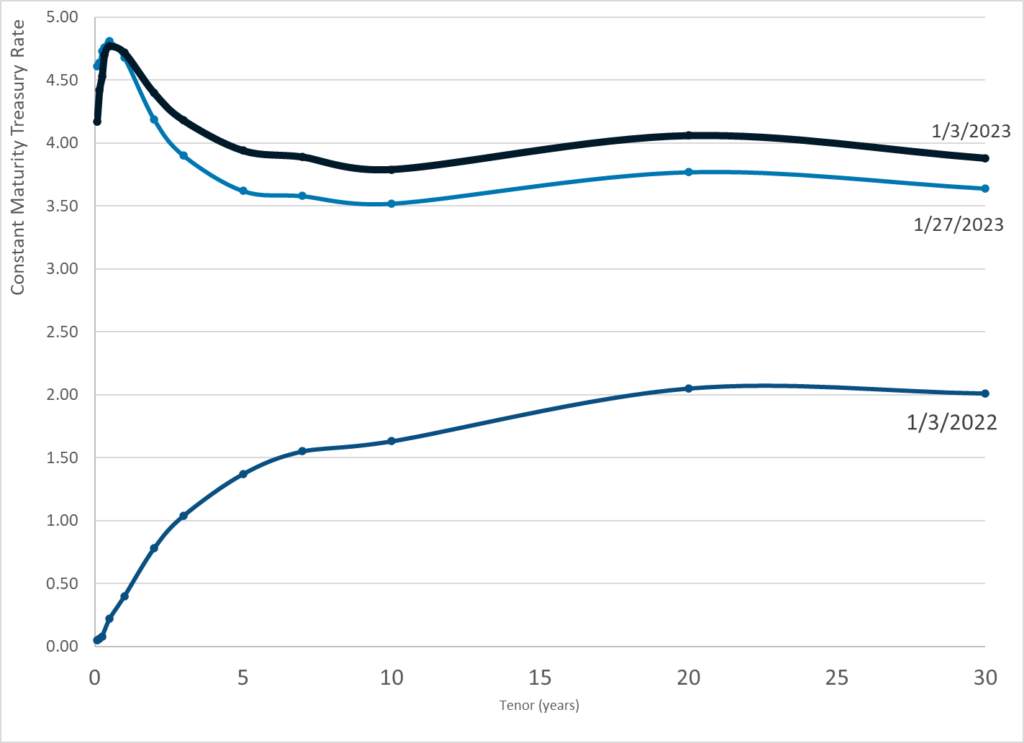

Graphic:

Publication Date: 27 Jan 2023

Publication Site: Treasury Dept

All about risk

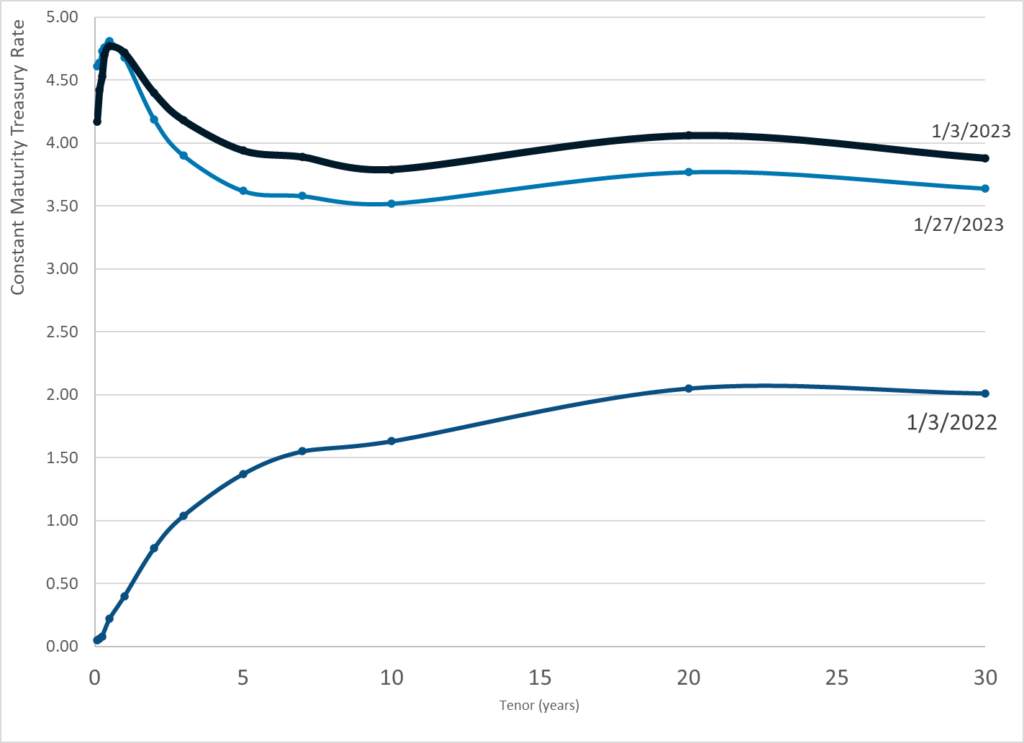

Graphic:

Publication Date: 27 Jan 2023

Publication Site: Treasury Dept

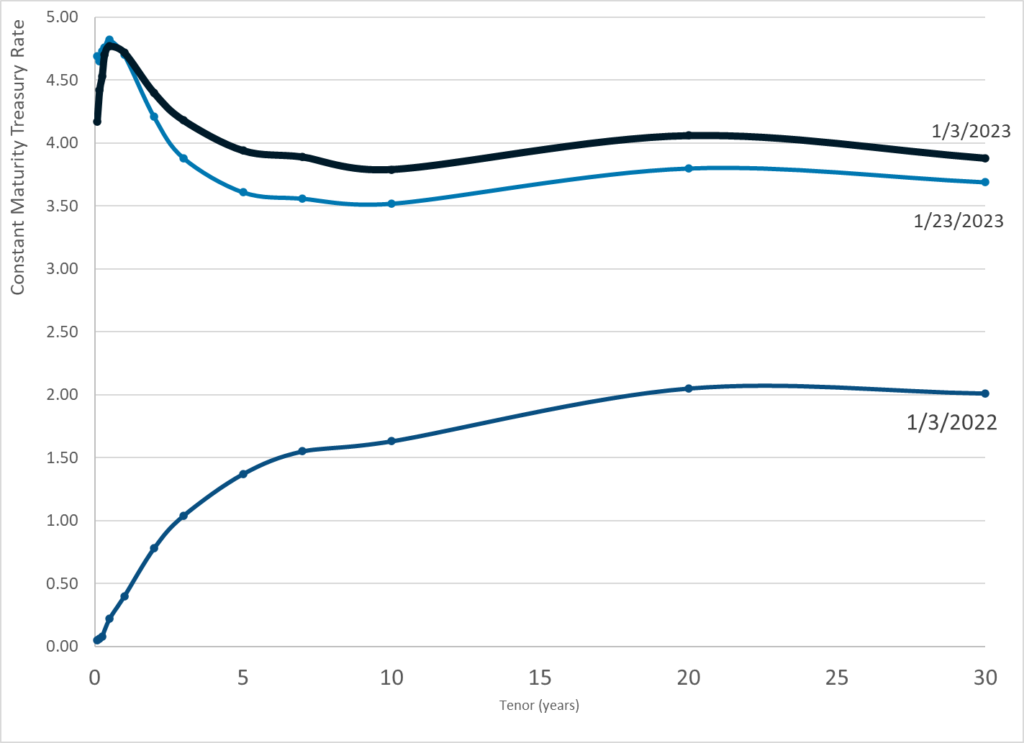

Graphic:

Publication Date: 24 Jan 2023

Publication Site: Treasury Department

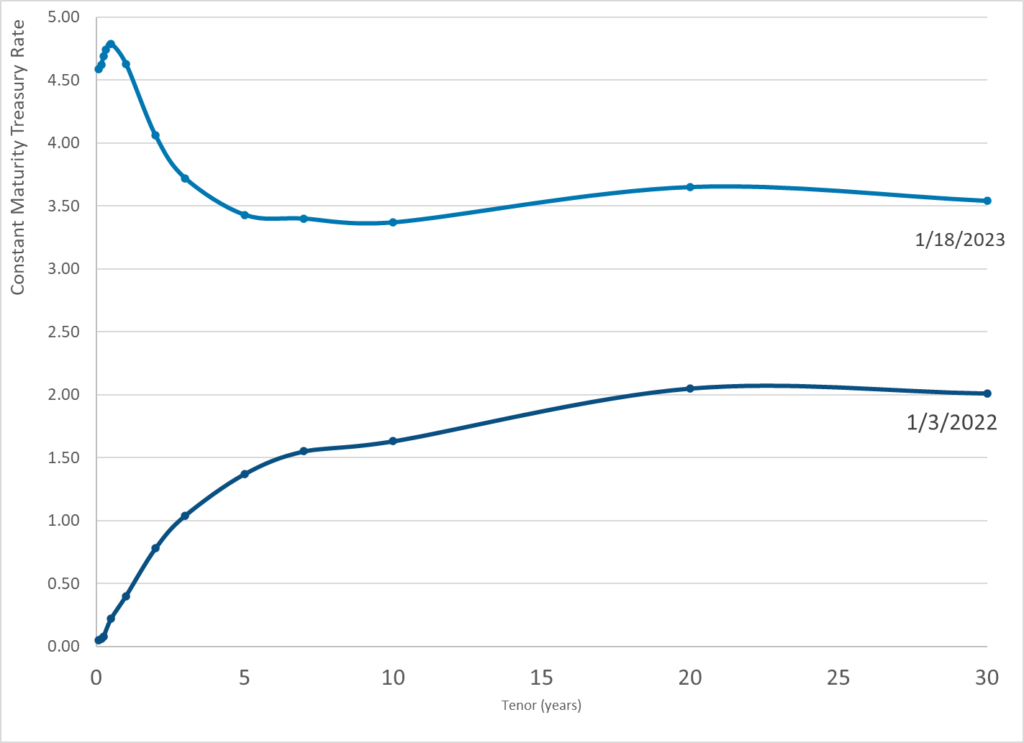

Graphic:

Publication Date: 23 Jan 2023

Publication Site: Treasury Dept

Link: https://www.governing.com/finance/more-and-better-uses-ahead-for-governments-financial-data

Excerpt:

In its lame duck session last month, Congress tucked a sleeper section into its 4,000-page omnibus spending bill. The controversial Financial Data Transparency Act (FDTA) swiftly came out of nowhere to become federal law over the vocal but powerless objections of the state and local government finance community. Its impact on thousands of cities, counties and school districts will be a buzzy topic at conferences all this year and beyond. Meanwhile, software companies will be staking claims in a digital land rush.

The central idea behind the FDTA is that public-sector organizations’ financial data should be readily available for online search and standardized downloading, using common file formats. Think of it as “an http protocol for financial data” that enables an investor, analyst, taxpayer watchdog, constituent or journalist to quickly retrieve key financial information and compare it with other numbers using common data fields. Presently, online users of state and local government financial data must rely primarily on text documents, often in PDF format, that don’t lend themselves to convenient data analysis and comparisons. Financial statements are typically published long after the fiscal year’s end, and the widespread online availability of current and timely data is still a faraway concept.

…..

