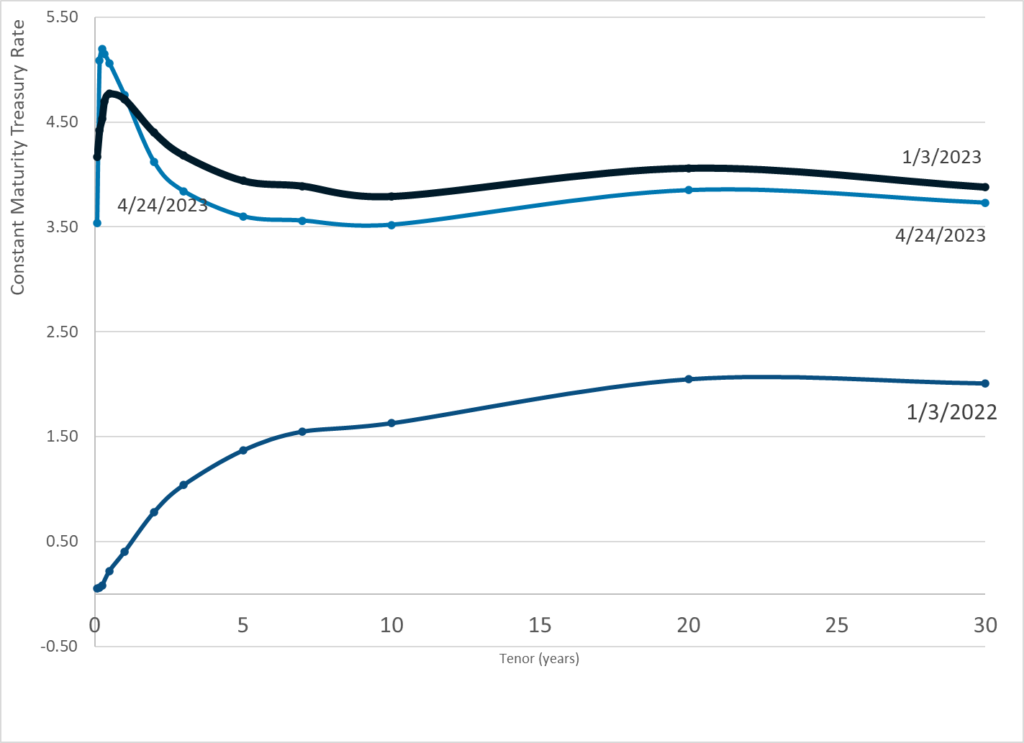

Graphic:

Publication Date: 24 Apr 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 24 Apr 2023

Publication Site: Treasury Dept

Link: https://www.thinkadvisor.com/2023/04/24/federal-financial-watchdog-aims-to-expand-its-reach/

Excerpt:

The Financial Stability Oversight Council — the federal agency in charge of keeping the U.S. financial system upright — wants to change a 2019 document that limits how it tries to keep problems at life insurers, money market funds, cryptocurrency firms and other nonbank financial companies from destroying the economy.

FSOC announced Friday that it’s proposing a new version of the document that would free it from the 2019 restrictions.

….

FSOC started a fight with life insurers and their regulators by designating companies such as MetLife and Prudential Financial as “systemically important financial institutions,” or companies needing extra oversight.

Life insurers argued that the SIFI designation process was unclear, arbitrary and unfair.

MetLife sued FSOC over its SIFI designation. A federal appeals court threw out MetLife’s designation in 2018.

FSOC withdrew the last designation of a nonbank company — Prudential Financial — in October 2018.

…..

FSOC says it needs more flexibility to address potential risks as early and as quickly as possible, and that comparing the potential benefits of focusing attention on a nonbank company to the potential impact on the company is not useful.

“This is in part because it is not feasible to estimate with any certainty the likelihood, magnitude or timing of a future financial crisis,” FSOC said. FSOC argued that, if it does prevent a financial crisis, it would save the country trillions of dollars.

FSOC noted that it consults with state regulators and federal regulatory agencies regularly, and that its own members are made up mostly of state and federal agency heads.

“The council expects that most potential risks to financial stability will continue to be addressed by existing regulators rather than by use of the council’s nonbank financial company designation authority,” FSOC said.

