Graphic:

Publication Date: 6 Jan 2023

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 6 Jan 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

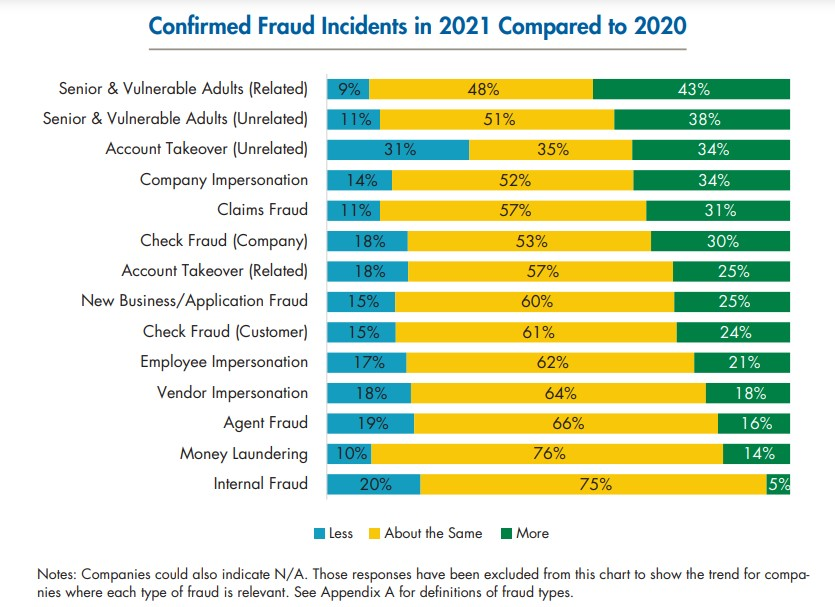

LIMRA discussed its FraudShare program in this June 2022 story, and the statistics were striking.

More than a third (34%) of companies reported increases in account takeover attempts in 2021 as compared to the previous year, according to LIMRA. Account takeovers occur when someone takes ownership of an online account without the owner’s knowledge, often with stolen credentials. In addition to account takeovers attempts, 34% of companies saw increases in company impersonation and 31% had increases in claims fraud.

A LIMRA report showed that fraud incidents increased in 2021 in all but two categories of fraud. (Please note that fraud “incidents” shown in the chart below are attempts and do not indicate that the account takeover attempts were successful.)

Author(s): John Hilton, InsuranceNewsNet

Publication Date: 30 Dec 2022

Publication Site: The Wealth Advisor

Graphic:

Publication Date: 5 Jan 2023

Publication Site: Treasury Dept

Graphic:

Excerpt:

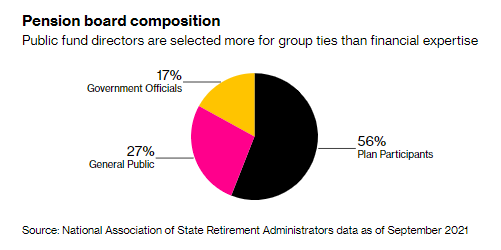

In the US, a lineup of unpaid union-backed reps, retirees and political appointees are the vanguards of a $4 trillion slice of the economy that looks after the nation’s retired public servants. They’re proving to be no match for a system that’s exploded in size and complexity.

The disparity is dragging on state and local finances and — together with headwinds that include a growing ratio of retirees to workers and lenient accounting standards — gobbling up an increasing share of government budgets. Precisely how much it’s costing Americans is hard to say. But a Bloomberg News analysis of data from CEM Benchmarking, which tracks industry performance, indicates that the price tag over the past decade could run into the hundreds of billions of dollars.

….

The disconnect was on display at a 2021 investment committee meeting of the California Public Employees’ Retirement System, which provides benefits to more than 750,000 individuals. An external adviser warned board members that the boom in blank-check companies was a sign of froth in financial markets.

“I had never heard of those,” chairwoman Theresa Taylor told her fellow directors of the then-sizzling products known as SPACs, according to a transcript of the meeting.

….

Systems are underfunded partly because public officials face greater pressure to fulfill today’s demands than to fund obligations 20 or 30 years away. And because hikes in taxes and contributions are unpopular, there’s an incentive to downplay the problem.

Instead, plans are investing in higher risk assets, which make up about one-third of holdings, according to data from Preqin. That allocation has more than doubled since just before the 2008 financial crisis as plans have poured $1 trillion into alternatives.

….

Many pension advisers make smart recommendations: the guidance that CalPERS should stay away from SPACs, for one, was proven sound once regulators ramped up scrutiny of that market, which has all but ground to a halt. Yet it remains unclear how closely individual directors evaluate investments that get put in front of them.

“I served with one director for about 15 years and never saw him ask a question” about his system’s investments, said Herb Meiberger, a finance professor who sat on the board of the $36 billion San Francisco Employees’ Retirement System until 2017. A spokesman for the system said it takes governance and fiduciary duty very seriously, and that board members receive training to help them execute their duties.

Harvard finance professor Emil Siriwardane has researched why some US plans have put more money into alternatives. It wasn’t the worst-funded or those with the most aggressive performance targets. “By a factor of eight-to-ten,” the closest correlation is the investment consultants that pension plans hire, Siriwardane found.