So far, so good. But the devil is in the details. The first question is just what kind of information will be required in this new system, and when. Most would agree that a complete download of every byte of data now formatted in voluminous governmental financial reports and their notes is overwhelming, unnecessary and burdensome. Thus, a far more incremental and focused approach is a wiser path. For starters, it may be helpful to keep the initial data requirements skeletal and focus initially on a dozen or more vital fiscal data points that are most important to financial statement users. Then, after that foundation is laid, the public finance industry can build out. Of course, this will require that regulators buy into a sensible implementation plan.

The debate over information content requirements should focus first on “decision-useful information.” Having served briefly two decades ago as a voting member of the Governmental Accounting Standards Board (GASB), contributing my professional background as a chartered financial analyst, I can attest that almost every one of their meetings included a board member reminding others that required financial statement information should be decision-useful. A key question, of course, is “useful to whom?”

Author(s): Girard Miller

Publication Date: 17 Jan 2023

Publication Site: Governing

Graphic:

Publication Date: 20 Jan 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 18 Jan 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 17 Jan 2023

Publication Site: Treasury Dept

Graphic:

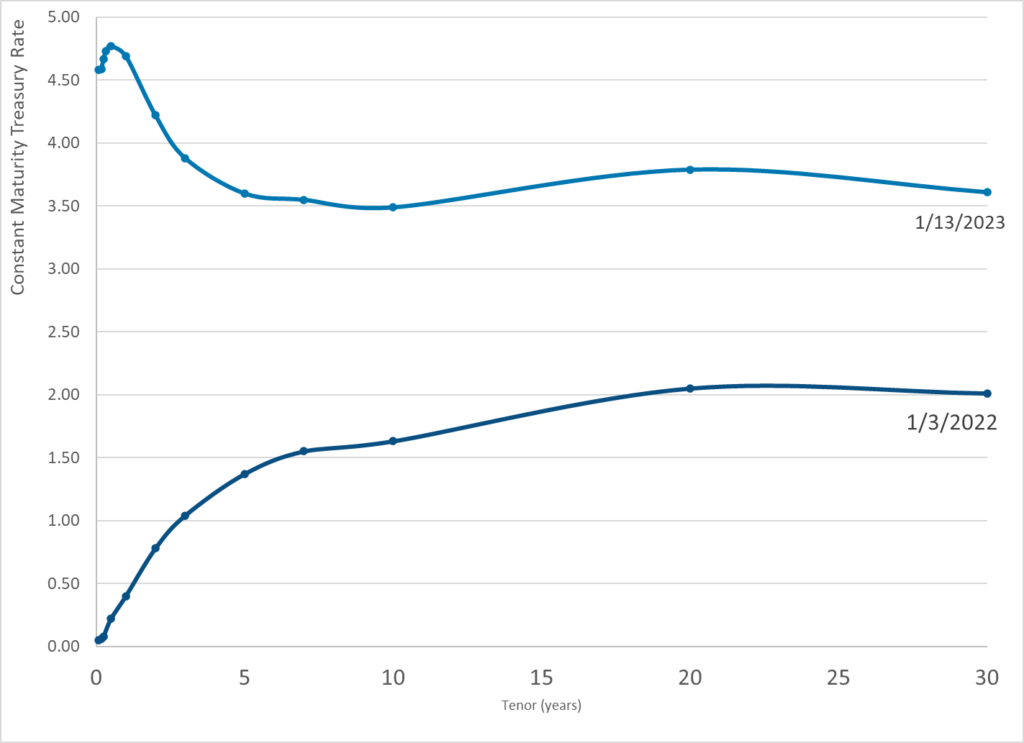

Publication Date: 13 Jan 2023

Publication Site: Treasury Department

Link: https://www.federalreserve.gov/newsevents/speech/powell20230110a.htm

Excerpt:

It is essential that we stick to our statutory goals and authorities, and that we resist the temptation to broaden our scope to address other important social issues of the day.4 Taking on new goals, however worthy, without a clear statutory mandate would undermine the case for our independence.