Author(s): Allison Bell

Publication Date: 24 Apr 2023

Publication Site: Think Advisor

Excerpt:

The House Committee on Financial Services will hold an oversight hearing on the Securities and Exchange Commission next Wednesday and Chairman Gary Gensler is expected to testify. The SEC’s proposed budget and their recent proposals, especially the climate disclosure proposal will all likely be discussed.

The SEC requested $2.436 billion for 2024, an increase of $265 million from this year primarily to hire new staff. The new hires are proportionally concentrated in the Divisions of Risk Analysis and Investment Management, whose staffs would increase by more than 5% each. The largest aggregate staffing increase would be to the Division of Enforcement, from its current 1,505 positions to 1,558.

…..

Womack also suggested that the SEC’s proposal on climate disclosure, which would require entities registered with the SEC to disclose their carbon emissions, was not within the SEC’s legal authority, a concern shared by several other Republican members of the committee.

The climate disclosure proposal has been a sensitive issue for agricultural interests. Representative Ashley Hinson, R-Iowa, emphasized the potential impact of this rule on farmers at the hearing. She said that this proposal would be bad for farmers in her state who would have to collect and disclose their emissions data to issue securities and to work with larger businesses who must collect emissions data from their value chain.

Representative Michael Cloud, R-Texas, shared this sentiment during the hearing and said that any issuer subject to Scope 3 disclosure would compel farms in their supply chain to collect this data, a tedious process, which might reduce farmer’s access to credit if they do not comply.

Author(s): Paul Mulholland

Publication Date: 12 April 2023

Publication Site: ai-CIO

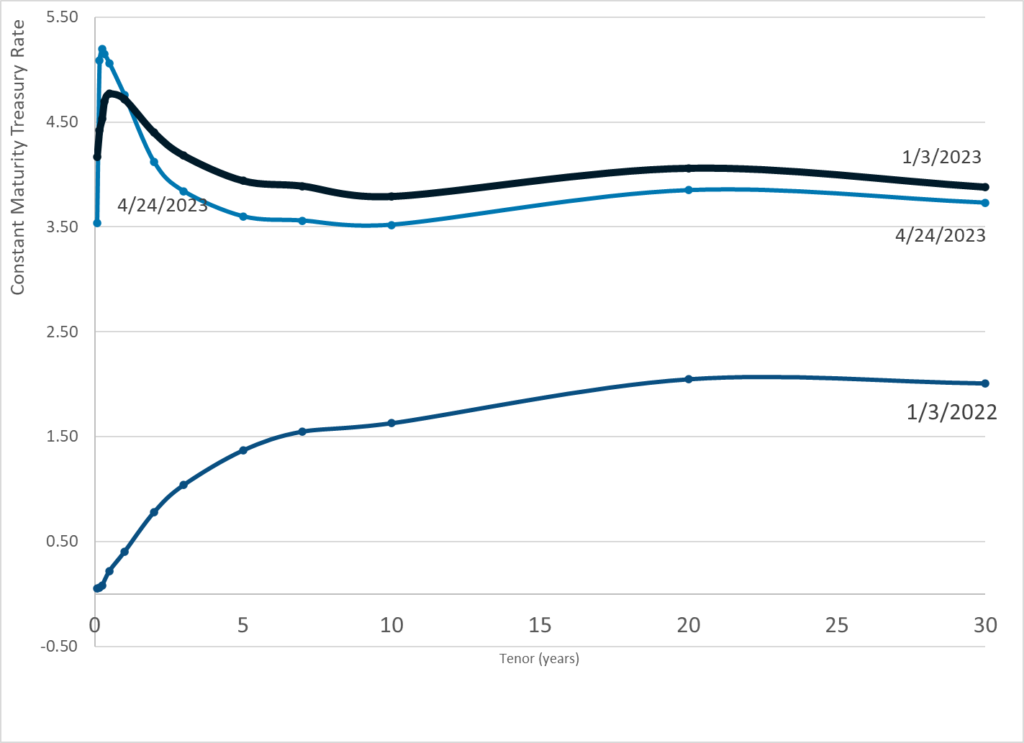

Graphic:

Publication Date: 19 Apr 2023

Publication Site: Treasury Department

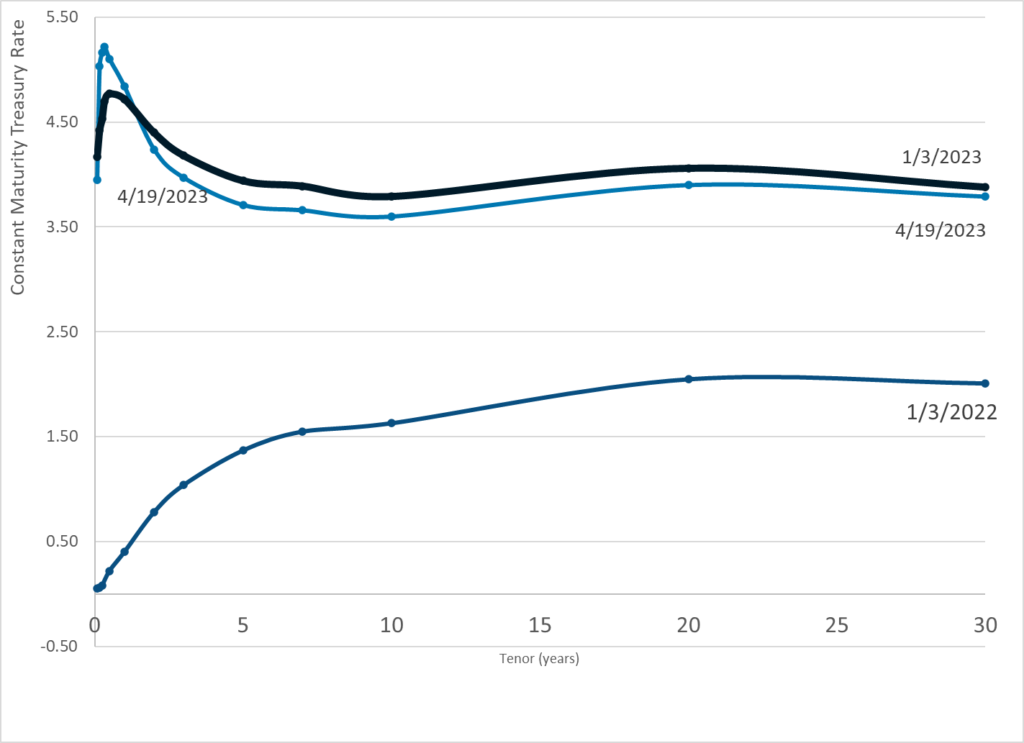

Graphic:

:

Publication Date: 17 Apr 2023

Publication Site: Treasury Department

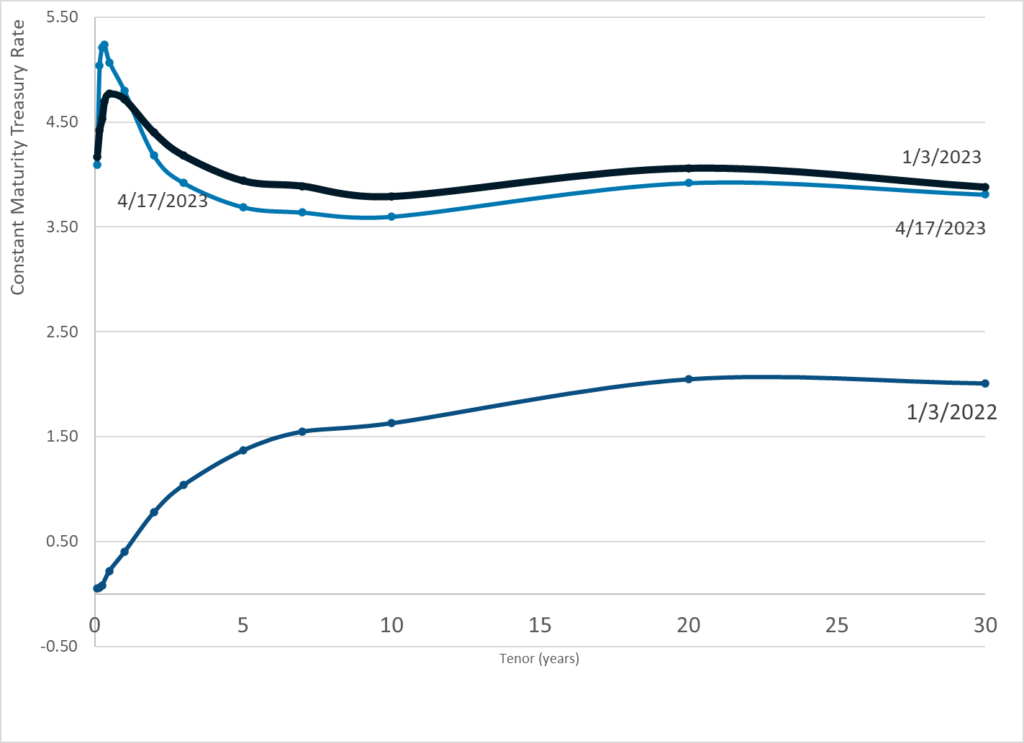

Graphic:

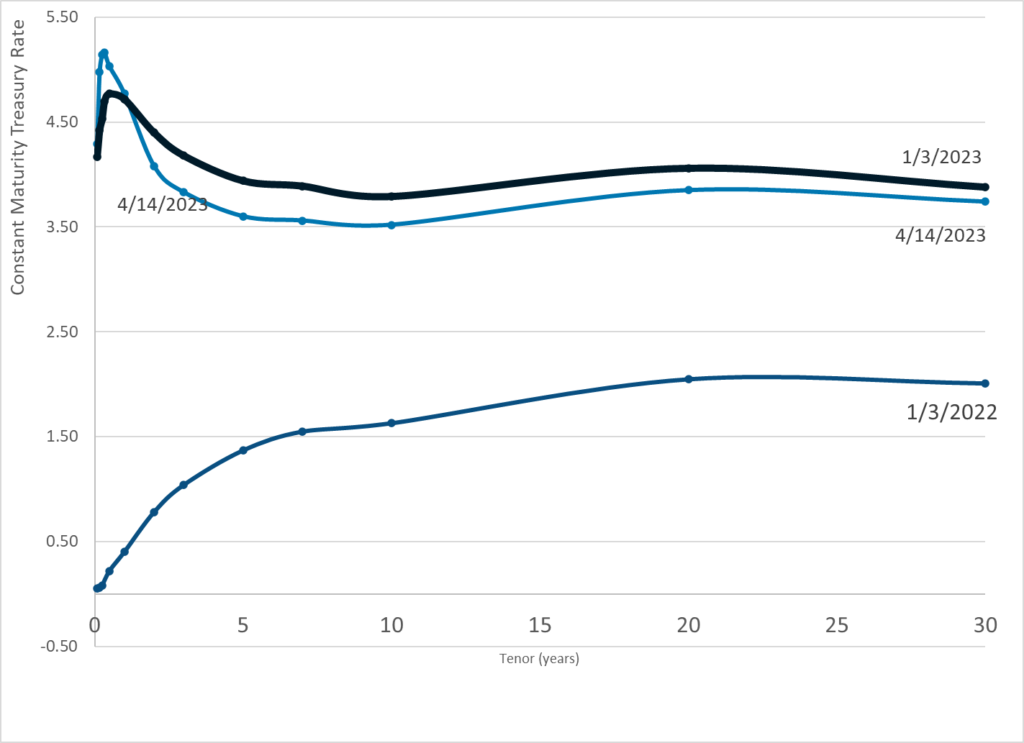

Publication Date: 14 Apr 2023

Publication Site: Treasury Dept

Graphic:

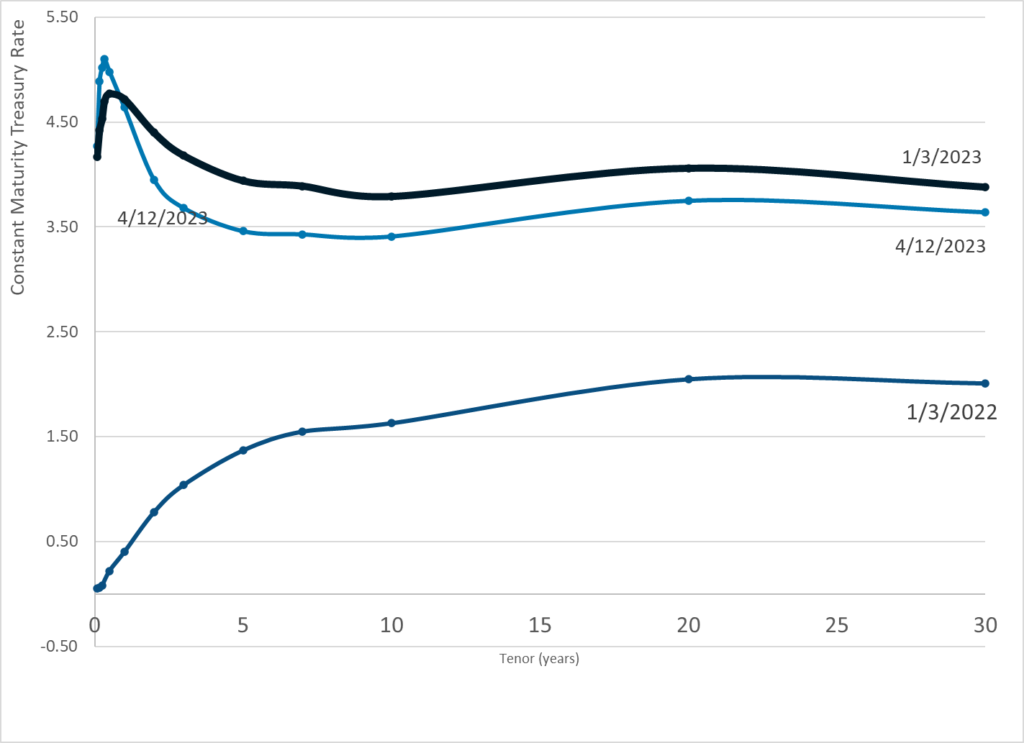

Publication Date: 12 Apr 2023

Publication Site: Treasury Dept

Graphic:

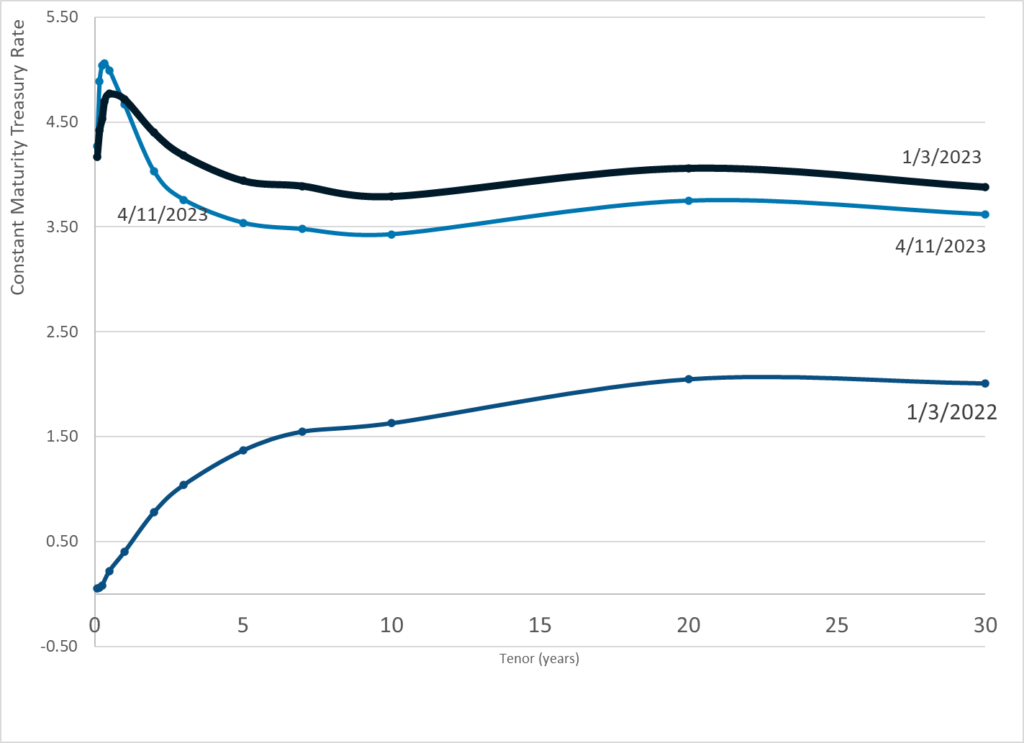

Publication Date: 11 April 2023

Publication Site: Treasury Dept

Link: https://kelleyk.substack.com/p/covid-national-emergency-ends

Graphic:

Excerpt:

Biden signed H.J.Res. 7, which ended the national emergency for Covid. Both the text of the bill, and the corresponding press release from the White House are short and sweet. The White House recently said Biden “strongly opposes HJ Res 7,” but that he would sign the bill if it passed. It passed with bipartisan support in both the House.

One thing that is tied to the national emergency is an extension of COBRA deadlines for people who are out of work. These deadlines are extended during the “outbreak period” which ends 60 days after the end of the national emergency.