….

Canada’s detour from the American-style model began in the late 1980s, when Ontario’s government and teacher federation decided to reboot a plan that was invested in non-marketable provincial bonds. They set up the Ontario Teachers’ Pension Plan in 1990, concluding the province could save $1.2 billion over a decade by operating more like a business.

Ontario Teachers’ first board chairman was a former Bank of Canada governor and its first finance chief was a corporate finance veteran. It soon began investing directly in private markets and infrastructure, opened offices in Europe and Asia and acquired a large real estate firm. The system pays its board members close to what corporate directors make, and manages 80% of its investments internally. Those practices have put it on a solid financial base: Ontario Teachers’ says it’s been fully funded for the past nine years, with a current funding ratio of 107%.

Until the 2008 financial crisis, boards in the Netherlands — where traditional public sector pensions are common — looked a lot like those in the US. Then the country’s central bank was given authority to assess candidates. It looked at directors’ combined risk management, actuarial and other expertise.

Many smaller Dutch funds didn’t make the cut. The regulatory hurdles helped set off a wave of mergers that, over the past decade, has reduced the number of plans by over two-thirds. The system has sprouted professional directors who serve more than one at a time.

Few US boards are following suit. Only 19 of 113 funds studied made changes to their board composition from 1990 to 2012, a paper published in The Review of Financial Studies in 2017 found.

“A lot of funds in the US like the idea of transforming, want to transform, but don’t have the political fortitude to do it,” said Brad Kelly of Global Governance Advisors, a Toronto-based firm that works with US and Canadian pension funds.

Author(s): Neil Weinberg

Publication Date: 3 Jan 2023

Publication Site: Bloomberg

Graphic:

Publication Date: 4 Jan 2023

Publication Site: Treasury Department

Excerpt:

Twitter’s ban on “COVID-19 misinformation,” which Elon Musk rescinded after taking over the platform in late October, mirrored the Biden administration’s broad definition of that category in two important respects: It disfavored perspectives that dissented from official advice, and it encompassed not just demonstrably false statements but also speech that was deemed “misleading” even when it was arguably or verifiably true. In a recent Free Press article, science writer David Zweig shows what that meant in practice, citing several striking examples of government-encouraged speech suppression gleaned from the internal communications that Musk has been disclosing to handpicked journalists.

Twitter’s moderation of pandemic-related content was intertwined with government policy from the beginning. Even before Joe Biden was elected president and his administration began publicly and privately demanding that social media companies suppress speech it viewed as a threat to public health, the company’s guidelines deferred to the positions taken by government agencies such as the Centers for Disease Control and Prevention (CDC). And those rules explicitly covered “misleading information” as well as “demonstrably false” statements.

….

That July, Twitter sought to clarify “our rules against potentially misleading information about COVID-19″ (emphasis added). “For a Tweet to qualify as a misleading claim,” the company said, “it must be an assertion of fact (not an opinion), expressed definitively, and intended to influence others’ behavior.” Possible topics included “the origin, nature, and characteristics of the virus”; “preventative measures, treatments/cures, and other precautions”; “the prevalence of viral spread, or the current state of the crisis”; and “official health advisories, restrictions, regulations, and public-service announcements.”

That was a very wide net, potentially encompassing anyone who questioned the CDC’s ever-shifting guidance or criticized government policies, such as lockdowns and mask mandates, aimed at reducing virus transmission. While the intent requirement ostensibly allowed dissent as long as it was not aimed at influencing behavior, that limitation did not mean much in practice, since moderators were apt to infer the requisite intent when they encountered tweets that implicitly or explicitly deviated from the recommendations of “public health authorities and governments.”

….

Another example that Zweig cites: Last August, @KelleyKga, a self-described “public health fact checker,” responded to another Twitter user’s claim that “COVID has been the leading cause of death from disease in children” since December 2021. “What an excellent example of cherry picking!” @KelleyKga wrote. “If you narrow it down to only the specific months you specify, which include the largest Covid wave (seen across the world), AND you ignore all non-disease deaths, AND you ignore cancer, heart disease, SIDS, then COVID is ‘leading.'”

Author(s): Jacob Sullum

Publication Date: 2 Jan 2023

Publication Site: Reason

Excerpt:

Yves here. While this post gives an introduction to the problem of the magnitude of currency swaps, I suspect readers will find it a bit frustrating because it raises more questions than it answers. I feel I should provide far more than I do in this intro, but it is a big topic to address properly, so I hope to keep chipping away at it over time.

Some initial observations:

First, the size of the dollar-related swaps market belies the idea that the dollar is going to be displaced all that soon.

Second, and not to sound Pollyannish, but there was a lot of currency volatility last year, yet nothing blew up. That may be due to dumb luck. But also recall that the Bank of International Settlements has been a Cassandra. It first flagged rapidly rising housing prices and related increases in lending as a risk…in 2003.

Third, interviewer Paul Jay keeps pushing on the idea that shouldn’t this activity be regulated? Wellie, it never has been and I don’t see how you can put that genie in the bottle. Foreign exchange trading has always been over the counter.

