, according to a Financial Times report that cited Bloomberg data.

Credit default swaps – or CDSs – are a form of insurance against a borrower not making scheduled payments on their debt.

The price of one-year government CDSs has spiked 15 basis points in 2023 with traders spooked by the looming threat of a debt-ceiling crisis, the FT reported.

The debt ceiling is a limit on how much the government can borrow, set by Congress. The US hit its $31.4 trillion debt limit in January – and that means it could run out of money to pay its bills as soon as July if lawmakers don’t vote to raise the ceiling, according to the Congressional Budget Office.

Author(s): George Glover

Publication Date: 24 Apr 2023

Publication Site: Yahoo Finance

Excerpt:

Competition to claim a market that could be worth $100 billion a year for drugmakers alone has triggered a wave of advertising that has provoked the concern of regulators and doctors worldwide. But their tools for curbing the ads that go too far are limited — especially when it comes to social media. Regulatory systems are most interested in pharma’s claims, not necessarily those of doctors or their enthused patients.

Few drugs of this type are approved by the FDA for weight loss — they include Novo Nordisk’s Wegovy. But after shortages made that treatment harder to get, patients turned to other pharmaceuticals — like Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro — that are approved only for Type 2 diabetes. Those are often used off-label — though you wouldn’t hear that from many of their online boosters.

The drugs have shown promising clinical results, Jaisinghani and her peers emphasize. Patients can lose as much as 15% of their body weight. Novo Nordisk is sponsoring research to examine whether Wegovy causes reductions in the rate of heart attacks for patients with obesity.

The medications, though, come at a high price. Wegovy runs patients paying cash at least $1,305 a month in the Washington, D.C., area, according to a GoodRx search in late March. Insurers only sometimes cover the cost. And patients typically regain much of their lost weight after they stop taking it.

Author(s):Darius Tahir and Hannah Norman

Publication Date: 18 Apr 2023

Publication Site: KFF Health News

Excerpt:

It’s no surprise to anyone at this point that local governments are struggling to find workers. But finance departments are especially hard-hit when it comes to brain drain. A National Association of State Treasurers study found that 60% of public finance workers are over 45 while less than 20% are younger than 35.

The private sector is facing similar issues. According to the American Institute of Certified Public Accountants (AICPA), the accounting profession has an acute shortage of workers as the population of graduates with accounting degrees has declined over the years.

….

ACFRs, unlike quarterly or other interim reports, are the official account of a government’s finances for the previous year and show how those numbers compare with previous years. It takes some time for finance departments to gather the year-end data, but getting those numbers audited is the last and generally the most time-consuming step before publishing the annual financial report. In some cases, like in Indiana and Ohio, the audit is conducted or signed off by the state auditor’s office. In other instances, localities hire a firm to audit their financial statements.

According to new data published by the University of Illinois Chicago and Merritt Research Services, the last decade has seen a 13% increase in the median amount of time for local government audits to be completed. That means most governments are posting their ACFRs at least three weeks later in the year compared with a decade ago. Nearly half of the increase has occurred over the last two years. The research focuses on the median—rather than the average—because some governments are extreme outliers and take a year and a half or even more than two years to file their annual report.

Author(s): Liz Farmer

Publication Date: 18 Apr 2023

Publication Site: Route Fifty

Link:https://www.thecentersquare.com/illinois/article_6616e81a-e074-11ed-8a30-8b0b8fc31490.html

Excerpt:

Two bills in the Illinois legislature this session will require air conditioning, or at least a common room with air conditioning, in buildings housing seniors.

Last May, when a heat wave sent temperatures in Illinois soaring into the high 90s, three older women living in state-subsidized housing died of heat exposure in the Rogers Park neighborhood of Chicago. The three seniors, Delores McNeely, 76, Gwendolyn Osborne, 72, and Janice Reed, 68, were constituents of state Sen. Mike Simmons, D-Chicago. Two separate bills now aim to prevent these types of deaths,

Simmons sponsored a proposal that would require all state-funded affordable housing to have air conditioning. The bill passed the state Senate in March.

….

In March, the National Low Income Housing Coalition and Housing Action Illinois found that Illinois is lacking 300,000 affordable housing units for the 443,746 poorest households in the state. For every 100 extremely low-income renters, there are only 34 affordable and available units, the report found.

The report defines “very low income” in the Chicago area as households that earn less than $31,250 a year for a family of four, and $22,000 a year for a single person. Many seniors on Social Security live on half of that, Palmer said.

Author(s): Zeta Cross

Publication Date: 22 Apr 2023

Publication Site: The Center Square