The DHS rules for vaccine mandates for foreign travelers at land border crossings from Canada and Mexico rely on the national emergency as their legal basis, so theoretically they will end with the national emergency. But there has been no official actions to lift those rules, and I suspect the White House expects this vaccine mandate to continue for at least another month. (See section on travel vaccine mandates further down for more details.)

Author(s): Kelly K

Publication Date: 11 April 2023

Publication Site: Check Your Work

Link: https://pensionwarriorsdwardsiedle.substack.com/p/state-pensioners-can-learn-lots-from

Excerpt:

Finally, and most important, this month there is an election for one active, or contributing member seat on the STRS board—the outcome of which will be determined in early May. If the reform coalition candidate wins this seat, it’s likely control of the board will shift. Then the concerns of the state auditor and reform-minded members will be addressed regarding the need to restore transparency, lower investment fees paid to Wall Street, improve investment performance and move toward restoring benefits previously promised. If so, STRS Ohio’s participant-driven reforms may serve as a template for all of the nation’s public pensions. (On the other hand, if our request for public records is granted by the Ohio Supreme Court later this year—and court-ordered transparency ensues—there may be little need for board action because any mismanagement or wrongdoing will have been exposed to the public.)

But here’s the big picture: Since all public pensions in America have moved like a herd, pouring over $1 trillion into many of the same high-cost, high-risk secretive alternative investments, if any single state pension—such as Rhode Island, or Ohio STRS—restores full transparency and releases alternative investment information to the public revealing widespread industry abuses and violations of law, all participants in public pensions which have also invested in these funds, as well as taxpayers, will benefit. One obscure pension fund board vote in Ohio could ultimately force the transparency and accountability Wall Street has successfully resisted for decades.

Author(s): Edward Siedle

Publication Date: 11 April 2023

Publication Site: Pension Warriors on substack

Graphic:

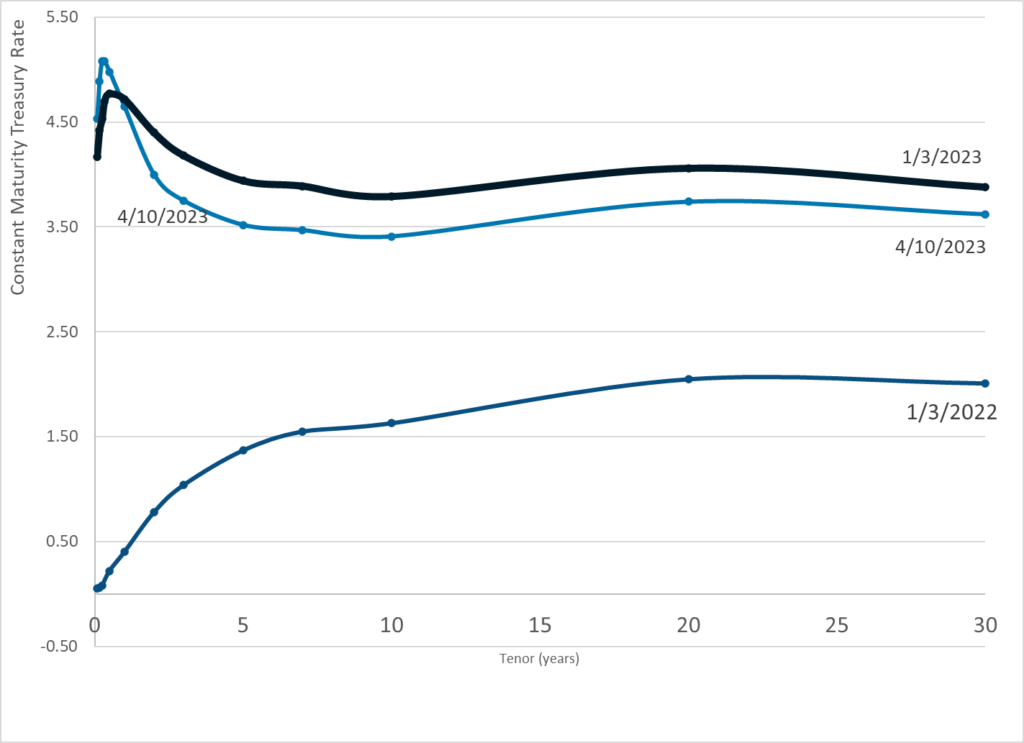

Publication Date: 10 April 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 7 April 2023

Publication Site:Treasury Department