And non-US banks are regulated not by the US but by their home country under what is called the “home host” practice. So it is France’s job to see that French banks fly right, even when they are trading dollars and other non-Eurozone currencies. If a French bank gets in trouble, even on its dollar exposures, it is France that has to bail them out or put it down. That is why, during the financial crisis, when French and even much more so German banks bought a lot of bad US subprime debt and CDOs and then had a lot of losses, they needed dollar funding to cover the holes in their dollar book (as in no one would provide them with short-term dollar funding to keep funding these dollar assets and no one would buy them at any reasonable price if they had tried to sell them). But the ECB could only lend dollars to these Eurobanks, which would not solve this funding problem. So the Fed opened up big currency swap lines with the major central banks. These central banks then swapped to get dollars so they could provide emergency dollar funding to their banks.

Author(s): Yves Smith, Rob Johnson, Paul Jay

Publication Date: 3 Jan 2023

Publication Site: Naked Capitalism, theAnalysis.news

Excerpt:

The Centers For Disease Control (CDC) deleted a reference to a study it commissioned after a group of gun-control advocates complained it made passing new restrictions more difficult.

The lobbying campaign spanned months and culminated with a private meeting between CDC officials and three advocates last summer, a collection of emails obtained by The Reload show. Introductions from the White House and Senator Dick Durbin’s (D., Ill.) office helped the advocates reach top officials at the agency after their initial attempt to reach out went unanswered. The advocates focused their complaints on the CDC’s description of its review of studies that estimated defensive gun uses (DGU) happen between 60,000 and 2.5 million times per year in the United States–attacking criminologist Gary Kleck’s work establishing the top end of the range.

“[T]hat 2.5 Million number needs to be killed, buried, dug up, killed again and buried again,” Mark Bryant, one of the attendees, wrote to CDC officials after their meeting. “It is highly misleading, is used out of context and I honestly believe it has zero value – even as an outlier point in honest DGU discussions.”

Bryant, who runs the Gun Violence Archive (GVA), argued Kleck’s estimate has been damaging to the political prospects of passing new gun restrictions and should be eliminated from the CDC’s website.

Author(s): Stephen Gutowski

Publication Date: 15 Dec 2022

Publication Site: The Reload

Excerpt:

The Charitable Corporation was established in London in 1707 with the noble mission of providing “relief of the industrious poor by assisting them with small sums at legal interest.”

Essentially, it sought to provide low-interest loans to poor tradesmen, shielding them from predatory pawnbrokers who charged as much as 30% interest. The corporation made loans available at the rate of 5% in return for a pledge of property for security.

The Charitable Corporation was modeled on Monti di Pietà, a charitable institution of credit established in Catholic countries during the Renaissance era to combat usury, or high rates of interest.

Unlike the Monti di Pietà, however, the British version – despite its name – wasn’t a nonprofit. Instead, it was a business venture. The enterprise was funded by offering shares to investors who, in return, would make money while doing good. Under its original mission, it was like an 18th century version of today’s socially responsible investing, or “sustainable investment funds.”

….

There are several key characteristics that stand out in the collapses of both the Charitable Corporation and FTX. Both companies were offering something new or venturing into a new sector. In the former’s case, it was microloans. In FTX’s case, it was cryptocurrency.

Meanwhile, the management of both ventures was centralized in the hands of just a few people. The Charitable Corporation got into trouble when it reduced its directors from 12 to five and when it consolidated most of its loan business in the hands of one employee – namely, Thomson. FTX’s example is even more extreme, with founder Sam Bankman-Fried calling all the shots.

Author(s): Amy Froide

Publication Date: 21 Dec 2022

Publication Site: The Conversation

Graphic:

Publication Date: 3 Jan 2023

Publication Site: Treasury Department

Graphic:

Publication Date: 30 Dec 2022

Publication Site: Dept of Treasury

Link: https://xbrl.us/events/230124/

Date and Time of upcoming event: 3:00 PM ET Tuesday, January 24, 2023 (60 Minutes)

Description:

The U.S. Congress passed legislation on December 15, 2022 that includes requirements for the Securities and Exchange Commission to adopt data standards related to municipal securities. The Financial Data Transparency Act (FDTA) aims to improve transparency in government reporting, while minimizing disruptive changes and requiring no new disclosures. The University of Michigan’s Center for Local State and Urban Policy (CLOSUP) has partnered with XBRL US to develop open, nonproprietary financial data standards that represent government financial reporting which could be freely leveraged to support the FDTA. The Annual Comprehensive Financial Reporting (ACFR) Taxonomy today represents general purpose governments, as well as some special districts, and can be expanded upon to address all types of governments that issue debt securities. CLOSUP has also conducted pilots with local entities including the City of Flint.

Attend this 60-minute session to explore government data standards, find out how governments can create their own machine-readable financial statements, and discover what impact this legislation could have on government entities. Most importantly, discover how machine-readable data standards can benefit state and local government entities by reducing costs and increasing access to time-sensitive information for policy making.

Presenters:

Publication Site: XBRL.us