In the area of bank regulation, too, the Fed has a degree of independence, as do the other federal bank regulators. Independence in this area helps ensure that the public can be confident that our supervisory decisions are not influenced by political considerations.5 Today, some analysts ask whether incorporating into bank supervision the perceived risks associated with climate change is appropriate, wise, and consistent with our existing mandates.

Addressing climate change seems likely to require policies that would have significant distributional and other effects on companies, industries, regions, and nations. Decisions about policies to directly address climate change should be made by the elected branches of government and thus reflect the public’s will as expressed through elections.

At the same time, in my view, the Fed does have narrow, but important, responsibilities regarding climate-related financial risks. These responsibilities are tightly linked to our responsibilities for bank supervision.6 The public reasonably expects supervisors to require that banks understand, and appropriately manage, their material risks, including the financial risks of climate change.

Author(s): Jerome Powell

Publication Date: 10 Jan 2023

Publication Site: Federal Reserve

Link: https://mishtalk.com/economics/fed-chair-warns-president-biden-we-will-not-be-a-climate-policymaker

Excerpt:

Author(s): Mike Shedlock

Publication Date: 10 Jan 2023

Publication Site: Mish Talk

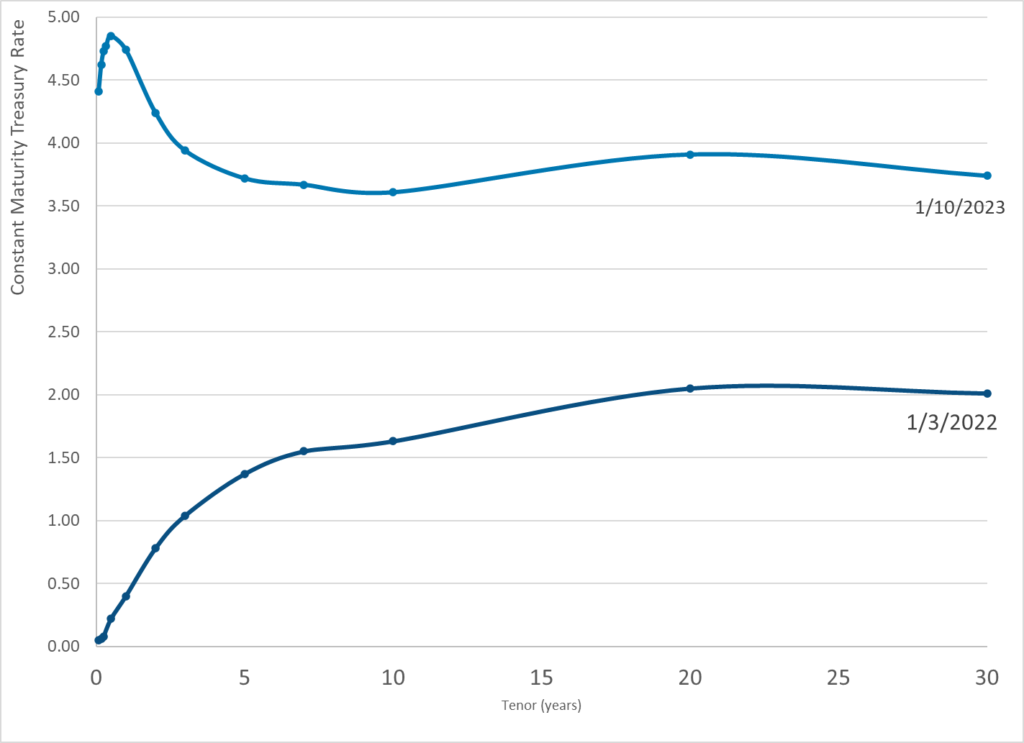

Graphic:

Publication Date: 10 Jan 2023

Publication Site: Treasury Dept

Graphic:

Publication Date: 9 Jan 2023

Publication Site: Treasury Dept